Asia Pacific Fire-Rated Glass Ceramic Market Size (2024-2030)

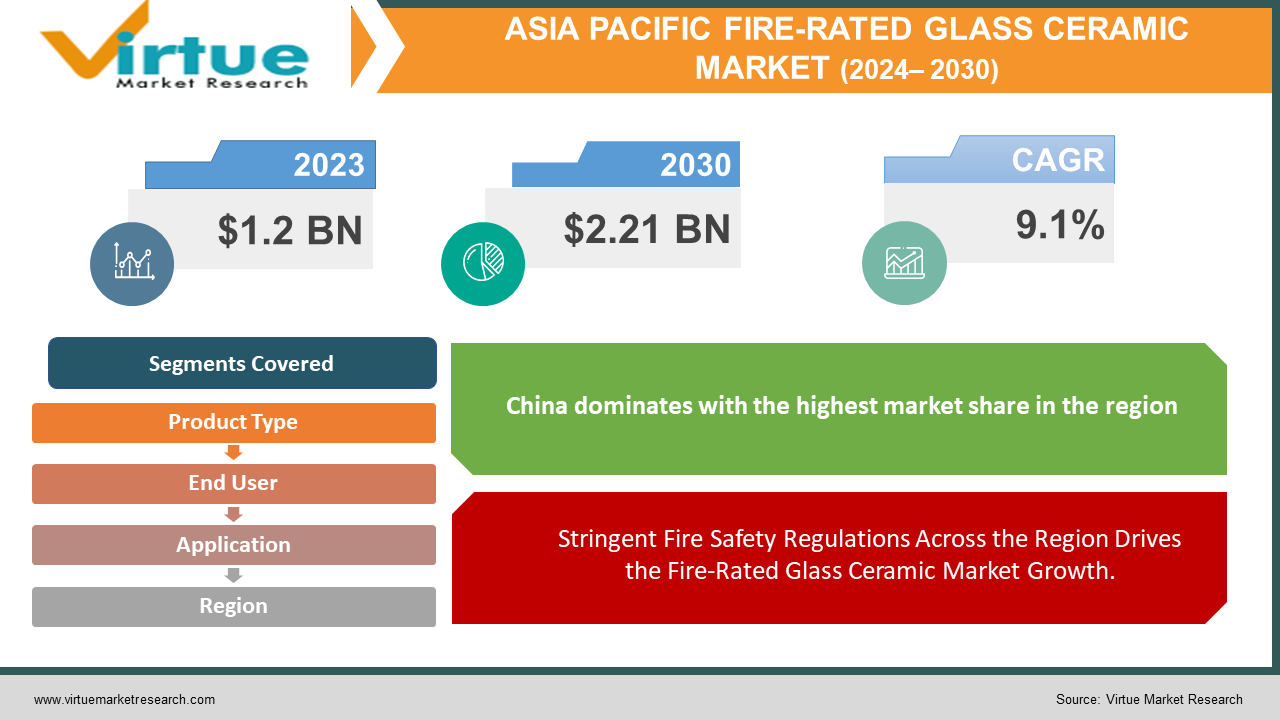

The Asia Pacific Fire-Rated Glass Ceramic Market was valued at USD 1.2 billion in 2023 and is projected to reach a market size of USD 2.21 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 9.1% between 2024 and 2030.

The Asia Pacific Fire-Rated Glass Ceramic Market is witnessing significant growth, driven by increasing safety regulations and a rising emphasis on fire protection across various industries. Fire-rated glass ceramic, known for its superior fire-resistant properties, plays a critical role in safeguarding buildings and infrastructure in the event of a fire. This material is particularly valued in sectors such as construction, automotive, and aerospace, where stringent safety standards are paramount. The region's rapid urbanization, coupled with expanding industrial activities, has further amplified the demand for fire-rated glass ceramics, as governments and businesses prioritize safety and compliance with evolving building codes. Additionally, advancements in manufacturing technologies have enhanced the performance and affordability of fire-rated glass ceramic, making it more accessible for widespread use. As key players in the Asia Pacific market continue to innovate and develop new products, the market is poised for robust growth, with increasing adoption across residential, commercial, and industrial applications. However, challenges such as the high cost of raw materials and the complexity of installation may impact market dynamics. Overall, the Asia Pacific Fire-Rated Glass Ceramic Market is on a strong growth trajectory, driven by the region's commitment to safety and technological advancements.

