Asia Pacific Infant Nutrition Market Size (2024-2030)

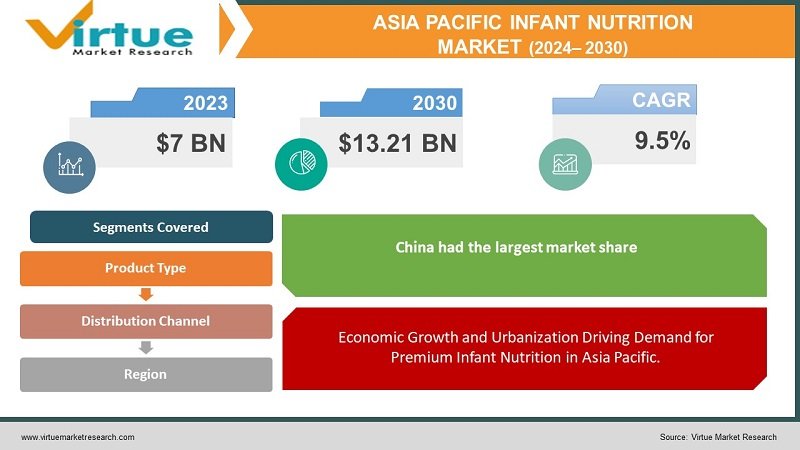

The Asia Pacific Infant Nutrition Market was valued at USD 7 billion in 2023 and is projected to reach a market size of USD 13.21 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 9.5% between 2024 and 2030.

The Asia Pacific infant nutrition market is experiencing significant growth, driven by rising birth rates, increasing disposable incomes, and growing awareness about the importance of early childhood nutrition. This dynamic region, encompassing diverse economies from emerging markets like India and Indonesia to developed nations such as Japan and Australia, presents a unique landscape for the infant nutrition industry. The demand for infant formula, baby food, and dietary supplements is surging, propelled by urbanization, changing lifestyles, and a greater emphasis on health and well-being. Moreover, the expansion of e-commerce and improved healthcare infrastructure are facilitating easier access to high-quality nutritional products. Major players in the market are focusing on innovation, quality enhancement, and strategic partnerships to cater to the diverse preferences and regulatory environments across different countries. As parents become increasingly informed about the nutritional needs of infants, the market is expected to witness robust growth, making the Asia Pacific region a pivotal area of interest for global infant nutrition brands.

Key Market Insights:

Follow-on milk formula likely holds over 40% of the market share due to its convenience and perceived benefits for growing infants.

Rising disposable income and urbanization contribute to over 8% year-over-year growth, leading families to spend more on premium baby food perceived as healthier and more convenient.

Increasing awareness about child health and the rise of working mothers, especially in China and India, create a demand that exceeds 35% of the market for convenient and fortified infant products.

Specialty stores offer expert advice and cater to specific needs, but they likely hold below 20% of the distribution channel market.

The rise of e-commerce and modern retail formats provides convenience and potentially competitive pricing, challenging specialty stores.

Breastfeeding promotion by health organizations may influence the market, but follow-on formula is still expected to remain the leader.

Asia Pacific Infant Nutrition Market Drivers:

Economic Growth and Urbanization Driving Demand for Premium Infant Nutrition in Asia Pacific.

The economic growth in the Asia Pacific region is significantly boosting the infant nutrition market, as rising disposable incomes enable families to invest more in premium baby food products perceived as healthier and more convenient. This financial uplift allows parents to prioritize high-quality nutrition for their infants, leading to a growing preference for premium brands that offer enhanced nutritional value and safety assurances. Concurrently, urbanization is reshaping lifestyles across the region, with more families living in cities and leading increasingly busy lives. The fast-paced urban environment amplifies the need for convenient feeding options, making infant formula and packaged baby food particularly appealing. These products provide a reliable and time-saving alternative for working parents who might otherwise struggle to balance professional commitments with the nutritional needs of their children. As a result, the market for premium infant nutrition is expanding, driven by the dual forces of higher disposable incomes and urban living. This trend underscores the evolving consumer behavior in the region, where health consciousness and convenience are becoming key determinants in purchasing decisions for infant nutrition products.

