Asia Pacific Food Colours Market Size (2024-2030)

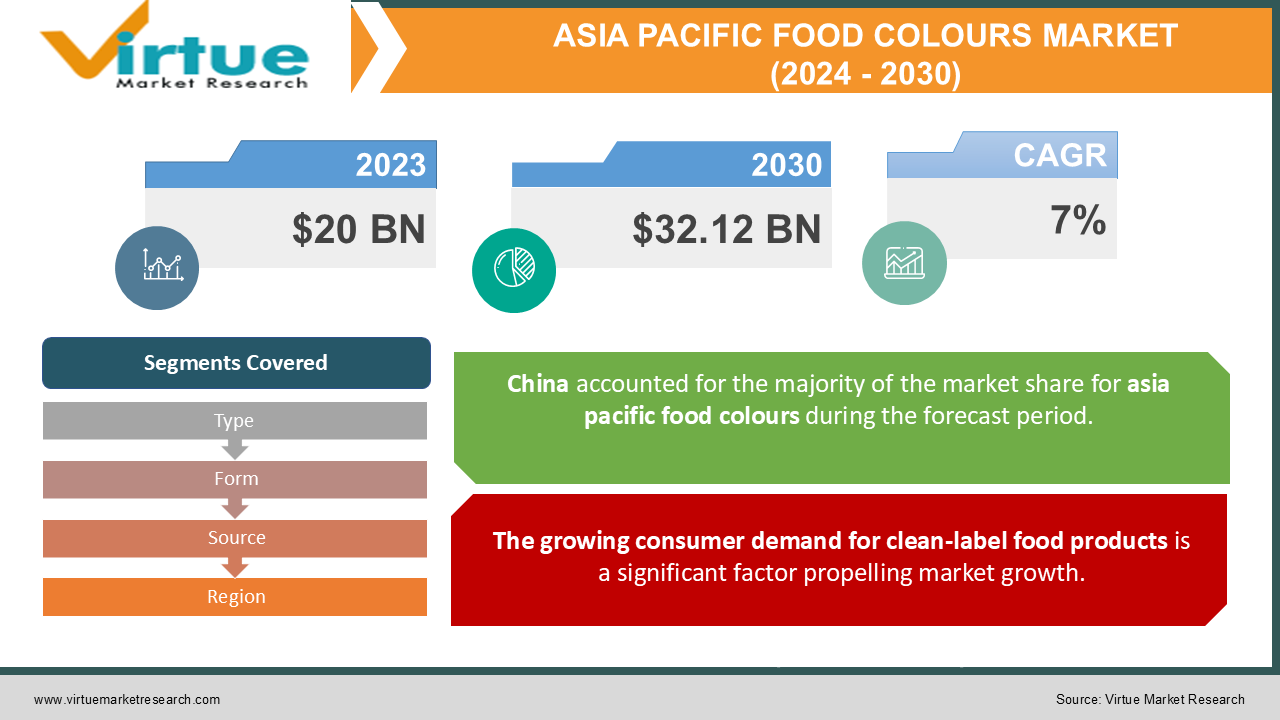

The Asia Pacific Food Colours Market was valued at USD 20 billion in 2023 and is projected to reach a market size of USD 32.12 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 7% between 2024 and 2030.

The Asia Pacific food colors market is experiencing a surge in demand, fueled by a confluence of factors. With a massive and growing population increasingly drawn to visually appealing processed foods and beverages, the need for vibrant colours is on the rise. This trend is particularly strong in countries like China and India, where disposable incomes are rising and urbanization is creating a demand for convenient, colourful food options. While synthetic colours have traditionally held a dominant position, consumer preferences are shifting towards natural alternatives. Growing concerns about the health impacts of artificial additives are propelling the demand for natural colorants derived from fruits, vegetables, and minerals. This presents a significant opportunity for manufacturers who can cater to the growing demand for clean-label products. The Asia Pacific market is expected to witness significant growth in the coming years, driven by a combination of factors like rising disposable incomes, urbanization, and increasing health consciousness. The dominance is projected to shift towards natural colors, creating a dynamic and exciting landscape for food colorant producers.