Key Market Insights:

- China holds approximately 40% of the total market share in the Asia Pacific Fire-Rated Glass Ceramic Market.

- The construction industry drives nearly 50% of the market demand for fire-rated glass ceramic in the region.

- Stricter fire safety regulations have resulted in a 25% rise in the adoption of fire-rated glass ceramic over the past five years.

- Technological advancements have reduced production costs by 15%, making fire-rated glass ceramic more accessible.

- The automotive industry contributes about 20% to the fire-rated glass ceramic market in Asia Pacific.

- The market is projected to grow at a CAGR of 8% over the next five years, driven by increased safety awareness and infrastructure development.

Asia Pacific Fire-Rated Glass Ceramic Market Drivers:

Stringent Fire Safety Regulations Across the Region Drives the Fire-Rated Glass Ceramic Market Growth.

One of the primary drivers of the Asia Pacific Fire-Rated Glass Ceramic Market is the implementation of stringent fire safety regulations across the region. As urbanization accelerates and the density of residential, commercial, and industrial spaces increases, the need for enhanced fire safety measures has become paramount. Governments in the Asia Pacific region are enforcing stricter building codes and safety standards, mandating the use of fire-resistant materials in construction projects. This includes the requirement for fire-rated glass ceramics in windows, doors, and partitions to prevent the spread of fire and protect occupants. These regulations are particularly stringent in countries like China, Japan, and Australia, where urban centers are expanding rapidly, and the risk of fire incidents is heightened. The enforcement of these regulations has led to a significant rise in demand for fire-rated glass ceramics, as builders and developers seek to comply with legal requirements while ensuring the safety of their structures. This trend is expected to continue as governments further tighten safety norms, driving sustained growth in the market.

Rapid Infrastructure Development Revolutionizing the Market Growth.

The rapid pace of infrastructure development in the Asia Pacific region is another crucial driver of the Fire-Rated Glass Ceramic Market. With ongoing urbanization, there is an unprecedented demand for new buildings, transportation hubs, and industrial facilities. Countries like China, India, and Southeast Asian nations are investing heavily in expanding their infrastructure to support economic growth and accommodate increasing populations. This surge in construction activities has created a significant need for advanced building materials that can ensure safety and durability. Fire-rated glass ceramics, known for their high resistance to heat and ability to contain fire, have become essential components in modern construction, particularly in high-rise buildings, airports, and large commercial complexes. The use of these materials is not only driven by regulatory requirements but also by the growing awareness among developers and architects of the importance of fire safety in safeguarding lives and assets. As infrastructure projects continue to proliferate across the region, the demand for fire-rated glass ceramics is expected to rise, making it a critical market driver in the Asia Pacific.

Asia Pacific Fire-Rated Glass Ceramic Market Restraints and Challenges:

The Asia Pacific Fire-Rated Glass Ceramic Market faces several restraints and challenges that could impact its growth trajectory. One of the primary challenges is the high cost of production and installation of fire-rated glass ceramics. The manufacturing process involves sophisticated technology and the use of premium raw materials, making the end product relatively expensive compared to traditional glass alternatives. This cost factor can be a deterrent, particularly in price-sensitive markets within the Asia Pacific region, where cost considerations often take precedence over safety features. Additionally, the complexity of installing fire-rated glass ceramics, which requires specialized skills and adherence to strict safety standards, can further escalate costs and limit their widespread adoption. Another significant challenge is the growing environmental and sustainability concerns associated with the production processes, which are energy-intensive and may not align with the increasing global focus on reducing carbon footprints. Moreover, the lack of awareness and understanding of the long-term benefits of fire-rated glass ceramics in some emerging markets within the region can hinder market penetration. As a result, these factors collectively pose challenges to the growth of the Asia Pacific Fire-Rated Glass Ceramic Market, despite the increasing demand driven by safety regulations and infrastructure development.

