Asia Pacific Carbonated Soft Drinks Market Size (2024-2030)

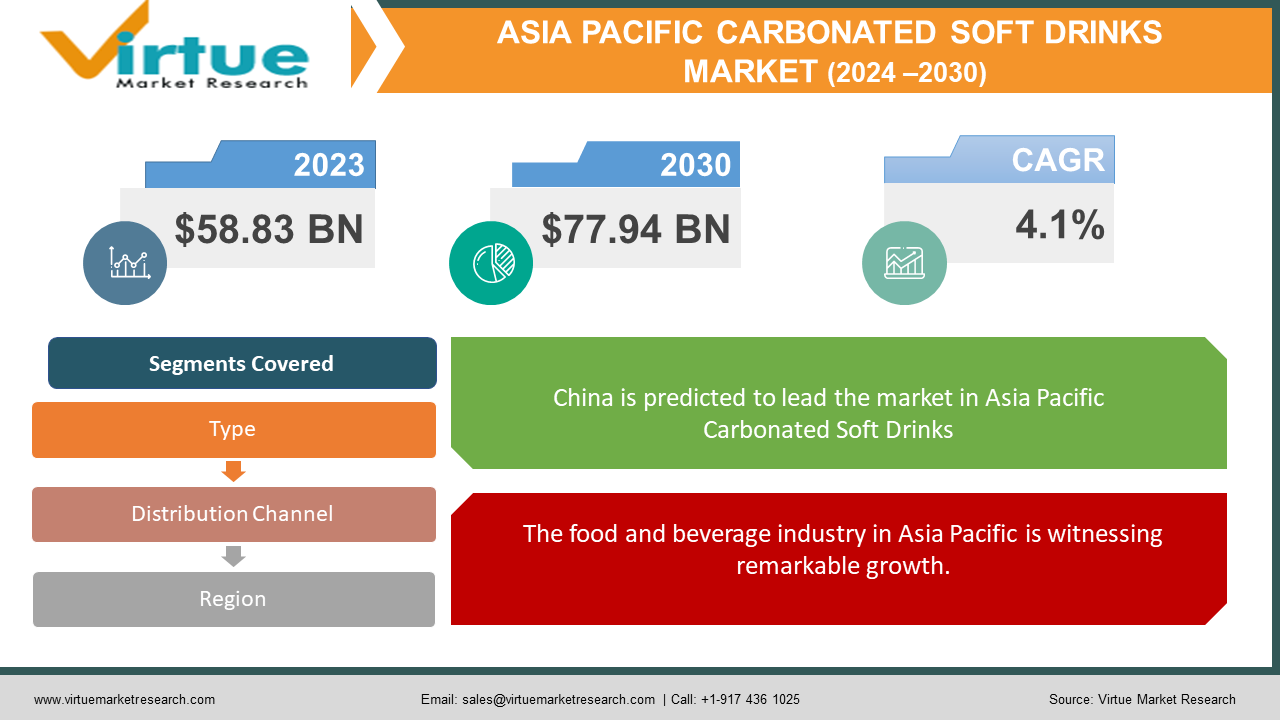

The Asia Pacific Carbonated Soft Drinks Market was valued at USD 58.83 Billion in 2023 and is projected to reach a market size of USD 77.94 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.1%.

Greater buying power is a result of the region's expanding middle class. More money can be spent by consumers, especially younger generations, on luxuries like carbonated soft drinks. Convenient and refreshing beverages are in high demand due to rapid urbanization and hectic lifestyles. Carbonated soft drinks meet this need due to their easily accessible formats and alleged ability to increase energy. Cola remains the dominant flavor, followed by fruit-flavored varieties. However, trends like sugar-free options and niche flavors are gaining traction. PET bottles are the most popular format due to their convenience and portability. However, glass bottles and cans still hold a market share, particularly in certain regions. Environmental consciousness is prompting consumers to seek out CSDs with eco-friendly packaging and responsible production practices.

Key Market Insights:

- Cola remains the undisputed king of flavors, capturing an estimated 45% market share in 2024.

- Fruit-flavoured CSDs are a close second, accounting for approximately 30% of the market share in 2024.

