Asia Pacific Coffee Premixes Market Size (2024-2030)

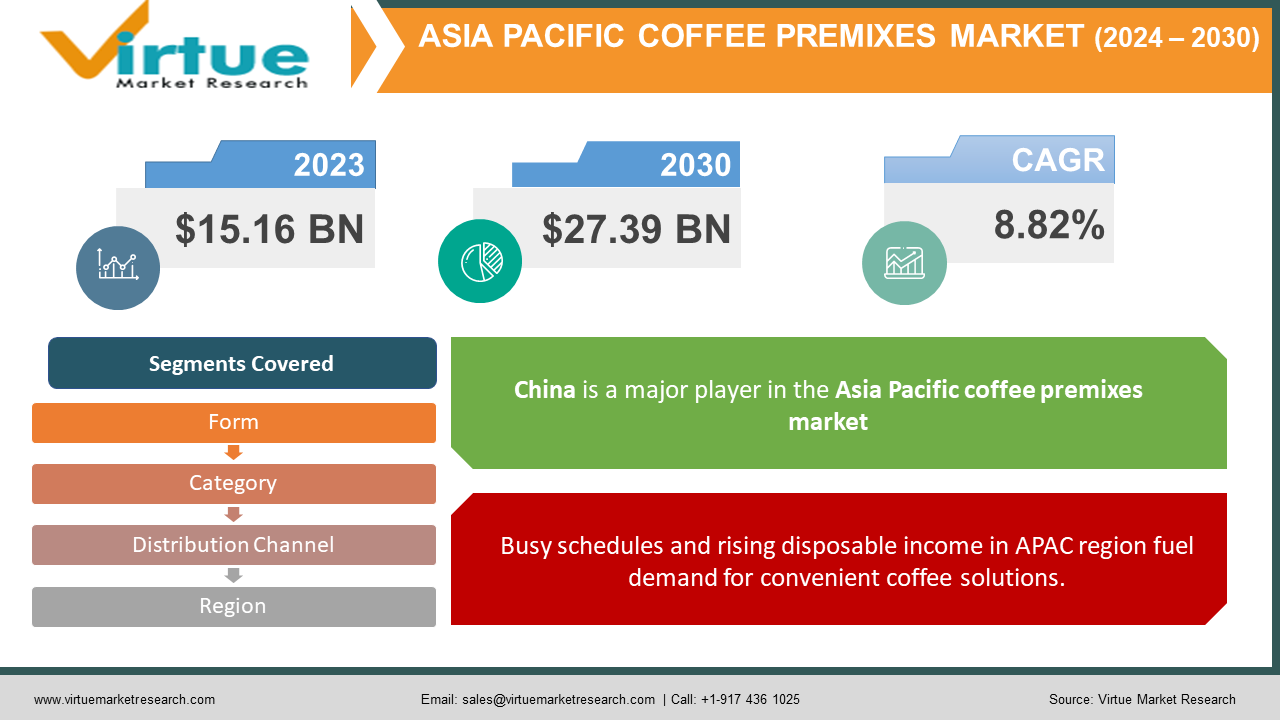

The Asia Pacific Coffee Premixes Market was valued at USD 15.16 billion in 2023 and is projected to reach a market size of USD 27.39 billion by the end of 2030. Over the forecast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 8.82%.

The Asia Pacific coffee premixes market is experiencing a surge in popularity, fueled by a combination of factors. Consumers in the region have more money to spend on convenient beverages, and their busy lifestyles demand quick coffee solutions. As urbanization continues to rise, the demand for portable coffee options like premixes is growing. The influence of Western coffee culture is also at play, leading to a rising taste for coffee across the region.

Key Market Insights:

- The Asia Pacific coffee premixes market is shaped by evolving consumer preferences. This has led to a demand for premium coffee premixes with high-quality ingredients and unique flavors.

- Additionally, health-consciousness is on the rise, reflected in a 25% growth projection for healthier coffee premixes with lower sugar and calories, sometimes even containing added nutrients.

- The rise of e-commerce is another key trend, making it easier for consumers to find and purchase their favorite coffee premixes. This, along with the presence of established multinational companies and a growing number of regional players catering to local tastes, paints a bright picture for the future of the Asia Pacific coffee premix market.

- Major players like Nestle and Mondelez dominate the market, but regional and local competitors are also making their mark.

