Asia Pacific Chocolate Powdered Drinks Market Size (2024-2030)

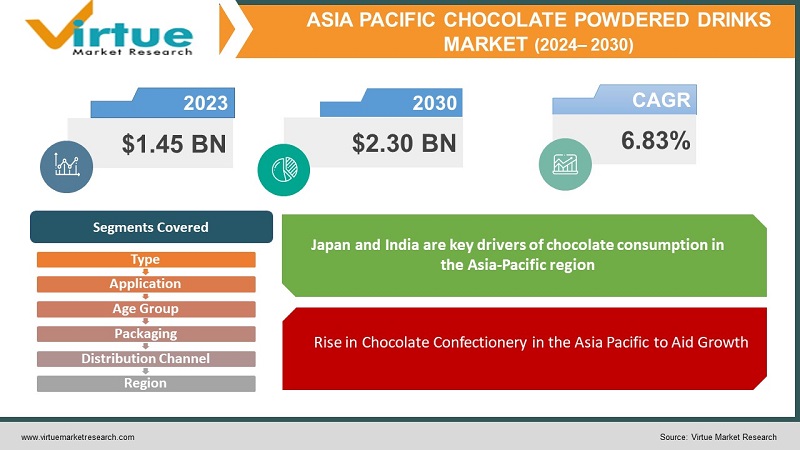

The Asia Pacific Chocolate Powdered Drinks Market was valued at USD 1.45 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 2.30 billion by 2030, growing at a CAGR of 6.83%.

Key Market Insights:

Chocolate consumption in the Asia-Pacific region is relatively modest in comparison to Western eating habits. Nevertheless, the Asia-Pacific region, with China and India in particular, is anticipated to experience some of the most rapid growth in this market. This is attributed to the growing impact of Western lifestyle trends and a heightened awareness of the health benefits associated with chocolate.

Asia Pacific Chocolate Powdered Drinks Market Drivers:

Demand for chocolate based products increases market growth.

In the Asia Pacific region, the growing demand for chocolate confections and related products such as chocolate beverages, baked goods, and dairy items can be attributed to the expanding middle-class population. The consistent economic progress in the area has contributed to a decline in poverty rates. As consumers become more willing to invest in luxury and indulgent items, the demand for chocolates has correspondingly risen.

The surge in urbanization and the enhancement of consumer purchasing power have led to heightened concerns about the sourcing of chocolate ingredients. This has prompted manufacturers to ensure the delivery of high-quality products within the Asia Pacific cocoa and chocolate market.

Rise in Chocolate Confectionery in the Asia Pacific to Aid Growth

Over time, shifts in consumer preferences and lifestyles, evolving eating habits, and increased exposure to international chocolate brands have significantly enhanced the chocolate industry in the Asia Pacific region. The extensive use of cocoa in chocolate confectionery manufacturing supports market growth in the area. The rising emphasis on the social and cultural significance of chocolate confections in Asian countries, including India, China, and Australia, has further

accelerated the expansion of the cocoa and chocolate market. Currently, chocolate confections play a central role in celebrating major festivals and special occasions in these countries, driving the demand for innovative and high-quality chocolate products in the region.

Asia Pacific Chocolate Powdered Drinks Market Restraints and Challenges: Growing Cocoa Substitutes and Alternatives to Hinder Market Growth.

Many countries in the region import cocoa and chocolate ingredients from African nations such as Ghana and Côte d'Ivoire, leading to an unstable supply chain and fluctuations in the prices of these raw materials. To address these disruptions, confectioners are focusing on mitigating supply chain issues by using cocoa ingredient equivalents and substitutes, including palm oil, soybean oil, shea, rapeseed oil, and others. The growing use of these alternatives may negatively affect the cocoa and chocolate market due to their greater availability and cost-effectiveness. The favorable fat stability and enhanced fat composition profile offered by cocoa butter substitutes are contributing to their increased market adoption.

Asia Pacific Chocolate Powdered Drinks Market Opportunities:

Chocolate consumption in the Asia-Pacific region remains relatively low compared to Western countries. Nonetheless, nations within Asia Pacific, particularly China and India, are expected to experience rapid growth in the chocolate market. This growth is attributed to the increasing influence of Western lifestyles and heightened awareness of the health benefits associated with chocolate. Key trends likely to drive the market forward include a rising demand for fair trade chocolates and innovations in flavor. While milk chocolate remains extremely popular, there is notable growth in the sales of dark and compound chocolates due to their extended flavor release, which has made them a preferred choice for many consumers.

In some parts of the region, chocolate is traditionally viewed as a luxury and premium confectionery, with high raw material costs contributing to elevated prices. The price of an average chocolate bar ranges from USD 2 to USD 20. However, the health benefits of chocolate, particularly dark chocolate, are leading consumers to seek healthier options even within confectionery products. India, in particular, stands out as a leading chocolate-consuming country in the region. In 2022, approximately 44% of Indian consumers were willing to pay a premium for healthier chocolate options.