Key Market Insights:

- Consumers are increasingly opting for natural food colors derived from plants and minerals due to health concerns about synthetic alternatives. Natural colors are estimated to have a 40% market share and are gaining traction.

- Powdered food colors are the most popular choice, holding an estimated 60% market share. They are favored for their ease of storage, handling, and versatility across various food applications.

- China leads the Asia Pacific market with an estimated 50% share. This dominance is attributed to its massive population, growing middle class, and booming food processing industry.

- Regulations in some countries may restrict the use of certain synthetic colors, further boosting the natural food color segment.

- Technological advancements can enhance the performance, affordability, and variety of natural color options, making them more competitive with synthetic alternatives.

- Educational campaigns about the benefits of natural food colors can influence consumer choices and drive the market further towards natural options.

Asia Pacific Food Colours Market Drivers:

Surge in Processed & Packaged Food Demand Fuels Food Color Market in Asia Pacific.

The Asia Pacific region is witnessing a significant surge in demand for processed and packaged foods, driven by rapid urbanization, increasingly busy lifestyles, and rising disposable incomes. As the population in this region continues to grow, there is a notable shift towards convenience foods that cater to the need for quick and easy meal solutions. This evolving consumer preference has led to an escalating reliance on food colors to enhance the visual appeal and attractiveness of these products. Vibrant and appealing food colors play a crucial role in capturing consumer interest and differentiating products in a crowded marketplace. The burgeoning middle class, with its increased purchasing power, seeks out visually appealing foods that align with their modern, fast-paced lifestyles. Consequently, the food color market in Asia Pacific is experiencing robust growth, as manufacturers strive to meet the aesthetic demands of discerning consumers. This trend underscores the broader shift towards convenience and processed foods, reflecting changing dietary habits and lifestyle choices in one of the world's most dynamic and populous regions.

Growing Preference for Natural Ingredients Boosts Demand for Natural Food Colours.

Consumers are increasingly gravitating towards natural ingredients, driven by heightened health consciousness and concerns over the potential risks of synthetic additives. This shift is transforming the food industry, as more people seek out products free from artificial substances. The demand for natural food colors, derived from fruits, vegetables, and minerals, is surging as a result. Health-conscious consumers prefer these natural alternatives due to their perceived safety and nutritional benefits, fostering a market environment ripe for innovation and growth. Producers of natural food colors are seizing this opportunity, leveraging the appeal of cleaner labels and wholesome ingredients. This trend is particularly pronounced among millennials and younger demographics, who prioritize health and transparency in their food choices. Consequently, food manufacturers are reformulating products to incorporate natural colors, aligning with consumer preferences and regulatory pressures for cleaner, more sustainable food production. The move towards natural food colors not only addresses health concerns but also taps into the growing demand for environmentally friendly and ethically sourced ingredients, marking a significant shift in the industry landscape.

Asia Pacific Food Colours Market Restraints and Challenges:

The Asia Pacific food colors market faces several restraints and challenges despite its growth potential. One of the primary challenges is the high cost of natural food colors compared to synthetic alternatives. This price disparity can limit the adoption of natural colors, especially among cost-sensitive manufacturers and consumers. Additionally, the regulatory landscape across various countries in the region is complex and inconsistent, making it difficult for food color producers to navigate compliance requirements effectively. The stringent regulations on food safety and additives further complicate market entry and expansion. Moreover, there is a significant challenge in sourcing consistent, high-quality raw materials for natural colors, which can affect the reliability and scalability of production. Another restraint is the relatively lower stability and shelf life of natural food colors compared to synthetic ones, posing formulation challenges for manufacturers. Consumer skepticism and varying levels of awareness about the benefits of natural colors also hinder market growth. Educating consumers and building trust in natural alternatives require significant marketing efforts. Finally, the competitive landscape, dominated by established players, presents a barrier for new entrants looking to gain a foothold in the market. These challenges necessitate strategic innovation and investment to overcome and leverage the growing demand for natural food colors in the region.