Asia Pacific Coffee Premixes Market Drivers:

Busy schedules and rising disposable income in APAC region fuel demand for convenient coffee solutions.

The fast-paced lives of Asia Pacific consumers, coupled with their increasing disposable income, are creating a strong demand for convenient coffee solutions. Coffee premixes perfectly address this need by offering a quick and hassle-free way to enjoy a cup of coffee, eliminating the need for elaborate brewing processes. This convenience factor is especially attractive for busy professionals and urban dwellers who value their time.

Urbanization and growing city populations create a need for portable beverages like coffee premixes.

As urbanization continues to accelerate across Asia Pacific, with projections suggesting over 50% of the population in major economies residing in cities by 2030, the demand for portable and convenient food and beverages is surging. Coffee premixes, with their single-serve format and extended shelf life, cater perfectly to this urban population on the go. Their compact size and ease of use make them ideal for busy commutes, office environments, or quick coffee breaks throughout the day.

Western coffee culture's influence fosters a taste for premium coffee premixes with unique flavors.

The influence of Western coffee culture is undeniable in the Asia Pacific region, leading to a growing appreciation for coffee. This shift in consumer preferences has fostered a demand for premium coffee premixes that offer a taste experience like cafes. Consumers are seeking out coffee premixes that boast unique and exciting flavor profiles, along with high-quality ingredients that elevate their everyday coffee experience. This trend presents a significant opportunity for manufacturers to develop innovative and premium premix options that cater to this discerning market.

Health-conscious consumers drive demand for lower-sugar and healthier coffee premix options.

The rise of health consciousness among Asia Pacific consumers is impacting the coffee premix market as well. Consumers are increasingly looking for healthier alternatives that fit their wellness goals. This translates to a demand for coffee premixes with lower sugar and calorie content. Some manufacturers are even incorporating added vitamins and minerals into their premixes to cater to this growing segment.

Asia Pacific Coffee Premixes Market Restraints and Challenges:

Despite the promising growth trajectory of the Asia Pacific coffee premixes market, there are hurdles to overcome. One key challenge is consumer concern about the quality of ingredients. The presence of artificial flavors, preservatives, and added sugars in some premixes deters health-conscious consumers from seeking natural options. Traditional coffee brewing methods also pose a competitive threat. Some consumers perceive freshly brewed coffee to be more authentic and flavorful than premixes. This can be particularly true in regions with a long-standing coffee culture and established brewing traditions.

Price sensitivity is another factor to consider. In some Asia Pacific economies, consumers may be hesitant to pay a premium for coffee premixes compared to the perceived value of traditional coffee grounds or instant coffee options. The environmental impact of coffee premixes also presents a challenge. The single-use packaging format and potential for waste generation raise concerns among environmentally conscious consumers.

Finally, local players in the market may struggle with brand awareness. While regional and local companies are making their mark, they may not have the same brand recognition as established multinational corporations. This can limit their ability to compete effectively and capture market share.

Asia Pacific Coffee Premixes Market Opportunities:

The Asia Pacific coffee premixes market, while not without challenges, offers a multitude of opportunities for companies to capitalize on. The growing demand for premium premixes with high-quality ingredients and exciting flavor profiles presents a chance for manufacturers to develop innovative options that cater to discerning consumers. Furthermore, the rise of health consciousness creates a gap for healthier premixes. This includes options with lower sugar and calories, added vitamins and minerals, or organic and natural ingredients. By tapping into this trend, companies can attract health-conscious consumers who still value the convenience of premixes. The booming e-commerce industry offers another golden opportunity. Utilizing online platforms to market and sell coffee premixes can significantly expand distribution channels and reach geographically dispersed customers. Addressing environmental concerns is also important. Developing eco-friendly packaging made from recycled materials or biodegradable options can attract environmentally conscious consumers and enhance brand image. Finally, regional and local players have a chance to carve out a niche in the market by catering to specific local tastes and preferences. They can offer unique flavor profiles and ingredients that resonate with local consumers, propelling further growth in the Asia Pacific coffee premixes market.

