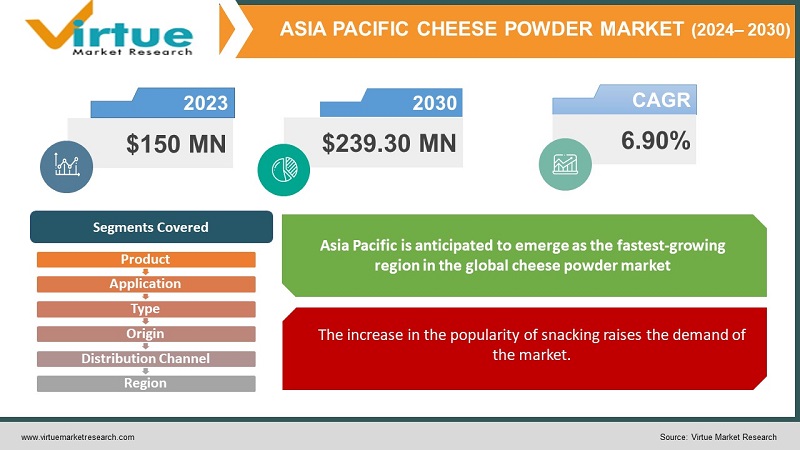

Asia Pacific Cheese Powder Market Size (2024-2030)

The Asia Pacific Cheese Powder Market was valued at USD 150 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 239.30 million by 2030, growing at a CAGR of 6.90%.

Cheese powder, produced from dehydrated cheese, is created by dissolving cheese in a liquid such as milk or oil before dehydrating it. This process yields a dry, powdered cheese versatile enough for various culinary applications. Typically located in the baking or spice sections of most grocery stores, cheese powders are available in multiple flavors, including cheddar, parmesan, and blue cheese. They frequently serve as key flavoring agents or seasonings in an array of savory dishes.

The Asia Pacific region is anticipated to experience significant market growth due to the rising number of quick-service restaurants like Pizza Hut, Domino’s, McDonald’s, and Burger King.

Key Market Insights:

Cheese powder imparts a flavor akin to fresh cheese and is utilized in a variety of food products, including sauces, soups, pizzas, seafood, salads, meats, and canned foods, as well as in seasoned salts and spices. Its numerous health benefits, such as blood pressure regulation, enhanced bone health, improved muscle and nerve function, and boosted immunity, are expected to drive increased demand for the product in the coming years.

Asia Pacific Cheese Powder Market Drivers:

Rise in Consumer Spending on Fast Food drives market growth.

Quick-service restaurants (QSRs) have gained significant popularity in recent years, particularly among the working population and students with busy schedules. These restaurants typically offer a few standardized menu items, such as burgers, pizzas, Chinese food, or fish and chips, which can be prepared quickly. Consequently, they often require ingredients that are easy to store, handle, and incorporate into various dishes, creating a promising demand for powdered cheese over regular cheese. Powdered cheese boasts a longer shelf life than fresh cheese, enabling businesses to maintain a consistent supply without frequent restocking, thereby reducing operational disruptions and minimizing waste. Additionally, the increasing trend of on-the-go cheese-flavored snacks presents lucrative opportunities for market players to introduce innovative products and expand their market share.

The increase in the popularity of snacking raises the demand of the market.

Snacking has gained popularity as people seek convenient, healthy options. Adding cheese powder to snacks like popcorn, chips, and crackers enhances their taste and nutritional value.

Asia Pacific Cheese Powder Market Restraints and Challenges:

The quality and authenticity of the cheese hinder market growth.

Manufacturers face challenges in creating authentic cheese flavors and ensuring consistent quality in cheese powder. This product, used in snacks, sauces, and seasonings, depends on the specific type of cheese—such as cheddar or parmesan—for its complex flavor profile. Accurately translating these nuances into powder form is intricate, and any variations in cheese type or processing can impact flavor consistency. Key processing steps, including drying and milling, must be meticulously managed to preserve delicate flavor compounds. The cheese flavor is also sensitive to environmental factors like temperature and humidity, which can degrade its complexity over time. To maintain authenticity, manufacturers need to balance processing efficiency with flavor preservation and choose suitable packaging to ensure stable flavors throughout the product's shelf life.

High Price restrains market growth.

The prices of raw materials like milk and cheese can be volatile, impacting the production cost of cheese powder. For instance, the COVID-19 pandemic in 2020 caused an increase in milk prices, which subsequently raised the production costs of cheese powder.

Asia Pacific Cheese Powder Market Opportunities:

The popularity of various cuisines has led to the fusion of traditional flavors and methods with modern ingredients. Cheese powder has emerged as a popular component in this diverse culinary landscape, seamlessly bridging different cuisines and cultures. With growing food preferences and the ease of cross-cultural communication, home cooks and chefs are blending flavors and cooking techniques from various cultures. As a versatile ingredient, cheese powder enhances the flavor profiles of both traditional and innovative recipes. From vibrant Asian markets to contemporary kitchens, cheese powder represents culinary innovation and adaptability.

