Asia Pacific Industrial Sugar Market Size (2024-2030)

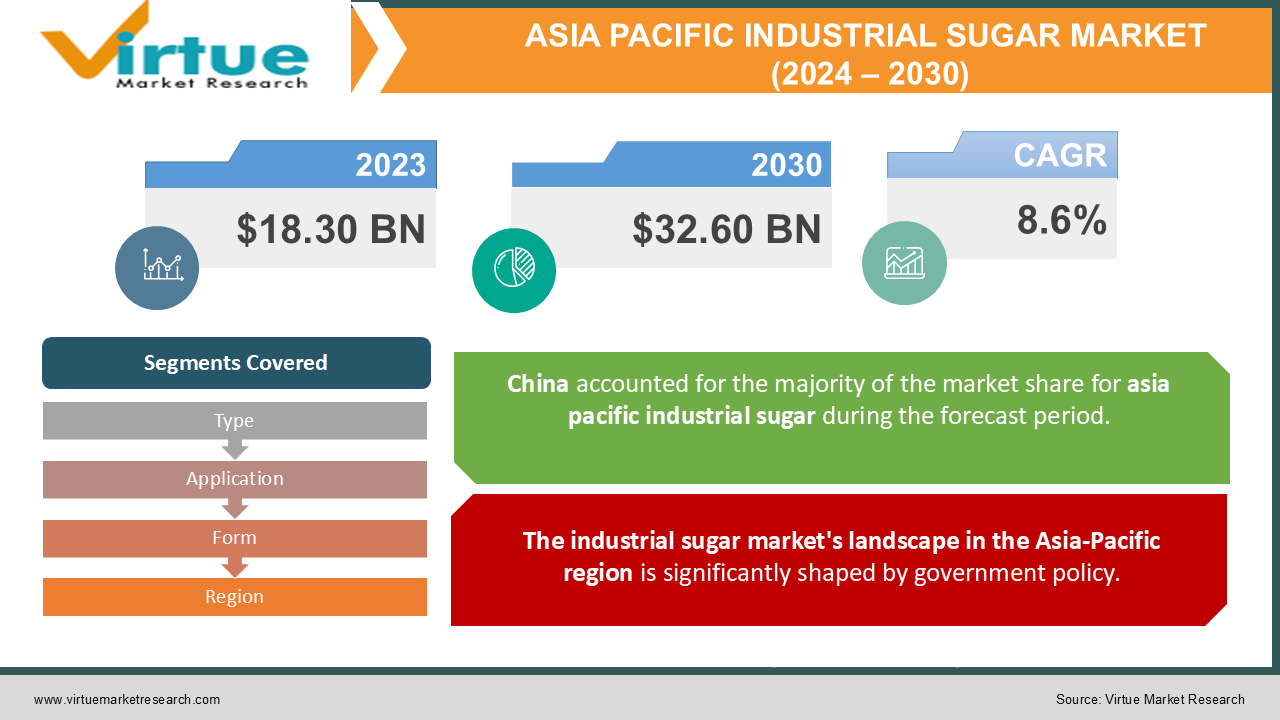

The Asia Pacific Industrial Sugar Market was valued at USD 18.30 billion in 2023 and is projected to reach a market size of USD 32.60 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.6%.

The Asia Pacific area is a significant global center for industrial sugar, with a large consumer base, a developing middle class, and a wide range of uses in sectors including baking, confectionery, and medicines. Australia, China, India, and other major producers all contribute to the supremacy of the region. Although the market is driven by causes such as increasing disposable income, urbanization, and industrial expansion, obstacles such as changes in sugar prices, health concerns, and competition from replacements continue to exist. The forecast for the future is promising, with sustained growth anticipated; nevertheless, industry participants will need to adjust to changing consumer tastes and deal with sustainability issues.

Key Market Insights:

- The Asia Pacific region's economy is expanding quickly, which is driving up disposable income. Increased consumer demand for processed goods and drinks, which account for a sizable portion of the world's sugar consumption. The region's industrial sugar consumption growth rate annually in relation to the world average.

- With their sizable populations and expanding economies, China and India dominate the Asia-Pacific industrial sugar industry. Their ability to produce, consumer trends, and governmental regulations all have a big impact on market dynamics.

- Industrial sugar is used in a variety of industries outside of confectionery. There is fresh growth potential due to the growing demand for biofuels, cosmetics, and medicines.

- Customers are growing more aware of the effects on their health and the environment. In response, the industry is taking steps to encourage sustainable practices and lower the amount of sugar in products. Market share of low-sugar and sugar replacements in the area.

Asia Pacific Industrial Sugar Market Drivers:

Growing disposable income and fast urbanization are combined to provide a powerful development engine for the Asia Pacific industrial sugar industry.

