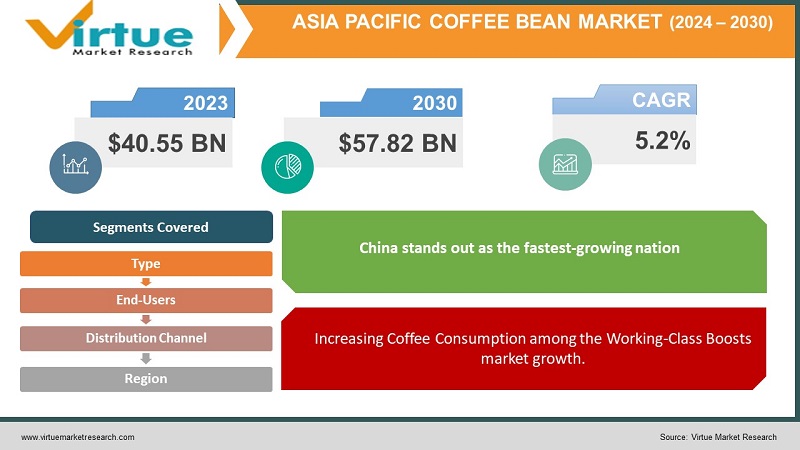

Asia Pacific Coffee Bean Market Size (2024-2030)

The Asia Pacific Coffee Bean Market was valued at USD 40.55 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 57.82 billion by 2030, growing at a CAGR of 5.2%.

Coffee stands as one of the most beloved hot beverages globally. Crafted from coffee beans, predominantly of two varieties, Arabica and Robusta, it also encompasses other lesser-produced bean types. Laden with antioxidants and caffeine, these beans harbor anti-inflammatory attributes, offering a boon in combating specific ailments while elevating both vitality and mood. The medicinal advantages of coffee beans have prompted their integration into various end-use sectors, including pharmaceuticals, food and beverage, as well as personal care and cosmetics.

Key Market Insights:

Within the Asia Pacific region, coffee enthusiasts are displaying a growing inclination towards ethically sourced products, driven by both social and ecological considerations. Particularly notable is the rising traction of organic certification within consumer markets, notably witnessed in countries like India and China. This surge is underpinned by a prevailing consumer belief that organically cultivated products offer a shield against synthetic chemicals and pesticides, thus amplifying the demand for certified organic coffee.

Asia Pacific Coffee Bean Market Drivers:

Rise in the popularity of coffee drives the market growth.

The pervasive popularity of coffee finds expression in its consistent consumption levels over the years. The market is saturated with an array of coffee varieties, prompting producers to experiment with diverse cultivation methods. Simultaneously, companies leverage advanced technology and consumer insights to introduce innovative products to the market. The robust demand within the food and beverage sector, commanding a substantial market share, serves as a catalyst for coffee producers to expand cultivation, thereby driving market growth.

Increasing Coffee Consumption among the Working-Class Boosts market growth.

Coffee consumption serves as a cornerstone of the daily routine for many working professionals, with its purposes ranging from enhancing alertness to reducing fatigue and fostering workplace camaraderie. Consequently, the consumption of coffee is closely linked to productivity enhancement, as individuals rely on it to optimize their performance amidst the demands of their busy lives. Moreover, with the rise of the female workforce and the prevalence of dual-income nuclear families, there's an anticipated surge in coffee demand within the commercial sector. This ongoing trend is poised to further bolster the demand for coffee within these workplace settings, reflecting its integral role in contemporary work culture.

Asia Pacific Coffee Bean Market Restraints and Challenges:

Changing Climatic Condition and Price Fluctuations hinders market growth.

The coffee industry faces significant challenges due to shifting weather patterns and worsening drought conditions attributed to rising temperatures, reduced rainfall, and inadequate irrigation infrastructure. This phenomenon particularly impacts coffee plantations in various regions, a major coffee producer. Consequently, there's a projected deterioration in coffee plant health, evidenced by yellowing and damaged plants, resulting in ruined beans. Subsequently, a substantial number of coffee farmers have incurred substantial crop losses, prompting consideration of transitioning away from coffee cultivation due to its high-water requirements. Notably, leading coffee exporters are experiencing diminished production capacity, disrupting the market's demand and supply chain dynamics. These circumstances contribute to heightened volatility in raw material prices within the industry.

Asia Pacific Coffee Bean Market Opportunities:

Rise in the use of Coffee Beans in Food & Liquor creates opportunities.

The demand for premium coffee experiences has surged among consumers, spurred by the proliferation of coffee shops like Starbucks, Costa, and CCD, transforming coffee consumption into a social activity. This trend has stimulated a heightened interest in diverse coffee bean varieties, driving demand in the market. Moreover, the integration of coffee into bakery and pastry offerings has further fueled its popularity within the business sector.

