Asia-Pacific Bio-Based Coating Market (2024-2030)

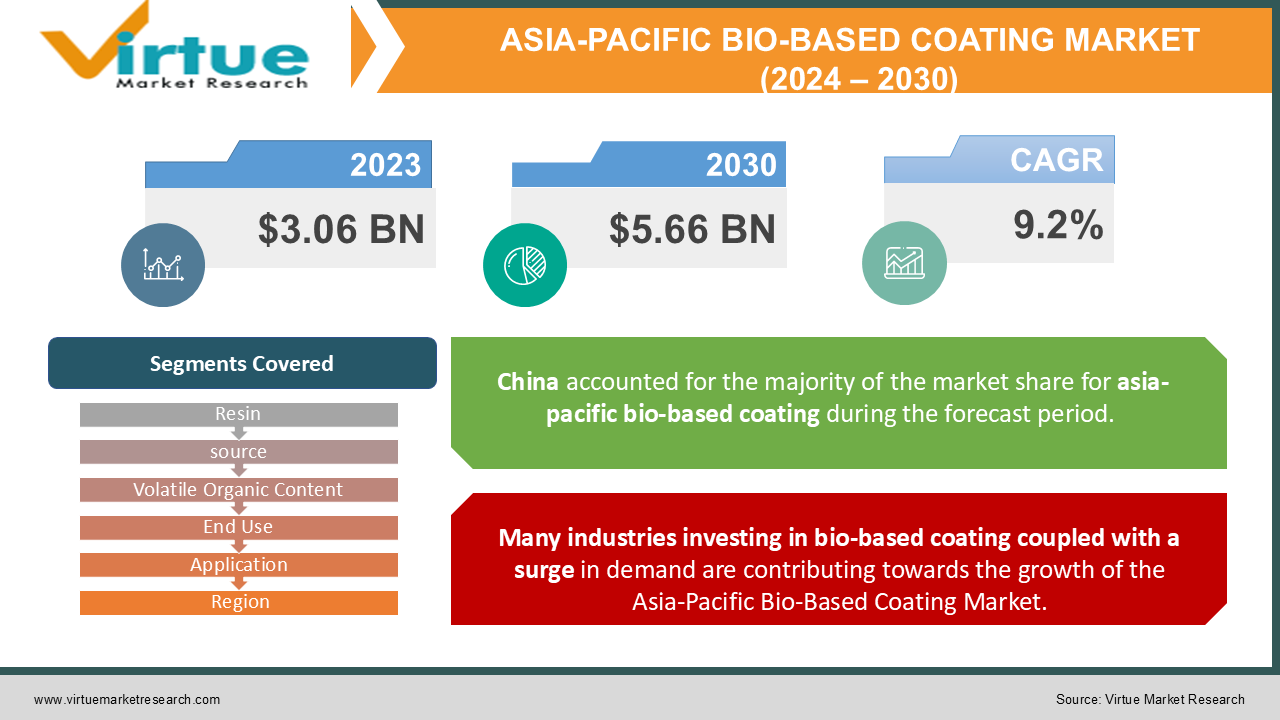

Asia-Pacific Bio-Based Coating Market is estimated to be $3.06 Billion in 2023 and is estimated to reach a value of $5.66 Billion by 2030, growing at a CAGR of 9.2% during the forecast period of 2024 – 2030.

Bio–based coating is a coating that is made from organic sources and reduces the reliance on exhausting fossil fuels. This can help in dealing with pertaining social challenges and can also help in promoting employment and rural development. Resins, additives, and pigments are bio–solvents produced using bio–based coating made from renewable raw materials.

The world has been battling various environmental problems that can threaten the survival of future generations. Hence, there have been many private and government-led initiatives that include sustainable development to tackle these problems and come up with eco-friendlier solutions for them. This has increased the trends of eco-friendly alternatives in the coating industry which has given rise to the bio-based coating industry which is booming since last decade and is one of the biggest reasons for the growth of this market. There have been regulations by the United Nations and initiatives by various countries to reduce carbon emissions and Volatile Organic Content in the coating life cycle which has influenced the bio-based market. As people get more educated and aware of the benefits of bio-based coating, it will fuel the growth of the market.