ASIA PACIFIC CHOCOLATE POWDERED DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.83% |

|

Segments Covered |

By Application, Type, age group,packaging, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

APAC, India, china, australia, japan, newzealand, south korea |

|

Key Companies Profiled |

Nestle S.A., Olam International, Cargill, Incorporated, Fuji Oil Company, Ltd., Barry Callebaut AG, Touton S.A. |

Asia Pacific Chocolate Powdered Drinks Market Segmentation-

Asia Pacific Chocolate Powdered Drinks Market Segmentation: By Type:

- White Chocolate

- Dark Chocolate

- Milk Chocolate

Dark chocolate is the leading segment in the market. Dark chocolate powdered drinks, which combine dark chocolate and caffeine, are popular energy drinks. These drinks are often incorporated into protein shakes, energy drinks, chocolate beverages, cappuccino mixes, and various other food products.

White chocolate, composed of cocoa butter and sugar, is melted and then cooled to produce the final product. White chocolate powdered drinks are beverages made from a blend of white chocolate and powdered drink mix. These drinks can be utilized both as ingredients in recipes and as standalone beverages.

Asia Pacific Chocolate Powdered Drinks Market Segmentation-By Application:

- Milk Beverages

- Protein Shakes

- Energy Drinks

- Chocolate Drinks

- Cappuccino Mixes

Milk beverages have emerged as the dominant application segment. In recent years, milk chocolate-type powdered drinks have gained considerable popularity among consumers seeking healthier alternatives to traditional sugar-free chocolate bars. These products are also utilized in a variety of milk-based recipes, such as hot cocoa and cappuccino mixes, which are anticipated to further boost demand.

Protein shakes are recognized as one of the fastest-growing segments, driven by increasing health awareness among consumers and a rising demand for protein supplements from fitness enthusiasts and athletes. Protein powder is highly valued for its role in muscle mass development when consumed before workout sessions, complementing nutritious diet plans followed by fitness professionals across different regions.

Asia Pacific Chocolate Powdered Drinks Market Segmentation- By Age Group:

- Children

- Adults

- Elderly

Chocolate powdered drinks are enjoyed by people across all age groups, from children to the elderly. These beverages appeal to a broad audience due to their rich flavor and versatility, making them a favored choice among consumers of all ages.

Asia Pacific Chocolate Powdered Drinks Market Segmentation- By Packaging:

- Pouches

- Jars

- Tins

- Sachets

Sachets are commonly favored by consumers seeking a quick and convenient drink option while on the go. These single-serving packets are easy to carry and use.

Pouches, which contain powder drinks packaged in flexible, lightweight, and easily storable formats, are preferred by consumers needing a larger quantity of powder for multiple servings.

Jars, which feature resealable containers, are often chosen by those who require a substantial amount of powder drink for extended use. The resealable nature of jars allows for long-term storage and easy access to multiple servings.

Asia Pacific Chocolate Powdered Drinks Market Segmentation-By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Stores

This growth is attributed to an increasing consumer preference for convenient shopping options. Within this segment, convenience stores were the largest retailing unit by volume in 2023. Prominent convenience stores in China include Easy Joy, uSmile, and MYJ. The convenience store segment in Asia-Pacific is projected to grow by 4.48% by volume by 2025.

Supermarkets and hypermarkets rank as the second-largest retail channels for chocolate products in the Asia-Pacific market. These retailers offer a broad array of chocolate items along with innovative promotions. In 2022, sales volume of chocolate products in supermarkets and hypermarkets increased by 4.22% compared to 2021. A compound annual growth rate (CAGR) of 19.7% is expected in the region from 2023 to 2029. Chocolate represents the largest share, at 58.8%, of all confectionery products sold through supermarkets and hypermarkets in 2023, driven by rising demand for premium options.

Online retailing, or e-commerce, is the fastest-growing segment in the Asia-Pacific retail market. The e-commerce sector achieved a CAGR of 5.92% in 2023, with the increasing number of internet users in the region being a key driver of this growth.

During the forecast period, retailing units in Asia-Pacific are expected to see an 8.21% growth by volume share. The expanding availability of ethnic flavors in confectionery products and rising demand for discount offers are anticipated to further boost the retail industry.

Asia Pacific Chocolate Powdered Drinks Market Segmentation- by region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

Japan and India are key drivers of chocolate consumption in the Asia-Pacific region, collectively accounting for nearly 50% of the market by value. This growth is fueled by an increasing

emphasis on innovative, premium chocolates. Over the review period, both the premium and super-premium segments have expanded due to trends such as transparent sourcing and the use of rare ingredients that offer a sense of exclusivity. The rise in this segment is also attributed to the growing number of chocolate producers focusing on unique premium products and consumers’ heightened interest in trying new offerings.

In 2022, the Asia-Pacific chocolate market grew by 4.16% by value compared to 2021. In these countries, chocolate is considered an exotic delicacy and a luxury gift, particularly during the Lunar New Year, contributing to increased consumption.