In addition to its role in traditional beverages, coffee has established itself as a coveted ingredient in cocktails, featuring prominently in classics like the Irish Coffee and the Espresso Martini. While many coffee-based cocktails traditionally require brewed coffee or espresso for flavor and caffeine, an expanding array of spirits and liqueurs now encapsulate the essence of coffee, facilitating their seamless incorporation into beverages or enjoyment on their own, often as a complement to desserts. Recognized brands such as Kahlua and Bailey's Irish Cream have earned acclaim for their signature coffee liqueurs, crafted with premium coffee beans to deliver distinctive flavors and aromas.

ASIA-APCIFIC COFFEE BEAN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Type, End User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestle, The Kraft Heinz Company, The J.M. Smucker Co., JAB Holding Company, Massimo Zanetti Beverage Group, Four Sigmatic, Califia Farms, LLC, LUIGI LAVAZZA SPA , F. Gaviña & Sons, Inc, Cedar Lake |

Asia Pacific Coffee Bean Market Segmentation:

Asia Pacific Coffee Bean Market Segmentation By Type:

- Arabica

- Robusta

- Others

Arabica and Robusta stand out as the two predominant coffee plant species with significant commercial significance, collectively contributing to approximately 60% of global coffee production, with Arabica leading at around 60% and Robusta trailing at roughly 40%. Arabica beans typically contain 0.8-1.4% caffeine content, whereas Robusta beans are characterized by a higher caffeine concentration ranging from 1.7-4.0%.

Given the widespread popularity of coffee as a beverage, coffee beans serve as a vital cash crop and a crucial export commodity, representing a substantial portion of foreign exchange earnings for several developing nations. This underscores the economic importance of coffee within trade, playing a pivotal role in the economic landscapes of numerous countries.

Asia Pacific Coffee Bean Market Segmentation By End-User:

- Pharmaceutical

- Food and Beverage

- Cosmetics

Over the years, the coffee beans market has diversified its applications, extending into emerging sectors such as pharmaceuticals and cosmetics. Leveraging the inherent health benefits of coffee, including its anti-inflammatory and antioxidant properties, the pharmaceutical and cosmetics industries have successfully marketed products to consumers. Caffeine, a key component of coffee, is utilized to enhance mental alertness, complement pain relief medications, and alleviate migraine headaches within the pharmaceutical realm.

In the cosmetics sector, coffee serves as a potent antioxidant, promoting collagen production to combat premature aging at the cellular level. Additionally, it finds application in acne-fighting scrubs, offering a natural solution for skincare concerns. With increasing demand for coffee-based solutions in pharmaceutical and cosmetics applications, the coffee beans market is poised for significant growth, further solidifying its position as a versatile and valuable commodity.

Asia Pacific Coffee Bean Market Segmentation By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Specialist Retailers

- Online Channels

- Other Distribution Channels

The supermarkets and hypermarkets segment has emerged as a formidable force within the market landscape, wielding extensive distribution networks and enjoying a broad consumer base unparalleled by other retail formats. Consumers gravitate towards these retail giants due to their convenience, appreciating the convenience of finding a diverse range of brands and products all under one roof. This strong consumer preference constitutes a primary driver behind the segment's dominance.

Furthermore, the ongoing trend of urbanization, coupled with the expansion of retail chains, is poised to further propel the growth trajectory of this segment. The proliferation of supermarkets and hypermarkets in urban locales aligns seamlessly with the increasing demand for easily accessible and hassle-free shopping experiences.

Moreover, many brands are strategically leveraging the substantial foot traffic in these venues by organizing product demonstrations and in-store activations. These initiatives not only engage potential customers but also elevate brand visibility and foster consumer loyalty, thus providing an additional boost to the segment's expansion.

Asia Pacific Coffee Bean Market Segmentation- by region

- China

- India

- Japan

- Australia

- Rest of Asia Pacific

China stands out as the fastest-growing nation, witnessing a notable surge in coffee consumption among the urbanized and affluent segments across various countries in the Asia Pacific region, including China, India, and Japan. The economic upturn in China has ushered in a demographic with increased disposable income and a penchant for upgrading their lifestyles. This, coupled with a growing penchant for coffee consumption and a heightened willingness to explore new flavor profiles, has fueled demand for coffee within the region.

Furthermore, there has been a notable shift among young Chinese consumers who have transitioned from favoring western coffee to preferring domestic coffee brands, thereby driving domestic coffee consumption.

To capitalize on this burgeoning market opportunity, coffee manufacturers are strategically expanding their presence in China by opening new stores and broadening their geographical footprint. For example, in 2022, Vietnamese coffee chain Trung Nguyen commenced the international expansion of its premium café brand, Trung Nguyen Legend, alongside its instant coffee range, with the inauguration of its first store in Shanghai. Additional store openings in Beijing and Chongqing are slated for October 2022, reflecting the concerted efforts to tap into and cater to the growing Chinese coffee market.

