Asia Pacific Nutraceuticals Market Size (2024-2030)

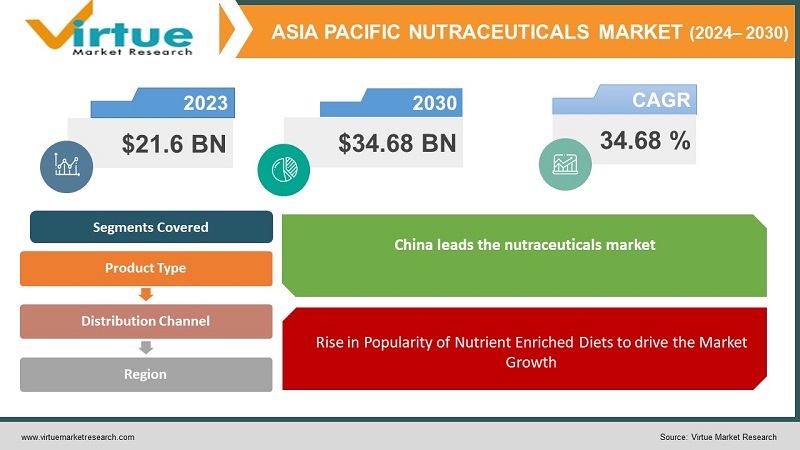

The Asia Pacific Nutraceuticals Market was valued at USD 21.6 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 34.68 billion by 2030, growing at a CAGR of 34.68 %.

Nutraceuticals refer to food products that offer medical or nutritional benefits. These functional foods are fortified with probiotic and prebiotic components, aiding in the maintenance of gastrointestinal health. They contribute to lowering the risk of diabetes and cardiovascular conditions while providing various physiological advantages. Nutraceuticals encompass several categories, including functional foods, functional beverages, dietary supplements, and personal care products as well as pharmaceuticals. They find diverse applications in overall wellness, beauty and anti-aging, weight management, digestive health, and sports and energy sectors.

Key Market Insights:

The rising demand for dietary supplements and nutraceuticals is also driven by a shift in consumer preferences towards self-directed management of lifestyle-related conditions, such as cardiovascular disorders and malnutrition.

Elevated mortality rates, combined with growing consumer awareness regarding health-oriented products and an increase in chronic diseases, are driving the expansion of the nutraceuticals market in the Asia Pacific region. Major causes of death such as cardiovascular diseases, diabetes, and cancer are contributing to the increased consumption of nutraceuticals in this area.

Numerous government initiatives and non-profit organizations are actively conducting awareness campaigns highlighting the significance of a nutritious diet in disease prevention. These efforts are expected to further propel the growth of the nutraceuticals market in the Asia Pacific during the forecast period.

Asia Pacific Nutraceuticals Market Drivers:

Personalization of Nutrition drives market growth.

The personalized nutrition market is projected to experience significant growth in the coming years. This substantial growth potential is anticipated to benefit the market, particularly for products that offer evidence-based health advantages and clean-labeled characteristics. The sustained expansion of this market is expected to be driven by personalized solutions rather than generic ones. Additionally, there is a growing consumer preference for customized options, including tailored supplements, diets, and exercise plans. Furthermore, nutritional supplements are expected to play a vital role in proactive and predictive health management. These factors are anticipated to contribute to the continued growth of the nutraceuticals market.

Rise in Popularity of Nutrient Enriched Diets to drive the Market Growth

Improvements in healthcare opportunities, reductions in mortality rates, and increasing consumer willingness to invest in health and wellness have contributed to population growth in various regions. This has provided a significant boost to the global nutraceuticals sector. Additionally, shifting consumer preferences towards functional foods and beverages have further enhanced sales performance in the market.

Consumers are increasingly inclined towards concentrated sources of nutrition, with dietary supplements meeting this demand effectively and conveniently. The pandemic has heightened awareness of their role in supporting immune and overall health, leading to substantial market growth prospects in the coming years. For instance, in September 2020, the Indian government launched eight new nutraceutical products as part of the Pradhan Mantri Bhartiya Janaushadhi Pariyojana scheme. These products aim to enhance users' immune systems.