Growing Awareness and Workforce Participation Boosting Demand for Fortified Infant Nutrition in Asia Pacific.

Increasing awareness about child health and nutrition is prompting parents in the Asia Pacific region to seek out infant formula enriched with added benefits such as probiotics and vitamins. This heightened focus on early childhood development underscores a shift towards prioritizing the long-term well-being of children through enhanced dietary choices. Concurrently, the rise in the number of working women, especially in rapidly developing countries like China and India, is creating a substantial demand for convenient and fortified infant nutrition products. As more women join the workforce, balancing professional responsibilities with childcare becomes a critical concern, driving the need for reliable, high-quality infant formulas that can offer comprehensive nutritional support. These products not only provide essential nutrients but also fit seamlessly into the busy schedules of working mothers, who require practical and efficient feeding solutions. This dual trend of increasing health awareness and growing female workforce participation is significantly shaping the infant nutrition market in the region. It highlights the evolving dynamics of modern parenting, where convenience and nutritional efficacy are paramount in ensuring the healthy growth and development of infants amidst changing societal norms and economic conditions.

Asia Pacific Infant Nutrition Market Restraints and Challenges:

Despite the promising growth prospects, the Asia Pacific infant nutrition market faces several restraints and challenges that could hinder its development. One significant challenge is the stringent regulatory landscape across different countries, which can complicate market entry and product approval processes for manufacturers. Variations in food safety standards, labeling requirements, and import regulations necessitate substantial compliance efforts and can delay product launches. Additionally, the market is highly competitive, with numerous local and international players vying for market share, which pressures companies to continuously innovate and reduce costs. Economic disparities within the region also pose a challenge, as not all consumers can afford premium nutrition products, limiting market penetration in lower-income segments. Furthermore, cultural preferences and traditional feeding practices in certain areas may slow the adoption of modern infant nutrition solutions. Environmental concerns related to the production and packaging of infant formula, along with rising awareness about breastfeeding benefits, add another layer of complexity, potentially reducing demand for formula products. Addressing these challenges requires strategic adaptation, robust regulatory navigation, and sustained efforts to educate consumers about the benefits of scientifically formulated infant nutrition products.

Asia Pacific Infant Nutrition Market Opportunities:

The Asia Pacific infant nutrition market presents substantial opportunities driven by several key factors. One of the foremost opportunities lies in the rapid expansion of e-commerce, which offers an efficient and far-reaching distribution channel for infant nutrition products. Online platforms enable manufacturers to reach a broader audience, including those in remote and underserved areas, thus boosting market penetration. Additionally, the growing trend of health and wellness across the region opens avenues for premium and specialized products, such as organic baby food, hypoallergenic formulas, and products enriched with functional ingredients like probiotics and DHA. The increasing middle-class population, particularly in emerging economies like India and Indonesia, is also fostering demand for higher-quality nutrition options. Innovations in product formulation and packaging can cater to the evolving preferences of health-conscious parents seeking convenience and enhanced nutritional benefits. Moreover, partnerships with healthcare providers and government initiatives promoting child nutrition can further drive market growth. Investments in research and development to create scientifically advanced products tailored to regional dietary preferences and nutritional needs will also be crucial. As awareness about the importance of early childhood nutrition continues to rise, companies that can effectively address these demands while navigating local regulatory landscapes stand to gain significant market share.