Asia Pacific Food Colours Market Opportunities:

The Asia Pacific food colors market is ripe with opportunities driven by evolving consumer preferences and industry trends. A significant opportunity lies in the growing demand for natural food colors, spurred by increasing health awareness and consumer desire for clean-label products. Manufacturers can capitalize on this trend by developing and promoting natural food colors derived from sustainable sources such as fruits, vegetables, and minerals. The rising popularity of plant-based and organic foods also fuels the need for natural additives, opening new avenues for innovation and product differentiation. Additionally, the expanding middle-class population with higher disposable incomes is willing to pay a premium for quality and health benefits, creating a lucrative market segment. Technological advancements in food processing and color extraction techniques present further opportunities to enhance the stability and vibrancy of natural colors, making them more competitive with synthetic options. The region's diverse culinary traditions and booming food and beverage industry, particularly in countries like China, India, and Japan, provide a vast market for tailored color solutions. Collaborations and partnerships with local food manufacturers and distributors can help in navigating regulatory complexities and expanding market reach. Overall, the shift towards healthier, sustainable food choices positions the Asia Pacific food colors market for robust growth and innovation.

ASIA-APCIFIC FOOD COLOURS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

7% |

||

|

Segments Covered |

By Type, Form, source, and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Sensient Technologies Corporation, Givaudan (Naturex), Archer Daniels Midland Company (ADM), Symrise AG, Koninklijke DSM N.V., DIC Corporation, DDW The Color House, BASF SE, FMC Corporation (Colorcon), San-Ei Gen F.F.I., Inc., Roha Dyechem Pvt. Ltd., Kalsec Inc. |

Asia Pacific Food Colours Market Segmentation:

Asia Pacific Food Colours Market Segmentation By Type:

- Natural

- Synthetic

- Nature-identical

The Asia Pacific Food Colours Market Segmented by Type, Natural had the largest market share last year and is poised to maintain its dominance throughout the forecast period. In the Asia Pacific region, especially in developed nations like Japan and Australia, there is a growing consumer concern about the health impacts of artificial ingredients, driving a preference for natural food colors derived from plants and minerals. Regulatory measures in some countries further bolster the natural segment by restricting the use of certain synthetic colors. However, the transition to natural colors is nuanced. Synthetic colors are generally cheaper to produce, which is a significant factor in price-sensitive markets such as those in Southeast Asia. Additionally, synthetic colors often offer a broader range of vibrant hues and better stability, which can be crucial for manufacturers. Thus, while natural colors are gaining traction, the shift is likely to be gradual. Synthetic colors may continue to hold a substantial market share in the near term, particularly in cost-sensitive areas. Nonetheless, the trend clearly favors natural colors, which are expected to capture a larger market share over time. This shift will be accelerated by technological advancements that improve the performance and affordability of natural colors, along with consumer education and awareness campaigns highlighting their benefits. These factors collectively indicate a promising future for natural food colors in the Asia Pacific market.

Asia Pacific Food Colours Market Segmentation By Form:

- Powder

- Liquid

- Gel & Paste

The Asia Pacific Food Colours Market Segmented by Form, Powder had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Powdered food colors are emerging as the preferred choice in the Asia Pacific market due to their cost-effectiveness, ease of use, and versatility. These powders are generally lighter and more compact than liquids, gels, or pastes, making storage and transportation more economical—an essential advantage in a region characterized by diverse geography and logistical challenges. Additionally, powdered food colors can be precisely weighed and measured, facilitating accurate dosing for various food and beverage applications. They are also less expensive to produce compared to other forms that require additional processing and preservation. However, the choice of food color form can depend on specific application needs; for instance, liquids are easier to disperse in beverages, while gels or pastes might offer superior heat stability for baking. Despite these nuances, powdered food colors are likely to maintain their dominance due to their overall practicality. The rise of automated food processing systems might also favor powders for their ease of integration. Furthermore, consumer preference for clean-label products with minimal processing may influence the demand for certain forms. Considering these factors provides a comprehensive understanding of the evolving market for food color forms in the Asia Pacific region, where powdered forms are set to lead.