Asia-Pacific Bio-Based Coating Market Drivers:

Increasing awareness among consumers regarding the environment and the toxic materials used in paints in their houses has been fueling the growth of the Asia-Pacific Bio-Based Coating Market.

Worries about both personal health and environmental impact are fueling a rising demand among consumers for coatings with low emissions. The desire to have cleaner and safer indoor and outdoor air quality is a key driver. There is a growing awareness among consumers regarding potentially harmful substances that traditional interior paints could introduce into their living spaces. The biggest concern is the release of hazardous emissions during the process of painting interiors, particularly in spaces designated for children. Both consumers and professional painters agree that the most appealing recent advancement in wall paints is the emphasis on personal safety. There is an increasing trend where customers are increasingly inclined to opt for paints that are manufactured using bio-based materials. The perception is that these options are not only healthier but also in line with environmental sustainability. This shift in preferences is predicted to open up lucrative opportunities for the expansion of the Asia-Pacific market for bio-based coatings.

Many industries investing in bio-based coating coupled with a surge in demand are contributing towards the growth of the Asia-Pacific Bio-Based Coating Market.

Promising prospects and significant value applications of bio-based coating materials are being propelled by the automotive, furniture, and packaging industries. These sectors are actively investing in and launching novel products, driven by the imperative for sustainable alternatives. The forecasted trajectory shows an upward surge in the demand for solvent-free coatings. Manufacturers' focus on addressing Asia-Pacific warming and environmental concerns is capturing their attention and is anticipated to be a driving force for growth in the forecast period.

Asia-Pacific Bio-Based Coating Market Challenges:

Strict environmental policies by the governments to reduce solvents based coatings and paints are one major factor. Bio-based coatings are more expensive compared to traditional chemical-induced coatings which can make them non-feasible to developing and underdeveloped countries. Also, people in these countries are not well educated about the environmental implications and continue using old traditional coatings. Companies have been trying to promote bio-based coatings through advertisements and promotions but very less progress has been witnessed which can hinder the growth of the Asia-Pacific Bio-Based Coating Market.

Asia-Pacific Bio-Based Coating Market Opportunities:

Conventional raw materials within coating systems are anticipated to be taken over by plant-based sources as an alternative. Within various end-use sectors like construction and furniture, bio-based resins are employed in crafting coating systems. Primary sources for producing these bio-resins are typically by-products from corn and soybean stemming from bio-diesel refinement processes. Supplementary sources include potatoes, sugarcane, sugar beets, castor beans, lignocellulose, cashew nut shells, algae, and whey. While the utilization of bio-based raw materials in coatings is not a recent advancement, its history goes far behind the inception of the petrochemical industry. Nonetheless, until now, the majority of manufactured paints and varnishes have been rooted in fossil-derived resources. This landscape, however, is poised for transformation, as bio-based resins, once seen as unconventional, are making their way into the mainstream and are projected to offer lucrative business opportunities for the market during the forecast period.

COVID-19 Impact on Asia-Pacific Bio-Based Coating Market:

The pandemic forced various governments to enforce lockdowns and restrict transport which severely affected the bio-based coating market. The demand and the production both went down and manufacturers had to suffer serious loss of revenue. Since the pandemic, there have been increasing environmental and health concerns among people which has shifted their preference towards opting for bio-based coatings for their homes. During the post-pandemic when all the restrictions have been lifted, the market is estimated to witness significant growth.

Asia-Pacific Bio-Based Coating Market Recent Developments:

- In July 2023, Melodea, Ltd., a prominent producer of sustainable barrier coatings for packaging, unveiled its latest breakthrough named MelOx NGen. This cutting-edge innovation represents a high-performance bio-based solution tailored to enable the recyclability of various plastic food packaging formats and more. MelOx NGen is a water-based coating derived from plant sources, meticulously engineered to provide a lining for the interior surfaces of diverse plastic food packaging types, including films, pouches, bags, lidding, and blister packs.

