Asia-Pacific Hydroponics Market Size (2024-2030)

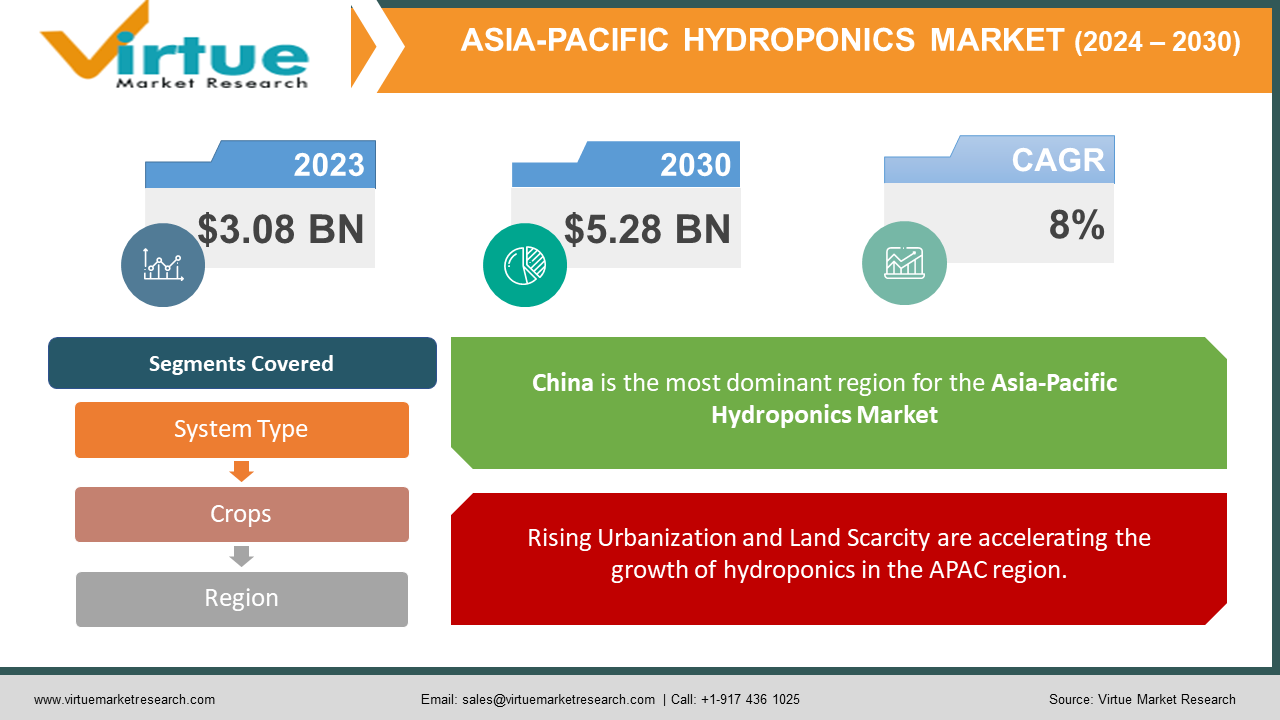

The Asia-Pacific Hydroponics Market was valued at USD 3.08 Billion and is projected to reach a market size of USD 5.28 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8%.

The Asia-Pacific hydroponics market is experiencing significant growth and innovation in the cultivation of crops without traditional soil methods. Factors driving this expansion include the region's burgeoning population, rising urbanization, increasing demand for fresh and locally grown produce, and the need for efficient and sustainable agricultural practices. Countries like China, Japan, Australia, and India are witnessing notable adoption of hydroponic systems in both commercial and small-scale farming ventures. The market offers a wide range of hydroponic systems, including nutrient film technique (NFT), deep water culture (DWC), and vertical farming, to meet the diverse needs of growers. Additionally, advancements in technology, automation, and controlled environment agriculture are further propelling the growth of the hydroponics industry in the Asia-Pacific region.

Key Market Insights:

- The Asia-Pacific indoor farming market is projected to experience robust growth at an annual rate of 14.2% between 2023 and 2032, with a total market size estimated at $125 million.

