Ascorbic acid Market Size (2025 – 2030)

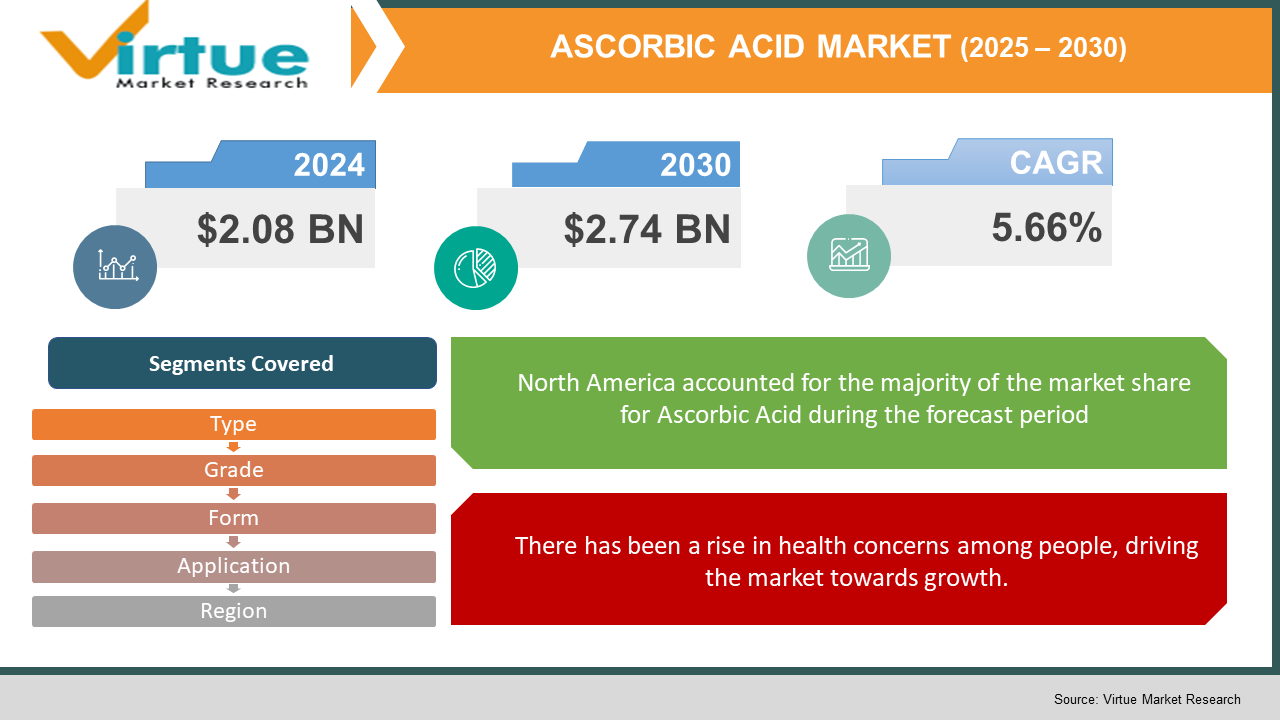

The Global Ascorbic Acid Market was valued at USD 2.08 billion and is projected to reach a market size of USD 2.74 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.66%.

Owing to its antioxidant qualities and health advantages, ascorbic acid, often called vitamin C, is a crucial nutrient widely used across multiple sectors, including food and drink, pharmaceuticals, cosmetics, and animal feed. Since ascorbic acid is widely used in beauty products for its antioxidant qualities, this raises its share in the makeup business. Its capacity to promote collagen synthesis improves skin resilience and reduces the appearance of wrinkles and fine lines. Accordingly, items including lotions, creams, and serums that include ascorbic acid have exploded in popularity for their ability to get a youthful and radiant appearance.

Key Market Insights:

- Underlining its major role in the market, China manufactures nearly 70% of the world's vitamin C.

- Apart from nutritional supplements, ascorbic acid is frequently found in cosmetics and animal feed, demonstrating its adaptability throughout sectors.

- Innovations in industrial synthesis, such as the two-step fermentation process, have improved production efficiency and reduced costs, impacting global supply dynamics.

