Asia Pacific Food Grade Alcohol Market Size (2024-2030)

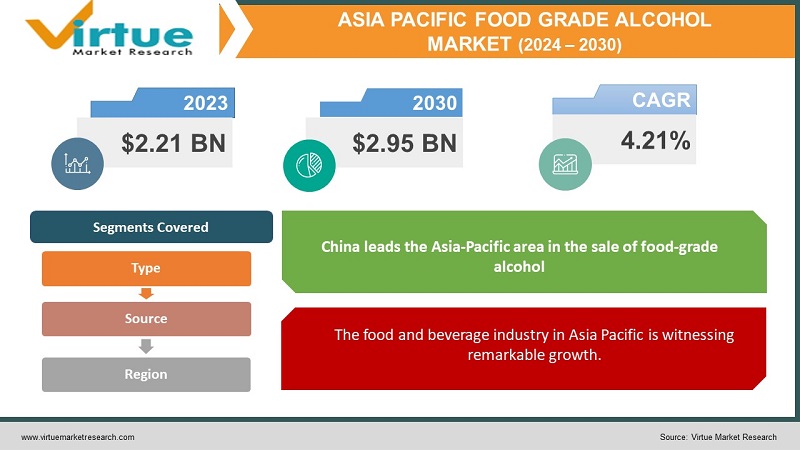

The Asia Pacific Food Grade Alcohol was valued at USD 2.21 Billion in 2023 and is projected to reach a market size of USD 2.95 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.21%.

Due to a combination of social, economic, and cultural factors, the demand for food-grade alcohol is rising across the Asia Pacific region. This market includes several kinds of ethanol and polyols used in personal care, pharmaceuticals, and food and beverage production. Disposable earnings are rising as the economies of the Asia Pacific region grow. Higher-quality food and drinks are in demand as a result of a bigger consumer base with more disposable income, which frequently includes food-grade alcohol for flavouring, textural enhancement, or preservation. The rapid pace of urbanization across the region fosters a shift towards processed and convenient food options. Food-grade alcohol plays a crucial role in the production of these items, ensuring longer shelf life and contributing to their convenience. Additionally, changing lifestyles with busier schedules contribute to the popularity of these convenient food choices.

Key Market Insights:

Ethanol accounts for the dominant share of the market, estimated to be around 75% in 2024. This segment is expected to maintain its lead due to its diverse applications in beverages, food processing, and pharmaceuticals.

The polyols segment, encompassing sugar alcohols like sorbitol and xylitol, is witnessing significant growth, projected to reach a market share of around 12% by 2029, driven by the rising demand for low-calorie and sugar-free products.

The pharmaceutical and personal care sectors are projected to witness a combined market share of around 25% by 2029. The demand for food-grade alcohol in these sectors is driven by the increasing use of alcohol in syrups, sanitizers, and cosmetics.

Rising disposable incomes (projected to reach an average of USD 10,000 per capita across the Asia Pacific by 2028) are leading to increased spending on higher-quality food and beverages, often containing food-grade alcohol.

Urbanization is expected to reach 60% across the region by 2030, fueling the demand for convenient and processed food options that utilize food-grade alcohol for preservation.

The pharmaceuticals segment is estimated to be worth USD 2.1 billion in 2024 and is expected to grow steadily due to rising healthcare expenditure.

Asia Pacific Food Grade Alcohol Market Drivers:

Across the Asia Pacific region, economic growth is leading to a rise in disposable incomes. This translates to a burgeoning consumer class with more money to spend on discretionary items, including higher-quality food and beverages.

Alcoholic drinks with ethanol as a preservative have a longer shelf life and less deterioration. In addition, it is used in processed foods to prevent the formation of mould and germs, extending their shelf life and enhancing safety. A solvent used to extract flavours from different food sources is ethanol. The taste profiles of food and beverage goods are then improved by the use of these flavour extracts. Sugar alcohols, or polyols, are one kind of food-grade alcohol that can be used to change the texture of food products. For instance, they can give low-fat yoghurts and ice creams a silky, creamy mouthfeel. The rise in disposable incomes is accompanied by a shift in lifestyles across the Asia Pacific. Busy schedules and urbanization are fostering a demand for convenient food options. This trend fuels the market for processed and packaged foods that often utilize food-grade alcohol for the reasons mentioned above. Additionally, with growing health concerns, consumers are increasingly opting for low-calorie and sugar-free alternatives. Polyols, a type of sugar alcohol, come into play here as sugar substitutes in these products.

The food and beverage industry in Asia Pacific is witnessing remarkable growth.

The Asia Pacific region boasts a massive and continuously growing population, creating a vast consumer base for food and beverage products. Urbanization fosters a demand for convenient food options. Additionally, with exposure to global trends, consumer preferences in Asia Pacific are evolving. There's a growing interest in new and exciting flavours, which food and beverage companies cater to by using various food-grade alcohol ingredients. Beyond direct applications, food-grade alcohol also plays a crucial role in the fermentation processes used to create various food and beverage products. For instance, ethanol is a byproduct of the fermentation process used to produce yoghurt, kimchi, and other fermented food items. These fermented foods are gaining popularity due to their perceived health benefits and unique flavours.