Asia Pacific Fire-Rated Glass Ceramic Market Opportunities:

The Asia Pacific Fire-Rated Glass Ceramic Market presents several compelling opportunities, driven by advancements in technology and the region's growing focus on safety and sustainability. One significant opportunity lies in the rising demand for energy-efficient and environmentally friendly building materials. As countries across the Asia Pacific region commit to reducing carbon emissions and enhancing energy efficiency, fire-rated glass ceramics, which offer both fire resistance and energy-saving properties, are poised to gain traction. Innovations in manufacturing processes, such as the development of thinner, lighter, and more cost-effective fire-rated glass ceramics, also open up new market segments, including residential buildings and smaller commercial projects that previously may have avoided these materials due to cost constraints. Additionally, the growing awareness of the importance of fire safety in emerging markets within the region offers a substantial opportunity for market expansion. As governments and industries in countries like India, Vietnam, and Indonesia invest in infrastructure and update building codes, the demand for advanced fire-rated materials is expected to surge. Moreover, the integration of fire-rated glass ceramics in green building certifications and smart city projects presents a lucrative avenue for growth, aligning with the broader trend of sustainable urban development in the Asia Pacific region.

ASIA PACIFIC FIRE-RATED GLASS CERAMIC MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.1% |

|

Segments Covered |

By Product Type, application, end use industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

Saint-Gobain, AGC Inc. Schott AG, NSG Group, Jiangxi Hongyu New Materials Co., Ltd. FireGlass, Glassformance, Pyroguard, Alufire, SIS |

Asia Pacific Fire-Rated Glass Ceramic Market Segmentation:

Asia Pacific Fire-Rated Glass Ceramic Market Segmentation By Product Type:

- Wired Glass

- Ceramic Glass

- Laminated Glass

- Tempered Glass

Wired Glass is poised to maintain its dominance throughout the forecast period. Wired glass has faced declining popularity due to several safety concerns and performance limitations. The presence of wire mesh within wired glass poses a significant risk of severe injuries in case of breakage, as the shards can cause dangerous lacerations. This safety issue has prompted a shift towards alternative materials. Additionally, wired glass provides limited fire resistance compared to advanced technologies like ceramic and laminated glass, which offer superior performance in high-temperature conditions. The aesthetic appeal of wired glass is also a drawback; its appearance is often seen as restrictive, especially in modern architectural designs where sleek, unobstructed views are preferred. In response to these challenges, there has been a notable rise in the adoption of ceramic glass. Ceramic glass excels in fire resistance, combining high transparency with durability, making it a preferred choice for various applications, including high-rise buildings and commercial spaces. Its ability to provide both safety and aesthetic appeal has positioned ceramic glass as a leading alternative in the fire-rated glass market, addressing the limitations of wired glass and meeting the evolving demands of contemporary architecture and safety standards.