- In June 2022, Eco Safety Company completed the acquisition of Soy Technologies, a strategic move that has enabled Eco Safety to broaden its range of bio-based coatings and provide additional options as substitutes for methylene chloride.

- In January 2022, Covestro AG and Genomatica Inc jointly announced a milestone achievement: the successful large-scale production of a plant-derived variant of the chemical raw material HMDA (hexamethylenediamine). This accomplishment holds particular significance as HMDA constitutes a crucial building block for the formulation of raw materials utilized in Covestro's coatings and adhesive products

ASIA-PACIFIC BIO-BASED COATING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.2% |

|

Segments Covered |

By Resin, source, Volatile Organic Content, End – Use, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, India, Japan, South Korea, Australia |

|

Key Companies Profiled |

KCC Corporation, Eco Safety, BioSheilds, Nippon Paint Holdings Co. Ltd. , Reliance Industries Ltd. , Carpoly Chemical Group, Genomatica Inc. , Zhongshang Daoqum. , Noroo Paint and Coating Co. Ltd, Japan Polypropylene Corporation |

Asia-Pacific Bio-Based Coating Market Segmentation:

Asia-Pacific Bio-Based Coating Market Segmentation: By Resin

- Polyurethane

- Acrylic

- Alkyd

- Others

Polyurethane has dominated the segment and held the highest share of the market in 2022 and is estimated to hold the position during the forecast period. Polyurethane showcases resilient and promising growth owing to its advantages over other conventional coatings. This popularity is due to its resistance to wear and tear, durability, and excellent mechanical properties. Acrylic is also the fastest-growing resin after polyurethane and is estimated to hold a significant amount of share during the coming years.

Asia-Pacific Bio-Based Coating Market Segmentation: By Source

- Soybean

- Corn

- Sugarcane

- Biodiesel

- Others

Soybean has dominated the segment by holding the largest share of the market in 2022 as it is widely used to make plant-based coating. Its popularity is owed to the fact that soybean is easily available, costs less compared to other sources, and is more efficient as a coating raw material. Sugarcane is also one of the fastest-growing sources in the segment and is estimated to hold a considerable amount of market share during the forecast period.

Asia-Pacific Bio-Based Coating Market Segmentation: By Volatile Organic Content

- Zero VOC

- Low VOC

- VOC Absorbing

Zero VOC dominated the segment by holding the largest share of the market in 2022. This is because extra chemical solvents are absent in zero VOC which positions them as the least environmentally detrimental option. The concentration of volatile organic compounds within a paint formulation defines the category of chemicals that initiate vaporization under indoor temperatures. The substantial demand for zero VOC options is primarily driven by the anticipation of robust revenue growth during the forecast period, owing to their positive environmental and health implications. There is also a discernible trend towards increased acceptance and demand for low VOC and natural paints within the bio-based coatings market, hence it is projected to be the second-highest growing market.

Asia-Pacific Bio-Based Coating Market Segmentation: By End – Use

- Packaging

- Architectural

- Woodwork

- Others

Architectural is the most dominant segment in the market accounting for the highest revenue in 2022 which was propelled by the escalating need for top-notch coatings that deliver exceptional performance while remaining cost-efficient. The woodworking domain stands as the second largest sector, leveraging its strong sustainability credentials to offer coatings characterized by impressive hardness, resistance to chemicals and light, and environmentally conscious industrial application processes. Water-based wood coatings exhibit quicker drying times compared to their solvent-based counterparts. Among the frequently employed wood coatings, polishes and water repellents take a prominent place.

Asia-Pacific Bio-Based Coating Market Segmentation: By Application

- Paints

- Metal Industries Coating

- Automotive Refinish

- Metal Industries Coating

- Powder Coating

- Others

Paints are the most dominant segment in the application. There has been a rising awareness among people about the dangers of conventional paintings inside their homes which are harmful for humans and something they don’t want around children hence consumers are shifting towards paints that will not affect humans and keep the insides of the home clean. Bio-Based coating is also widely used in the automotive sector which is the second highest growing sector in this segment and will hold a significant amount during the forecast period.