Asia Pacific Nutraceuticals Market Restraints and Challenges:

High Regulatory Stringent Laws hinder Market Growth

Despite the growing demand for nutraceutical products, several factors are impeding market growth. One significant issue is the stringent and intricate regulatory framework governing the commercialization of these products. There is a lack of standardized regulations concerning the composition of nutraceuticals, with varying upper limits and usage conditions for botanicals, botanical preparations, and bioactive substances still awaiting harmonization. Additionally, differing perspectives among various regulatory bodies on permissible ingredients and their quantities further complicate efforts to achieve regulatory consistency.

Asia Pacific Nutraceuticals Market Opportunities:

Technological Advancement to create market opportunities.

Significant investments in research and development are positively influencing production technology and quality within the nutraceutical sector. The industry has swiftly adapted to the rising demand for health-enhancing products, evidenced by the substantial increase in the introduction of new functional beverages and dietary supplements. The widespread use of antibiotics, particularly in over-the-counter medications, has had detrimental effects on health, leading to infections caused by antibiotic-resistant pathogens. This situation underscores the need for nutraceutical products that support a diverse microbiota, thereby promoting enhanced immunity and overall well-being.

Rowing Agricultural Crops for Medical Use creates opportunities.

The legalization of hemp cultivation and cannabinoids in developed regions is prompting nutraceutical manufacturers to introduce cannabis-based products as dietary supplements. Market participants are investing in research and development to validate the efficacy of cannabis as a beneficial ingredient. This focus on strengthening the credibility of cannabis-based nutraceuticals is expected to drive increased adoption in the coming years.

ASIA PACIFIC NUTRACEUTICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

34.68% |

|

Segments Covered |

By Product Type, , Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

Amway, Nestle, Pfizer Inc., The Hain Celestial Group, Inc., The Kraft Heinz Company, General Mills Inc., Nature's Bounty, Tyson Foods, Danone and GlaxoSmithKline plc. |

Asia Pacific Nutraceuticals Market Segmentation:

Asia Pacific Nutraceuticals Market Segmentation- by By Product Type:

- Dietary Supplements

- Functional Foods

- Functional Beverages

The functional beverages segment has captured a leading share of the market, driven by the rising number of health-conscious consumers shifting from sugary drinks to lower-calorie, lower-sugar beverages that offer functional benefits.

In the Asia-Pacific region, there is a growing awareness of health and well-being among consumers, which is boosting the demand for functional foods and beverages. This trend is particularly noticeable among younger consumers, who are increasingly focused on fitness and health, leading them to choose dietary supplements and energy drinks. In response to this demand, market players are introducing new products with unique flavors. For example, in February 2022, Red Bull India launched a new watermelon-flavored energy drink, available through e-commerce platforms such as Amazon, Big Basket, and Flipkart.

The rising health consciousness among consumers is driving the replacement of traditional soft drinks, colas, and sodas with functional beverages. Additionally, the emphasis of major brands on developing low and no-sugar functional foods is expected to reinforce their market position.

Asia Pacific Nutraceuticals Market Segmentation- by By Distribution Channel:

-

Hypermarkets/Supermarkets

- Convenience Stores

- Online Retail

- Others

Online retail marketplaces serve as digital platforms that connect consumers and merchants without requiring physical warehousing of products. These platforms provide various services, including shipping, delivery, and a range of payment options. Factors such as competitive pricing, discounts, shopping convenience, free shipping, and a wide product selection are expected to drive steady growth in the online retail segment.

The supermarkets and hypermarkets segment is projected to experience significant growth during the forecast period. This growth is attributed to the role of these stores as major distributors, given their high consumer trust and reliance for purchasing a wide array of food products, including healthy foods and beverages.

Asia Pacific Nutraceuticals Market Segmentation- by region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific

China leads the nutraceuticals market, with promising growth prospects driven by increasing health and wellness awareness among the urban population and rising disposable incomes. Chinese nutraceuticals often feature natural plant extracts with established effectiveness and safety. The aging population in China, coupled with a rise in age-related diseases such as arthritis and cardiovascular conditions, is contributing to a higher demand for nutraceuticals.