COVID-19 Pandemic: Impact Analysis

The onset of the COVID-19 pandemic presented formidable obstacles for numerous stakeholders within the coffee industry, with baristas bearing the brunt of initial closures as coffee shops shuttered their doors. Moreover, several small coffee chains succumbed to the economic strain and were unable to resume operations post-pandemic. However, amidst these challenges, the resilience of the coffee supply network and the proactive measures undertaken by coffee manufacturers played a crucial role in ensuring that consumers continued to access their beloved coffee throughout the pandemic period.

Latest Trends/ Developments:

In September 2022, Nestlé unveiled plans to invest Rs 5,000 Cr ($613m) in India by 2025, driven by robust demand for its key products, including its diverse portfolio of coffee brands in the market. Notably, Nestlé offers a range of Nescafé products in India, comprising popular blends such as Nescafé Classic, Gold, and Sunrise.

Simultaneously, the Coffee Board of India, representing coffee growers and the industry, announced plans to broaden its reach by introducing four premium coffees under the 'India Coffee' brand, alongside two affordable variants under the 'Coffees of India' brand, exclusively available on Amazon.

Furthermore, in July 2022, China's burgeoning coffee chain brand, 'Bestar Coffee,' disclosed successful fundraising efforts to fuel its expansion strategy. Bestar intends to establish 500 new locations across Jiangsu, Zhejiang, and Shanghai within the next three years. Additionally, the chain aims to establish a coffee education facility to further its commitment to coffee culture and expertise.

Key Players:

These are the top 10 players in the Asia Pacific Coffee Bean Market: -

- Nestle

- The Kraft Heinz Company

- The J.M. Smucker Co.

- JAB Holding Company

- Massimo Zanetti Beverage Group

- Four Sigmatic

- Califia Farms, LLC

- LUIGI LAVAZZA SPA

- F. Gaviña & Sons, Inc

- Cedar Lake

Chapter 1. Asia Pacific Coffee Bean Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Coffee Bean Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Coffee Bean Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Coffee Bean Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Coffee Bean Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Coffee Bean Market– By End-User

6.1. Introduction/Key Findings

6.2. Pharmaceutical

6.3. Food and Beverage

6.4. Cosmetics

6.5. Y-O-Y Growth trend Analysis By End-User

6.6. Absolute $ Opportunity Analysis By End-User , 2023-2030

Chapter 7. Asia Pacific Coffee Bean Market– By Types

7.1. Introduction/Key Findings

7.2. Arabica

7.3. Robusta

7.4. Others

7.5. Y-O-Y Growth trend Analysis By Types

7.6. Absolute $ Opportunity Analysis By Types , 2023-2030

Chapter 8. Asia Pacific Coffee Bean Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Convenience/Grocery Stores

8.4. Specialist Retailers

8.5. Online Channels

8.6. Other Distribution Channels

8.7. Y-O-Y Growth trend Analysis Distribution Channel

8.8. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Asia Pacific Coffee Bean Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.2. By Country

9.1.2.1. China

9.1.2.2. Japan

9.1.2.3. South Korea

9.1.2.4. India

9.1.2.5. Australia & New Zealand

9.1.2.6. Rest of Asia-Pacific

9.1.3. By End-User

9.1.4. By Types

9.1.5. By Distribution Channel

9.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Coffee Bean Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Nestle

10.2. The Kraft Heinz Company

10.3. The J.M. Smucker Co.

10.4. JAB Holding Company

10.5. Massimo Zanetti Beverage Group

10.6. Four Sigmatic

10.7. Califia Farms, LLC

10.8. LUIGI LAVAZZA SPA

10.9. F. Gaviña & Sons, Inc

10.10. Cedar Lake

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The pervasive popularity of coffee finds expression in its consistent consumption levels over the years. The market is saturated with an array of coffee varieties, prompting producers to experiment with diverse cultivation methods

The top players operating in the Asia Pacific Coffee Bean Market are - Nestle, The Kraft Heinz Company, The J.M. Smucker Co., JAB Holding Company, Massimo Zanetti Beverage Group, Four Sigmatic, Califia Farms, LLC, LUIGI LAVAZZA SPA, F. Gaviña & Sons, Inc, Cedar Lake.

The onset of the COVID-19 pandemic presented formidable obstacles for numerous stakeholders within the coffee industry, with baristas bearing the brunt of initial closures as coffee shops shuttered their doors

In September 2022, Nestlé unveiled plans to invest Rs 5,000 Cr ($613m) in India by 2025, driven by robust demand for its key products, including its diverse portfolio of coffee brands in the market. Notably, Nestlé offers a range of Nescafé products in India, comprising popular blends such as Nescafé Classic, Gold, and Sunrise

China stands out as the fastest-growing nation, witnessing a notable surge in coffee consumption among the urbanized and affluent segments across various countries in the Asia Pacific region.