Asia Pacific Fire-Rated Glass Ceramic Market Segmentation By Application:

- Doors

- Windows

- Partitions & Facades

- Roofs & Floors

- Others

The doors segment had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Fire-rated doors play a critical role in compartmentalizing buildings, preventing the spread of fire, and ensuring safe evacuation, making them essential components in both commercial and residential structures. Regulatory requirements and stringent building codes mandate their use, driving their demand in the Asia Pacific region. The ongoing construction boom, fueled by rapid urbanization and infrastructure development, has further amplified the need for these doors. Market research reports consistently underscore the dominance of the doors segment in the consumption of fire-rated glass ceramics in this region, attributing the growth to heightened construction activities, rigorous safety standards, and increased safety awareness. However, potential challenges could impact this trend. The emergence of alternative materials for fire-rated doors may pose competition to fire-rated glass ceramics. Economic downturns can affect construction activity, thereby influencing demand for these doors. Additionally, a growing focus on passive fire protection systems might shift attention toward other fire-resistant materials used in various building components. While fire-rated doors remain crucial, these factors could shape the future dynamics of the fire-rated glass ceramic market.

Asia Pacific Fire-Rated Glass Ceramic Market Segmentation By End-Use Industry:

- Commercial Buildings

- Residential Buildings

- Industrial Facilities

- Others

Commercial Buildings had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Stringent building codes are driving the demand for fire-rated materials in commercial buildings, which are subject to stricter fire safety regulations. The surge in large-scale construction projects, including office buildings, shopping malls, and hotels, further propels the need for fire-rated glass ceramics. Commercial building owners prioritize the safety of occupants and assets, leading to an increased adoption of fire-resistant materials to meet regulatory standards and ensure security. Market research consistently highlights that commercial buildings are the leading end-use segment for fire-rated glass ceramics in the Asia Pacific region. This trend is supported by the rapid urbanization and economic growth in countries such as China and India, which intensify the demand for robust fire-resistant solutions. However, potential challenges could impact market dynamics. Economic downturns may affect commercial construction activity, thereby influencing the demand for fire-rated glass ceramics. Additionally, rising construction costs could affect the feasibility of adopting these materials in new projects. Moreover, a growing emphasis on sustainable construction practices might drive exploration into alternative fire-resistant materials, potentially shifting focus away from traditional fire-rated glass ceramics.

Asia Pacific Fire-Rated Glass Ceramic Market Segmentation By Country:

- China

- India

- Japan

- Australia

- South Korea

China had the largest market share last year and is poised to maintain its dominance throughout the forecast period. China's dominance in the fire-rated glass ceramic industry is supported by its massive manufacturing base, extensive infrastructure, and large domestic market driven by rapid urbanization and infrastructure development. The country's lower production costs make it a cost-effective manufacturing hub, further bolstered by government support aimed at industrial growth and infrastructure expansion. This strong foundation has positioned China as a leader in the fire-rated glass ceramic sector. However, several challenges could impact its continued dominance. Rising labor costs in China may erode its cost competitiveness, potentially affecting its edge over other manufacturing hubs. Additionally, stricter environmental regulations could increase production costs by imposing more stringent compliance requirements. The competitive landscape is also evolving, with other countries such as India and South Korea investing heavily in their own fire-rated glass ceramic industries, which could intensify competition and influence market dynamics. Despite these challenges, China's robust manufacturing capabilities and supportive policies are likely to sustain its leading position in the fire-rated glass ceramic market, although adapting to these evolving factors will be crucial for maintaining its competitive edge.

COVID-19 Impact Analysis on the Asia Pacific Fire-Rated Glass Ceramic Market.

The COVID-19 pandemic significantly impacted the Asia Pacific Fire-Rated Glass Ceramic Market, disrupting supply chains, production schedules, and demand across various industries. The initial outbreak led to widespread lockdowns, halting construction activities and reducing demand for fire-rated glass ceramics in commercial and residential buildings. Manufacturing facilities faced challenges in maintaining operations due to labor shortages and stringent health protocols, further exacerbating delays. However, the market witnessed a gradual recovery as countries in the region adapted to the new normal, with construction activities resuming and a renewed focus on safety and building regulations. The pandemic also highlighted the importance of fire safety in healthcare facilities and essential infrastructure, driving demand for fire-rated glass ceramics in these sectors. Additionally, the increased emphasis on green and sustainable building practices post-pandemic is expected to contribute to market growth, as fire-rated glass ceramics offer both safety and energy efficiency. Despite initial setbacks, the Asia Pacific Fire-Rated Glass Ceramic Market is poised for recovery, with a focus on innovation and the adoption of advanced materials in construction to ensure resilience against future disruptions.

