Asia Pacific Canned Food Market Size (2024-2030)

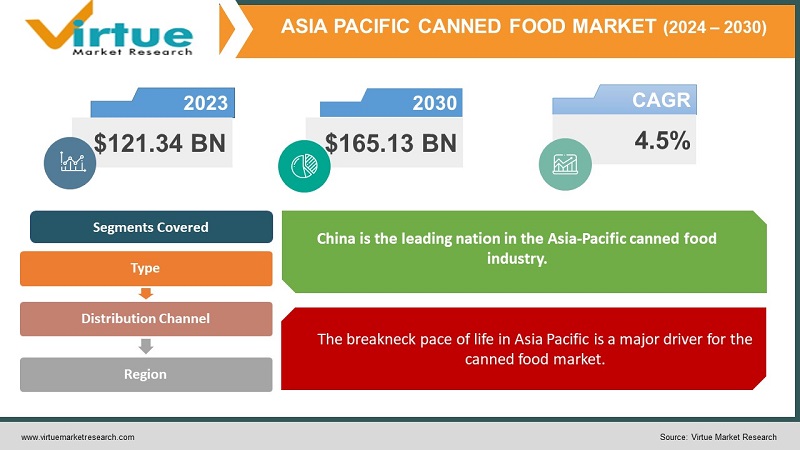

The Asia Pacific Canned Food Market was valued at USD 121.34 Billion in 2023 and is projected to reach a market size of USD 165.13 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

The Asia Pacific canned food market brims with diverse offerings, serving as a staple for many households and a significant contributor to the region's food industry. The rise of single-person households and convenience demands fuels the growth of single-serve canned food options. A growing segment of consumers seeks premium canned food options with organic ingredients, unique flavor profiles, and specialty products. The premiumization trend indicates a growing consumer willingness to pay more for higher-quality canned food products. Sustainability concerns are prompting manufacturers to adopt eco-friendly practices throughout the supply chain. The Chinese market dominates the region, driven by a large population base and a long history of consuming canned food. Popular canned items in China include vegetables, fish, and ready-to-eat meals with regional flavors.

Key Market Insights:

Households in Asia Pacific are expected to spend an average of $62 on canned food annually in 2024.

68% of canned food consumption in Asia Pacific is estimated to occur in urban areas, driven by busy lifestyles and limited access to fresh produce.

Canned fruits and vegetables lead the market share, accounting for approximately 45% of total sales, with peaches, tomatoes, and pineapples being particularly popular choices.

The canned seafood segment holds a significant value of around $18 billion in 2024, driven by its protein content and perceived health benefits. Popular options include tuna, sardines, and salmon.

The market for convenient, ready-to-eat canned meals is on the rise, particularly among young adults and working professionals, expected to reach $5.2 billion by 2024.

85% of consumers in Asia Pacific express a willingness to pay a slight premium for canned food packaged with eco-friendly materials like recycled steel and BPA-free linings.

Online grocery sales of canned food are expected to reach $12.5 billion in Asia Pacific by 2024, with growing consumer adoption of e-commerce platforms.

72% of canned food purchases in Asia Pacific are influenced by in-store promotions and discounts.

Asia Pacific Canned Food Market Drivers:

The breakneck pace of life in Asia Pacific is a major driver for the canned food market.

Canned fruits, vegetables, and seafood come pre-washed, pre-cut, and pre-cooked, eliminating the need for extensive preparation. This allows for quick and easy meal assembly, ideal for working professionals and time-pressed families. Canned food boasts a long shelf life, typically lasting for several years without refrigeration. This translates to less frequent grocery shopping trips and reduces food waste in households with unpredictable schedules. A well-stocked pantry with canned goods provides a safety net for unexpected situations. Busy individuals can whip up a quick meal without a grocery run when working late or facing unexpected guests. The growing number of single-person households in Asia Pacific fuels the demand for single-serve canned food options. These smaller portions cater to individual needs and prevent leftover waste. The proliferation of convenience stores and online grocery platforms offers greater accessibility to canned food. Consumers can now easily order canned goods for quick delivery, further enhancing convenience.

While convenience is king, affordability remains a crucial factor influencing consumer choices in Asia Pacific.

Canned fish like tuna and sardines offer a protein punch at a lower price point compared to fresh seafood. This is particularly relevant for consumers in developing economies within the region. Canned food often provides a larger quantity of food for the price compared to fresh produce, especially when considering spoilage and waste. This makes it a cost-effective way to stock a pantry and feed a family. Having a well-stocked pantry with canned goods reduces the need for impulse purchases of more expensive ready-made meals or takeout options. This contributes to long-term cost savings for budget-conscious consumers.