Asia Pacific Food Colours Market Segmentation By Source:

- Plants

- Animals & Insects

- Microorganisms

- Petroleum

The Asia Pacific Food Colours Market Segmented by Source, Plants had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Consumers in the Asia Pacific region, particularly in developed areas, are increasingly health-conscious and prefer natural ingredients, making plant-based colors attractive as perceived safer and healthier alternatives to synthetic options. Regulatory measures in some countries restrict certain synthetic colors, further boosting demand for plant-based alternatives. Despite the strong trend towards natural colors, the transition is nuanced. Synthetic colors are generally cheaper to produce, an important consideration in price-sensitive markets. They also offer a wider range of vibrant hues and better stability, which manufacturers value for consistent and intense coloring. While the variety of plant-based colors is expanding, it may not yet fully match synthetic options. Therefore, synthetic colors might still hold a significant market share in the near term, especially for specific applications where performance is crucial. However, technological advancements are improving the performance, affordability, and variety of plant-based colors. Consumer education and awareness campaigns highlight their benefits, aligning with the clean-label product trend. Evolving regulations encouraging natural alternatives further support this shift. Collectively, these factors indicate that while synthetic colors remain significant, the market share of plant-based colors is likely to grow substantially over the forecast period, potentially achieving dominance as preferences and technologies evolve.

Asia Pacific Food Colours Market Segmentation By Region:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

The Segmented by Region, China had the largest market share last year and is poised to maintain its dominance throughout the forecast period. China, with the world's largest population and a rapidly growing middle class, represents a significant and expanding consumer base for processed and packaged foods that heavily rely on food colors. Rising disposable incomes are driving Chinese consumers towards visually appealing and convenient food options, thereby increasing the demand for food colors. The country's food processing industry is undergoing rapid growth and modernization, creating a robust demand for various food colorants to cater to diverse applications. Government regulations, which sometimes restrict the use of certain synthetic colors, indirectly benefit the growing segment of natural food colors. Additionally, rapid urbanization in China is leading to busier lifestyles, further boosting the demand for convenient, processed foods that often depend on food colors for visual appeal. While China is poised to maintain its dominance in the Asia Pacific food colors market, the growth in other regional economies, such as India and Southeast Asian countries, could lead to a more balanced market share in the future. These regions are also experiencing significant growth in their food processing sectors, which may diversify the market dynamics over time. Nonetheless, China's massive population, economic growth, and expanding food industry strongly position it as a key player in the regional market.

COVID-19 Impact Analysis on the Asia Pacific Food Colours Market.

The COVID-19 pandemic has had a profound impact on the Asia Pacific food colors market, leading to both challenges and opportunities. Initially, the pandemic disrupted supply chains, causing delays in the production and distribution of food colors due to lockdowns and restrictions. Many food processing facilities faced operational challenges, leading to decreased production capacities. However, the pandemic also accelerated changes in consumer behavior, with a heightened focus on health and wellness driving demand for natural food colors. The increased consumption of processed and packaged foods during lockdowns, as consumers sought convenience and shelf-stable products, further bolstered the market. E-commerce growth surged, providing a new channel for food color manufacturers to reach consumers directly. Additionally, the emphasis on clean-label products and transparency in ingredients became more pronounced, benefiting the natural food color segment. Despite the initial disruptions, the market showed resilience as companies adapted by enhancing their supply chain logistics and investing in local production capabilities to mitigate future risks. Overall, while the pandemic posed significant challenges, it also accelerated trends that favor the long-term growth of the food colors market in the Asia Pacific region, particularly for natural and health-oriented products.

