Asia Pacific Non-Alcoholic Beverage Market Size (2024-2030)

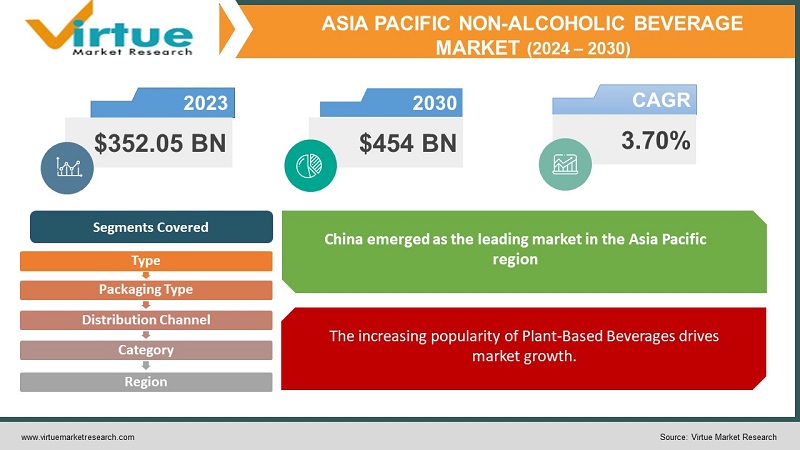

The Asia Pacific Non-Alcoholic Beverage Market was valued at USD 352.05 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 454 billion by 2030, growing at a CAGR of 3.70%.

With the increasing demand for revitalizing beverages and the progression of societal advancements across various human civilizations, the market offers investors a thorough insight into the industry. Manufacturers are incentivized to enhance their production capabilities on a global scale due to reduced trade restrictions and tariff barriers in the international market. In the forthcoming years, numerous opportunities for market expansion are anticipated, driven by the growth of emerging markets and shifts in consumer preferences resulting from the introduction of innovative products.

Key Market Insights:

With the increasing embrace of non-alcoholic and low-alcohol categories by consumers, market manufacturers are adapting to these emerging trends by innovating their existing product ranges, a strategy poised to fuel future expansion. The consequential impact of consumer preference shifting towards non-alcoholic beverages has spurred the emergence of a distinct segment comprising premium, intricately flavored soft drinks tailored to adult tastes.

Asia Pacific Non-Alcoholic Beverage Market Drivers:

The increasing popularity of Plant-Based Beverages drives market growth.

The vegan demographic has experienced substantial growth in recent years, with individuals increasingly adopting a vegan lifestyle due to heightened concerns regarding health and sustainability. As evidenced by the International Food Information Council's 2021 Food and Health Survey, more than 40% of consumers perceive plant-based food and beverages as healthier alternatives to their conventional counterparts, even when ingredient compositions and nutritional profiles are similar. The burgeoning demand for dairy alternatives stems from the expanding influence of veganism and the rising prevalence of lactose intolerance.

In response to this demand, beverage manufacturers are progressively introducing products boasting plant-based attributes. These offerings, such as those featuring oat milk and carrying vegan certification, cater to the evolving preferences of consumers. Notably, Sanitarium, a prominent health and nutrition company based in Australia, has launched UP&GO, a dairy-free, gluten-free, and vegan-friendly breakfast beverage. Formulated with soy milk fortified with protein, fiber, and calcium, this product also boasts a low glycemic index.

The increasing number of product launches within the plant-based beverage category is poised to fuel the demand for non-alcoholic beverages in the foreseeable future.

E-Commerce Platforms to increase market growth.

The beverage industry is anticipated to undergo substantial transformation due to the growing dependence of consumers on the Internet and e-commerce platforms. Forecasts suggest that technological innovations and the rise of virtual shopping habits will exert a notable impact on industry dynamics.

Asia Pacific Non-Alcoholic Beverage Market Restraints and Challenges:

Fluctuations in the Price of Natural Resources to hamper the Supply Chain restrain market growth.

Given the beverage industry's significant reliance on natural resources such as electricity and water, it generates various social and environmental externalities. These include indirect greenhouse gas emissions, diminishing water reservoirs, and escalating pollution levels, which collectively pose disruptions to the availability of natural resources and are expected to impede market production capacity.

Recognizing the potential and risks associated with sustainability challenges, beverage manufacturers collaborated with the alcoholic drinks sector to establish the Beverage Industry Environmental Roundtable (BIER). Leading corporations such as The Coca-Cola Company, PepsiCo, and others have joined forces within the BIER technical coalition to advance sustainability practices throughout the beverage industry.

Asia Pacific Non-Alcoholic Beverage Market Opportunities:

With the expanding acceptance of non-alcoholic and low-alcohol categories among consumers, market manufacturers are proactively adapting to these shifting trends by enhancing their current product offerings. This strategic response is foreseen to propel future expansion. Moreover, the rising consumer consciousness concerning the health advantages linked to consuming bottled water is projected to stimulate demand in this sector. Notably, a preference for bottled water over tap water, particularly among younger demographics, is contributing to heightened product sales. Consequently, several restaurants are diversifying their offerings by providing a variety of bottled water options to meet consumer preferences.

