Asia-Pacific Cloud-Based Contact Center Market Size (2024-2030)

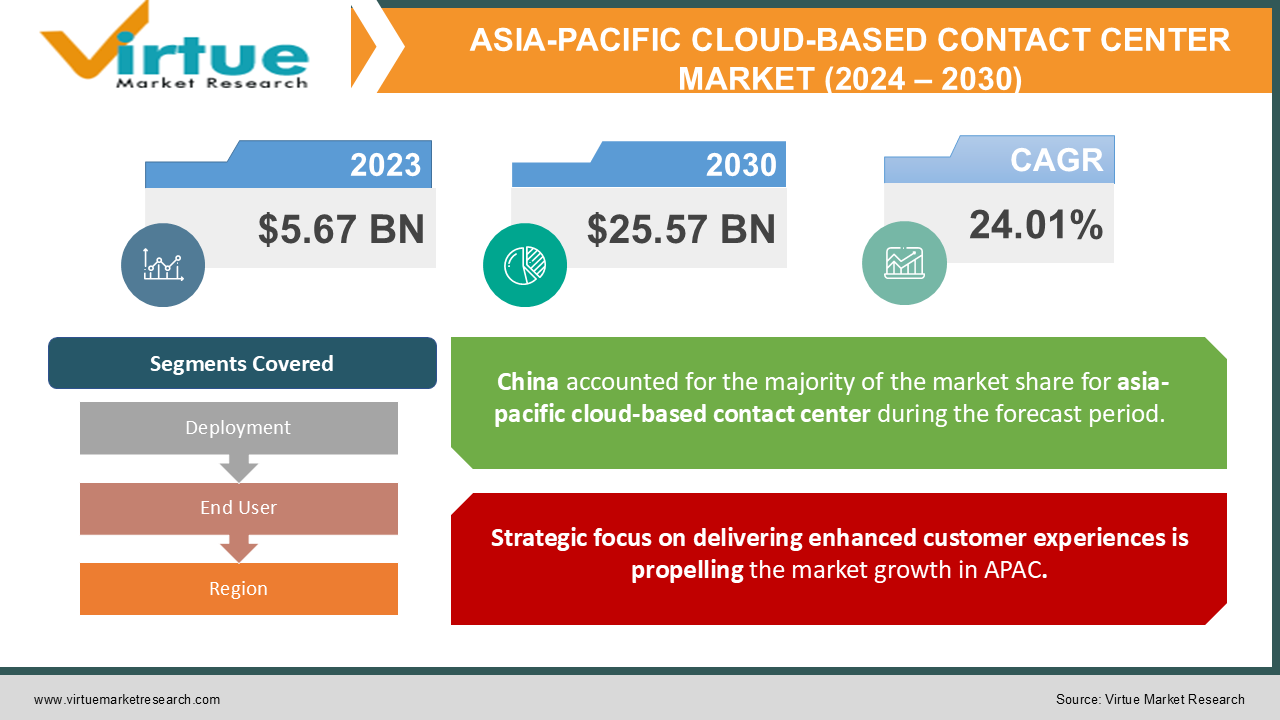

The APAC cloud-based contact center market was valued at USD 5.67 billion in 2023 and is projected to reach a market size of USD 25.57 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 24.01%.

The usage of cloud-based contact center solutions is growing quickly in the Asia-Pacific area. This rise is being driven by factors such as the growing need for better customer experiences, the need for scalability and flexibility, and the cost savings associated with cloud migration. Asia-Pacific is home to a large number of companies looking to improve their customer service skills by utilizing the advantages of cloud contact centers. Businesses can offer omnichannel routing via phone, email, social media, and other channels from a single interface by putting cloud systems in place. Gaining access to the complete history of client interactions across all channels enables contextual interactions. Furthermore, cloud contact centers facilitate automation via APIs and simpler integration of new digital channels. This enables businesses in the Asia-Pacific region to adapt to the shifting demands of customers for self-service and quick, round-the-clock assistance. Adding and updating new features with ease through straightforward cloud settings is far more flexible than requiring extensive on-premises installations, which is highly desirable. Asia-Pacific businesses find the pay-as-you-go cloud contact center pricing models appealing from an economic standpoint. Businesses gain financial flexibility when they shift from significant fixed capital investments to flexible operational expenses for contact center operations. Additionally, cloud economics make it easier for businesses to scale up or down in response to changing demand.

