Asia-Pacific Apple Juice Market Size (2024-2030)

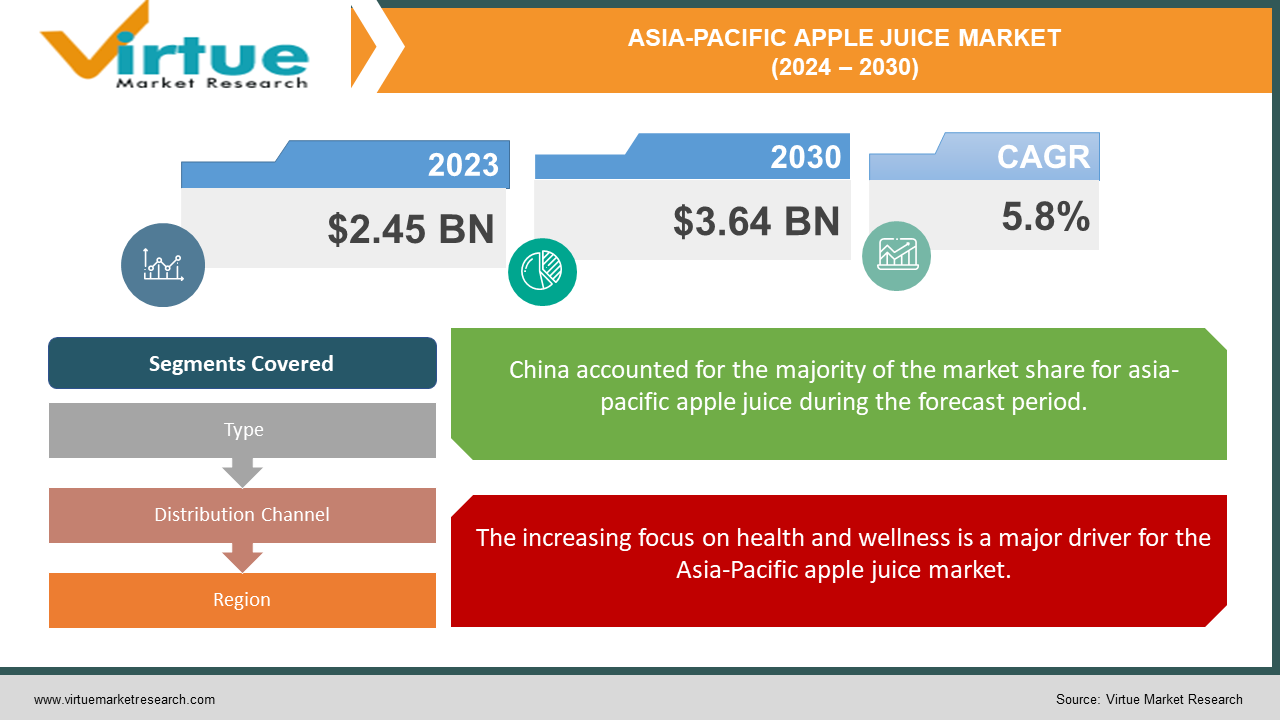

The Asia-Pacific Apple Juice Market was valued at USD 2.45 Billion in 2023 and is projected to reach a market size of USD 3.64 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.8%.

Due to growing middle-class populations, rising disposable incomes, and growing consumer health consciousness, the Asia-Pacific apple juice industry is developing significantly. There are many different types of goods available in the market, such as mixes, concentrates, and pure apple juice. The Asia-Pacific area is witnessing a boom in demand for natural and nutritious beverages due to consumers' growing health consciousness. This trend is perfectly suited for apple juice, which is well-known for its strong antioxidant and vitamin C content. The market for apple juice is expanding as people choose better diets and lifestyles. Product quality and shelf life of apple juice have increased due to technological advancements in production. Contemporary processing methods, such aseptic packing and cold pressing, guarantee that the juice's flavours and nutritional content are retained, increasing its attractiveness to consumers. Because these technical advancements are producing high-quality apple juice products, the industry is expanding.