Furthermore, the non-alcoholic beverage industry is being propelled by shifting demographics and evolving drinking habits among younger generations. Millennials and Generation Z, in particular, are demonstrating a preference for moderation and balance, opting for reduced alcohol consumption. This demographic shift has led to the emergence of innovative and diverse non-alcoholic beverage alternatives, ranging from alcohol-free beer and wine to artisanal mocktails, tailored to appeal to a more discerning and sophisticated palate.

ASIA-PACIFIC NON-ALCOHOLIC BEVERAGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.70% |

|

Segments Covered |

By Type, Distribution Channel , Packaging type, category, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China , Japan , India, South Korea , Australia & New Zealand |

|

Key Companies Profiled |

Bolthouse Farms, Inc., Asahi Group Holdings, Ltd., Califia Farms, LLC, Keurig Dr Pepper, Inc., Danone S.A., PepsiCo Inc., Nestlé S.A., SUNTORY HOLDINGS LIMITED, Red Bull, The Coca-Cola Company |

Asia Pacific Non-Alcoholic Beverage Market Segmentation:

Asia Pacific Non-Alcoholic Beverage Market Segmentation By Type:

- Carbonated Soft Drinks

- Juices & Nectars

- Bottled Waters

- Dairy-Based Beverages

- Dairy Alternative Beverages

- RTD Tea and Coffee

- Others

The carbonated soft drinks (CSDs) segment captured a notable market share of 26.8%, totaling US$ 124.82 million. Renowned for their effervescence and wide range of flavors, carbonated soft drinks cater to diverse taste preferences. Their popularity is further bolstered by the convenience and availability of CSDs in various packaging sizes, making them a preferred choice for consumers seeking a quick and satisfying thirst-quencher.

On the other hand, the Juices & Nectars segment is poised to experience significant market growth in the foreseeable future. This growth is driven by increasing awareness and emphasis on health and wellness among consumers. With a rising focus on health-conscious choices, there is a growing demand for beverages offering not only refreshments but also functional benefits. Juices & Nectars, comprising products enriched with vitamins, minerals, antioxidants, and other health-promoting ingredients, align with the contemporary emphasis on preventive healthcare and overall well-being.

Asia Pacific Non-Alcoholic Beverage Market Segmentation By Packaging Type:

- Bottles

- Cartons

- Cans

- Pouches

The bottles segment dominated the market with a significant share of 51.3%, totaling US$ 239.15 million. This dominance can be attributed to the convenience of carrying bottles, as well as their space-saving nature.

Conversely, the cans segment is expected to witness growth during the forecast period. Cans offer environmental benefits compared to bottles, as they are considered less harmful to the environment. This eco-friendly aspect of cans is anticipated to drive their market growth in the coming years.

Asia Pacific Non-Alcoholic Beverage Market Segmentation By Category:

- Sugar-Free

- Conventional

The conventional segment dominated the market, commanding a substantial share of 79.0%, totaling US$ 368.51 million. Traditionally, consumers have favored beverages containing sugar. However, there has been a notable shift in preferences towards sugar-free alternatives, driven by a growing emphasis on healthier lifestyles.

In the forecasted period, the sugar-free segment is anticipated to experience significant growth, reflecting consumers' increasing preference for healthier beverage options. This trend towards sugar-free beverages aligns with the broader societal focus on adopting healthier lifestyles.

Asia Pacific Non-Alcoholic Beverage Market Segmentation By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Others

The supermarkets & hypermarkets segment commanded a significant market share of 50.4%, totaling US$ 234.81 million. These establishments offer a wide array of brands and products under one roof, making them a preferred choice among consumers. Notably, supermarkets and hypermarkets are expanding their offerings in the alcohol-free market, with major players such as Whole Foods, Target, Aldi, and Walmart increasing their selections in this subcategory.

Food service outlets, including restaurants and cafes, incorporate beverages into their menu options to cater to consumer preferences. Additionally, vending machines offer quick and convenient beverage service in public spaces. Companies can strategically position their products to ensure widespread availability and enhance customer convenience, leveraging channels such as convenience stores and college campuses.

Asia Pacific Non-Alcoholic Beverage Market Segmentation- by Region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

China emerged as the leading market in the Asia Pacific region, capturing the largest share. A key factor driving this growth is the rising health consciousness among Chinese consumers. With increasing awareness of the health implications of lifestyle choices, many consumers in China are turning to non-alcoholic beverages as a healthier option compared to traditional sugary and alcoholic drinks. This shift is especially noticeable among the younger demographic, who are actively seeking beverages that complement their preference for a balanced and nutritious diet.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has exerted a significant impact on the growth trajectory of the Non-Alcoholic Beverage Market. Despite the challenges posed by the pandemic, the market is poised for growth as consumers persist in prioritizing health and seeking more enjoyable experiences with beverages. In response to evolving consumer preferences, manufacturers and brands are anticipated to increase investments in research and development initiatives aimed at creating innovative and healthier beverage options. Additionally, there is a growing emphasis on adopting eco-friendly packaging and enhancing production methods to align with sustainability goals and consumer demands.