Consumers in nations like China, India, and Southeast Asia are spending more on discretionary goods as their economies grow and their middle classes increase. The need for a greater variety of goods, such as processed meals and beverages that frequently mostly rely on industrial sugar, is fuelled by this increasing purchasing power. Furthermore, a move from a rural to an urban area alters nutritional and lifestyle choices. Convenience foods, such as ready-to-eat meals, snacks, and soft drinks, are often chosen by busy urbanites, and they greatly increase the industrial sugar intake. There is a sizable market for industrial sugar in the area thanks to the combined effects of growing earnings and urbanization.

The industrial sugar market's landscape in the Asia-Pacific region is significantly shaped by government policy.

Subsidies, R&D projects, and infrastructure development are examples of supportive agricultural policies that may greatly increase sugarcane farming and sugar output. These actions provide a steady supply of raw materials for the sector while also improving domestic supply. Favorable trade policies, such as lower tariffs and trade agreements, can also make it easier for industrial sugar to be exported to international markets, extending its market reach and boosting producer profits. The Asia Pacific industrial sugar sector's competitiveness and steady expansion depend on favorable policy conditions.

The Various Uses of Industrial Sugar from Sweetening to Medicines, Cosmetics, and Biofuels

Applications for industrial sugar are not limited to the food and beverage industry; they also include the pharmaceutical, cosmetic, and biofuel industries. It functions as a humectant and exfoliant in cosmetics and as an important excipient in medications. Sugarcane is used by the biofuels sector to produce ethanol. Furthermore, continued research and development are producing novel sugar-based products that broaden the market's potential beyond conventional uses.

The Factors Fuelling the Industrial Sugar Need the Booming Food and Drink Sector

The demand for sugar in the industry is mostly driven by the growing food and beverage sector. Growing consumer demand for processed and ready-to-eat goods that have a longer shelf life and are more convenient means that large amounts of industrial sugar are required. These goods which range from frozen dinners to packaged snacks use sugar as an essential component for flavor, texture, and shelf life. Simultaneously, a major contributor to industrial sugar consumption is the beverage sector, driven by the demand for carbonated drinks, juices, and other liquids sweetened with sugar. The use of processed foods and beverages has increased, which in turn has increased demand for industrial sugar, a necessary component.

Asia Pacific Industrial Sugar Market Restraints and Challenges:

Numerous obstacles confront the industrial sugar sector in Asia Pacific. As customers move towards healthier options, there are substantial obstacles due to growing health consciousness and tougher limitations on sugar content. The market is unstable due to weather-related and geopolitical events price swings and supply chain interruptions. In addition, the rise in popularity of sugar alternatives poses a challenge to the market share of industrial sugar. Finally, the sector is under additional pressure to embrace eco-friendly processes due to environmental concerns and the desire for sustainable practices.

Asia Pacific Industrial Sugar Market Opportunities:

The industrial sugar market in the Asia Pacific is a dynamic environment full of possibilities and challenges. Growth is fuelled by reasons like urbanization, growing disposable income, and the food and beverage sector, but there are other challenges facing the market as well, such as price instability, competition from sugar alternatives, health concerns, and environmental issues. Industry participants need to take a strategic approach to navigating this difficult environment. New development opportunities may be created by extending the uses of industrial sugar outside traditional industries, creating novel and value-added goods, and using e-commerce platforms. Long-term success depends on giving sustainability programs top priority to solve environmental challenges. Furthermore, investigating unexplored markets in the area and cultivating strategic alliances helps improve market penetration.

ASIA PACIFIC INDUSTRIAL SUGAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.6% |

|

Segments Covered |

By Type, application, form, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

ADM (Archer Daniels Midland Company), AMERICAN CRYSTAL SUGAR, American Sugar Refining, Inc., Associated British Foods plc, Bajaj Hindusthan Sugar Ltd., Balrampur Chini Mills Limited, Cargill, Global Organics, Ltd., Lantic Inc., Louis Dreyfus Company |

Asia Pacific Industrial Sugar Market Segmentation:

Asia Pacific Industrial Sugar Market Segmentation: By Type:

- White Sugar

- Brown Sugar

- Liquid Sugar

The three main categories of the Asia Pacific industrial sugar market are liquid, brown, and white sugar. Because of its neutral flavor, white sugar is the most widely used variety; nonetheless, the prevalence of any type varies among nations and end-use sectors. The demand for each kind is influenced by variables such as product uses, production costs, and customer preferences. Precisely identifying the largest and fastest-growing category necessitates a thorough examination taking certain market factors into account.

Asia Pacific Industrial Sugar Market Segmentation: By Form

- Granulated Sugar

- Powdered Sugar

- Syrup

Granulated, powdered, and syrup are the three form categories used to categorize the Asia Pacific industrial sugar market. Granulated sugar usually has a dominant position because of its extensive industry use and adaptability. However, depending on consumer trends, product uses, and geographical preferences, each form's relative dominance may change. The demand for powdered sugar can be influenced by factors like the expansion of the bakery and confectionery sectors, but the syrup segment may see an increase due to the beverage business.