ASIA-PACIFIC INFANT NUTRITION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.5% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Australia & New Zealand, Rest of Asia-Pacific |

|

Key Companies Profiled |

Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition Company (a subsidiary of Reckitt Benckiser Group plc), Royal FrieslandCampina N.V., Beingmate Baby & Child Food Co., Ltd., Feihe International Inc., Synutra International, Inc., Morinaga Milk Industry Co., Ltd. Meiji Holdings Co., Ltd. |

Asia Pacific Infant Nutrition Market Segmentation:

Asia Pacific Infant Nutrition Market Segmentation By Product Type:

- follow-on Milk Formula

- Starting Milk Formula

- Special Milk Formula

- Toddlers Milk Formula

The Asia Pacific Infant Market Segmented by Product Type, follow-on Milk Formula had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Working parents and those seeking easier feeding solutions increasingly turn to follow-on formulas after the initial breast milk or standard infant formula stage. These formulas are marketed for their perceived benefits, specifically tailored to meet the nutritional needs of growing infants, which appeals to health-conscious parents aiming to support their child's development. The Asia Pacific region, characterized by its massive and rapidly growing population, particularly in countries like China and India, is witnessing a significant rise in working mothers. This demographic shift fuels the demand for convenient infant feeding options that align with busy lifestyles while ensuring comprehensive nutritional intake for infants. Follow-on formulas offer a practical solution, providing essential nutrients that support the transition from infancy to toddlerhood. As more families embrace dual-income structures, the reliance on these formulas is set to grow, driven by the need for reliable and nutritionally rich alternatives to traditional feeding methods. The expanding middle class and increasing urbanization further amplify this trend, creating a robust market for follow-on formulas. Companies that effectively market these products, highlighting their health benefits and convenience, are well-positioned to capitalize on this burgeoning demand in the Asia Pacific region.

Asia Pacific Infant Nutrition Market Segmentation By Distribution Channel:

- speciality Outlets

- Online

- Supermarkets

- Chemist/pharmacist/Drugstore

The Asia Pacific Infant Market Segmented by Distribution Channel, Speciality Outles had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The Asia Pacific region is witnessing a notable surge in online shopping and the emergence of modern retail formats such as supermarkets and hypermarkets. These channels provide unparalleled convenience, a wider array of product choices, and potentially competitive pricing compared to specialty stores. This trend is particularly pronounced in developing countries within the region, where traditional grocery stores and pharmacies often serve as primary shopping destinations, especially in rural areas where specialty outlets might be scarce. While specialty stores offer personalized service and expert advice, they face significant challenges from the convenience and pricing advantages offered by modern retail channels. Busy parents, in particular, are drawn to the ease of online shopping or the one-stop shopping experience provided by supermarkets, fitting seamlessly into their hectic schedules. Moreover, price sensitivity plays a crucial role, with modern retail outlets engaging in fierce price competition to attract budget-conscious consumers. As a result, specialty stores are compelled to innovate and differentiate themselves to retain their customer base, focusing on unique offerings, expert guidance, and specialized services to remain competitive amidst the evolving retail landscape in the Asia Pacific region.

Asia Pacific Infant Nutrition Market Segmentation By Region:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

The Asia Pacific Infant Market Segmented by Region, China had the largest market share last year and is poised to maintain its dominance throughout the forecast period. China, with its colossal population, particularly composed of numerous young families, represents a prime market for infant products. The nation's economic ascent has facilitated a surge in disposable incomes, empowering parents to allocate more resources towards premium infant necessities, spanning from formula and food to hygiene items. The relaxation of the one-child policy has spurred a notable uptick in birth rates, further fueling the demand for infant products across the country. Additionally, the increasing participation of mothers in the workforce has intensified the need for convenient feeding solutions, such as formula and packaged food, to accommodate their professional obligations while ensuring their children's nutritional needs are met. This convergence of demographic and socio-economic factors underscores the immense potential within China's infant product market, attracting significant attention and investment from both domestic and international companies aiming to capitalize on the vast opportunities presented by this burgeoning segment.

COVID-19 Impact Analysis on the Asia Pacific Infant Market.