ASIA PACIFIC COFFEE PREMIXES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.82% |

|

Segments Covered |

By form, category, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Australia & New Zealand, Rest of Asia-Pacific |

|

Key Companies Profiled |

Nestle (Nescafe), Unilever, The Coca-Cola Company, Starbucks Corporation, Godrej & Boyce Manufacturing Company Limited, European Coffee Federation, Paulig Juhla Mokka |

Asia Pacific Coffee Premixes Market Segmentation:

Asia Pacific Coffee Premixes Market Segmentation: By Category:

- Regular Coffee Premixes

- Flavored Coffee Premixes

The dominant segment in the Asia Pacific coffee premixes market by category is "Regular Coffee Premixes," offering the classic coffee taste preferred by many consumers. This segment caters to traditional coffee drinkers who prioritize a familiar and straightforward coffee experience. However, the fastest-growing segment is "Flavored Coffee Premixes," driven by a growing demand for exciting flavor profiles like mocha, caramel, and hazelnut. This segment caters to consumers seeking a more indulgent and adventurous coffee experience.

Asia Pacific Coffee Premixes Market Segmentation: By Form:

- Roasted/Ground Coffee Premixes

- Blended Coffee Premixes

- Soluble Coffee Premixes

The Asia Pacific coffee premixes market is segmented by form, with two dominant players: blended coffee premixes, offering a convenient mix of coffee, creamer, and sugar; and soluble coffee premixes, the fastest-growing segment due to their ease of preparation and rising popularity. This segmentation allows companies to target specific consumer preferences, like convenience or a more traditional coffee experience.

Asia Pacific Coffee Premixes Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

By distribution channel, supermarkets, and hypermarkets dominate the Asia Pacific coffee premix market, offering a vast selection to consumers during their grocery shopping. However, online retail is experiencing the fastest growth, driven by the convenience of e-commerce platforms and the ability to reach geographically dispersed customers. This trend is likely to continue as online shopping becomes increasingly popular in the region.

Asia Pacific Coffee Premixes Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

China: China is a major player in the Asia Pacific coffee premixes market, driven by its massive population and rising disposable income. Consumers are increasingly seeking convenient and high-quality coffee solutions, making premixes a popular choice. The market here is dominated by established multinational companies alongside a growing number of local players catering to specific regional tastes.

Japan: Japan boasts a well-established coffee culture with a preference for premium and specialty coffee. While traditional brewing methods remain popular, coffee premixes are gaining traction, particularly for their convenience. The focus here lies on high-quality ingredients and unique flavor profiles that cater to discerning Japanese consumers.

South Korea: Similar to Japan, South Korea has a strong coffee culture with a growing demand for convenient coffee solutions. The market here is witnessing a rise in popularity for flavored coffee premixes, with younger consumers driving the trend. Local and international companies are competing fiercely to capture market share in this dynamic market.

India: India is a rapidly growing market for coffee premixes, fueled by its young population, increasing urbanization, and rising disposable income. Consumers are increasingly adopting Western coffee habits, leading to a demand for convenient and flavorful premixes. The market here is dominated by a few major players, but regional and local brands are also making their mark, offering affordable and innovative premix options.

Australia & New Zealand: Australia and New Zealand have a well-established coffee culture with a preference for high-quality coffee. While instant coffee remains popular, premium coffee premixes are gaining traction, particularly in the on-the-go consumption segment. Consumers here are health-conscious, and there's a growing demand for premixes with natural ingredients and lower sugar content.

Rest of Asia-Pacific: This region encompasses a diverse range of countries with varying coffee cultures and preferences. Southeast Asian nations like Vietnam and Indonesia are witnessing a rise in coffee premix consumption due to urbanization and growing disposable income. These markets present significant potential for future growth, with opportunities for companies to cater to local tastes and preferences.

COVID-19 Impact Analysis on the Asia Pacific Coffee Premixes Market:

The COVID-19 pandemic undoubtedly impacted the Asia Pacific coffee premixes market, presenting a mixed bag of challenges and opportunities. Lockdowns and restrictions disrupted supply chains, causing temporary shortages of ingredients and impacting production. Out-of-home coffee consumption in cafes and restaurants also saw a significant decline due to social distancing measures. Initially, some consumers focused on essential purchases, leading to a potential dip in demand for coffee premixes.

However, the pandemic also presented positive developments. With people staying home more, the demand for in-home coffee solutions surged. Coffee premixes, with their convenience and long shelf life, benefitted from this trend. The e-commerce boom during the pandemic provided a vital sales channel as consumers increasingly turned online to purchase coffee premixes. Furthermore, the heightened health consciousness fostered by the pandemic may lead to a rise in demand for healthier coffee premix options with lower sugar and calories or added vitamins and minerals.