Additionally, the prevalence of lactose intolerance is boosting the consumption of plant-based products. Market players in China are responding by launching new and innovative products to capture consumer interest. For example, in May 2022, Marvelous Foods, a Chinese company specializing in plant-based snacks, launched Yeyo Coconut Yogurt on the e-commerce platform Tmall. Yeyo is a plant-based coconut yogurt that contains no added sugar, artificial flavors, or sweeteners.

Japan ranks as the second-largest producer of nutraceutical products. Japanese consumers are increasingly adopting preventive health measures, leading to a demand for innovative health solutions. Manufacturers in Japan are focusing on developing new and effective health products, with natural and organic nutraceuticals gaining significant consumer attention.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has had a substantial and positive impact on the nutraceutical market. Reports indicate a significant surge in demand for products purported to enhance health and immunity. The widespread recommendations from healthcare professionals to include functional foods and dietary supplements in daily routines to support the immune system have greatly contributed to the increased adoption of these products.

Latest Trends/ Developments:

January 2024: Zingavita, an Indian startup focused on nutraceuticals and supplements, successfully secured approximately USD 1.2 million in its pre-series A funding round.

April 2023: Fonterra, a major dairy producer from New Zealand, introduced functional beverage products under its Anchor and Fernleaf brands to cater to the growing demand for ready-to-drink beverages in South East Asia. The company collaborated with the convenience store chain 7-Eleven to distribute its functional dairy beverages, Actif-Fiber and Anchor-Beaute.

October 2022: Remedy Drinks launched Remedy K! CK, an all-natural clean energy drink, at 7-Eleven stores across Australia. Remedy K! CK is offered in three fruity flavors: blackberry, lemon-lime, and mango pineapple.

July 2022: PureHarvest, an Australian company specializing in organic and natural foods, introduced four new plant-based milk alternatives. The expanded PureHarvest lineup now includes Organic Hazelnut Milk, Organic Cashew Milk, Australian Macadamia Milk, and Creamy Oat Milk, in addition to its existing almond, oat, soy, rice, and coconut milk options.

Key Players:

These are top 10 players in the Asia Pacific Nutraceuticals Market :-

- Amway

- Nestle

- Pfizer Inc.

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company

- General Mills Inc.

- Nature's Bounty

- Tyson Foods

- Danone

- GlaxoSmithKline plc.

Chapter 1. Asia Pacific Nutraceuticals Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Nutraceuticals Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Nutraceuticals Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Nutraceuticals Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Nutraceuticals Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Nutraceuticals Market– By Product Type

6.1. Introduction/Key Findings

6.2. Dietary Supplements

6.3. Functional Foods

6.4. Functional Beverages

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Asia Pacific Nutraceuticals Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Hypermarkets/Supermarkets

7.3. Convenience Stores

7.4. Online Retail

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Asia Pacific Nutraceuticals Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Product Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Nutraceuticals Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Amway

9.2. Nestle

9.3. Pfizer Inc.

9.4. The Hain Celestial Group, Inc.

9.5. The Kraft Heinz Company

9.6. General Mills Inc.

9.7. Nature's Bounty

9.8. Tyson Foods

9.9. Danone

9.10. GlaxoSmithKline plc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Improvements in healthcare opportunities, reductions in mortality rates, and increasing consumer willingness to invest in health and wellness have contributed to population growth in various regions.

The top players operating in the Asia Pacific Nutraceuticals Market are - Amway, Nestle, Pfizer Inc., The Hain Celestial Group, Inc., The Kraft Heinz Company, General Mills Inc., Nature's Bounty, Tyson Foods, Danone and GlaxoSmithKline plc.

The COVID-19 pandemic has had a substantial and positive impact on the nutraceutical market. Reports indicate a significant surge in demand for products purported to enhance health and immunity

Market participants are investing in research and development to validate the efficacy of cannabis as a beneficial ingredient. This focus on strengthening the credibility of cannabis-based nutraceuticals is expected to drive increased adoption in the coming years

Japan ranks as the second-largest producer of nutraceutical products. Japanese consumers are increasingly adopting preventive health measures, leading to a demand for innovative health solutions