Key Market Insights:

Asia-Pacific consumers expect seamless, contextual customer service across all the channels they use to interact with companies. Whether through a website chat, email, telephone call, or social media, customers want consistency. Cloud-based contact centers enable unified management of the customer journey by integrating all channels into a single cloud platform. By implementing omnichannel routing and interaction analytics, companies gain more holistic customer data to facilitate continuous improvement of the customer experience. Call center demand fluctuates significantly in Asia-Pacific based on new product launches, seasonal peaks, and other factors. The scalability of contact center operations is critical to handling unexpected spikes and scaling down during slower periods to save costs. The flexibility of cloud-based contact centers to scale up or down elastically based on changing requirements makes them appealing to Asia-Pacific companies. Businesses only pay for what they use instead of purchasing on-premises infrastructure with fixed capacity limitations. Artificial intelligence integration is a major next wave in enhancing Asia-Pacific contact center operations. AI use cases relevant to the region include conversational chatbots for automated self-service, predictive routing based on past interactions, agent assist functionality with knowledge recommendations during calls, emotion detection through voice analysis, and smart quality management evaluation. Embedding AI in customer interactions is easier and more affordable with cloud contact centers compared to legacy on-premises infrastructure.

Asia-Pacific Cloud-Based Contact Center Market Drivers:

Strategic focus on delivering enhanced customer experiences is propelling the market growth in APAC.

The foremost strategic priority compelling brands across the diverse Asia-Pacific region to adopt cloud contact center platforms is the mandate to deliver continually optimized customer experiences. Asia-Pacific consumers across both mature and emerging economies set exceedingly high expectations when it comes to service quality, convenience, and brand interactions. Market research unambiguously shows that Asia-Pacific customers will readily switch brands after just one poor service interaction. This capriciousness reflects the competitive intensity of APAC markets, where consumers enjoy abundant choice. To retain customers longer-term, brands must provide incredibly smooth, satisfying, and personalized engagements whenever clients interface with the company, especially through critical contact center channels. Customers interact through various means, like website chat, email, messaging apps, phone calls, or social media. On-premises contact centers have information silos across these touchpoints, preventing unified customer journey mapping, interaction analytics, and channel consistency. However, integrated cloud platforms provide complete visibility into omnichannel profiles and journeys. APAC brands leverage this for superior personalization. The urgency in Asia-Pacific around sustaining excellent end-to-end customer experiences across engagement touchpoints makes cloud contact centers the undisputed choice.

Asia-Pacific's substantial emerging middle-class demographic expansion over the last decade has led to market augmentation.

The expansive emergence of Asia-Pacific's middle class over the last decade acts as a formidable driver propelling the region's migration to cloud-based contact center platforms. This segment's ballooning discretionary incomes fuel substantial consumer purchasing power. However, with higher consumption comes greater customer service demands and expectations of quality interactions for continued loyalty. Cloud innovation holds the key to efficiently serving this ballooning segment. Economic prosperity has provided the middle class with an appetite for buying various goods and services. Home products, electronics, apparel, entertainment, travel, and financial services represent just a sampling of booming consumption. Already accounting for over 70% of spending across key Asia-Pacific economies, the middle class is projected to hit 3.5 billion people regionally by 2030. This virtuous cycle of increasing middle-class affluence and purchasing has greatly intensified competition between brands in practically every industry. With abundant choice, consumers have little hesitation about switching brands after subpar engagements. Customer retention has become precarious, placing immense pressure on optimizing post-purchase servicing and support interactions handled primarily via contact centers. The integration, intelligence, and innovations underlying advanced cloud contact center platforms provide indispensable capabilities for brands hoping to satiate and retain the region’s middle-class boom. Omnichannel routing, automated resolutions, virtual assistance, predictive analytics, flexible scalability, and rapid iteration available via the cloud are vital to efficiently servicing massive middle-class growth. By removing customer service friction points, Asia-Pacific brands inoculate budding relationships with this rewarding yet demanding segment and maximize lifetime value.

Asia-Pacific Cloud-Based Contact Center Market Restraints and Challenges:

Asia-Pacific organizations and consumers remain apprehensive regarding the data security, privacy, and sovereignty implications of migrating contact center data to the public cloud.

While the strategic and economic drivers accelerating cloud contact center adoption across the Asia-Pacific are compelling, lingering apprehension around the security and privacy aspects of migrating data to the public cloud continues to pose a formidable barrier. Conservative perspectives on data governance coupled with restrictive cross-border data transfer laws in major APAC countries fuel the ongoing wariness. The virtualized nature of public cloud infrastructure conflicts with traditional preferences for on-premises environments with localized data centers. There is ingrained skepticism about external vendor cloud security measures and system availability assurances. These views hold especially true for highly regulated Asia-Pacific industries like finance, insurance, and healthcare dealing with sensitive customer information. Beyond cultural inertia, objective regulatory hurdles also exist. Nations including China, Indonesia, and India have enacted strict data localization laws controlling cross-border transfers and foreign hosting of certain in-country data. This directly conflicts with the globalized nature of the most prominent cloud contact center platforms. Subjective perceptions and objective legal constraints both fuel fears of uncontrolled data leakage, foreign surveillance, and lack of visibility if contact center data repositories move wholesale to the cloud. Business leaders worry about litigation, loss of public trust, and competitive position if lapses occur.