- Among the different types of indoor farming, the indoor greenhouse segment held the majority share, exceeding 57% of the market in 2021.

- Since hydroponics is an important segment of Vertical farming, the Asia-Pacific market for crops grown through vertical farming is anticipated to witness substantial expansion, increasing from $41.29 million in 2021 to approximately $200.87 million by 2028. This growth is expected to occur at a remarkable CAGR of 25.4% from 2021 to 2028.

- The urban farming market in Asia-Pacific is projected to grow at a CAGR of 6.5% from 2021 to 2028, driven by urbanization and the adoption of innovative farming techniques.

Asia-Pacific Hydroponics Market Drivers:

Rising Urbanization and Land Scarcity are accelerating the growth of hydroponics in the APAC region.

The rapid urbanization in many Asia-Pacific countries has led to increased demand for fresh produce in urban areas, where traditional agriculture may be constrained by limited land availability. Hydroponics offers a space-efficient solution as it can be set up in urban and peri-urban environments, including rooftops and vertical farms. For instance, in densely populated countries like Singapore and Japan, hydroponic farms are becoming increasingly popular to meet urban consumers' demand for locally grown, fresh produce.

A major driver in the Asia-Pacific Hydroponics market is sustainability and water efficiency.

Hydroponics is recognized for its environmentally friendly aspects, including reduced water usage compared to traditional soil-based farming. Many countries in the Asia-Pacific region face water scarcity challenges, making water-efficient farming methods crucial. Hydroponic systems recycle water, using significantly less water than conventional agriculture. This sustainability factor has gained prominence in regions like Australia, where water conservation is a top priority. For example, a hydroponic lettuce farm in Australia, using 95% less water than traditional farming, serves as an exemplar of the water-saving potential of hydroponics, increasing the trend of hydroponics adoption.

Asia-Pacific Hydroponics Market Restraints and Challenges:

Initial Capital Investment could limit the adoption of hydroponics in Asia Pacific.

One major challenge is the high initial capital required to set up hydroponic systems. The cost includes purchasing equipment like grow lights, nutrient delivery systems, temperature and humidity control systems, and greenhouse infrastructure. According to market reports, the initial investment can range from thousands to millions of dollars, depending on the scale and complexity of the operation. This poses a barrier for small-scale farmers and startups, making it difficult for them to enter the hydroponics market.

Lack of Knowledge and Skilled Labor is a hindrance to the hydroponics market growth of the region.

Another challenge is the need for specialized knowledge and skilled labor to operate hydroponic systems effectively. Hydroponics involves precise control of nutrient solutions, monitoring environmental conditions, and disease management, which requires expertise. In many Asia-Pacific countries, there is a shortage of trained hydroponic growers and technicians. Addressing this skill gap through training and education programs is essential for the sustainable growth of the hydroponics industry in the region.

Asia-Pacific Hydroponics Market Opportunities:

The Asia-Pacific hydroponics market presents significant opportunities driven by a growing demand for fresh, locally sourced, and pesticide-free produce, especially in urban areas. The region's increasing population and limited arable land make hydroponics an attractive solution for sustainable agriculture. Additionally, technological advancements, such as automation and smart farming practices, are enhancing efficiency and crop yields. Collaborations between research institutions, governments, and private enterprises are further catalyzing innovation in hydroponics systems and cultivation techniques. As consumers prioritize food safety and sustainability, the Asia-Pacific hydroponics market is well-positioned to meet these demands and continue its expansion in the coming years.

ASIA-PACIFIC HYDROPONICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By System Type, Crops, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Australia & New Zealand, Rest of Asia-Pacific |

|

Key Companies Profiled |

Taiyo Green Power Co., Ltd., Plenty Unlimited, Eco Growing Co., Ltd., Sky Greens, LettUs Grow, East Asia Hydroponics, Flora Limited, Badia Farma, Harvest Gourmet, Top Greenhouses |

Market Segmentation Analysis

Asia-Pacific Hydroponics Market Segmentation: By System Type:

- Aggregate System

- Liquid System

Aggregate systems are the largest segment, having 55% of the market share, attributed to their versatility and suitability for a wide range of crops, including larger plants like tomatoes and peppers. Aggregate systems provide stable support to plant roots and can effectively retain moisture and nutrients, making them attractive for growers aiming to maximize crop yields. Additionally, their relatively lower cost compared to some other hydroponic systems contributes to their popularity, especially among small-scale and hobbyist growers.