- PET bottles dominate the packaging landscape, holding an estimated 70% market share due to their convenience and portability.

- Traditional convenience stores and supermarkets hold a strong grip on distribution channels, accounting for an estimated 60% share in 2024.

- Governments are implementing sugar taxes at an increasing rate, with the global market for sugar-sweetened beverages projected to decline by 1.4% annually until 2027.

- The rise of bottled water, fruit juices, and functional drinks poses a significant threat to traditional CSDs, with the bottled water market in Asia Pacific projected to reach USD 280 billion by 2027.

- Traditional convenience stores remain the primary distribution channel for CSDs in Asia Pacific, accounting for about 45% of total sales.

- Supermarkets hold a significant share of the market at around 30%, offering consumers a wider variety of CSD options.

- Online sales platforms are experiencing a boom, with a growing segment of consumers purchasing CSDs online for home delivery. This channel is estimated to account for 5% of the market share and is projected for further growth.

Asia Pacific Carbonated Soft Drinks Market Drivers:

Across the Asia Pacific region, a burgeoning middle class is witnessing a significant rise in disposable income.

Rapid urbanization across the Asia Pacific is another critical driver. As people migrate to cities, their lifestyles transform. They embrace fast-paced routines with limited time for elaborate meal preparations. Convenience becomes paramount, and carbonated soft drinks, with their readily available formats and perceived energy-boosting properties, cater perfectly to this need. Additionally, the rise of convenience stores and supermarkets in urban centers creates easy access to a wide variety of CSD options, further propelling market growth. CSD manufacturers can leverage this trend by crafting targeted marketing campaigns that resonate with young, urban consumers. Social media engagement, influencer partnerships, and eye-catching product packaging can effectively capture their attention. Understanding the evolving preferences of a younger demographic is crucial. Experimenting with new and exciting flavors, offering smaller portion sizes for on-the-go consumption, and developing limited-edition releases can keep consumers engaged and interested.

The food and beverage industry in Asia Pacific is witnessing remarkable growth.

Consumers are increasingly drawn to premium CSDs perceived as higher quality and crafted with unique flavor profiles or natural ingredients. Highlighting these aspects through targeted marketing campaigns can tap into this growing segment. Addressing health concerns associated with traditional CSDs is essential. Manufacturers can emphasize natural ingredients, responsible sourcing practices, and the potential benefits of moderate consumption in a balanced diet. Cultural nuances and regional preferences play a significant role. Developing flavors that cater to local tastes and incorporating regional fruits into product offerings can resonate with consumers and build brand loyalty. Social media and digital marketing have revolutionized how CSD brands interact with customers. New product releases can build excitement and buzz through influencer relationships, interactive campaigns, and engaging web content. Decisions about targeted marketing campaigns and product development can also be influenced by using data analytics to comprehend customer preferences.

Asia Pacific Carbonated Soft Drinks Market Restraints and Challenges:

The public's growing worry over the harmful health impacts of consuming excessive amounts of sugar presents the largest obstacle for the CSD business. Sugar-filled drinks are being linked more and more by consumers, especially those in health-conscious demographics, to diabetes, obesity, and other health problems. The sales of conventional CSDs with a high sugar content may decrease as a result of this impression change. Government initiatives like sugar tariffs and more stringent controls on beverage additives are just fueling the flames. These actions are intended to prevent overindulgence in sugar and to encourage better living. Sugar tariffs have already been imposed in nations like Thailand and Mexico, and other countries in the area are considering enacting laws along similar lines. The financial success of CSD producers may be greatly impacted by this, especially if they primarily use conventional, high-sugar formulations. The usage of plastic packaging for CSDs has come under investigation as consumers grow more environmentally conscientious. There is growing worry about the effects of plastic manufacture, waste, and potential pollution on the environment.