Asia-Pacific Cloud-Based Contact Center Market Opportunities:

Artificial intelligence represents a major upgrade opportunity for Asia-Pacific contact centers to embed more automation and intelligence into customer interactions. AI use cases highly relevant across the region include virtual assistants, speech analytics, predictive lead routing, knowledge mining during calls, and self-learning quality evaluation. As global AI development accelerates, worldwide spending on AI-enabled customer engagement is forecast to surpass $13 billion by 2027. Asia-Pacific specifically is primed for sizable growth as businesses aim to serve growing consumer bases more efficiently via AI while enhancing experiences. Leveraging cloud contact center infrastructure for easy integration of conversational AI, machine learning, and predictive analytics tools offers APAC brands a key opportunity to gain advantages. Nations across Southeast Asia, India, and China present massive underpenetrated markets for migration from basic on-premises contact centers to flexible and intelligent cloud platforms. High growth rates, averaging 6% GDP expansion across emerging APAC, will compel businesses to invest in customer experience capabilities to capture market share. Building out sophisticated contact centers is integral for companies in APAC's emerging economies seeking to satisfy their rapidly expanding consumer bases and match the service standards of multinational brands. The scalability, quick deployment, and extensive feature sets of cloud contact center solutions make them ideal for enterprises in high-growth Asia-Pacific markets that lack legacy infrastructure constraints. Millennial demographics across the Asia-Pacific, as both contact center agents and consumer segments offer cloud vendors lucrative opportunities, demand omnichannel service experiences matching their digital lifestyles. They also thrive using advanced platforms that integrate automation and data-driven insights during customer engagements.

ASIA-PACIFIC CLOUD-BASED CONTACT CENTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

24.01% |

|

Segments Covered |

By Deployment, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, India, Japan, South Korea |

|

Key Companies Profiled |

Genesys, NICE inContact , Five9, Avaya, Cisco, 8x8, Talk desk, ZTE Corporation |

Asia-Pacific Cloud-Based Contact Center Market Segmentation:

Asia-Pacific Cloud-Based Contact Center Market Segmentation: By Deployment Model

- Public cloud

- Private cloud

- Hybrid cloud

The largest growth is in the public category. A third-party service provider hosts and maintains the cloud-based contact center infrastructure in a public deployment approach. Businesses may avoid making significant upfront expenditures on hardware and infrastructure by using public cloud deployments. Rather, customers usually pay as they go or through a subscription for usage, which may be more economical, particularly for smaller businesses or those with variable call volumes. Hybrid cloud deployments combine elements of both public and private cloud environments. This offers flexibility by leveraging the scalability of a public cloud for variable workloads while maintaining sensitive components on a private cloud. The hybrid cloud deployment model has the fastest growth trajectory within the APAC market.

Asia-Pacific Cloud-Based Contact Center Market Segmentation: By End-Use Industry

- BFSI (Banking, Financial Services, & Insurance)

- Telecommunications & ITES

- Retail & Consumer Goods

- Government & Public Sector

- Healthcare & Life Sciences

- Manufacturing

BFSI (Banking, Financial Services, & Insurance), with an approximate share of 25–30%, is the largest end-user. This is because adopting these systems helps secure and scalable cloud contact centers drive customer service, collections, fraud prevention, and omnichannel support. Compliance with strict financial regulations is a top priority. Banks and financial institutions need to manage a diverse customer base, driving the need for scalable and feature-rich contact center solutions. The ability of cloud providers to fulfill stringent security and compliance requirements is essential for the BFSI sector. Retail and consumer goods are the fastest-growing categories. Managing seasonal demand peaks, omnichannel communication for a seamless customer journey, and integrating post-sales support solutions are achieved by this.

Asia-Pacific Cloud-Based Contact Center Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia and New Zealand

- Rest of Asia-Pacific

China represents the largest market for cloud-based contact center solutions in the APAC region. Rapid urbanization, the rise of digital-native consumers, and widespread e-commerce fuel demand for these services. This area boasts a highly developed technology landscape with early adoption of cloud solutions. Businesses across industries demand sophisticated contact center solutions to meet the expectations of discerning customers. India is the fastest-growing region. With a burgeoning IT services sector and a rapidly growing middle class, India is driving significant expansion in its cloud-based contact center market. This growth is supported by government initiatives promoting digitalization and favorable demographics.