Asia Pacific Food Grade Alcohol Market Restraints and Challenges:

In order to fulfil compliance standards, new regulations frequently require investments in new technologies and processes. For manufacturers, this may result in higher production costs, which could have an effect on their profitability. More attention is being paid by regulatory agencies to the origin and manufacturing processes of alcohol constituents that are fit for food. Manufacturers are responsible for making sure that their supply chains are transparent and follow safety and sustainability regulations. Manufacturers may have to make tough choices about product pricing or manufacturing costs as a result of abrupt increases in raw material prices, which can reduce their profit margins. Geopolitical tensions or climate-related events can disrupt the supply chain of raw materials, leading to shortages and price hikes. This can impact production schedules and create uncertainty for manufacturers. The unpredictable nature of raw material prices makes it difficult for manufacturers to maintain optimal inventory levels. Overstocking can lead to financial losses if prices fall, while understocking can lead to production disruptions if there's a sudden shortage.

Asia Pacific Food Grade Alcohol Market Opportunities:

Turning agricultural or forestry waste into usable feedstock can reduce reliance on traditional crops and promote circular economy principles. Research into utilising cellulose from plants or algae for ethanol production holds immense promise for a more sustainable future. The rising demand for low-calorie and sugar-free food and beverage products presents a lucrative opportunity for the polyol segment of the market. Polyols offer sweetness with fewer calories compared to traditional sugar, catering to health-conscious consumers and those with diabetes. Polyols can provide bulk and mouthfeel to low-calorie products, mimicking the texture of sugar. Developing more efficient production processes can make polyols a more cost-competitive alternative to sugar. The growing emphasis on healthy living presents a strong opportunity for the polyol segment. Manufacturers who can develop innovative and cost-effective polyol-based products can tap into this growing market segment. Rapidly growing economies with increasing disposable incomes in countries like Vietnam, Thailand, and Indonesia present a promising market for food-grade alcohol in various applications.

ASIA-PACIFIC FOOD GRADE ALCHOHOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

4.21% |

||

|

Segments Covered |

By Type, Source, and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Cargill Incorporated , Wilmar International Limited , Dow Chemical Company , China National Alcohol Group , Chengzhao Liquor Group , Shree Renuka Sugars Ltd , Myriant Corporation , Bio-engineered Foods Inc |

Asia Pacific Food Grade Alcohol Market Segmentation:

Asia Pacific Food Grade Alcohol Market Segmentation: By Type:

- Ethanol

- Polyols

With almost three-quarters of the market, ethanol (75% Market Share) is the dominant product. Also referred to as ethyl alcohol or grain alcohol, ethanol is a widely applicable, reasonably priced, and adaptable solution. Making alcoholic beverages like wine, beer, and distilled spirits is without a doubt the most important use of ethanol. In Asia Pacific, the demand for luxury spirits and craft brews is rising, which is driving up the price of ethanol. Ethanol's antiseptic and disinfectant properties make it valuable in the pharmaceutical industry. It's also used in topical medications and various personal care products like lotions and fragrances.

The fastest-growing segment in the Asia Pacific food-grade alcohol market belongs to polyols, also known as sugar alcohols. Consumers across the Asia Pacific are increasingly prioritizing health and wellness. Polyols offer a compelling alternative to traditional sugar as they have fewer calories and don't cause blood sugar spikes. This makes them ideal for sugar-free and low-calorie food and beverages, catering to health-conscious consumers and those with diabetes. Polyols find use in a wide range of products beyond sugar-free alternatives. They can be used in dietary supplements, pharmaceutical formulations, and even in certain types of sugar-free chewing gum. This versatility broadens their market appeal. Advancements in polyol processing are leading to the development of new types with improved functionality. This includes polyols with a taste profile closer to sugar and those that offer better bulking and texturizing properties in low-calorie products.

Asia Pacific Food Grade Alcohol Market Segmentation: By Source:

- Grains

- Sugarcane

- Fruits

- Others

The grains (Approximately 60%) segment remains the backbone of the market, with corn being the most widely used grain for ethanol production. Other grains like sorghum and wheat can also be utilized, though to a lesser extent. Decades of experience with grain-based ethanol production have resulted in a well-established infrastructure, from efficient cultivation practices to well-developed fermentation processes. Corn is a relatively inexpensive and readily available crop, making it a cost-competitive source for ethanol production compared to some alternatives.

The food-grade alcohol market in the Asia Pacific is expected to develop at the quickest rate in the category that includes sugar alcohol. The increased demand for low-calorie and sugar-free products is the main driver of this expansion. Sugarcane molasses is fermented to make ethanol, which is especially relevant in nations like Brazil, Thailand, and India which have a robust sugarcane industry. This section provides these areas with a good substitute for grain-based production. Polyols find use in a wide range of products, including sugar-free confectionery, diabetic-friendly food and beverages, and dietary supplements. Polyols offer sweetness with fewer calories compared to sugar, while also providing bulk and mouthfeel to low-calorie products.