Asia Pacific Canned Food Market Restraints and Challenges:

Consumers concerned about maximizing nutrient intake might shy away from canned options. The traditional image of canned food might conjure up images of monotonous and bland options. A lack of perceived variety and exciting flavor profiles can deter consumers from seeking more adventurous and flavorful culinary experiences. Advancements in refrigeration technology have led to longer shelf life for fresh produce, making it a more viable option for busy consumers. Consumers might opt for fresh options perceived to be tastier and more nutritious. The frozen food industry has seen significant innovation, offering a wider variety of pre-prepared and convenient frozen meals. These options often cater to dietary restrictions and health trends, posing a challenge to the perceived limitations of canned food. Metal can waste from discarded canned food packaging contributes to landfill burdens. Eco-conscious consumers might be hesitant to purchase products with significant packaging waste. The lack of proper recycling infrastructure in some parts of Asia Pacific makes it difficult for consumers to recycle used cans effectively. This can lead to increased waste and discourage consumers who prioritize sustainability.

Asia Pacific Canned Food Market Opportunities:

Consumers are increasingly willing to pay a premium for canned food products made with high-quality ingredients, organic produce, and unique flavor profiles. This caters to a growing desire for gourmet experiences even in a shelf-stable format. Embracing diverse ethnic influences and innovative flavor combinations can broaden the appeal of canned food. This could involve incorporating regional spices, herbs, and cooking techniques to create exciting new product lines. Pre-seasoned and pre-marinated canned options can offer convenience while catering to a desire for more flavorful and exciting dishes. This allows consumers to create gourmet meals at home without extensive preparation. The growing prevalence of gluten intolerance and food allergies necessitates the development of certified gluten-free and allergen-friendly canned food products. This can cater to a segment of consumers who might otherwise shy away from canned options. Offering low-sodium and health-conscious canned food options can address concerns about the traditional sodium content of canned goods. This could involve introducing products packed in water or natural broths, with a focus on highlighting their nutritional value. The burgeoning popularity of plant-based diets presents an opportunity for canned beans, lentils, and vegetables marketed specifically toward vegans and vegetarians. Additionally, exploring plant-based protein alternatives like canned jackfruit can attract a wider audience.

ASIA-PACIFIC CANNED FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

4.5% |

||

|

Segments Covered |

By Type, Distribution Channel and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Dole Food Company Inc. , Del Monte Pacific Ltd. , ConAgra Brands Inc., HJ Heinz Company , Uni-President Enterprises Corporation, Coca-Cola Amatil Ltd. , ITC Limited , Teaspoon of Spice , Shouten, Happy Not Healthy |

Asia Pacific Canned Food Market Segmentation:

Asia Pacific Canned Food Market Segmentation: By Type

- Fruits and Vegetables

- Canned Seafood

- Canned Meat Products

- Canned Ready-to-Eat Meals

- Other Segments

Fruits and Vegetables (45%) segment reigns supreme, offering a convenient and shelf-stable source of essential nutrients. Popular choices include peaches, tomatoes, pineapples, and various beans. The versatility of canned fruits and vegetables allows them to be consumed as standalone dishes, side dishes, or incorporated into recipes. Compared to fresh produce, canned options offer a larger quantity at a lower price point, especially considering spoilage and waste. This makes them a budget-friendly way to stock a pantry and feed a family. Canned fruits and vegetables come pre-washed, and pre-cut, and require no refrigeration, saving time and effort in meal preparation. Their extended shelf life ensures a constant supply, eliminating the need for frequent grocery trips.

The canned ready-to-eat meals segment is experiencing the most significant growth. Busy schedules and urbanization leave less time for elaborate meal preparation. Canned ready-to-eat meals offer a convenient and quick solution, requiring minimal preparation or heating. Manufacturers are introducing a wider variety of pre-cooked meals with international flavors and healthier options, catering to diverse dietary preferences and taste buds. Offering single-serve options and meal kits with mix-and-match components allows for greater customization and portion control. Introducing gourmet ingredients, organic options, and low-sodium varieties can attract health-conscious consumers seeking convenient yet nutritious meals.

Asia Pacific Canned Food Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialist Retailers

- E-commerce Platforms

- Other Channels

Supermarkets and hypermarkets reign supreme in the Asia Pacific canned food market, accounting for an estimated 55% share. These large retail stores offer a one-stop shopping experience, providing consumers with the widest variety of canned food options under one roof. From budget-friendly private labels to premium imported brands, supermarkets cater to diverse consumer needs and price points. Canned food products are often strategically placed on shelves, with impulse buy sections and promotional displays near high-traffic areas to encourage purchases.

E-commerce platforms are the fastest-growing distribution channel within the Asia Pacific canned food market, with an estimated growth rate of 12%. E-commerce platforms can personalize product recommendations and promotions based on a customer's past purchase history, leading to a more convenient and efficient shopping experience. Some online retailers offer subscription services for canned food, ensuring a regular supply of pantry staples delivered directly to the doorstep.

Asia Pacific Canned Food Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

With a substantial market share, China is the leading nation in the Asia-Pacific canned food industry. Numerous causes, such as a large population, shifting food tastes, and an increase in the need for convenient and shelf-stable items, can contribute to this dominance. From classic canned fruits and vegetables to more contemporary options like canned ready-to-eat meals and soups, the Chinese canned food market is a varied terrain. Local producers have been instrumental in meeting Chinese consumers' desires by providing goods that suit local gastronomic customs and tastes. China's fast-growing urban population is one of the main reasons for the country's supremacy in canned goods.