COVID-19 Impact Analysis on the Asia-Pacific Cloud-Based Contact Center Market:

The onset of the COVID-19 pandemic delivered short-term disruption but is serving as an enduring catalyst, accelerating Asia-Pacific migration into cloud-based contact center platforms. COVID-19 underscored benefits from business continuity, remote work, and scalability perspectives that affirm the value of cloud investments. During initial lockdowns, premise-based Asia-Pacific contact centers faced huge logistical constraints. Many physical centers depend on dense agent workstations. Stay-at-home orders rendered sites inactive overnight while scrambling to equip home-based work. Cloud contact centers, however, can easily activate remote teams with portable licenses. The efficacy of cloud-enabled remote contact center agents surprised initially skeptical Asia-Pacific leaders. Virtual supervisory oversight, collaboration tools, and performance management integrated into cloud platforms drove impressive agent productivity, matching/exceeding on-site efforts. The cloud dispelled location-dependent misconceptions. Sporadic COVID-19 waves produced extreme demand fluctuations for Asia-Pacific contact centers in transport, healthcare, and e-commerce. Having near-instant elasticity to add cloud licenses and redirect cross-trained remote agents was instrumental in managing spikes and minimizing customer delays. Combined, these experiences underscored cloud contact center investments as strategic imperatives, no longer discretionary. In essence, the pandemic primer for cloud capabilities has been the tipping point for transforming regional perceptions. Leaders now view cloud contact centers as indispensable customer relationship safeguards.

Latest Trends/ Developments:

A pivotal trend reshaping Asia-Pacific cloud contact centers is embedding advanced conversational artificial intelligence into customer interactions. Chatbots, virtual assistants, analytical assistants, and interactive voice responses leveraging natural language processing, machine learning, and sentiment analysis are gaining strong traction. Demand for automated self-service and blended human + bot engagements is accelerating across Asia-Pacific as consumers increasingly expect seamless, chat-like exchanges through their preferred messaging apps. Providers like Google, IBM Watson, and AWS Lex are further democratizing access to enterprise-grade AI integration for contact center players. The scalability of the cloud also unlocks more iterative, data-centric AI training. APAC contact centers gain capabilities like 24/7 micro-personalization and context preservation across bot-to-human hand-offs. AI augments rather than replaces agents in Asia-Pacific deployments, as the emotional connection remains valued. Instead of traditional static schedules, advanced Asia-Pacific brands now leverage AI-enabled cloud contact centers to optimize staffing hour-to-hour automatically based on predictive interaction analytics. Historical patterns, external event tracking, and talk-time models drive automated scheduling. Dynamic distribution of back-office tasks during low periods and automated cross-skilling recommendations also help contact centers maximize resources. Agent satisfaction improves with reduced idle time and more empowered development. Customers benefit from consistent service levels aligned with their time zones and patterns.

Key Players:

- Genesys

- NICE inContact

- Five9

- Avaya

- Cisco

- 8x8

- Talk desk

- ZTE Corporation

Chapter 1. Asia-Pacific Cloud-Based Contact Center Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Cloud-Based Contact Center Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Cloud-Based Contact Center Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Cloud-Based Contact Center Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Cloud-Based Contact Center Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Cloud-Based Contact Center Market– By Deployment Model

6.1. Introduction/Key Findings

6.2. Public cloud

6.3. Private cloud

6.4. Hybrid cloud

6.5. Y-O-Y Growth trend Analysis By Deployment Model

6.6. Absolute $ Opportunity Analysis By Deployment Model , 2024-2030

Chapter 7. Asia-Pacific Cloud-Based Contact Center Market– By End-Use Industry

7.1. Introduction/Key Findings

7.2. BFSI (Banking, Financial Services, & Insurance)

7.3. Telecommunications & ITES

7.4. Retail & Consumer Goods

7.5. Government & Public Sector

7.6. Healthcare & Life Sciences

7.7. Manufacturing

7.8. Y-O-Y Growth trend Analysis By End-Use Industry

7.9. Absolute $ Opportunity Analysis By End-Use Industry , 2024-2030

Chapter 8. Asia-Pacific Cloud-Based Contact Center Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Deployment Model

8.1.3. By End-Use Industry

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia-Pacific Cloud-Based Contact Center Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Genesys

9.2. NICE inContact

9.3. Five9

9.4. Avaya

9.5. Cisco

9.6. 8x8

9.7. Talk desk

9.8. ZTE Corporation

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Superior customer experiences and emerging middle-class demographics are the key factors driving the market

The APAC region has a patchwork of varying data privacy and security regulations, with some countries having stringent requirements. Ensuring compliance across borders can be complex

Genesys, NICE inContact, Five9, Avaya, Cisco, 8x8, Talk Desk, and ZTE Corporation are the key players

China currently holds the largest market share, estimated at around 40%.

India exhibits the fastest growth, driven by its increasing population and expanding economy