Latest trends / Developments:

The Asia Pacific Fire-Rated Glass Ceramic Market is experiencing several key trends and developments, driven by increasing safety regulations and advancements in construction technologies. One of the most significant trends is the growing adoption of fire-rated glass ceramics in green and sustainable building projects. Architects and builders are increasingly prioritizing materials that offer both safety and energy efficiency, leading to the integration of fire-rated glass ceramics in modern building designs. Additionally, the rise in urbanization across the Asia Pacific region has heightened the demand for high-rise buildings and commercial complexes, where fire-rated glass ceramics play a crucial role in ensuring safety without compromising aesthetics. Technological advancements have also led to the development of thinner, lighter, and more transparent fire-rated glass ceramics, enhancing their appeal for a broader range of applications, including facades, partitions, and doors. Another notable development is the increasing use of fire-rated glass ceramics in the healthcare and education sectors, where stringent safety standards are mandatory. Furthermore, the market is witnessing growing investments in research and development to create more durable and versatile fire-rated glass ceramics, catering to the evolving needs of the construction industry in the region.

Key Players:

- Saint-Gobain

- AGC Inc.

- Schott AG

- NSG Group

- Jiangxi Hongyu New Materials Co., Ltd.

- FireGlass

- Glassformance

- Pyroguard

- Alufire

- SIS

Chapter 1. Asia Pacific Fire-Rated Glass Ceramic Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Fire-Rated Glass Ceramic Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Fire-Rated Glass Ceramic Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Fire-Rated Glass Ceramic Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Fire-Rated Glass Ceramic Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Fire-Rated Glass Ceramic Market– By Product Type

6.1. Introduction/Key Findings

6.2. Wired Glass

6.3. Ceramic Glass

6.4. Laminated Glass

6.5. Tempered Glass

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type, 2023-2030

Chapter 7. Asia Pacific Fire-Rated Glass Ceramic Market– By Application

7.1. Introduction/Key Findings

7.2. Doors

7.3. Windows

7.4. Partitions & Facades

7.5. Roofs & Floors

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2023-2030

Chapter 8. Asia Pacific Fire-Rated Glass Ceramic Market– By End-Use Industry

8.1. Introduction/Key Findings

8.2. Commercial Buildings

8.3. Residential Buildings

8.4. Industrial Facilities

8.5. Others

8.6. Y-O-Y Growth trend Analysis End-Use Industry

8.7. Absolute $ Opportunity Analysis End-Use Industry , 2023-2030

Chapter 9. Asia Pacific Fire-Rated Glass Ceramic Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By End-Use Industry

9.1.3. By Product Type

9.1.4. By application

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Fire-Rated Glass Ceramic Market– Company Profiles – (Overview, Application Portfolio, Financials, Strategies & Developments)

10.1 Saint-Gobain

10.2. AGC Inc.

10.3. Schott AG

10.4. NSG Group

10.5. Jiangxi Hongyu New Materials Co., Ltd.

10.6. FireGlass

10.7. Glassformance

10.8. Pyroguard

10.9. Alufire

10.10. SIS

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

By 2023, the Asia Pacific Fire-Rated Glass Ceramic market is expected to be valued at US$ 1.2 billion.

Through 2030, the Asia Pacific Fire-Rated Glass Ceramic market is expected to grow at a CAGR of 9.1%.

By 2030, the Asia Pacific Fire-Rated Glass Ceramic Market is expected to grow to a value of US$ 2.21 billion.

China is predicted to lead the Asia Pacific Fire-Rated Glass Ceramic market.

The Asia Pacific Fire-Rated Glass Ceramic Market has segments By Product

Type, End-User, Application, and Region