India is the nation with the quickest rate of growth in this industry. India has grown quickly due to a number of causes, such as a developing middle class, shifting lifestyles, and rising consumer demand for convenient and diverse food options. In recent times, there has been a notable shift in the Indian canned food market, surpassing the conventional belief that canned goods are harmful or inferior. Big manufacturers have added a variety of canned fruits, vegetables, pulses, and traditional cuisines to their lineup in order to accommodate Indian consumers varied nutritional requirements. The increase in nuclear families and urbanization are two major factors contributing to India's canned food industry. The need for quick and simple meal options has increased as more people move to cities and lead busy lifestyles.

COVID-19 Impact Analysis on the Asia Pacific Canned Food Market:

With anxieties running high and concerns about food shortages, consumers rushed to purchase shelf-stable staples like canned vegetables, fruits, and protein sources. Canned food offered a sense of security and a way to build a well-stocked pantry in case of disruptions to fresh food supply chains. Lockdowns and restrictions on movement impacted the movement of fresh produce, leading to temporary shortages and price fluctuations. This caused some consumers to turn to canned food as a reliable and readily available alternative. Restrictions on transportation and movement of goods made it more challenging to deliver canned food to retailers and consumers. This could lead to temporary stockouts in certain areas. The initial stockpiling frenzy subsided as consumers adapted to the "new normal" and fresh food supply chains gradually stabilized. However, demand for canned food remained higher than pre-pandemic levels, reflecting a continued focus on pantry staples.

Latest Trends/ Developments:

There's a growing demand for canned food packed with premium ingredients like sustainably sourced fish, organic vegetables, and unique flavor profiles. This caters to a desire for gourmet experiences even in a shelf-stable format. Canned food manufacturers are embracing diverse ethnic influences, offering options infused with regional spices, herbs, and cooking techniques. This trend caters to adventurous palates and expands the appeal of canned food beyond traditional offerings. Pre-seasoned and pre-marinated canned options strike a balance between convenience and flavor. This allows consumers to create restaurant-quality dishes at home without extensive preparation. The burgeoning popularity of plant-based diets is driving demand for canned beans, lentils, and vegetables marketed specifically toward vegans and vegetarians. Additionally, exploring innovative plant-based protein alternatives like canned jackfruit or hearts of palm caters to a wider audience seeking meat substitutes. Offering low-sodium and health-conscious canned food options addresses concerns about the traditional sodium content of canned goods. This could involve introducing products packed in water or natural broths, with a focus on highlighting their nutritional value.

Key Players:

- Dole Food Company Inc.

- Del Monte Pacific Ltd.

- ConAgra Brands Inc.

- HJ Heinz Company

- Uni-President Enterprises Corporation

- Coca-Cola Amatil Ltd.

- ITC Limited

- Teaspoon of Spice

- Shouten

- Happy Not Healthy

Chapter 1. Asia Pacific Canned Food Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Canned Food Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Canned Food Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Canned Food Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Canned Food Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Canned Food Market– By Type

6.1. Introduction/Key Findings

6.2. Fruits and Vegetables

6.3. Canned Seafood

6.4. Canned Meat Products

6.5. Canned Ready-to-Eat Meals

6.6. Other Segments

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Asia Pacific Canned Food Market– By Distribution channel

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Convenience Stores

7.4. Specialist Retailers

7.5. E-commerce Platforms

7.6. Other Channels

7.7. Y-O-Y Growth trend Analysis By Distribution channel

7.8. Absolute $ Opportunity Analysis By Distribution channel, 2024-2030

Chapter 8. Asia Pacific Canned Food Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Canned Food Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Dole Food Company Inc.

9.2. Del Monte Pacific Ltd.

9.3. ConAgra Brands Inc.

9.4. HJ Heinz Company

9.5. Uni-President Enterprises Corporation

9.6. Coca-Cola Amatil Ltd.

9.7. ITC Limited

9.8. Teaspoon of Spice

9.9. Shouten

9.10. Happy Not Healthy

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The rapid urbanization across Asia Pacific is leading to a growing population living in fast-paced environments. This translates to a demand for convenient and shelf-stable food options that require minimal preparation time.

Traditional canned food often contains higher levels of sodium for preservation purposes. This raises concerns for health-conscious consumers, particularly those managing hypertension or at risk of cardiovascular diseases.

Dole Food Company Inc., Del Monte Pacific Ltd., ConAgra Brands Inc., HJ Heinz Company, Uni-President Enterprises Corporation, Coca-Cola Amatil Ltd., ITC Limited, Teaspoon of Spice, Shouten, Happy Not Healthy.

Chia has firmly established itself as the most dominant player in the Asia-Pacific market, commanding an impressive 45% market share

. India emerges as the fastest-growing country in this sector. India's burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.