Latest trends / Developments:

The latest trends and developments in the Asia Pacific food colours market reflect a growing emphasis on natural and clean-label products, driven by increasing health consciousness among consumers. Natural food colors derived from fruits, vegetables, and other plant sources are gaining traction as consumers seek healthier alternatives to synthetic additives. This shift is supported by regulatory measures in some countries that restrict the use of certain synthetic colors, further boosting the demand for natural options. Additionally, technological advancements in processing natural colors have improved their performance, making them more competitive with synthetic alternatives. Furthermore, there is a rising demand for exotic and visually appealing colors to enhance the sensory experience of food and beverage products, particularly in the growing middle-class segments of countries like China and India. Manufacturers are also exploring innovative applications of food colors, such as color-changing or interactive products, to captivate consumers' interest. Moreover, the COVID-19 pandemic has accelerated the adoption of e-commerce channels, providing new opportunities for food color suppliers to reach a wider audience directly. Overall, the Asia Pacific food colors market is witnessing a dynamic shift towards natural, diverse, and technologically advanced solutions that cater to evolving consumer preferences and regulatory landscapes.

Key Players:

- Sensient Technologies Corporation

- Givaudan (Naturex)

- Archer Daniels Midland Company (ADM)

- Symrise AG

- Koninklijke DSM N.V.

- DIC Corporation

- DDW The Color House

- BASF SE

- FMC Corporation (Colorcon)

- San-Ei Gen F.F.I., Inc.

- Roha Dyechem Pvt. Ltd.

- Kalsec Inc.

Chapter 1. Asia Pacific Food Colours Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Food Colours Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Food Colours Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Food Colours Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Food Colours Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Food Colours Market– By Form

6.1. Introduction/Key Findings

6.2. Powder

6.3. Liquid

6.4. Gel & Paste

6.5. Y-O-Y Growth trend Analysis By Form

6.6. Absolute $ Opportunity Analysis By Form , 2023-2030

Chapter 7. Asia Pacific Food Colours Market– By Types

7.1. Introduction/Key Findings

7.2. Natural

7.3. Synthetic

7.4. Nature-identical

7.5. Y-O-Y Growth trend Analysis By Types

7.6. Absolute $ Opportunity Analysis By Types , 2023-2030

Chapter 8. Asia Pacific Food Colours Market– By Source

8.1. Introduction/Key Findings

8.2. Plants

8.3. Animals & Insects

8.4. Microorganisms

8.5. Petroleum

8.6. Y-O-Y Growth trend Analysis Source

8.7. Absolute $ Opportunity Analysis Source , 2023-2030

Chapter 9. Asia Pacific Food Colours Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Form

9.1.3. By Types

9.1.4. By Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Food Colours Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Sensient Technologies Corporation

10.2. Givaudan (Naturex)

10.3. Archer Daniels Midland Company (ADM)

10.4. Symrise AG

10.5. Koninklijke DSM N.V.

10.6. DIC Corporation

10.7. DDW The Color House

10.8. BASF SE

10.9. FMC Corporation (Colorcon)

10.10. San-Ei Gen F.F.I., Inc.

10.11. Roha Dyechem Pvt. Ltd.

10.12. Kalsec Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

By 2023, the Asia Pacific Food Colours market is expected to be valued at US$ 20 billion.

Through 2030, the Asia Pacific Food Colours market is expected to grow at a CAGR of 7%.

By 2030, the Asia Pacific Food Colours Market expected to grow to a value of US$ 32.12 billion

. China is predicted to lead the Asia Pacific Food Colours market.

The Asia Pacific Food Colours has segments like By Type, Source, Form and Region.