Latest Trends/ Developments:

- In July 2022, Keurig introduced BLK & Bold K-Cup pods, marking the availability of the largest black-owned coffee brand to over 36 million households using Keurig brewers.

- In February 2022, Nestlé launched a new plant-based version of Milo in Thailand. This Ready-To-Drink (RTD) product, soy-based and infused with Milo's signature malt flavor, offers a nutritious plant-based alternative.

Key Players:

These are the top 10 players in the Asia Pacific Non-Alcoholic Beverage Market: -

- Bolthouse Farms, Inc.

- Asahi Group Holdings, Ltd.

- Califia Farms, LLC

- Keurig Dr Pepper, Inc.

- Danone S.A.

- PepsiCo Inc.

- Nestlé S.A.

- SUNTORY HOLDINGS LIMITED

- Red Bull

- The Coca-Cola Company

Chapter 1. ASIA PACIFIC NON-ALCOHOLIC BEVERAGE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ASIA PACIFIC NON-ALCOHOLIC BEVERAGE MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. ASIA PACIFIC NON-ALCOHOLIC BEVERAGE MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. ASIA PACIFIC NON-ALCOHOLIC BEVERAGE MARK ET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. ASIA PACIFIC NON-ALCOHOLIC BEVERAGE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ASIA PACIFIC NON-ALCOHOLIC BEVERAGE MARKET – By Type

6.1 Introduction/Key Findings

6.2. Carbonated Soft Drinks

6.3. Juices & Nectars

6.4. Bottled Waters

6.5. Dairy-Based Beverages

6.6. Dairy Alternative Beverages

6.7. RTD Tea and Coffee

6.8. Others

6.9 . Y-O-Y Growth trend Analysis By Type

6.10. Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. ASIA PACIFIC NON-ALCOHOLIC BEVERAGE MARKET – By Packaging Type

7.1. Introduction/Key Findings

7.2. Bottles

7.3. Cartons

7.4. Cans

7.5. Pouches

7.6. Y-O-Y Growth trend Analysis By Packaging Type

7.7. Absolute $ Opportunity Analysis By Packaging Type , 2023-2030

Chapter 8. ASIA PACIFIC NON-ALCOHOLIC BEVERAGE MARKET – By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets and Hypermarkets

8.3. Convenience Stores

8.4. Online Retail

8.5. Others

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. ASIA PACIFIC NON-ALCOHOLIC BEVERAGE MARKET –By Category

9.1. Introduction/Key Findings

9.2. Sugar-Free

9.3. Conventional

9.4. Y-O-Y Growth trend Analysis Category

9.5. Absolute $ Opportunity Analysis Category , 2023-2030

Chapter 10. ASIA PACIFIC NON-ALCOHOLIC BEVERAGE MARKET – By Region

10.1. Asia Pacific

10.1.1. By Country

10.1.1.1. China

10.1.1.2. Japan

10.1.1.3. South Korea

10.1.1.4. India

10.1.1.5. Australia & New Zealand

10.1.1.6. Rest of Asia-Pacific

10.1.2. By Distribution Channel

10.1.3. By Packaging Type

10.1.4. By Crop Category

10.1.5. By Type

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. ASIA PACIFIC NON-ALCOHOLIC BEVERAGE MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. Bolthouse Farms, Inc.

11.2. Asahi Group Holdings, Ltd.

11.3. Califia Farms, LLC

11.3. Keurig Dr Pepper, Inc.

11.4. Danone S.A.

11.5. PepsiCo Inc.

11.6. Nestlé S.A.

11.7. SUNTORY HOLDINGS LIMITED

11.8. Red Bull

11.9. The Coca-Cola Company

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The vegan demographic has experienced substantial growth in recent years, with individuals increasingly adopting a vegan lifestyle due to heightened concerns regarding health and sustainability.

The top players operating in the Asia Pacific Non-Alcoholic Beverage Market are - Bolthouse Farms, Inc., Asahi Group Holdings, Ltd., Califia Farms, LLC, Keurig Dr. Pepper, Inc., Danone S.A., PepsiCo Inc., Nestlé S.A., SUNTORY HOLDINGS LIMITED, Red Bull, The Coca-Cola Company.

The COVID-19 pandemic has exerted a significant impact on the growth trajectory of the Non-Alcoholic Beverage Market

With the expanding acceptance of non-alcoholic and low-alcohol categories among consumers, market manufacturers are proactively adapting to these shifting trends by enhancing their current product offerings. This strategic response is foreseen to propel future expansion.

China emerged as the leading market in the Asia Pacific region, capturing the largest share. A key factor driving this growth is the rising health consciousness among Chinese consumers