Asia Pacific Food Flavors Market Size (2024-2030)

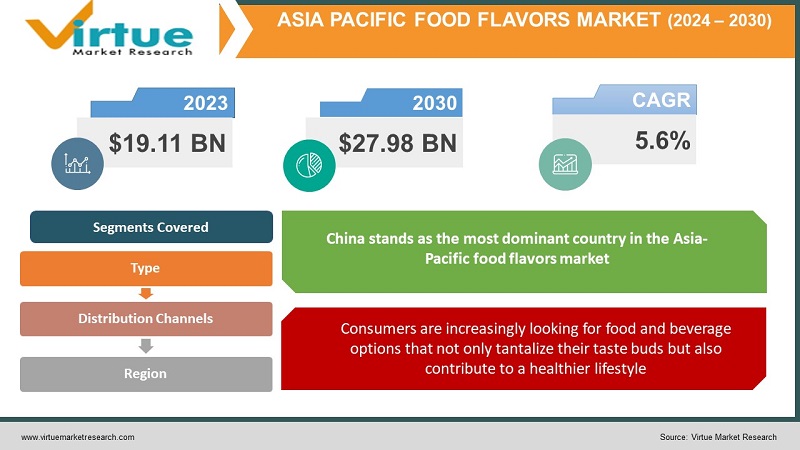

The Asia Pacific Food Flavors Market was valued at USD 19.11 Billion in 2023 and is projected to reach a market size of USD 27.98 Billion by the end of 2030. Over the forecast period of 2024-2030,the market is projected to grow at a CAGR of 5.6%.

The Asia Pacific food flavours market is a vibrant tapestry woven with diverse culinary traditions, innovative ingredients, and ever-evolving consumer preferences. This region, encompassing a vast array of cultures and cuisines, presents a unique landscape for food flavor companies. The Asia Pacific region boasts a rich culinary heritage, with each sub-region possessing distinct flavor profiles. From the fiery chilies of Southeast Asia to the delicate umami broths of East Asia, and the fragrant curries of South Asia, the demand for regional flavors is deeply ingrained. This cultural diversity presents a significant opportunity for food flavor companies to cater to specific taste preferences. As disposable incomes increase across the region, consumers are increasingly seeking out convenience foods and experimenting with new flavors. This creates demand for innovative and flavourful food products. Globalization and increased travel exposure have fueled a desire for international flavors. Consumers are looking for products that offer a taste of different cultures, creating a demand for authentic ethnic flavor profiles.

Key Market Insights:

The plant-based dairy segment is experiencing significant growth, reaching an estimated value of $4.2 billion USD in 2024, representing approximately 24% of the market share.

62% of Asia Pacific consumers report an increase in disposable income in the past year, leading to a willingness to experiment with new and premium food flavors.

78% of Asia Pacific consumers prioritize healthy food options, driving demand for natural and clean-label flavors with reduced sugar and sodium content.

Over 50% of Asia Pacific consumers seek convenient food options due to their busy lifestyles. This fuels the demand for flavourful ready-to-eat meals and snacks.

45% of Asia Pacific consumers report a growing interest in trying international cuisines, creating a demand for authentic ethnic flavor profiles.

Bakery and confectionery account for the largest share (35%) of the market, followed by beverages (28%), and savory snacks (22%).

The demand for natural flavors is expected to reach USD 7.8 billion by 2027, reflecting a consumer preference for clean-label ingredients.

The plant-based food market in Asia Pacific is expected to reach USD 51.4 billion by 2027, creating a significant demand for masking and enhancing flavors in plant-based products.

Online sales of food flavors are projected to grow by 20% annually, with e-commerce platforms offering access to niche flavor profiles and catering to specific dietary needs.

82% of Asia Pacific consumers are willing to pay a premium for sustainable food products, prompting food flavor companies to adopt eco-friendly practices and source ingredients ethically.

Asia Pacific Food Flavors Market Drivers:

The winds of health consciousness are undeniably blowing through the Asia Pacific region. Consumers are increasingly looking for food and beverage options that not only tantalize their taste buds but also contribute to a healthier lifestyle.