Key Market Insights:

Consumers in the APAC region under the age of 35 represent the largest demographic driving the growth of the apple juice market, accounting for over 50% of consumption.

Convenience is a key factor influencing consumer choices, with 72% of APAC consumers preferring single-serve or ready-to-drink apple juice options.

Growing health consciousness is leading to a rise in demand for sugar-free or reduced-sugar apple juice options. Over 40% of consumers in the APAC region are actively seeking these healthier alternatives.

Supermarkets and hypermarkets remain the dominant distribution channels for apple juice in the APAC region, accounting for over 55% of the market share.

Convenience stores are a significant distribution channel, particularly in urban areas, capturing over 20% of the APAC apple juice market share.

E-commerce platforms are witnessing rapid growth in the APAC region, with online sales of apple juice projected to reach over USD 3 billion by 2025.

Over 35% of APAC consumers now purchase apple juice through online grocery shopping platforms.

The perception of apple juice as a natural and healthy beverage for children remains strong in the APAC region, with 60% of households with children regularly purchasing apple juice.

The introduction of apple juice blends with popular regional fruits such as mango or guava is expected to contribute to market growth at a rate of over 7% per year.

The demand for organic and minimally processed apple juice options is on the rise in the APAC region, with a projected market share exceeding USD 1.5 billion by 2027.

Asia-Pacific Apple Juice Market Drivers:

The increasing focus on health and wellness is a major driver for the Asia-Pacific apple juice market.

The high vitamin C content of apple juice is well recognised for strengthening the immune system and enhancing general health. Additionally, it has antioxidants like polyphenols and flavonoids that aid in the body's battle against free radicals. Health-conscious customers are drawn to these benefits, especially in metropolitan regions where lifestyle-related health problems are becoming more prevalent. In the Asia-Pacific area, the movement toward natural and organic products is becoming more and more popular. Drinks produced with natural components and free of chemical additives and preservatives are becoming more and more popular among consumers. Organic apple juice, produced from apples that are cultivated organically, is become more and more well-liked among customers who are health conscious. The market for premium and organic apple juice products is being driven by this trend.

Economic growth and urbanization in the Asia-Pacific region are significant drivers for the apple juice market.

The spread of contemporary retail outlets like supermarkets, hypermarkets, and convenience stores is a result of urbanization. These retail outlets make it simpler for customers to obtain and buy apple juice goods by providing a large assortment of them. Apple juice is becoming more and more popular due to its accessibility and ease in contemporary retail establishments. Convenient and ready-to-drink drinks are becoming more and more popular as urban consumers lead busier lifestyles. Apple juice, which comes in a variety of packaging styles like bottles, cans, and tetra packs, complements this trend nicely. The urban apple juice industry is expanding due to consumer desire for portable beverages.

Asia-Pacific Apple Juice Market Restraints and Challenges:

The high cost of manufacturing is one of the main issues the apple juice industry in Asia-Pacific is dealing with. Harvesting, juicing, pasteurization, and packing are some of the steps involved in making apple juice. Significant investments in personnel, raw materials, and equipment are needed at each of these processes. Costs associated with raw materials, especially apples, account for a sizeable portion of total manufacturing expenses. The cost of producing apple juice can be affected by changes in apple pricing brought on by things like bad weather, insect outbreaks, and problems with the supply chain. Elevated apple costs have the potential to diminish producers' profit margins and result in increased consumer retail prices. Apple juice manufacturing is an energy-intensive process that uses a lot of water and power for pasteurization and processing.

Asia-Pacific Apple Juice Market Opportunities:

There are plenty of potential prospects due to the apple juice market's rise in emerging markets. The Asia-Pacific region is seeing economic growth, which is driving up demand for convenient and healthy beverage alternatives. Manufacturers of apple juice may benefit from this trend by entering new markets and growing existing brands. Asia-Pacific emerging economies, including Vietnam, the Philippines, and India, have sizable and expanding customer bases. The demand for upscale and healthy beverages is being driven by these nations' increased disposable incomes and rising living standards. Producers of apple juice may take advantage of this growing market by providing a range of products that are suited to regional tastes. Reaching customers in new areas requires making significant investments in strong distribution networks. In the apple juice sector, innovation and product diversification provide substantial development prospects. Customers are looking for more distinctive and varied beverage alternatives that suit their changing preferences and tastes. Manufacturers of apple juice can benefit from this trend by diversifying their product offerings and launching cutting-edge items.

