Asia Pacific Bioethanol Market Size (2024-2030)

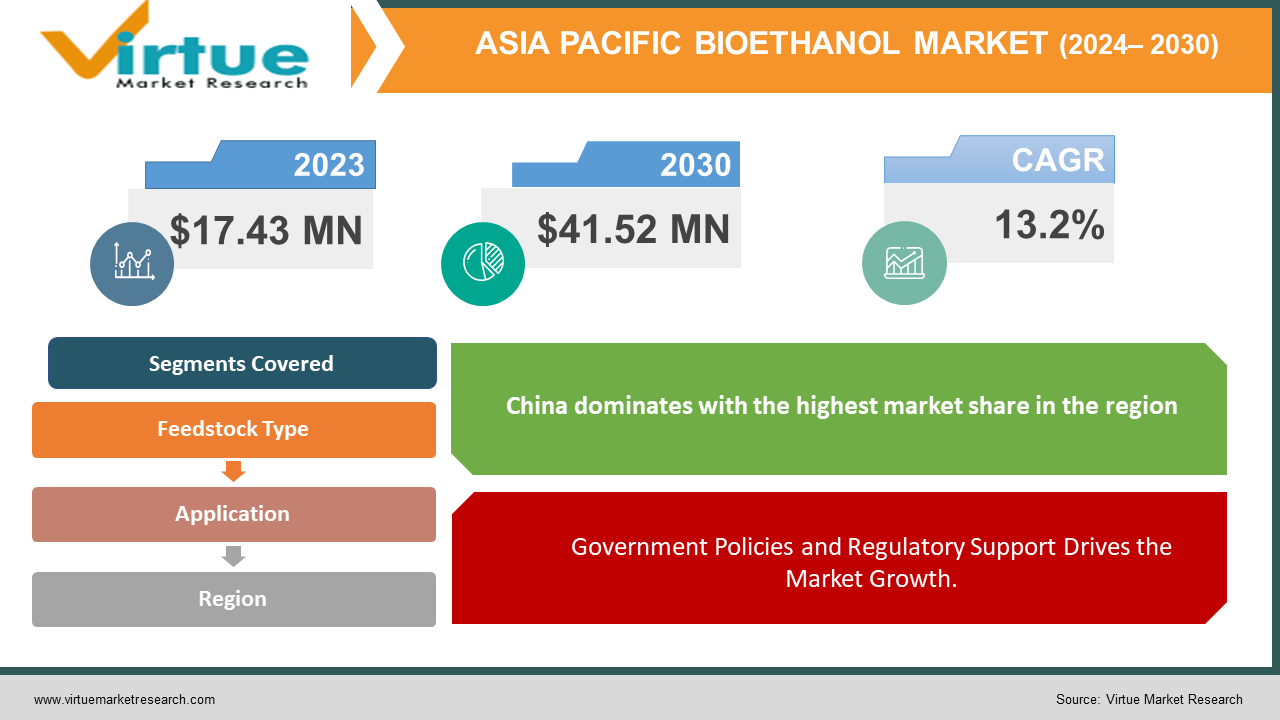

The Asia Pacific Bioethanol Market was valued at USD 17.43 million in 2023 and is projected to reach a market size of USD 41.52 million by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 13.2% between 2024 and 2030.

The Asia Pacific Bioethanol Market is experiencing significant growth, driven by increasing demand for renewable energy sources and the region's growing focus on reducing carbon emissions. Bioethanol, a sustainable alternative to fossil fuels, is derived from the fermentation of biomass such as sugarcane, corn, and other agricultural feedstocks. The market is witnessing robust expansion, fueled by government policies promoting biofuels, advancements in bioethanol production technologies, and rising environmental consciousness among consumers and industries. Countries like China, India, and Thailand are leading the charge in bioethanol adoption, with substantial investments in infrastructure and research to enhance production efficiency. Additionally, the transportation sector's shift towards cleaner energy options is propelling bioethanol demand, particularly in blending with gasoline to reduce vehicular emissions. The market's growth is further supported by the region's abundant agricultural resources and favorable climatic conditions, making it a key player in the global bioethanol landscape. As sustainability becomes a critical focus, the Asia Pacific Bioethanol Market is poised to play a pivotal role in the transition towards a greener and more energy-efficient future.

Key Market Insights:

- China leads the region, holding over 40% of total bioethanol production.