The COVID-19 pandemic has exerted profound effects on the Asia Pacific infant market, reshaping consumer behaviors, supply chain dynamics, and market strategies. Lockdown measures and social distancing protocols implemented to curb the spread of the virus disrupted traditional retail channels, leading to a surge in online purchases of infant products. This shift towards e-commerce accelerated existing trends towards digitalization, with parents increasingly relying on online platforms for purchasing essentials such as formula, food, and diapers. Moreover, the economic fallout from the pandemic, including job losses and income uncertainty, prompted some consumers to trade down to more affordable options, impacting sales of premium infant products. Supply chain disruptions, particularly in the early stages of the pandemic, led to sporadic shortages and logistical challenges, highlighting vulnerabilities in the global distribution network. Additionally, heightened health concerns prompted greater scrutiny of product safety and ingredient sourcing, driving demand for trusted and transparent brands. Moving forward, the infant market in the Asia Pacific region is expected to navigate continued uncertainties while capitalizing on opportunities presented by evolving consumer preferences and digital adoption.

Latest trends / Developments:

In the Asia Pacific infant market, several notable trends and developments are shaping the landscape. One prominent trend is the increasing demand for organic and natural infant products, driven by growing health consciousness among parents and concerns over product safety. This trend is particularly pronounced in developed markets like Japan, South Korea, and Australia, where consumers prioritize products free from artificial additives and pesticides. Additionally, there is a rising preference for products fortified with functional ingredients such as probiotics, omega-3 fatty acids, and vitamins, aimed at enhancing infant health and development. Digitalization is also revolutionizing the infant market, with a surge in online sales and the emergence of direct-to-consumer brands offering personalized shopping experiences and subscription services. Moreover, sustainability has become a key focus, with consumers seeking eco-friendly packaging and ethical sourcing practices. As governments in the region intensify regulations on infant nutrition and advertising, companies are increasingly investing in research and development to innovate and differentiate their offerings while complying with evolving standards. These trends underscore a dynamic and evolving market landscape, driven by changing consumer preferences, technological advancements, and regulatory shifts, presenting both challenges and opportunities for stakeholders in the Asia Pacific infant market.

Key Players:

- Nestlé S.A.

- Danone S.A.

- Abbott Laboratories

- Mead Johnson Nutrition Company (a subsidiary of Reckitt Benckiser Group plc)

- Royal FrieslandCampina N.V.

- Beingmate Baby & Child Food Co., Ltd.

- Feihe International Inc.

- Synutra International, Inc.

- Morinaga Milk Industry Co., Ltd.

- Meiji Holdings Co., Ltd.

Chapter 1. Asia Pacific Infant Nutrition Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Infant Nutrition Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Infant Nutrition Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Infant Nutrition Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Infant Nutrition Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Infant Nutrition Market– By Product Type

6.1. Introduction/Key Findings

6.2. follow-on Milk Formula

6.3. Starting Milk Formula

6.4. Special Milk Formula

6.5. Toddlers Milk Formula

6.4. Y-O-Y Growth trend Analysis By Product Type

6.5. Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Asia Pacific Infant Nutrition Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 speciality Outlets

7.3. Online

7.4. Supermarkets

7.5. Chemist/pharmacist/Drugstore

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Asia Pacific Infant Nutrition Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.5.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Product Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Infant Nutrition Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Nestlé

9.2. Danone S.A.

9.3. Abbott Laboratories

9.4. Mead Johnson Nutrition Company (a subsidiary of Reckitt Benckiser Group plc)

9.5. Royal FrieslandCampina N.V.

9.6. Beingmate Baby & Child Food Co., Ltd.

9.7. Feihe International Inc.

9.8. Synutra International, Inc.

9.9. Morinaga Milk Industry Co., Ltd.

9.10. Meiji Holdings Co., Ltd.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

. By 2023, the Asia Pacific Infant market is expected to be valued at US$ 7 billion.

Through 2030, the Asia Pacific Infant market is expected to grow at a CAGR of 9.5%.

By 2030, the Asia Pacific Infant Market is expected to grow to a value of US$ 13.21 billion.

. China is predicted to lead the Asia Pacific Infant market

The Asia Pacific Infant has segments By Product Type, Distribution Channel, and Region.