ASIA-PACIFIC APPLE JUICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, Australia & New Zealand, South Korea, India, Rest of Asia-Pacific |

|

Key Companies Profiled |

Pfizer Inc. (US), GlaxoSmithKline Plc. (UK), Nestlé S.A. ( Switzerland), Bayer AG (Germany), Hikma Pharmaceuticals PLC (Jordan), The Arab Company for Drug Industries and Medical Supplies (Egypt), Marcy Laboratory LLC (Saudi Arabia), Gulf Pharmaceutical Industries (UAE), Herbalife Nutrition (US), Amway Corporation (US), Nature's Way Products, Inc. (US), Solgar Vitamin and Herb (US), GNC Holdings LLC (US). |

Asia-Pacific Apple Juice Market Segmentation:

Asia-Pacific Apple Juice Market Segmentation: By Types:

- pure apple juice

- apple juice concentrates

- apple juice blends

Pure apple juice, made from freshly squeezed apples without any additives or preservatives, is highly popular among health-conscious consumers. It is known for its natural taste and nutritional benefits. Pure apple juice is the most dominant segment in the market, driven by its perceived healthiness and natural appeal.

Apple juice blends, which combine apple juice with other fruit juices, are gaining popularity for their unique flavour combinations and added nutritional benefits. This segment is the fastest growing, driven by consumer interest in trying new and exotic flavors. Apple juice blends offer a refreshing and flavourful alternative to traditional apple juice.

Asia-Pacific Apple Juice Market Segmentation: By Distribution Channel:

- Supermarkets, hypermarkets

- Retail stores

- online platforms

- direct-to-consumer sales

The most common distribution channels for apple juice are supermarkets and hypermarkets, which house a large assortment of brands and goods. These retail establishments draw a lot of customers because of their accessibility, affordable prices, and wide range of products.

Because of the growth of e-commerce and shifting consumer purchasing patterns, online platforms are the distribution channel that is expanding the quickest. Online shoppers are drawn to buying apple juice because it's convenient and allows them to compare goods and read reviews. Direct-to-consumer sales are another benefit of e-commerce platforms, which helps producers reach a wider market.

Asia-Pacific Apple Juice Market Segmentation: Regional Analysis:

- China

- Japan

- Australia & New Zealand

- South Korea

- India

- Rest of Asia-Pacific

In the Asia-Pacific apple juice market, China is the clear leader, with a large 40–45% market share. Numerous variables, including the nation's enormous apple output, strong processing infrastructure, and rising domestic demand, are responsible for this domination. China is the world's greatest apple producer, accounting for about half of the world's total apple supply. This plentiful supply of raw materials offers a major benefit in the manufacturing of apple juice. China's main apple-growing regions are the provinces of Shaanxi, Shandong, and Liaoning; these areas have ideal climates and have produced high-quality apples for generations due to their long history of cultivation.

India is the nation with the quickest rate of growth in the Asia-Pacific apple juice industry, however, China still has a dominant position. India's apple juice business is expanding quickly, despite its present tiny market share of 5-8%. This expansion is being fueled by a number of causes, such as shifting customer tastes, increased middle-class disposable income, and rising health consciousness. Compared to more developed economies like China or Japan, the apple juice business in India is still in its infancy. In India, fresh fruit juices made at home or by street sellers have historically been more popular. But bottled apple juice's extended shelf life and ease of use have made it more and more popular, particularly in cities.

COVID-19 Impact Analysis on the Asia-Pacific Apple Juice Market:

Apple juice consumption increased dramatically in the early stages of the epidemic due to panic buying and hoarding. Concerned about their well-being and any nutritional deficits, consumers resorted to drinks like apple juice that were thought to strengthen immunity. This fleeting fad, however, was overshadowed by a more substantial change in consumer behaviour. Increased home consumption as a result of mobility restrictions and lockdowns created a demand spike for larger-sized apple juice packets and online food shopping. E-commerce sites have become an essential lifeline for producers of apple juice since they provide consumers who are restricted to their homes with easy access. The pandemic heightened health consciousness among consumers, leading to a preference for products perceived as natural and healthy. This presented an opportunity for apple juice manufacturers to emphasize the vitamin C content and potential health benefits of their products.