Liquid systems are the fastest growing in the Asia-Pacific hydroponics market expanding at a CAGR of 15.6% over the projected period, influenced by factors such as evolving technology, increasing demand for specific crops, and advancements in agricultural practices due to their suitability for certain high-value crops like herbs and leafy greens, as well as their potential for resource efficiency, precise nutrient control, and adaptability to controlled environment agriculture.

Asia-Pacific Hydroponics Market Segmentation: By Crops

- Tomatoes

- Lettuce

- Peppers

- Cucumbers

- Herbs

Tomatoes comprise the largest segment among the various crop types in the Asia-Pacific region, holding over 40% of the market share. Hydroponically grown tomatoes often offer better quality and yield compared to traditional soil-based methods. Tomatoes are well-suited for hydroponic cultivation because they have relatively shallow roots and are responsive to controlled nutrient delivery. This makes them ideal for various hydroponic systems. Hydroponics allows for year-round production of tomatoes, which can be particularly advantageous in regions with seasonal limitations for traditional outdoor farming. Hydroponic systems are more resource-efficient in terms of water usage and nutrient management, which is beneficial for crops like tomatoes that require consistent hydration and nutrition.

Lettuce tends to be the fastest-growing segment, expanding with a notable CAGR of 23% in the projected period. Lettuce has a relatively short growth cycle, making it well-suited for hydroponic cultivation. This allows for multiple harvests throughout the year. Lettuce is a staple in salads and a variety of dishes, contributing to its consistent demand in the market. Hydroponic systems can be highly resource-efficient when growing lettuce, requiring less water and space compared to traditional soil-based methods. Hydroponic cultivation allows for precise control over nutrient delivery and environmental conditions, resulting in high-quality and consistent lettuce crops.

Asia-Pacific Hydroponics Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

China held the largest market share, accounting for over 32% of market revenue in the Asia-Pacific Hydroponics market. China has a large population, and there is a growing demand for fresh and safe agricultural products. Hydroponics allows for efficient, year-round cultivation of a wide variety of crops, meeting the rising demand for high-quality produce. China's rapid urbanization has led to increased interest in urban and peri-urban farming. Hydroponic systems can be set up in controlled environments, making them suitable for urban agriculture where space is limited.

China is not only a large consumer of agricultural products but also a major exporter. Hydroponics can enable consistent, export-quality crop production, making it attractive to both domestic and international markets. China has made significant strides in adopting advanced agricultural technologies, including hydroponics. Hydroponics can be a more environmentally friendly alternative to traditional soil-based farming, addressing concerns about land use, water conservation, and pesticide reduction, which align with China's sustainability goals.

India has emerged as the fastest-growing segment in the Asia-Pacific Hydroponics market due to several factors, growing at an approximate CAGR of 13.5%. India is experiencing rapid urbanization, leading to increased demand for fresh, locally sourced produce in urban areas. Hydroponics offers a solution for cultivating high-quality crops in limited urban spaces, making it appealing to urban consumers and entrepreneurs. India's diverse climate can pose challenges to traditional agriculture, including unpredictable weather patterns and water scarcity. Hydroponics allows for controlled and climate-independent cultivation, reducing the impact of weather-related disruptions.

The Indian government has shown interest in promoting innovative agricultural practices to enhance food security and support small-scale farmers. Various initiatives and subsidies have been introduced to encourage hydroponic farming. India's entrepreneurial spirit has led to the emergence of numerous hydroponic startups and small-scale hydroponic farms. These ventures are driving innovation and raising awareness about hydroponic agriculture. Hydroponically grown crops have the potential to meet export-quality standards, opening up opportunities for Indian growers to tap into international markets.