Consumers are wary of artificial ingredients and are actively seeking out natural flavor solutions. This creates a demand for food flavor companies to develop flavors using botanical extracts, essential oils, and natural spices. Transparency in labeling is crucial, with consumers seeking clear information about ingredients and their origins. Health concerns surrounding high sugar and sodium intake are leading consumers to prioritize healthier options. Food flavor companies are responding by developing flavor solutions that maintain deliciousness while reducing these ingredients. Techniques like taste modulation and masking allow for a full flavor experience with less sugar and sodium. Food flavor companies that invest in research and development to create innovative natural flavor solutions using botanicals and spices will be well-positioned to cater to the growing demand for clean-label products. Developing and sourcing natural flavors can be more expensive than using artificial ingredients. Food flavor companies need to strike a balance between cost and consumer preferences.

The Asia Pacific consumer is no longer a monolithic entity. Increased disposable income, exposure to diverse cultures through travel and media, and a growing online presence are fostering a desire for personalized experiences and a taste of the world.

Consumers are increasingly seeking food and beverage options that cater to their specific taste preferences and dietary restrictions. This opens doors for customized flavor solutions. Food flavor companies might explore creating flavoring kits that allow consumers to personalize their meals or develop flavor profiles targeted towards specific dietary needs like vegan, gluten-free, or low-carb. The internet and travel have exposed Asia Pacific consumers to a wider range of cuisines than ever before. This fuels a demand for authentic ethnic flavor profiles. Food flavor companies can capitalize on this trend by developing products that capture the essence of specific regional and international cuisines. For example, incorporating the unique spices and herbs of Thai cuisine into a ready-to-eat meal or developing a flavoring system for home cooks to recreate authentic Indian curries. Leveraging data analytics on consumer preferences and online trends can help food flavor companies develop personalized flavor solutions that cater to specific needs and desires.

Asia Pacific Food Flavors Market Restraints and Challenges:

Asia-Pacific governments are progressively enforcing more stringent laws pertaining to food safety and labeling. These laws can be intricate and differ from nation to nation. Food flavor companies must commit substantial resources to remain current and guarantee adherence to these rules in various regions. New product development and smaller competitors' ability to enter the market is hampered by the drawn-out and costly process of getting approvals for novel flavors or components. For a sizable section of consumers in Asia Pacific, cost is still a top issue. Food flavor producers must find a way to create flavors that are both affordable and of the highest caliber. This could entail maximizing production procedures, carefully selecting components, and providing a variety of flavor choices at various pricing points. Consumers are increasingly concerned about the sustainability of food production practices. Food flavor companies need to ensure that their ingredients are sourced ethically and sustainably. This involves partnering with responsible suppliers who prioritize environmental and social well-being.

Asia Pacific Food Flavors Market Opportunities:

Plant-based ingredients can sometimes have a bland or earthy taste. Food flavor companies can develop innovative solutions to mask these off-notes and enhance the overall palatability of plant-based products. This could involve creating flavors that mimic the taste and texture of meat or developing complementary flavors that elevate the inherent qualities of plant-based ingredients. Consumers are increasingly seeking plant-based products that offer additional health benefits. Food flavor companies can develop functional flavors that incorporate ingredients like prebiotics, probiotics, or even essential nutrients like iron or vitamin B12. This can enhance the nutritional profile of plant-based products and cater to health-conscious consumers. Building strong partnerships with plant-based food manufacturers can provide valuable insights into the specific flavor challenges they face. Co-creation of flavor solutions can lead to innovative products that meet consumer needs. Consumers are drawn to plant-based products with recognizable and natural ingredients. Food flavor companies should develop masking and enhancement solutions using natural flavors, botanical extracts, and spices. Developing flavor kits with pre-measured ingredients and accompanying recipes allows home cooks to experiment with new flavors and cuisines without extensive knowledge or ingredient sourcing.