COVID-19 Pandemic: Impact Analysis

The chocolate industry faced significant disruption due to the COVID-19 pandemic, which caused a major shift in demand dynamics. The pandemic is anticipated to have a negative impact on cocoa and chocolate sales in Asian countries for a certain period, primarily due to the ongoing lockdowns. As chocolate confectioneries and cocoa are not classified as essential products, consumer demand for these items has decreased in these countries over the past few months.

Latest Trends/ Developments:

- May 2023: Reliance Consumer Products (RCPL), the FMCG division of Reliance Retail Ventures (RRVL), secured a controlling stake in Lotus Chocolate Company Ltd.

- February 2023: The Hershey Company introduced limited-edition chocolate bars to commemorate International Women’s Day.

- February 2023: Ferrero International SA broadened its portfolio with the launch of a new chocolate variant, Kinder® Chocolate Mini Friends. This expansion is part of Ferrero's strategic effort to grow its consumer base through unique flavored offerings.

Key Players:

These are top 10 players in the Asia Pacific Chocolate Powdered Drinks Market:-

- Nestle S.A.

- Olam International

- Cargill, Incorporated

- Fuji Oil Company, Ltd.

- Barry Callebaut AG

- Touton S.A.

- ECOM Agroindustrial Corporation Ltd.

- Plot Enterprise Ghana Limited

- BD Associates Ghana Ltd

- Niche Cocoa Industry, Ltd.

Chapter 1. Asia Pacific Chocolate Powdered Drinks Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Chocolate Powdered Drinks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Chocolate Powdered Drinks Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Chocolate Powdered Drinks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Chocolate Powdered Drinks Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Chocolate Powdered Drinks Market – By Age group

6.1. Introduction/Key Findings

6.2. Children

6.3. Adults

6.4. Elderly

6.5. Y-O-Y Growth trend Analysis By Age group

6.6. Absolute $ Opportunity Analysis By Age group , 2024-2030

Chapter 7. Asia Pacific Chocolate Powdered DrinksMarket – By Application

7.1. Introduction/Key Findings

7.2 Milk Beverages

7.3. Protein Shakes

7.4. Energy Drinks

7.5. Chocolate Drinks

7.6. Cappuccino Mixes

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Asia Pacific Chocolate Powdered DrinksMarket – By Type

8.1. Introduction/Key Findings

8.2 White Chocolate

8.3. Dark Chocolate

8.4. Milk Chocolate

8.5. Y-O-Y Growth trend Analysis Type

8.6. Absolute $ Opportunity Analysis Type , 2024-2030

Chapter 9. Asia Pacific Chocolate Powdered DrinksMarket – By Packaging

9.1. Introduction/Key Findings

9.2 Natural

9.3. Processed

9.4. Y-O-Y Growth trend Analysis Packaging

9.5. Absolute $ Opportunity Analysis Packaging , 2024-2030

Chapter 10. Asia Pacific Chocolate Powdered DrinksMarket – By Distribution Channel

10.1. Introduction/Key Findings

10.2 Supermarkets/Hypermarkets

10.3. Convenience/Grocery Stores

10.4. Specialist Retailers

10.5. Online Channels

10.6. Other Distribution Channels

10.7. Y-O-Y Growth trend Analysis Distribution Channel

10.8. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 11. Asia Pacific Chocolate Powdered DrinksMarket , By Geography – Market Size, Forecast, Trends & Insights

11.1. Asia Pacific

11.1.1. By Country

11.1.1.1. China

11.1.1.2. Japan

11.1.1.3. South Korea

11.1.1.4. India

11.1.1.5. Australia & New Zealand

11.1.1.6. Rest of Asia Pacific

11.1.2. By AGE GROUP

11.1.3. By Application

11.1.4. By Type

11.1.5. Packaging

11.1.6. Distribution Channel

11.1.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Asia Pacific Chocolate Powdered DrinksMarket – Company Profiles – (Overview, Age group Portfolio, Financials, Strategies & Developments)

12.1. Nestle S.A.

12.2. Olam International Cargill, Incorporated

12.3. Fuji Oil Company, Ltd. 12.4. Barry Callebaut AG

12.5. Touton S.A.

12.6. ECOM Agroindustrial Corporation Ltd.

12.7. Plot Enterprise Ghana Limited

12.8. BD Associates Ghana Ltd

12.9. Niche Cocoa Industry, Ltd.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

In the Asia Pacific region, the growing demand for chocolate confections and related products such as chocolate beverages, baked goods, and dairy items can be attributed to the expanding middle-class population

The top players operating in the Asia Pacific Chocolate Powdered Drinks Market are - Nestle S.A., Olam International, Cargill, Incorporated, Fuji Oil Company, Ltd., Barry Callebaut AG, Touton S.A.

The chocolate industry faced significant disruption due to the COVID-19 pandemic, which caused a major shift in demand dynamics.

May 2023: Reliance Consumer Products (RCPL), the FMCG division of Reliance Retail Ventures (RRVL), secured a controlling stake in Lotus Chocolate Company Ltd.

Malaysia, on the other hand, is recognized as the fastest-growing chocolate market in the Asia-Pacific region, with an anticipated growth rate of 8.53% by value from 2024 to 2030.