- India aims to achieve 20% ethanol blending in gasoline by 2025, up from the current 10%.

- Sugarcane-based ethanol accounts for approximately 60% of production in countries like Thailand.

- Using bioethanol can reduce carbon emissions by up to 70% compared to gasoline.

- Investment in bioethanol infrastructure in the Asia Pacific region is increasing by over 15% annually.

Asia Pacific Bioethanol Market Drivers:

Government Policies and Regulatory Support Drives the Market Growth.

Government policies and regulatory frameworks are major drivers of the Asia Pacific Bioethanol Market. Many countries in the region are implementing aggressive renewable energy targets to reduce their reliance on fossil fuels and decrease carbon emissions. For instance, India’s National Biofuels Policy aims to achieve 20% ethanol blending in petrol by 2025, significantly boosting demand for bioethanol. Similarly, China’s efforts to cut down on pollution have led to increased bioethanol production and usage, supported by government mandates and subsidies. These policies not only encourage domestic production but also attract foreign investments, enhancing overall market growth. Furthermore, governments are promoting bioethanol as a cleaner fuel alternative in the transportation sector, which is one of the largest contributors to greenhouse gas emissions. Regulatory support, including tax incentives, subsidies, and grants, plays a crucial role in making bioethanol more economically viable, driving its adoption across the region.

Abundant Agricultural Feedstock Availability Revolutionizing the Market Growth.

The Asia Pacific region is rich in agricultural resources, providing an abundant supply of feedstocks for bioethanol production. Countries like India, China, and Thailand have vast agricultural lands dedicated to crops such as sugarcane, corn, and cassava, which are key raw materials for bioethanol. This abundance not only ensures a steady supply of feedstock but also helps in reducing production costs, making bioethanol more competitive with conventional fossil fuels. Additionally, the availability of agricultural waste products, like bagasse and corn stover, further contributes to the sustainability and cost-effectiveness of bioethanol production. The use of these feedstocks not only supports the agricultural economy but also helps in waste management, as they are converted into valuable fuel. The region’s favorable climatic conditions and government support for agriculture further enhance the potential for bioethanol production, positioning the Asia Pacific as a key player in the global bioethanol market.

Asia Pacific Bioethanol Market Restraints and Challenges:

The Asia Pacific Bioethanol Market faces several restraints and challenges that could hinder its growth. One of the primary challenges is the competition for feedstock between bioethanol production and food supply. As bioethanol production relies heavily on agricultural crops like sugarcane and corn, there is a growing concern about the impact on food prices and food security in the region. This issue is particularly pronounced in densely populated countries where agricultural land is limited. Additionally, the infrastructure for bioethanol production and distribution is still underdeveloped in many parts of the Asia Pacific, leading to high production and transportation costs. The lack of advanced technology and skilled labor further exacerbates these challenges, making it difficult for smaller producers to compete. Moreover, while government policies favor bioethanol, fluctuating policy frameworks and inconsistent enforcement across different countries can create uncertainty for investors and producers. Environmental concerns related to water usage and deforestation associated with bioethanol feedstock cultivation also pose significant challenges. These factors combined could slow the adoption of bioethanol and limit its market growth in the region, making it crucial for stakeholders to address these issues to ensure sustainable and balanced development of the market.

Asia Pacific Bioethanol Market Opportunities:

The Asia Pacific Bioethanol Market presents significant opportunities driven by technological advancements and increasing demand for sustainable energy. One of the key opportunities lies in the development of second-generation bioethanol, which uses non-food feedstocks such as agricultural residues, waste biomass, and lignocellulosic materials. This not only alleviates the competition between bioethanol production and food supply but also enhances the sustainability and efficiency of bioethanol production. As technology evolves, the cost of producing second-generation bioethanol is expected to decrease, making it a viable alternative to first-generation biofuels. Additionally, the growing focus on reducing carbon footprints and achieving climate goals is pushing industries and governments to adopt cleaner energy solutions, further boosting the demand for bioethanol as a renewable fuel. The transportation sector, in particular, offers vast potential for bioethanol adoption, especially as countries like India and China work towards blending higher percentages of ethanol with gasoline. Furthermore, the region's rich agricultural resources and favorable climatic conditions provide a solid foundation for expanding bioethanol production. As investment in research and development increases, new innovations in bioethanol production and feedstock utilization could unlock further growth opportunities, positioning the Asia Pacific as a leading player in the global bioethanol market.