Overall, while the initial stages of the pandemic brought challenges, the market exhibited resilience. The rise of home consumption, e-commerce boom, and potential shift towards healthier options are expected to contribute to the market's continued growth in the post-pandemic era. The long-term impact of COVID-19 on consumer behavior and the full recovery of out-of-home coffee consumption remain factors to be monitored.

Latest Trends/ Developments:

The Asia Pacific coffee premixes market is brimming with innovation, fueled by a desire to cater to ever-evolving consumer preferences. Plant-based enthusiasts are driving the introduction of premixes made with alternative milk options like oat milk, almond milk, or coconut milk, perfectly aligning with dietary restrictions or a simple desire for a dairy-free coffee experience. Subscription services are also gaining traction, offering a convenient way for busy consumers to discover new and exciting flavors. These services curate selections of coffee premixes delivered directly to doorsteps, ensuring a steady supply and eliminating the need for frequent grocery store visits.

Furthermore, the focus on health and wellness is influencing the development of "functional" coffee premixes. These go beyond the traditional caffeine boost by incorporating ingredients like adaptogens, probiotics, or nootropics. Adaptogens are natural substances that may help the body adapt to stress, while probiotics promote gut health, and nootropics are thought to enhance cognitive function. These functional premixes cater to health-conscious consumers seeking a holistic well-being boost alongside their daily cup of coffee.

Finally, the market is witnessing a surge in interest in local and artisanal options. Consumers are increasingly seeking out premixes made with regionally sourced ingredients, supporting local farmers and businesses. This trend reflects a growing desire for authenticity and sustainability. Additionally, artisanal coffee roasters are crafting gourmet premixes with unique flavor profiles and high-quality ingredients, catering to a discerning coffee enthusiast market. well positioned in light of the dynamic nature of the Asia Pacific coffee premixes market, and companies that can adapt and innovate to meet these evolving preferences are well-positioned to secure their place in this exciting and rapidly growing landscape.

Key Players:

- Nestle (Nescafe)

- Unilever

- The Coca-Cola Company

- Starbucks Corporation

- Godrej & Boyce Manufacturing Company Limited

- European Coffee Federation

- Paulig Juhla Mokka

Chapter 1. Asia Pacific Coffee Premixes Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Coffee Premixes Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Coffee Premixes Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Coffee Premixes Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Coffee Premixes Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Coffee Premixes Market– By Category

6.1. Introduction/Key Findings

6.2. Regular Coffee Premixes

6.3. Flavored Coffee Premixes

6.4. Y-O-Y Growth trend Analysis By Category

6.5. Absolute $ Opportunity Analysis By Category , 2023-2030

Chapter 7. Asia Pacific Coffee Premixes Market– By Form

7.1. Introduction/Key Findings

7.2. Roasted/Ground Coffee Premixes

7.3. Blended Coffee Premixes

7.4. Soluble Coffee Premixes

7.5. Y-O-Y Growth trend Analysis By Form

7.6. Absolute $ Opportunity Analysis By Form , 2023-2030

Chapter 8. Asia Pacific Coffee Premixes Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets and Hypermarkets

8.3. Convenience Stores

8.4. Online Retail

8.5. Specialty Stores

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel, 2023-2030

Chapter 9. Asia Pacific Coffee Premixes Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Distribution Channel

9.1.3. By Form

9.1.4. By Category

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Coffee Premixes Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestle (Nescafe)

10.2. Unilever

10.3. The Coca-Cola Company

10.4. Starbucks Corporation

10.5. Godrej & Boyce Manufacturing Company Limited

10.6. European Coffee Federation

10.7. Paulig Juhla Mokka

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia Pacific Coffee Premixes Market was valued at USD 15.16 billion in 2023 and is projected to reach a market size of USD 27.39 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 8.82%.

Soaring Convenience, Urbanization's Impact, Evolving Tastes, Health-Conscious Consumers.

Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Stores.

China, the world's most populous nation, is currently the most dominant player due to its rising disposable income and growing urbanization.

Nestle (Nescafe), Unilever, The Coca-Cola Company, Starbucks Corporation, Godrej & Boyce Manufacturing Company Limited, European Coffee Federation, Paulig Juhla Mokka.