Asia Pacific Carbonated Soft Drinks Market Opportunities:

Premium CSDs, thought to be of superior quality and made with distinctive flavor profiles or natural components, are attracting more and more attention from consumers, especially in urban areas. Manufacturers have great potential to create and sell high-end CSD lines thanks to this trend. A wide variety of calorie- and sugar-free CSD choices are available to satisfy health-conscious customers without sacrificing flavor. Examining natural sweeteners such as stevia or monk fruit extract can improve the nutritional value even more. It is essential to create an online store that is easy to use, has convenient ordering options, and has effective delivery systems. The market for CSD in Asia Pacific has enormous potential, but keeping ahead of the curve necessitates ongoing innovation and adaptability. CSD producers may secure a prosperous future in an ever-changing market by leveraging the opportunities provided by premiumization, health and wellness trends, e-commerce platforms, and sustainable practices.

ASIA-APCIFIC CARBONATED SOFT DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.1% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

The Coca-Cola Company, PepsiCo, Suntory , Parle Agro , Asahi Group , Britvic PLC , Monster Beverage Corp. |

Asia Pacific Carbonated Soft Drinks Market Segmentation:

Asia Pacific Carbonated Soft Drinks Market Segmentation: By Type:

- Standard CSDs

- Diet and Sugar-Free CSDs

- Fruit-Flavoured CSDs

- Other CSDs

The standard CSDs (55%) segment reigns supreme, accounting for over half of the market share. The classic cola flavors, along with other non-diet varieties like ginger ale and root beer, dominate this category. Their widespread availability, brand recognition, and association with refreshment solidify their position. Established brands like Coca-Cola and Pepsi have built a strong legacy and brand recognition over decades. This brand loyalty translates into consistent sales and market dominance. Standard CSDs are generally priced lower compared to other segments like sugar-free or premium options, making them accessible to a wider consumer base. The classic taste profile of standard CSDs, particularly cola, offers a familiar and satisfying experience for many consumers. This sense of familiarity, coupled with the perception of refreshment, fuels continued demand.

With a current 20% market share and forecast to increase even more, the Sugar-Free and Diet CSD sector is growing at the quickest rate in the Asia Pacific CSD market. Consumer preference for sugar-free options is being driven by a growing understanding of the detrimental impact that consuming too much sugar may have on one's health. Better-tasting sugar-free alternatives that taste more like regular CSDs have been created thanks to advancements in sweetener technology. In certain nations, the imposition of sugar levies is encouraging customers to select sugar-free CSDs. By providing a greater range of sugar-free CSD flavors, including fruit-flavored varieties, manufacturers may take advantage of this trend and satisfy a range of customer tastes. Addressing consumer concerns and fostering confidence can be achieved by promoting the use of safe and natural sugar replacements.

Asia Pacific Carbonated Soft Drinks Market Segmentation: By Distribution Channel:

- Traditional Convenience Stores

- Supermarkets and Hypermarkets

- E-commerce Platforms

- Other Channels

Traditional Convenience Stores (40%) stores hold the dominant position in CSD distribution across Asia Pacific. Their convenient locations, extended hours, and impulse purchase environment make them ideal for grabbing a cold CSD on the go. These stores have a dense network of outlets across urban and rural areas, ensuring easy accessibility for consumers. The convenient location and extended hours encourage impulse purchases, particularly for smaller-sized CSDs. Developed distribution networks between CSD manufacturers and convenience stores to ensure consistent product availability.

E-commerce platforms are rapidly transforming the CSD landscape in the Asia Pacific, driven by the region's growing internet penetration and smartphone adoption. Online shopping offers the ultimate convenience, allowing consumers to browse and purchase CSDs from the comfort of their homes. E-commerce platforms can offer a broader range of CSD options compared to traditional stores, including niche flavors and imported brands. Manufacturers can engage in targeted online marketing campaigns directly reaching specific consumer segments. Developing a user-friendly online store with efficient search functionalities and secure payment options is crucial.

Asia Pacific Carbonated Soft Drinks Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

With a huge market share and enormous growth potential, China emerges as the dominant force in the Asia-Pacific carbonated soft drink sector. Due to the impact of Western lifestyle styles, urbanization, and growing disposable incomes, this economic giant has seen a notable change in consumer preferences. CSDs have a substantial market in China. Market expansion is further propelled by the growing middle class and their rising disposable incomes. Broad distribution networks ensure that consumers in both urban and rural areas can easily access CSDs. Prominent CSD companies have invested much in marketing campaigns that have increased their brand recognition and fostered customer loyalty. Coca-Cola remains the most consumed flavor in China and is associated with both social gatherings and refreshments.