ASIA-PACIFIC FOOD FLAVOURS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Australia & New Zealand, Rest of Asia-Pacifi |

|

Key Companies Profiled |

Archer Daniels Midland (ADM), Cargill, Sensient Technologies, Koninklijke DSM N.V, Kerry Group plc, BASF SE, Firmenich, Symrise AG, IFF (International Flavors & Fragrances Inc.), Ingevity Corporation |

Asia Pacific Food Flavors Market Segmentation:

Asia Pacific Food Flavors Market Segmentation: By Type:

- Natural Flavors

- Artificial Flavors

- Nature-Identical Flavors

Nature-identical flavors currently hold the largest market share in the Asia Pacific region. These flavors are created synthetically but are chemically identical to their natural counterparts. Compared to natural flavors, which can be expensive to source and extract, nature-identical flavors offer a more affordable alternative. Nature-identical flavors offer consistent taste profiles, batch after batch, which is crucial for manufacturers seeking uniformity in their products. Since they are not limited by the availability of natural ingredients, nature-identical flavors can offer a broader range of flavor profiles, catering to diverse consumer preferences.

The demand for natural flavors in the Asia Pacific region is experiencing exponential growth. Consumers are increasingly prioritizing clean-label ingredients and perceive natural flavors as a healthier choice compared to artificial alternatives. Consumers are more aware of ingredients and actively seek products with recognizable and natural components. Natural flavors cater to this desire for transparency. There is a growing market for premium food and beverage products with high-quality ingredients. Natural flavors align with this trend, allowing manufacturers to position their products as superior offerings.

Asia Pacific Food Flavors Market Segmentation: By Distribution Channel:

- Traditional Convenience Stores

- Direct Distribution

- Wholesalers and Distributors

- Foodservice Distributors

- E-commerce Platforms

- Other Channels

Direct distribution, accounting for roughly 25% of the market share, offers food flavor companies greater control over their products and customer relationships. Multinational corporations with extensive in-house production capabilities often purchase food flavors directly from manufacturers. This allows for close collaboration, customization, and quality control throughout the supply chain. Some food flavor companies cater specifically to large manufacturers and establish direct sales teams to forge strong partnerships and meet their unique flavor needs. This approach allows for efficient communication, rapid response times, and potentially higher profit margins for flavor companies. Food flavor companies can maintain stricter control over the brand image and product messaging when interacting directly with customers.

E-commerce platforms, with a projected growth rate exceeding all other channels, are rapidly transforming the distribution landscape. Giant online retailers like Alibaba and JD.com offer food flavor companies access to a vast customer base across the Asia Pacific region. This allows smaller players and niche brands to compete effectively. Food flavor companies can establish their own online stores, offering specialized or customized flavor options directly to home cooks, small businesses, and niche markets. Online platforms overcome geographical limitations and allow companies to reach a broader customer base across the region. Efficient e-commerce operations require robust fulfillment systems and partnerships with reliable delivery companies.

Asia Pacific Food Flavors Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

China stands as the most dominant country in the Asia-Pacific food flavors market, driven by its vast population, rich culinary heritage, and thriving food and beverage industry. China's culinary landscape is deeply rooted in centuries-old traditions, with each region boasting its unique flavors and ingredients. This diversity has fostered a strong demand for authentic and traditional flavors, as well as innovative combinations. As Chinese consumers become more health-conscious and exposed to global trends, there has been a growing demand for natural, organic, and clean-label food flavors, prompting manufacturers to innovate and cater to these preferences.

India is the nation with the fastest rate of growth in the Asia-Pacific food flavors market, thanks to a confluence of economic, cultural, and shifting consumer preferences. Every region and group in India has its own distinct flavors and spice combinations, contributing to the country's rich and varied culinary legacy. Due to this diversity, there is a high desire for classic and authentic flavors as well as for creative pairings. The demand for a broader variety of food flavors is being driven by the middle class's ascent and India's swift urbanization, which has increased disposable income and encouraged people to try new foods. As Indian consumers become more health-conscious and exposed to global trends, there has been a growing demand for natural, organic, and clean-label food flavors, prompting manufacturers to innovate and cater to these preferences.