COVID-19 Impact Analysis on the Asia-Pacific Hydroponics Market:

The Asia-Pacific hydroponics market faced both challenges and opportunities due to the COVID-19 pandemic. While disruptions in the supply chain and restrictions on movement initially impacted the market, the crisis also underscored the importance of localized and resilient food production systems. This led to a surge in interest in hydroponics, as consumers and governments sought secure and sustainable food sources. According to reports, some regions witnessed a 20-30% increase in hydroponic system installations during the pandemic, with a notable rise in home gardening and urban farming initiatives. The crisis accelerated the adoption of hydroponic technology in the region, emphasizing its role in ensuring food security and crop resilience.

Latest Trends/ Developments:

- Companies in the hydroponics market are adopting several trends and strategies to stay competitive and address evolving consumer demands. Many companies are embracing vertical farming techniques and setting up urban farms near consumers. This trend reduces transportation costs, minimizes the carbon footprint, and provides fresh produce to urban populations. Vertical farms maximize space efficiency by stacking layers of crops, often in controlled environment setups, allowing for year-round production.

- Automation and technology integration are becoming key strategies. Companies are implementing IoT (Internet of Things) devices, sensors, and data analytics to monitor and control various parameters such as temperature, humidity, nutrient levels, and lighting. This not only improves crop yields but also reduces labor costs and ensures consistent crop quality. Additionally, some companies are adopting blockchain technology to enhance transparency and traceability in the supply chain, addressing consumers' growing concerns about food safety and origin.

Key Players:

- Taiyo Green Power Co., Ltd.

- Plenty Unlimited

- Eco Growing Co., Ltd.

- Sky Greens

- LettUs Grow

- East Asia Hydroponics

- Flora Limited

- Badia Farma

- Harvest Gourmet

- Top Greenhouses

- In June 2022, the parent company of Sky Greens, Sky Urban Solutions Holding Pte Ltd., signed an agreement with GEM Global Yield LLC SCS to secure a USD 50 million share subscription facility for 36 months after going public. This funding supports Sky Greens' expansion of its micro-farm franchise model worldwide and its goal to become a prominent provider of sustainable solutions.

Chapter 1. Asia-Pacific Hydroponics Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Hydroponics Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Hydroponics Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Hydroponics Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Hydroponics Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Hydroponics Market– By System Type

6.1. Introduction/Key Findings

6.2. Aggregate System

6.3. Liquid System

6.4. Y-O-Y Growth trend Analysis By System Type

6.5. Absolute $ Opportunity Analysis By System Type, 2024-2030

Chapter 7. Asia-Pacific Hydroponics Market– By Crops

7.1. Introduction/Key Findings

7.2. Tomatoes

7.3. Lettuce

7.4. Peppers

7.5. Cucumbers

7.6. Herbs

7.7. Y-O-Y Growth trend Analysis By Crops

7.8. Absolute $ Opportunity Analysis By Crops, 2024-2030

Chapter 8. Asia-Pacific Hydroponics Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By System Types

8.1.3. By Crops

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia-Pacific Hydroponics Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Taiyo Green Power Co., Ltd.

9.2. Plenty Unlimited

9.3. Eco Growing Co., Ltd.

9.4. Sky Greens

9.5. LettUs Grow

9.6. East Asia Hydroponics

9.7. Flora Limited

9.8. Badia Farma

9.9. Harvest Gourmet

9.10. Top Greenhouses

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia-Pacific Hydroponics Market was valued at USD 3.08 Billion and is projected to reach a market size of USD 5.28 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8%.

Rising Urbanization, Land Scarcity, sustainability, and water efficiency are expanding the Asia-Pacific Hydroponics market globally.

Based on the system, the Asia-Pacific Hydroponics market is divided into Aggregate and Liquid.

China is the most dominant region for the Asia-Pacific Hydroponics Market

Taiyo Green Power Co., Ltd., Plenty Unlimited, Eco Growing Co., Ltd., and Sky Greens. are the key players operating in the Asia-Pacific Hydroponics Market.