Latest Trends/ Developments:

Manufacturers are exploring various strategies to reduce sugar content without compromising taste. This includes using naturally sweeter apple varieties, blending apple juice with other low-sugar fruits, and utilizing stevia or other natural sweeteners. Introducing essential vitamins, minerals, or prebiotics can enhance the health perception of apple juice. This caters to consumers seeking beverages that offer additional health benefits beyond simple refreshments. Local apple varieties with unique flavour profiles are being used in blends or single-origin juices. This caters to consumer interest in supporting local farmers and experiencing distinctive taste experiences. Blending apple juice with popular regional fruits like mango, guava, or lychee creates exciting new flavour combinations. This approach caters to a desire for locally inspired beverages with a twist on the traditional apple juice taste. Online retailers offer a broader range of apple juice options, including niche varieties and functional blends, that might not be readily available in traditional brick-and-mortar stores. This caters to consumers seeking more diverse choices.

Key Players:

-

- PepsiCo (US)

- The Coca-Cola Company (US)

- Nestlé (Switzerland)

- Kraft Heinz Company (US)

- Mengniu Dairy (China)

- Yakult Honsha Co. (Japan)

- Lotte Chilsung Beverage (South Korea)

- ITC Limited (India)

- Asahi Group Holdings (Japan)

- Dabur India Ltd. (India)

- Vita Coco Company (US)

- China Huiyuan Juice Group Ltd. (China)

- ROKiT Group (UK) (with p

- Frucor Suntory (Australia)

Chapter 1. Asia-Pacific Apple Juice Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Apple Juice Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Apple Juice Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Apple Juice Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Apple Juice Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Apple Juice Market– By Types

6.1. Introduction/Key Findings

6.2. pure apple juice

6.3. apple juice concentrates

6.4. apple juice blends

6.5. Y-O-Y Growth trend Analysis By Types

6.6. Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Asia-Pacific Apple Juice Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3. Retail stores

7.4. online platforms

7.5. direct-to-consumer sales

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Asia-Pacific Apple Juice Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Types

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia-Pacific Apple Juice Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 PepsiCo (US)

9.2. The Coca-Cola Company (US)

9.3. Nestlé (Switzerland)

9.4. Kraft Heinz Company (US)

9.5. Mengniu Dairy (China)

9.6. Yakult Honsha Co. (Japan)

9.7. Lotte Chilsung Beverage (South Korea)

9.8. ITC Limited (India)

9.9. Asahi Group Holdings (Japan)

9.10. Dabur India Ltd. (India)

9.11. Vita Coco Company (US)

9.12. China Huiyuan Juice Group Ltd. (China)

9.13. ROKiT Group (UK) (with p

9.14. Frucor Suntory (Australia)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Economic growth in many APAC countries is leading to rising disposable incomes, particularly in urban areas. This allows families to allocate more resources towards packaged beverages like apple juice, perceived as a convenient and refreshing option.

Growing awareness of the negative health effects of excessive sugar consumption is leading some consumers to question the perceived health benefits of apple juice, particularly those with high sugar content.

Pfizer Inc. (US), GlaxoSmithKline Plc. (UK), Nestlé S.A. ( Switzerland), Bayer AG (Germany), Hikma Pharmaceuticals PLC (Jordan), The Arab Company for Drug Industries and Medical Supplies (Egypt), Marcy Laboratory LLC (Saudi Arabia), Gulf Pharmaceutical Industries (UAE), Herbalife Nutrition (US), Amway Corporation (US), Nature's Way Products, Inc. (US), Solgar Vitamin and Herb (US), GNC Holdings LLC (US).

The market is dominated by China, which commands a market share of around 45%.

With a market share of about 5%, India is the nation that is expanding the fastest.