ASIA PACIFIC CHEESE POWDER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.90% |

|

Segments Covered |

By Product, Type, application, origin, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

Warrnambool Cheese and Butter Factory Company Holdings Limited, Aarkay Food Products Ltd., Agropur Cooperative, Lactosan A/S, Archer Daniels Midland Company, Bluegrass Dairy & Food, Inc., Land O'Lakes, Inc., Leprino Foods Company, Kraft Heinz Company, Delitia Parmigiano Reggiano S.p.A. |

Asia Pacific Cheese Powder Market Segmentation:

Asia Pacific Cheese Powder Market Segmentation- By Product:

- Cheddar

- Parmesan

- Blue Cheese

- Romano

Cheddar is the dominant player in the market, commanding a significant share due to its versatility and widespread popularity. In contrast, Mozzarella is the fastest-growing segment, fueled by its increasing use in both traditional dishes and contemporary culinary trends such as gourmet pizzas and appetizers. This segmentation underscores Cheddar's established market position and Mozzarella's dynamic growth trajectory within the cheese industry.

Asia Pacific Cheese Powder Market Segmentation- By Application:

- Snacks

- Bakery & Confectionery

- Dips/Dressings/Dry Mix/Sauces

- Flavors

The snacks segment currently leads the market and is projected to experience rapid growth in the forecast period. The trend towards snacks as meal replacements is gaining traction, particularly in developed regions with expanding working-class populations. Increased sales of popular snacks like popcorn, pretzels, pasta, chips, and hummus, driven by the use of whole food ingredients and clean labels, are expected to fuel segment expansion.

Meanwhile, the bakery and confectionery segment is expected to progress at a compound annual growth rate (CAGR) during the forecast period. Consumer preferences are shifting towards baked goods, which is anticipated to drive growth in the industry. Consequently, there is expected to be significant demand for bakery and confectionery products, both domestically and industrially, presenting opportunities for manufacturers throughout the projected timeframe.

Asia Pacific Cheese Powder Market Segmentation- By Type:

- Cheddar

- Mozzarella

- Parmesan

- American Cheese

Cheddar cheese has maintained the highest revenue share due to its increasing integration into the fast food and convenience food markets. Known for its hard, ripened texture and long shelf life, Cheddar cheese has garnered popularity for its distinctive aroma, taste, and flavor, particularly in regions like North America and Europe. The rising demand for premium and specialty flavors is anticipated to further drive growth in this segment.

Conversely, the Swiss cheese segment is expected to achieve the highest compound annual growth rate (CAGR) during the forecast period. Swiss cheese is characterized by its shiny, pale yellow appearance and mild, nutty, sweet flavor profile, which appeals to consumers seeking a savory yet not overwhelming taste experience. Its versatility allows it to be used in dips, spreads, and appetizers, and enhances richness in mayo dips and cream cheeses, contributing to its growing demand in the market.

Asia Pacific Cheese Powder Market Segmentation- By Origin:

- Natural

- Processed

Natural cheeses, including varieties like Cheddar, Mozzarella, and Parmesan, are crafted from natural ingredients without significant alteration, reflecting consumer preferences for authentic flavors and artisanal production methods. This segment holds a dominant market share due to its perceived quality and traditional appeal.

In contrast, Processed cheeses such as cheese slices and spreads are produced by blending and pasteurizing natural cheeses with additional ingredients to achieve specific textures and flavors. Despite starting from a smaller base, Processed cheeses represent the fastest-growing segment. Their popularity is driven by factors like convenience, extended shelf life, and versatility in various culinary applications across both household and food service sectors.

Asia Pacific Cheese Powder Market Segmentation- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Specialist Retailers

- Online Channels

- Other Distribution Channels

In 2023, the supermarket sector is projected to experience the highest compound annual growth rate (CAGR) of 4%. Supermarkets are favored for their diverse selection of foods from various regions, catering to a wide range of consumer preferences.

During the COVID-19 pandemic, convenience stores and traditional grocery stores did not see significant growth. However, the pandemic did introduce consumers to a variety of international cuisines and cultures, prompting stores to stock packaged and processed foods to cater to diverse tastes. These segments are expected to contribute to potential growth in the forecasted year, driven by increasing consumer interest in exploring flavors and convenience in food choices.

Asia Pacific Cheese Powder Market Segmentation- by Region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

Asia Pacific is anticipated to emerge as the fastest-growing region in the global cheese powder market. This growth is driven by the rapid expansion of the fast-food industry and shifting dietary preferences in countries like China, India, and Australia. The increasing consumption of fast food, coupled with a rising demand for cheddar cheese powder, is expected to fuel market growth. Factors such as improved standards of living, fast-paced lifestyles, and the availability of online food channels are also contributing to heightened demand in the region. Favorable consumption trends in India and China are particularly influential, driving growth across the Asia Pacific cheese powder market.

COVID-19 Pandemic: Impact Analysis

The Cheese Powder Market experienced both positive and negative impacts during the pandemic. COVID-19 lockdowns led to closures of restaurants and schools, resulting in a decrease in cheese supply. Production was also hindered due to disruptions in raw material availability and distribution chain bottlenecks. Distributors such as grocery stores, supermarkets, specialty shops, and other outlets were similarly affected, leading to decreased sales and revenue.