- The production of ascorbic acid depends heavily on raw ingredients such as corn and sugar. Price fluctuations on these goods can have a major impact on operating costs, therefore presenting difficulties for businesses. For example, from 2018 to 2023, corn prices rose because of increased demand and bad weather, driving up expenses for ascorbic acid manufacturers.

Ascorbic Acid Market Drivers:

There has been a rise in health concerns among people, driving the market towards growth.

The rising focus on health and wellness by people all around is driving a surge in vitamin C supplements and fortified food sales. Renowned for its antioxidant and immune-boosting effects, ascorbic acid is a common selection among health-conscious people of late. Continuing this trend will bolster market expansion.

The expansion of the food and beverage industry has led to increased use of ascorbic acid.

In the food and beverage industry, ascorbic acid is a key nutrient enhancer and preservative. Its capacity to preserve product quality and stop oxidation has made it popular in many different food items. The rising use of ascorbic acid is greatly attributable to the booming food and beverage business, together with the increasing demand for processed and convenience food.

The growth of the pharmaceutical industry is a key market driver, leading to more demand for ascorbic acid.

Especially in developing countries, the growing pharmaceutical sector has resulted in a greater need for ascorbic acid for pharmaceutical preparations. Using antioxidant and immune support abilities, vitamin C is needed in several therapeutic contexts. Further driving the demand for ascorbic acid in the pharmaceutical industry is the increasing frequency of chronic diseases and the emphasis on preventative medicine.

Ascorbic Acid Market Restraints and Challenges:

Strict rules and regulations are a great challenge for the ascorbic acid market.

For manufacturers of ascorbic acid, compliance with different local rules raises operational hurdles. Dealing with various laws among nations demands a lot of money and can impede market entry or growth. This complexity can cause higher operating costs and product release delays.

Tough competition from alternatives can be very challenging for the market, affecting growth.

Ascorbic acid faces competition from artificial antioxidants and alternative preservatives. These options could have cost benefits or varied functional characteristics, therefore restricting ascorbic acid's market share. To sustain competition, manufacturers have to always be creative and emphasize the special advantages of ascorbic acid.

Supply chain disruptions can be a main hindrance to the growth of the market.

For example, the COVID-19 epidemic and other world events that have interrupted supply networks would cause ascorbic acid to be available inconsistently. These disturbances can cause production delays and higher expenses, therefore challenging market balance. Supply chain problems, for instance, resulted in higher costs and limited accessibility of ascorbic acid throughout the epidemic.

Ascorbic Acid Market Opportunities:

Developing regions are the emerging market allowing the market to expand its operation.

Rising wealth and greater health awareness are particularly prevalent in Asia-Pacific's developing areas. This change is increasing the need for vitamin C supplements and fortified meals, therefore offering great growth opportunities for ascorbic acid goods. The especially significant drivers of this phenomenon are nations like China and India.

The increased demand for organic products is seen as a great opportunity for the market to grow.

Rising consumer demand for natural and organic goods is driving vitamin C sales. This tendency is inspiring producers to investigate ascorbic acid sourced from natural sources, which corresponds with consumer demands for clean-label and plant-based components.

The rise in the popularity of functional foods presents the market with the potential for further growth.

Functional foods and nutrient-fortified drinks are gaining popularity and could help to grow the market. Catering to health-conscious customers looking for more nutritional value, ascorbic acid's antioxidant activities make it a valuable addition to these products. This direction is projected to change the food and beverage sector's demand.

The recent innovations in the field of technology allow the market to enhance its quality and competitiveness.

Improved quality and lower costs resulting from developments in extraction and synthesis techniques can make a company more competitive. Consumer demands for more powerful goods are met by innovations, including liposomal and nanoencapsulation methods that are increasing the bioavailability and durability of vitamin C supplements.