Asia Pacific Food Grade Alcohol Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

With a sizable market share and tremendous development potential, China leads the Asia-Pacific area in the sale of food-grade alcohol. Because of urbanisation, rising disposable incomes, and the adoption of Western culinary influences, this economic behemoth has witnessed a sharp shift in consumer preferences. Because of its sizable market and growing demand for high-quality food and beverage goods, China has emerged as a viable site for food-grade alcohol producers and suppliers. The demand for food-grade alcohol as an essential component has expanded due to the country's expanding food and beverage industry, which includes baked products, confections, and alcoholic beverages.

In this area, India is the nation with the quickest growth. India's growing population, increasing standard of living, and swift urbanisation have increased the country's need for packaged and processed food and drink items, including those that include food-grade alcohol. Due to shifting lifestyle patterns, the expanding impact of Western culture, and the rising demand for alcoholic beverages and confectionery, the Indian food-grade alcohol market has seen a significant upheaval in recent years. The demand for premium components, such as food-grade alcohol, has increased as more urban homes adopt these goods.

COVID-19 Impact Analysis on the Asia Pacific Food Grade Alcohol Market:

Lockdowns and movement restrictions disrupted the flow of raw materials like corn and sugarcane, impacting ethanol production. Additionally, limitations on transportation hampered the movement of finished products. Strict regulations on on-premises alcohol consumption (bars, restaurants) and a shift towards home consumption led to a decline in demand for certain types of alcoholic beverages, impacting ethanol consumption in this segment. Stockpiling of essential goods and a focus on health and hygiene initially led to a decrease in demand for non-essential products like sugar-free confectionery (using polyols), impacting this segment. The pandemic highlighted the critical role of ethanol as a disinfectant ingredient. This led to a significant increase in demand for ethanol for the production of hand sanitizers, disinfecting wipes, and surface cleaners. Restrictions on physical movement fueled the growth of e-commerce platforms. This provided new avenues for manufacturers to reach consumers directly, particularly for non-alcoholic food and beverage products utilizing polyols.

Latest Trends/ Developments:

Traditional ethanol production using corn or other grains can contribute to land-use change and greenhouse gas emissions. Bio-based ethanol, produced from alternative feedstocks like waste biomass or cellulosic materials, offers a more sustainable solution. Concepts like reusing wastewater or recovering byproducts from the production process are gaining traction. This minimises environmental impact and promotes resource efficiency. Research and development in bio-based technologies and improved fermentation processes are paving the way for a more sustainable future. Developing more efficient production processes for polyols can make them a more competitive alternative to sugar, increasing their market penetration. Applications for polyols are expanding beyond sugar substitutes. They are being explored for use as texturizers and bulking agents in various food and beverage products.

Key Players:

- Cargill Incorporated

- Wilmar International Limited

- Dow Chemical Company

- China National Alcohol Group

- Chengzhao Liquor Group

- Shree Renuka Sugars Ltd

- Myriant Corporation

- Bio-engineered Foods Inc

Chapter 1. Asia Pacific Food Grade Alcohol Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Food Grade Alcohol Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Food Grade Alcohol Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Food Grade Alcohol Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitute

Chapter 5. Asia Pacific Food Grade Alcohol Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Food Grade Alcohol Market– By Type

6.1. Introduction/Key Findings

6.2. Ethanol

6.3. Polyols

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Asia Pacific Food Grade Alcohol Market– By Source

7.1. Introduction/Key Findings

7.2. Grains

7.3. Sugarcane

7.4. Fruits

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Source

7.7. Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 8. Asia Pacific Food Grade Alcohol Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Product

8.1.3. By Source

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Food Grade Alcohol Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cargill Incorporated

9.2. Wilmar International Limited

9.3. Dow Chemical Company

9.4. China National Alcohol Group

9.5. Chengzhao Liquor Group

9.6. Shree Renuka Sugars Ltd

9.7. Myriant Corporation

9.8. Bio-engineered Foods Inc

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

A growing middle class across Asia Pacific translates to increased purchasing power. Consumers are spending more on discretionary items, including food and beverages, pharmaceuticals, and personal care products, all of which utilize food-grade alcohol in various capacities

. The current dependence on corn and other grains for ethanol production can contribute to land-use change, deforestation, and competition with food production

Cargill Incorporated, Wilmar International Limited, Dow Chemical Company

China National Alcohol Group, Chengzhao Liquor Group, Shree Renuka Sugars Ltd

Myriant Corporation, Bio-engineered Foods Inc.

China has firmly established itself as the most dominant player in the Asia-Pacific market, commanding an impressive 40% market share.

India emerges as the fastest-growing country in this sector. India's burgeoning population, rising disposable incomes, and rapid urbanisation have fueled the demand for processed and packaged food and beverage products, including those containing food-grade alcohol.