COVID-19 Impact Analysis on the Asia Pacific Food Flavors Market:

Lockdowns and border restrictions disrupted the flow of raw materials and ingredients essential for food flavor production. This led to shortages, delays, and price fluctuations for key components. The closure of restaurants, hotels, and food service establishments caused a sharp decline in demand for food flavors used in commercially prepared meals. This impacted the segment servicing the food service industry. With limited in-person shopping, consumers turned to online platforms for their food flavor needs. This fueled the growth of e-commerce channels for food flavor companies, particularly for home cooks and small businesses. The pandemic heightened health consciousness, leading to increased demand for food flavors associated with immune-boosting properties or perceived health benefits. This created opportunities for natural flavors with functional ingredients like botanical extracts or vitamins.

Latest Trends/ Developments:

Bringing the vibrant flavors of street food markets from around the world into packaged foods and restaurant menus. This could involve incorporating spices from Vietnamese pho or the smoky notes of Korean barbecue into convenient food options. Partnering with chefs and food trendsetters can provide valuable insights into emerging flavor preferences and inspire innovative flavor creations. Natural plant-based ingredients can sometimes have a bland or earthy taste. Food flavor companies are creating innovative solutions using botanical extracts, spices, and fermentation techniques to mask these off-notes and enhance the overall palatability of plant-based products. Consumers are drawn to plant-based products with recognizable and natural ingredients. Food flavor companies should develop masking and enhancement solutions using natural flavors and botanical extracts. AI algorithms can analyze vast amounts of data on flavor profiles, consumer preferences, and ingredient interactions. This can help optimize existing formulations and identify new flavor combinations.

Key Players:

- Archer Daniels Midland (ADM)

- Cargill

- Sensient Technologies

- Koninklijke DSM N.V

- Kerry Group plc

- BASF SE

- Firmenich

- Symrise AG

- IFF (International Flavors & Fragrances Inc.)

- Ingevity Corporation

Chapter 1. Asia Pacific Food Flavors Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Food Flavors Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Food Flavors Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Food Flavors Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitute

Chapter 5. Asia Pacific Food Flavors Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Food Flavors Market– By Type

6.1. Introduction/Key Findings

6.2. Natural Flavors

6.3. Artificial Flavors

6.4. Nature-Identical Flavors

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Asia Pacific Food Flavors Market– By Distribution channel

7.1. Introduction/Key Findings

7.2. Traditional Convenience Stores

7.3. Direct Distribution

7.4. Wholesalers and Distributors

7.4. Foodservice Distributors

7.5. E-commerce Platforms

7.6. Other Channels

7.7. Y-O-Y Growth trend Analysis By Distribution channel

7.8. Absolute $ Opportunity Analysis By Distribution channel , 2024-2030

Chapter 8. Asia Pacific Food Flavors Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Food Flavors Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland (ADM)

9.2. Cargill

9.3. Sensient Technologies

9.4. Koninklijke DSM N.V

9.5. Kerry Group plc

9.6. BASF SE

9.7. Firmenich

9.8. Symrise AG

9.9. IFF (International Flavors & Fragrances Inc.)

9.10. Ingevity Corporation

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Growing economies across the Asia Pacific region are leading to an increase in disposable income. This allows consumers to spend more on processed and convenient food options, often featuring unique and exciting flavors.

Governments across the Asia Pacific region are implementing stricter regulations concerning food safety and additives. This can create challenges for food flavor companies, requiring them to ensure their products comply with ever-evolving regulations. The cost of reformulating products and navigating complex regulatory processes can be a significant hurdle

Archer Daniels Midland (ADM), Cargill, Sensient Technologies

Koninklijke DSM N.V, Kerry Group plc, BASF SE, Firmenich, Symrise AG

IFF (International Flavors & Fragrances Inc.), Ingevity Corporation

China has firmly established itself as the most dominant player in the Asia-Pacific market, commanding an impressive 40% market share.

India emerges as the fastest-growing country in this sector. India's burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.