ABSORBIC ACID MARKET REPORT COVERAGE:

|

REPORT METRIC A |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.66% |

|

Segments Covered |

By Type, grade, application, form, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Koninklijke DSM N.V., BASF SE, Merck KGaA, Northeast Pharmaceutical Group Co. Ltd., CSPC Pharmaceutical Group, Shandong Luwei Pharmaceutical Co. Ltd., Foodchem International Corporation, MC Biotech Inc., Hebei Welcome Pharmaceutical Co. Ltd., Bactolac Pharmaceutical Inc. |

Ascorbic Acid Market Segmentation:

Ascorbic acid Market Segmentation: By Type

- Sodium Ascorbate

- Calcium Ascorbate

- Potassium Ascorbate

- Magnesium Ascorbate

Sodium Ascorbate is both the dominant and the fastest-growing segment in the market. Sodium Ascorbate leads the market since its stability and bioavailability enable it to be appropriate for several uses. Derived from ascorbic acid, sodium ascorbate is favored in many uses because of its increased stability and availability.

Calcium Ascorbate combines vitamin C with calcium, therefore, it is rather kind on the stomach and is sometimes found in dietary supplements. Although it is less prevalent, potassium ascorbate is used in some particular dietary supplements. Used in supplements to lower acidity, magnesium ascorbate is renowned for its buffering effects.

Ascorbic acid Market Segmentation: By Grade

- Pharmaceutical Grade

- Food Grade

The food grade ascorbate is the dominant segment, and the pharmaceutical grade is the fastest-growing segment. The great demand of the food and beverage industry for a preservative and antioxidant in ascorbic acid helps to explain its substantial market share. Driven by the increasing need for vitamin C supplements and immune-boosting goods, Pharmaceutical Grade is expected to experience notable expansion.

Pharmaceutical Grade is utilized in the manufacture of vitamin C pills and several medicinal compounds. Food Grade, on the other hand, is used as an antioxidant and preservative in the food and beverage sector.

Ascorbic acid Market Segmentation: By Form

- Powder

- Granules

- Tablet

- Injection

The Powder Form is the dominant segment, and the Granules Form is the fastest-growing segment in this market. The powder form is the dominant segment of the market by revenue since it is so versatile and widely used in many contexts. The granules' form is expected to see significant need thanks in part to its increasing use in the production of effervescent tablets and other pharmaceutical formulations.

Tablet is commonly found in dietary supplements meant for direct consumption. Rapid vitamin C delivery is accomplished in clinical environments by injection.

Ascorbic acid Market Segmentation: By Application

- Pharmaceuticals and Nutraceuticals

- Food and Beverages

- Personal Care

- Animal Feed

The Food and Beverage segment is the dominant one, and the Personal Care segment is the fastest-growing segment. With the widespread use of ascorbic acid as a preservative and antioxidant in the food sector, the food and beverage segment is likely to stifle other application segments in share of revenue. Driven by the rising demand for natural and organic skin products enhanced with ascorbic acid, the beauty and personal care sector is projected to grow most rapidly.

In the Pharmaceutical and Nutraceuticals segment, ascorbic acid is vital in therapeutic items of many kinds as well as vitamin C supplements. In animal feed, ascorbic acid is added to enhance growth and health.

Ascorbic acid Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In this market, North America is the leading region, followed by Europe and Asia-Pacific. South America and the MEA regions are the emerging markets. North America has a strong pharmaceutical industry and increasing consumer knowledge of health supplements. Asia-Pacific relies on the growing food and pharmaceutical sectors in India and China. Driven by tough food safety and quality laws, Europe holds a significant portion of the market. South America is an emerging market whose growth results from rising urbanization and evolving consumer habits. Middle East and Africa are growing as knowledge of enriched foods and dietary supplements is becoming more widely spread.

COVID-19 Impact Analysis on the Global Ascorbic Acid Market:

The epidemic of COVID-19 greatly changed the world market for ascorbic acid (vitamin C), affecting supply chains as well as demand. The epidemic raised consciousness of immune health, which led to more intake of vitamin C supplements. With immune-boosting qualities, ascorbic acid is well-reputed and has experienced a marked increase in demand. Further piquing interest was research on the possible advantages of ascorbic acid as an add-on treatment for COVID-19 patients. Although final judgments are still pending, research has examined its effectiveness and safety in seriously unwell patients. Lockdowns and limitations caused disruptions in production sites, thereby impacting the availability of vital raw materials needed for ascorbic acid synthesis. This led to product shortages and higher costs. Reduced shipping volumes and border restrictions among global transportation obstacles postponed the distribution of ascorbic acid products, hence affecting timely deliveries to businesses and consumers. Fluctuations in ascorbic acid values resulted from the disparity between rising demand and limited supply. Meeting the increased market needs was difficult for manufacturers when it came to stabilizing expenses. Nations with developed ascorbic acid manufacturing facilities saw less severe shortages and price increases than those heavily dependent on imports. The epidemic has sparked a long-term fascination with vitamin supplements, therefore implying perhaps lasting higher need for ascorbic acid. The pandemic showed weaknesses in world supply chains, which made manufacturers expand sourcing and improve logistical systems to reduce future disruptions.