Asia-Pacific Bio-Based Coating Market Segmentation: By Region

- China

- India

- Japan

- South Korea

- Australia

China has dominated the segment by having the highest share in the market in 2022 and is projected to hold the position during the forecast period owing to that it is the world’s highest carbon emitter hence the government and the private sector in the country have been taking active measures to shift eco-friendlier products. As disposable income people are rising, they are willing to spend more on bio-based coating. India is also projected to witness one of the fastest growth in the Asia-Pacific Bio-Based Market during the forecast period.

Asia-Pacific Bio-Based Coating Market Key Players:

- KCC Corporation

- Eco Safety

- BioSheilds

- Nippon Paint Holdings Co. Ltd.

- Reliance Industries Ltd.

- Carpoly Chemical Group

- Genomatica Inc.

- Zhongshang Daoqum.

- Noroo Paint and Coating Co. Ltd

- Japan Polypropylene Corporation

Chapter 1. ASIA-PACIFIC BIO-BASED COATING MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ASIA-PACIFIC BIO-BASED COATING MARKET– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. ASIA-PACIFIC BIO-BASED COATING MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. ASIA-PACIFIC BIO-BASED COATING MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. ASIA-PACIFIC BIO-BASED COATING MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ASIA-PACIFIC BIO-BASED COATING MARKET– By Resin

6.1. Polyurethane

6.2. Acrylic

6.3. Alkyd

6.4. Others

Chapter 7. ASIA-PACIFIC BIO-BASED COATING MARKET– By Source

7.1. Soybean

7.2. Corn

7.3. Sugarcane

7.4. Biodiesel

7.5. Others

Chapter 8. ASIA-PACIFIC BIO-BASED COATING MARKET– By Volatile Organic Content

8.1 Zero VOC

8.2. Low VOC

8.3.VOC Absorbing

Chapter 9. ASIA-PACIFIC BIO-BASED COATING MARKET– By End Users

9.1 Packaging

9.2. Architectural

9.3. Woodwork

9.4. Others

Chapter 10. ASIA-PACIFIC BIO-BASED COATING MARKET– By Application

10.1 Paints

10.2. Metal Industries Coating

10.3. Automotive Refinish

10.4. Metal Industries Coating

10.5. Powder Coating

10.6. Others

Chapter 11. ASIA-PACIFIC BIO-BASED COATING MARKET– By Region

11.1. China

11.2. India

11.3. Japan

11.4. South Korea

11.5. Australia

Chapter 12. ASIA-PACIFIC BIO-BASED COATING MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

12.1. KCC Corporation

12.2. Eco Safety

12.3. BioSheilds

12.4. Nippon Paint Holdings Co. Ltd.

12.5. Reliance Industries Ltd.

12.6. Carpoly Chemical Group

12.7. Genomatica Inc.

12.8. Zhongshang Daoqum.

12.9. Noroo Paint and Coating Co. Ltd

12.10. Japan Polypropylene Corporation

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Asia-Pacific Bio-Based Coating Market is estimated to be $3.06 Billion in 2023 and is estimated to reach a value of $5.66 Billion by 2030, growing at a CAGR of 9.2% during the forecast period of 2024 – 2030.

Increasing environmental and health concerns and investments of major Asia-Pacific coating companies in bio-based coating are the major market drivers.

By Source, Asia-Pacific Bio-Based Coating Market is segmented into Soybean, Corn, Sugarcane, Bio-Diesel, and others

China is the most dominant country in the region of Asia-Pacific for the Bio-Based Coating Market.

KCC Corporation, Eco Safety, BioSheilds, Nippon Paint Holdings Co. Ltd., Reliance Industries Ltd., Carpoly Chemical Group, Genomatica Inc., Zhongshang Daoqum., Noroo Paint and Coating Co. Ltd, Japan Polypropylene Corporation