ASIA PACIFIC BIOETHANOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.2% |

|

Segments Covered |

By Feedstock Type, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

Praj Industries Ltd., Shree Renuka Sugars Ltd., Wilmar International Ltd., China National Petroleum Corporation (CNPC), Tereos S.A., Sinopec Corp., Bharat Petroleum Corporation Limited (BPCL), Jilin Fuel Ethanol Co., Ltd., Saraswati Sugar Mills Ltd., Sekab Biofuels & Chemicals AB, Cosan S.A., Indian Oil Corporation Limited (IOCL) |

Asia Pacific Bioethanol Market Segmentation Analysis:

Asia Pacific Bioethanol Market Segmentation By Feedstock Type:

- Sugarcane

- Corn

- Wheat

- Other Feedstocks

The country's large-scale production is supported by its status as a major agricultural producer, with abundant corn and other feedstocks facilitating cost-effective bioethanol manufacturing. The expanding automotive market further boosts demand for bioethanol blends, while substantial investments in production facilities and infrastructure enhance China's market position. Despite China's continued dominance, other countries in the Asia Pacific, such as India and Thailand, are making notable advancements in bioethanol production. India's commitment to increasing ethanol blending in gasoline and Thailand's investments in bioethanol infrastructure highlight the region's growing interest in renewable fuels. However, potential challenges could impact the market, including global economic fluctuations and shifts in energy policies that might affect bioethanol demand and production. Technological advancements in bioethanol production could also alter the competitive landscape, potentially impacting established leaders. Additionally, environmental concerns related to land use and water consumption for bioethanol production may influence market dynamics, necessitating ongoing adaptation and innovation within the industry.

Asia Pacific Bioethanol Market Segmentation By Application

- Automotive and Transportation

- Food and Beverage

- Pharmaceutical

- Cosmetics and Personal Care

- Other Applications

The Automotive and Transportation segment held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Government mandates across various countries in the region have significantly driven the demand for bioethanol, as policies require blending bioethanol with gasoline to cut carbon emissions and enhance air quality. This regulatory push, coupled with the rising cost of traditional fuels, has made bioethanol an attractive and cost-effective alternative for both consumers and transportation companies. Increasing environmental awareness and the need for sustainable fuel sources have further accelerated the shift towards bioethanol, as it offers a cleaner energy option. Additionally, substantial investments in bioethanol production facilities and distribution infrastructure have bolstered the growth of the automotive and transportation sectors. While the food and beverage industry is also experiencing a rise in bioethanol use, the automotive and transportation sector is anticipated to remain the primary growth drivers for the bioethanol market. These combined factors underscore bioethanol’s crucial role in the evolving energy landscape, ensuring its continued dominance in meeting both regulatory requirements and consumer demands for cleaner fuel alternatives.

Asia Pacific Bioethanol Market Segmentation By Country:

- China

- India

- Japan

- Australia

- South Korea

China has demonstrated robust support for bioethanol through supportive policies, mandates for ethanol blending in gasoline, and financial incentives for production. Leveraging its extensive agricultural land and abundant corn resources, the country has established a solid foundation for large-scale bioethanol production. The rapidly growing automotive industry further drives the demand for bioethanol blends as a fuel alternative. Significant investments in bioethanol production facilities and distribution infrastructure have reinforced China’s leading position in the global market. Although other countries in the region, like India and Thailand, are also ramping up bioethanol production, China’s early adoption, substantial investments, and consistent government backing are likely to sustain its dominance. However, potential challenges could impact China's market share in the future. Global economic fluctuations could affect both bioethanol demand and production. Technological advancements in production processes might alter the competitive landscape. Additionally, increasing environmental concerns regarding land use and water consumption for bioethanol production could influence market dynamics. These factors underscore the need for ongoing adaptation and innovation to maintain leadership in the bioethanol sector amidst evolving global and regional trends.

COVID-19 Impact Analysis on the Asia Pacific Bioethanol Market.