Looking forward, as distribution channels and networks recover from the shutdowns, the Cheese Powder market is expected to rebound. The consumption of Organic Cheddar Cheese has notably increased, driven by higher home consumption during extended periods spent at home post-COVID-19.

Latest Trends/ Developments:

September 2023: Grozette collaborated with SFA Packaging to introduce a new sprinkler can for its cheese sprinkles.

June 2023: Lactosan A/S partnered with Danish NGO Dairy - Mejerifolk uden grænser to support the Kiteto Dairy Cooperative in Tanzania. The cooperative, owned by 60 smallholder farmers, processes up to 750 liters of milk daily.

January 2023: Cheesepop Food Group expanded its production facility in De Meern, the Netherlands, to begin manufacturing cheese powder solutions.

Key Players:

These are the top 10 players in the Asia Pacific Cheese Powder Market: -

- Warrnambool Cheese and Butter Factory Company Holdings Limited

- Aarkay Food Products Ltd.

- Agropur Cooperative

- Lactosan A/S

- Archer Daniels Midland Company

- Bluegrass Dairy & Food, Inc.

- Land O'Lakes, Inc.

- Leprino Foods Company

- Kraft Heinz Company

- Delitia Parmigiano Reggiano S.p.A.

Chapter 1. Asia Pacific Cheese Powder Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Cheese Powder Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Cheese Powder Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Cheese Powder Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Cheese Powder Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Cheese Powder Market – By Product

6.1. Introduction/Key Findings

6.2. Cheddar

6.3. Parmesan

6.4. Blue Cheese

6.5. Romano

6.6. Y-O-Y Growth trend Analysis By Product

6.7. Absolute $ Opportunity Analysis By Product , 2024-2030

Chapter 7. Asia Pacific Cheese Powder Market – By Application

7.1. Introduction/Key Findings

7.2 Snacks

7.3. Bakery & Confectionery

7.4. Dips/Dressings/Dry Mix/Sauces

7.5. Flavors

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Asia Pacific Cheese Powder Market – By Type

8.1. Introduction/Key Findings

8.2 Cheddar

8.3. Mozzarella

8.4. Parmesan

8.5. American Cheese

8.6. Y-O-Y Growth trend Analysis Type

8.7. Absolute $ Opportunity Analysis Type , 2024-2030

Chapter 9. Asia Pacific Cheese Powder Market – By Origin

9.1. Introduction/Key Findings

9.2 Natural

9.3. Processed

9.4. Y-O-Y Growth trend Analysis Origin

9.5. Absolute $ Opportunity Analysis Origin , 2024-2030

Chapter 10. Asia Pacific Cheese Powder Market – By Distribution Channel

10.1. Introduction/Key Findings

10.2 Supermarkets/Hypermarkets

10.3. Convenience/Grocery Stores

10.4. Specialist Retailers

10.5. Online Channels

10.6. Other Distribution Channels

10.7. Y-O-Y Growth trend Analysis Distribution Channel

10.8. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 11. Asia Pacific Cheese Powder Market , By Geography – Market Size, Forecast, Trends & Insights

11.1. Asia Pacific

11.1.1. By Country

11.1.1.1. China

11.1.1.2. Japan

11.1.1.3. South Korea

11.1.1.4. India

11.1.1.5. Australia & New Zealand

11.1.1.6. Rest of Asia Pacific

11.1.2. By Product

11.1.3. By Application

11.1.4. By Type

11.1.5. Origin

11.1.6. Distribution Channel

11.1.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Asia Pacific Cheese Powder Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1. Warrnambool Cheese and Butter Factory Company Holdings Limited

12.2. Aarkay Food Products Ltd.

12.3. Agropur Cooperative

12.4. Lactosan A/S

12.5. Archer Daniels Midland Company

12.6. Bluegrass Dairy & Food, Inc.

12.7. Land O'Lakes, Inc.

12.8. Leprino Foods Company

12.9. Kraft Heinz Company

12.10. Delitia Parmigiano Reggiano S.p.A.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Cheese powder imparts a flavor akin to fresh cheese and is utilized in a variety of food products, including sauces, soups, pizzas, seafood, salads, meats, and canned foods, as well as in seasoned salts and spices.

The top players operating in the Asia Pacific Cheese Powder Market are - Warrnambool Cheese and Butter Factory Company Holdings Limited, Aarkay Food Products Ltd., Agropur Cooperative, Lactosan A/S, Archer Daniels Midland Company, Bluegrass Dairy & Food, Inc., Land O'Lakes, Inc., Leprino Foods Company, Kraft Heinz Company, Delitia Parmigiano Reggiano S.p.A.

The Cheese Powder Market experienced both positive and negative impacts during the pandemic. COVID-19 lockdowns led to closures of restaurants and schools, resulting in a decrease in cheese supply.

September 2023: Grozette collaborated with SFA Packaging to introduce a new sprinkler can for its cheese sprinkles.

Favorable consumption trends in India and China are particularly influential, driving growth across the Asia Pacific cheese powder market.