Latest Trends/ Developments:

To meet the demand for clean-label items, there is an increasing inclination toward getting ascorbic acid from natural sources.

To decrease their carbon footprints and attract environmentally aware buyers, companies are using green manufacturing processes.

The rising need for fortified foods and drinks is driving producers to include ascorbic acid, therefore improving nutritional compositions.

Microencapsulation and nanotechnology innovations are enhancing the stability and availability of ascorbic acid in many uses.

Key Players:

- Koninklijke DSM N.V.

- BASF SE

- Merck KGaA

- Northeast Pharmaceutical Group Co. Ltd.

- CSPC Pharmaceutical Group

- Shandong Luwei Pharmaceutical Co. Ltd.

- Foodchem International Corporation

- MC Biotech Inc.

- Hebei Welcome Pharmaceutical Co. Ltd.

- Bactolac Pharmaceutical Inc.

Chapter 1. Ascorbic Acid Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Global Ascorbic Acid Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Ascorbic Acid Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Ascorbic Acid Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Ascorbic Acid Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Ascorbic Acid Market– By Type

6.1 Introduction/Key Findings

6.2 Sodium Ascorbate

6.3 Calcium Ascorbate

6.4 Potassium Ascorbate

6.5 Magnesium Ascorbate

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. Global Ascorbic Acid Market– By Grade

7.1 Introduction/Key Findings

7.2 Pharmaceutical Grade

7.3 Food Grade

7.4 Y-O-Y Growth trend Analysis By Grade

7.5 Absolute $ Opportunity Analysis By Grade , 2025-2030

Chapter 8. Global Ascorbic Acid Market– By Form

8.1 Introduction/Key Findings

8.2 Powder

8.3 Granules

8.4 Tablet

8.5 Injection

8.6 Y-O-Y Growth trend Analysis Form

8.7 Absolute $ Opportunity Analysis Form , 2025-2030

Chapter 9. Global Ascorbic Acid Market– By Application

9.1 Introduction/Key Findings

9.2 Pharmaceuticals and Nutraceuticals

9.3 Food and Beverages

9.4 Personal Care

9.5 Animal Feed

9.6 Y-O-Y Growth trend Analysis Application

9.7 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 10. Ascorbic Acid Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By Application

10.1.4. By Grade

10.1.5. Form

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By Application

10.2.4. By Form

10.2.5. Grade

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Application

10.3.4. By Form

10.3.5. Grade

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Type

10.4.3. By Form

10.4.4. By Application

10.4.5. Grade

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Form

10.5.3. By product

10.5.4. By grade

10.5.5. Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Ascorbic Acid Market– Company Profiles – (Overview, Service Type Portfolio, Financials, Strategies & Developments)

11.1 Koninklijke DSM N.V.

11.2 BASF SE

11.3 Merck KGaA

11.4 Northeast Pharmaceutical Group Co. Ltd.

11.5 CSPC Pharmaceutical Group

11.6 Shandong Luwei Pharmaceutical Co. Ltd.

11.7 Foodchem International Corporation

11.8 MC Biotech Inc.

11.9 Hebei Welcome Pharmaceutical Co. Ltd.

11.10 Bactolac Pharmaceutical Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The common name of ascorbic acid is vitamin C.

The industries where ascorbic acid is widely used are the food and beverages industry, animal feed industry, and cosmetic industry.

Ascorbic acid helps in the preservation of color, nutrients, and flavors in food products by acting as an antioxidant.

Although the pandemic resulted in supply chain disruptions, it also benefited the market as the demand for vitamin C increased worldwide.

The North American region leads the Global Ascorbic Acid Market due to its strong pharmaceutical industry and increasing consumer knowledge of health supplements.