The COVID-19 pandemic had a mixed impact on the Asia Pacific Bioethanol Market. Initially, the market faced significant challenges as lockdowns and restrictions led to a sharp decline in transportation fuel demand, reducing the consumption of bioethanol blended with gasoline. The sudden drop in fuel demand, coupled with disruptions in supply chains, caused a slowdown in bioethanol production across the region. Additionally, the diversion of agricultural resources to address food security concerns during the pandemic further strained the availability of feedstocks for bioethanol production. However, the pandemic also accelerated the shift towards renewable energy sources as governments and industries recognized the importance of sustainable practices in building resilience against future crises. As economies began to recover, there was a renewed focus on reducing carbon emissions and promoting cleaner energy, leading to a gradual rebound in the bioethanol market. Governments in countries like India and China introduced stimulus packages and policy measures to support the biofuels industry, encouraging investments in bioethanol production. The pandemic highlighted the need for energy security and sustainability, which is likely to drive long-term growth in the Asia Pacific Bioethanol Market as the region continues its recovery and transition towards greener energy solutions.

Latest trends / Developments:

The Asia Pacific Bioethanol Market is witnessing several key trends and developments that are shaping its future growth. One notable trend is the increasing focus on second-generation bioethanol production, which uses non-food feedstocks such as agricultural residues and waste biomass. This shift is driven by the need to overcome the challenges associated with food security and land use, making bioethanol production more sustainable. Another significant development is the expansion of ethanol blending mandates across the region. Countries like India are aggressively pushing towards higher ethanol blending targets, with the Indian government aiming for a 20% ethanol blend in gasoline by 2025. This has led to substantial investments in bioethanol production facilities and infrastructure. Additionally, advancements in technology are enhancing production efficiency and reducing costs, making bioethanol a more competitive alternative to fossil fuels. The growing adoption of electric vehicles (EVs) is also influencing the market, as hybrid EVs can use bioethanol blends, creating new opportunities for bioethanol producers. Moreover, collaborations between governments, private sectors, and research institutions are fostering innovation in bioethanol production processes, such as the development of genetically modified crops that yield higher ethanol content. These trends underscore the dynamic evolution of the Asia Pacific Bioethanol Market towards a more sustainable and integrated energy future.

Key Players:

- Praj Industries Ltd.

- Shree Renuka Sugars Ltd.

- Wilmar International Ltd.

- China National Petroleum Corporation (CNPC)

- Tereos S.A.

- Sinopec Corp.

- Bharat Petroleum Corporation Limited (BPCL)

- Jilin Fuel Ethanol Co., Ltd.

- Saraswati Sugar Mills Ltd.

- Sekab Biofuels & Chemicals AB

- Cosan S.A.

- Indian Oil Corporation Limited (IOCL)

Chapter 1. Asia Pacific Bioethanol Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Bioethanol Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Bioethanol Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Bioethanol Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Bioethanol Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Bioethanol Market– By Feedstock Type

6.1. Introduction/Key Findings

6.2. Sugarcane

6.3. Corn

6.4. Wheat

6.5. Other Feedstocks

6.6. Y-O-Y Growth trend Analysis By Feedstock Type

6.7. Absolute $ Opportunity Analysis By Feedstock Type , 2024-2030

Chapter 7. Asia Pacific Bioethanol Market– By Application

7.1. Introduction/Key Findings

7.2 Automotive and Transportation

7.3. Food and Beverage

7.4. Pharmaceutical

7.5. Cosmetics and Personal Care

7.6. Other Applications

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Asia Pacific Bioethanol Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Feedstock Type

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Bioethanol Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Praj Industries Ltd.

9.2. Shree Renuka Sugars Ltd.

9.3. Wilmar International Ltd.

9.4. China National Petroleum Corporation (CNPC)

9.5. Tereos S.A.

9.6. Sinopec Corp.

9.7. Bharat Petroleum Corporation Limited (BPCL)

9.8. Jilin Fuel Ethanol Co., Ltd.

9.9. Saraswati Sugar Mills Ltd.

9.10. Sekab Biofuels & Chemicals AB

9.11. Cosan S.A.

9.12. Indian Oil Corporation Limited (IOCL)

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Asia Pacific Bioethanol market is expected to be valued at US$ 17.43 million

Through 2030, the Asia Pacific Bioethanol market is expected to grow at a CAGR of 13.2%.

By 2030, the Asia Pacific Bioethanol Market is expected to grow to a value of US$ 41.52 million.

China is predicted to lead the Asia Pacific Bioethanol market.

The Asia Pacific Bioethanol Market has segments By feedstock Type, Application, and Region.