Asia Pacific Industrial Sugar Market Segmentation: By Application

- Food and Beverages

- Pharmaceuticals

- Other Industries

The main consumer category in the Asia Pacific industrial sugar market is food and drinks, with applications accounting for the majority of the market share. This market category includes a broad variety of goods, such as drinks, dairy products, confections, and baked goods. Although industrial sugar is also used by the pharmaceutical and other sectors, its consumption is far lower. Various factors, including customer preferences, regulatory changes, and economic situations, might affect the specific growth rate within each application category.

Asia Pacific Industrial Sugar Market Segmentation: By Region:

|

|

|

|

|

|

The industrial sugar market is dominated by the Asia Pacific area, which includes major players such as China, India, Australia, and New Zealand. These countries make major contributions to consumption as well as production. However, the growth patterns differ throughout the region due to many factors including population increase, economic development, and dietary preferences. Southeast Asian nations are becoming more significant actors because of their developing food and beverage sectors.

COVID-19 Impact Analysis on the Asia Pacific Industrial Sugar Market:

Significant effects of the COVID-19 epidemic were seen in the Asia Pacific industrial sugar market. Early limitations and lockdowns caused demand to fluctuate, with increases in food intake at home and decreases in food service. Price volatility, labor shortages, and supply chain interruptions made matters worse. On the other hand, the pandemic hastened the adoption of e-commerce, and the growing emphasis on fitness and health has raised the demand for substitutes. Even while the short-term consequences were mostly unfavorable, the long-term repercussions need industrial adaptation to the new normal, which includes adjusting to changing customer preferences and creating robust supply networks.

Recent Trends and Developments in the Asia Pacific Industrial Sugar Market:

The industrial sugar market in the Asia-Pacific region is dynamically changing. The growing demand from consumers for organic and functional sugar choices is propelling innovation in product creation. Businesses prioritize sustainability and work to lessen their influence on the environment. Technological developments are increasing the productivity and quality of sugar extraction. Furthermore, industrial processes are being shaped by strict rules pertaining to food safety. Southeast Asian countries are becoming important participants despite China and India's continued dominance because of growing wealth and shifting nutritional preferences. When taken as a whole, these variables alter the market environment and force players in the sector to be flexible and creative.

Key Players:

- ADM (Archer Daniels Midland Company)

- AMERICAN CRYSTAL SUGAR

- American Sugar Refining, Inc.

- Associated British Foods plc

- Bajaj Hindusthan Sugar Ltd.

- Balrampur Chini Mills Limited

- Cargill

- Global Organics, Ltd.

- Lantic Inc.

- Louis Dreyfus Company

Chapter 1. Asia Pacific Industrial Sugar Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Industrial Sugar Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Industrial Sugar Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Industrial Sugar Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Industrial Sugar Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Industrial Sugar Market– By Type

6.1. Introduction/Key Findings

6.2. White Sugar

6.3. Brown Sugar

6.4. Liquid Sugar

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2023-2030

Chapter 7. Asia Pacific Industrial Sugar Market– By Form

7.1. Introduction/Key Findings

7.2. Granulated Sugar

7.3. Powdered Sugar

7.4. Syrup

7.5. Y-O-Y Growth trend Analysis By Form

7.6. Absolute $ Opportunity Analysis By Form , 2023-2030

Chapter 8. Asia Pacific Industrial Sugar Market– By Application

8.1. Introduction/Key Findings

8.2. Food and Beverages

8.3. Pharmaceuticals

8.4. Other Industries

8.5. Y-O-Y Growth trend Analysis Application

8.6. Absolute $ Opportunity Analysis Application , 2023-2030

Chapter 9. Asia Pacific Industrial Sugar Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Application

9.1.3. By Type

9.1.4. By Form

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Industrial Sugar Market– Company Profiles – (Overview, Form Portfolio, Financials, Strategies & Developments)

10.1 ADM (Archer Daniels Midland Company)

10.2. AMERICAN CRYSTAL SUGAR

10.3. American Sugar Refining, Inc.

10.4. Associated British Foods plc

10.5.. Bajaj Hindusthan Sugar Ltd.

10.6. Balrampur Chini Mills Limited

10.7. Cargill

10.8. Global Organics, Ltd.

10.9. Lantic Inc.

10.10. Louis Dreyfus Company

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia Pacific Industrial Sugar Market size will be valued at USD 18.30 billion in 2023.

The worldwide Asia Pacific Industrial Sugar Market growth is estimated to be 8.6 % from 2024 to 2030.

Asia Pacific Industrial Sugar Market segmentation covered in the report By Type (White Sugar, Brown Sugar, Liquid Sugar); By Form (Granulated Sugar, Powdered Sugar, Syrup); By Application (Food and Beverages, Pharmaceuticals, Other Industries) and by region.

The growing demand for processed foods and drinks is expected to propel the expansion of the Asia Pacific industrial sugar market. Future trends influencing the industry will include an emphasis on sustainability, innovation in sugar-based goods, and investigating new uses outside of established industries.

Due to lockdowns and changed consumer behavior, the COVID-19 pandemic initially caused demand swings in the Asia Pacific industrial sugar market. Production and price were further affected by labor shortages and supply chain interruptions.