India boasts a young demographic with a growing taste for CSDs, particularly fruit-flavored varieties and those perceived as trendy. The rapid growth of urban areas creates a demand for convenient and refreshing beverages like CSDs. As disposable incomes increase, consumers are more likely to indulge in CSDs, previously considered a luxury by some. The hot and humid climate in India makes CSDs a popular choice for hydration and refreshment. Developing CSD flavors that cater to regional taste preferences and utilizing targeted marketing campaigns that resonate with the young demographic.

COVID-19 Impact Analysis on the Asia Pacific Carbonated Soft Drinks Market:

Travel restrictions and strict lockdowns had a substantial effect on out-of-home consumption, which is a key factor in CSD sales. Impulsive purchases of CSDs decreased as a result of closures or capacity reductions at restaurants, cafes, and entertainment venues. The seamless flow of raw materials and completed CSD products was impeded by border closures and restrictions on the transfer of goods. This resulted in price swings and shortages in certain areas. During the first stages of the epidemic, there was an increase in the hoarding of necessities, such as CSDs. However, as consumers adjusted their budgets, there was a period of cautious spending that followed. With restrictions on movement, consumers turned to online grocery shopping and home delivery services for their CSD needs. This trend benefited e-commerce platforms and fostered a shift towards larger pack sizes for household consumption. The pandemic heightened health consciousness, leading some consumers to reduce their intake of sugary drinks. This posed a challenge for standard CSDs but presented an opportunity for sugar-free and functional CSD segments.

Latest Trends/ Developments:

Manufacturers are reformulating classic CSDs with artificial or natural sweeteners, catering to consumers seeking a guilt-free indulgence. Stevia, sucralose, and monk fruit extract are gaining traction as viable sugar substitutes. Fortified with vitamins, minerals, or even probiotics, these CSDs aim to offer additional health benefits beyond refreshment. This segment caters to consumers seeking a more functional beverage choice. Transparency in labeling and a focus on natural ingredients are becoming increasingly important. Consumers are drawn to CSDs with recognizable ingredients and minimal artificial flavors or colors. Blending classic CSD flavors with fruit juices or extracts creates refreshing and innovative options, particularly appealing to younger consumers.

Key Players:

- The Coca-Cola Company

- PepsiCo

- Suntory

- Parle Agro

- Asahi Group

- Britvic PLC

- Monster Beverage Corp.

Chapter 1. Asia Pacific Carbonated Soft Drinks Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Carbonated Soft Drinks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Carbonated Soft Drinks Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Carbonated Soft Drinks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Carbonated Soft Drinks Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Carbonated Soft Drinks Market– By Type

6.1. Introduction/Key Findings

6.2. Standard CSDs

6.3. Diet and Sugar-Free CSDs

6.4. Fruit-Flavoured CSDs

6.5. Other CSDs

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Asia Pacific Carbonated Soft Drinks Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Traditional Convenience Stores

7.3. Supermarkets and Hypermarkets

7.4. E-commerce Platforms

7.5. Other Channels

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 8. Asia Pacific Carbonated Soft Drinks Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Product

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Carbonated Soft Drinks Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 The Coca-Cola Company

9.2. PepsiCo

9.3. Suntory

9.4. Parle Agro

9.5. Asahi Group

9.6. Britvic PLC

9.7. Monster Beverage Corp.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Rising economic prosperity across many Asian countries translates to increased disposable income for consumers. This allows them to indulge in previously considered luxuries like CSDs, especially among the burgeoning middle class.

Consumers are seeking healthier beverage alternatives. This includes a rise in demand for low-calorie or sugar-free CSDs, natural ingredient-based options, and functional CSDs fortified with vitamins or minerals. Manufacturers need to adapt by offering a wider range of healthier CSD options.

The Coca-Cola Company, PepsiCo, Suntory, Parle Agro, Asahi Group, Britvic PLC, Monster Beverage Corp

China has firmly established itself as the most dominant player in the Asia-Pacific market, commanding an impressive 40% market share

India emerges as the fastest-growing country in this sector. India's burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand