Aseptic and Hygienic Valve Market Size (2024 – 2030)

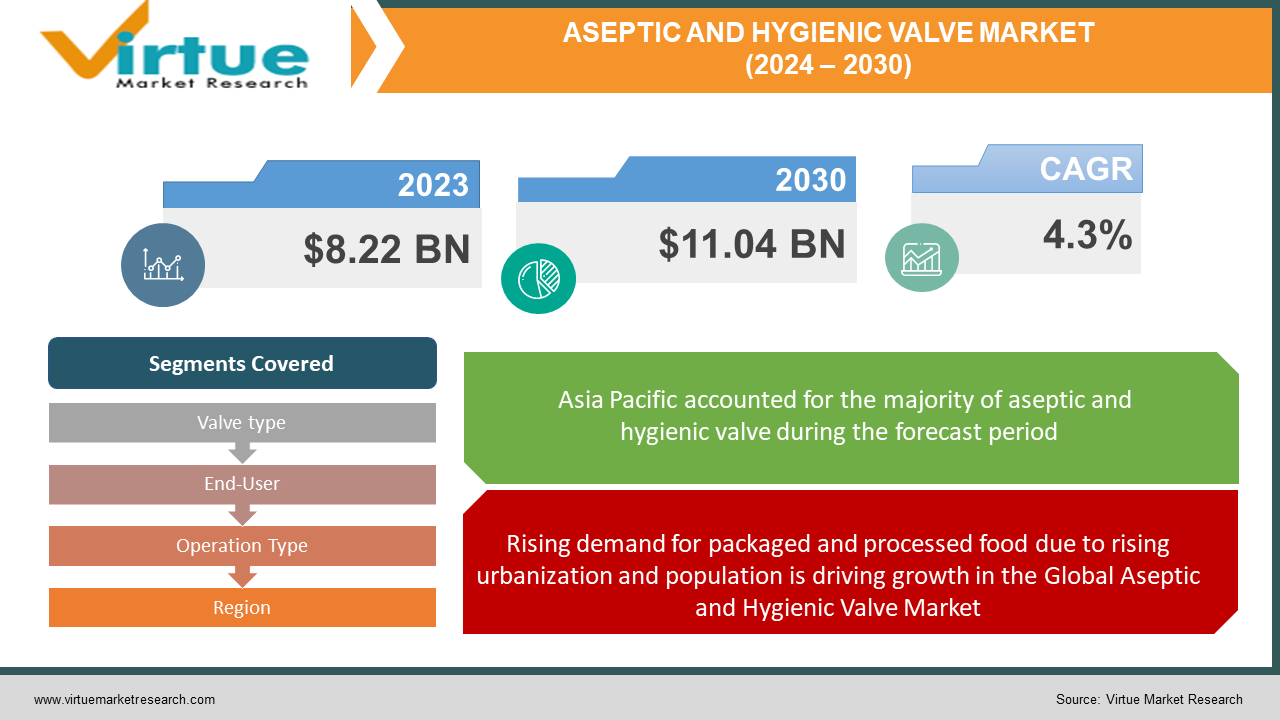

In 2023, the Global Aseptic and Hygienic Valve Market was valued at $8.22 billion, and is projected to reach a market size of $11.04 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 4.3%.

Market Overview:

Various businesses, including the food and beverage sectors, require aseptic and hygienic valves. Manufacturers in these sectors are required to adhere to several cleanliness standards set by different groups. These guidelines encourage the use of hygienic machinery because they provide producers more control over their operations, boost output, and prevent product contamination. To ensure the purity and quality of finished products as well as the potency of active ingredients, the pharmaceutical industry requires that manufacturing pharmaceutical products adhere to strict hygiene standards for all materials, equipment, premises, containers, and cleaning and disinfecting supplies. For patients, these requirements guarantee products that are suitable and secure.

There is now a large market for hygienic and aseptic valves due to customers' growing emphasis on adopting healthier lifestyles. These valves are mostly used to remove preservatives, which are employed in the production of many foods and beverages. The adoption of these valves in the food and beverage industry is anticipated to be facilitated by the increased knowledge of the detrimental effects of preservatives.

Aseptic and Hygienic Valve Market Drivers:

- Rising demand for packaged and processed food due to rising urbanization and population is driving growth in the Global Aseptic and Hygienic Valve Market.

The use of processed food has dramatically increased during the past few years on a global scale. The processed food sector has grown overall as a result of several factors. The acceptance of processed foods and drinks is mostly driven by evolving lifestyles, expanding globalization, and rising populations. The move towards packaged food and drink has been driven by both population growth and economic expansion since they are easier to get and store than fresh items. Because living expenses have decreased and people are busier, they choose to reduce the time and effort required to prepare meals. The markets for packaged, chilled, and ready-to-eat food have increased dramatically as a result of these causes.

Additionally, as urbanization increases, access to fresh produce and foods becomes constrained, leading residents of metropolitan areas to depend more on processed foods and beverages. Additionally, people are choosing to live healthier lives and consume food that is lower in fat, sugar, and salt. The packaged and processed food sector is aided by these more recent advances.

- Increasing emphasis on eliminating preservatives is driving growth in the Global Aseptic and Hygienic Valve Market.

Growth in the global market for hygienic and aseptic valves will also be aided by the food and beverage sector's increasing focus on sanitary rules. The demand for these valves is expected to increase as producers become more aware of the importance of following safe food handling procedures. The need for hygienic and aseptic valves has increased as a result of small and medium-sized organizations’ increasing adherence to these food safety laws. Hygienic and aseptic valve adoption has increased globally as a result of efforts to automate and modernize production facilities to satisfy the ever-increasing needs of customers.

Aseptic and Hygienic Valve Market Challenges:

Non-corrosive, odorless, and nontoxic materials, typically 304L or 316L stainless steel, are needed to make aseptic and hygienic valves. Raw elements such as nickel and chromium are found in stainless steel. The price of these raw materials, which fluctuates due to factors including geopolitical events, trade regulations, the global supply and demand imbalance, transportation costs, and others, determines the price of stainless steel. As a result, this has an impact on the price of stainless steel supply and manufacturing internationally. The widely fluctuating cost of raw materials also contributes to inefficient price management and changes in profit margins. Hygienic pumps and valve sales are impacted by this difference in end-product prices. These considerations alter how hygienic and aseptic valves are adopted by different industries, which restrains the market.

Global Aseptic and Hygienic Valve Market Opportunities:

Aseptic and sanitary/hygienic valves are essential parts of a variety of industrial machinery used in process industries like the food, beverage, and pharmaceutical sectors. Processes in the factory could be interrupted if these pumps and valves fail. Manufacturing organizations are unable to be warned about probable valve failures using conventional schedule-based maintenance techniques. As a result, personnel frequently report issues while inspecting pumps and valves, which causes unanticipated downtime. But with recent advancements in data science, connectivity, and computer power, businesses may now use the lloT technology to cut down on unscheduled downtime caused by valve failure. Hygienic pump and valve specialists may remotely check on a plant's health and assess the effectiveness, lifecycle, and potential failure rates of these valves thanks to the Internet of Things (IoT).

Impact of COVID-19 on Aseptic and Hygienic Valve:

This year, there is a genuine chance that the globe will experience more severe supply chain pain and manufacturing interruptions because of worries about additional COVID outbreaks and China's already hazy post-pandemic future. Further, the pandemic has raised the awareness for hygiene and sanitation which is somewhere boosting the market. The demand for these valves is expected to increase as producers become more aware of the importance of following safe food handling procedures.

Global Aseptic and Hygienic Valve Market Recent Developments:

- In March 2023, Alfa Laval will introduce its new ThinkTop V20, the hygienic valve indication unit of the next generation. This product will assist process industries undergo a digital transition. When it comes to installation, commissioning, operation, and maintenance, the ThinkTop V20 will aid with process control and save time and money.

- In June 2021, the general requirements of the dairy, beverage, and food industries will be satisfied by GEA Hilge CONTRA III, which will be introduced by GEA Group Aktiengesellschaft. With the addition of this range, GEA's centrifugal pumps now have a performance range that extends to a flow rate of 100 cubic metres per hour

- In July 2020, The BLV1 Series, a new line of ball valves offered under APV, was introduced by SPX FLOW, Inc. The innovative ball valves provide affordable and robust alternatives for a variety of unhygienic and hygienic applications.

ASEPTIC AND HYGIENIC VALVE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Valve type, End-User, Operation Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Alfa Laval AB, Armaturenwerk Hotensleben GmbH, Bardiani Valvole S.p.A., Burkert GmbH & Co. KG, Cipriani Harrison Valves Corp. (CHVC), Definox SAS, Evoguard GmbH, GEA Group AG, Gebr. Rieger GmbH & Co. KG, GEMu Gebr. Muller Apparatebau GmbH & Co. KG |

Aseptic and Hygienic Valve Market Segmentation- By Valve Type

- Hygienic Single Seat Valves

- Hygienic Double Seat Valves (Mix proof Valves)

- Hygienic Butterfly Valves

- Hygienic Control Valves

- Aseptic Valves

The segment for hygienic control valves held the biggest market share in 2022. In the process sectors, including oil and gas, chemicals, power generation, automotive, pharmaceuticals, food, and beverage manufacturing, and oil gas, hygienic control valves are used to control process variables including temperature, pressure, and fluid level. increased investment in all process sectors, especially the oil and gas sector, as well as the expansion of industrial infrastructure in developing nations. Additionally, the pharmaceutical industry is predicted to have a strong demand for control valves.

Aseptic and Hygienic Valve Market Segmentation -By End User

- Processed food

- Dairy

- Alcoholic Beverage

- Non-Alcoholic Beverage

- Pharmaceuticals

- Others

Growing urbanization, shifting consumer consumption habits, rising population, and rising living standards in developing nations are all factors driving the processed food business. To guarantee the quality and safety of food products, the governments of several nations have adopted safety standards that processed food manufacturers must adhere to. In the processed food business, using aseptic and hygienic valves helps meet cleanliness requirements as effectively as possible. In addition, the demand for clean, leak-proof containers in this sector drives the integration of hygienic valves in pipelines. Hygienic pumps and valves are utilized in food processing plants for applications such as cleaning/rinsing, mixing, CIP process, filling, machine control, factory solution, and food safety and compliance.

Aseptic and Hygienic Valve Market Segmentation- By Operation Type

- Manual

- Air-actuated

The manual operation of valves takes additional time and energy. It takes time to install tens of thousands of manually controlled valves of various types in the factories. As a result, firms are now concentrating on factory automation and transformation. By applying air pressure to a piston or diaphragm, air-actuated hygienic valves can move circularly or linearly. An air-actuated actuator uses the air as a control medium to open, close, or regulate fluid flow. These valves use positioners and actuators to lower the pressure in a controlled way. Many businesses utilize air-actuated valves because they have several advantages over manually operated pumps.

Aseptic and Hygienic Valve Market Segmentation- By Region

- North America

- Europe

- Asia- Pacific

- Latin America

- Rest of the World

The Asia Pacific region's largest and fastest-growing economy is China. With numerous medium-sized manufacturers situated there, the nation is one of the top producers and exporters of sanitary pumps and valves. As a result, it is the biggest producer and supplier of hygienic pumps and valve components due to the presence of local manufacturers of hygienic pumps and valves. The nation has a strong industrial basis, with process sectors like processed food and chemicals dominating the economy. The economies of other sectors, such as dairy, alcoholic drinks, and pharmaceuticals, also make significant contributions. These sectors need thorough control and monitoring procedures to transport fluids through pipes while regulating flow, pressure, and level, which calls for sanitary pumps and valves. Due to the population's rapid increase, the processed food and dairy industries are expanding quickly, driving demand for hygienic pumps and valves.

Aseptic and Hygienic Valve Market Segmentation-Key Players

The top 10 key players in the aseptic and hygienic valve market are:

- Alfa Laval AB

- Armaturenwerk Hotensleben GmbH

- Bardiani Valvole S.p.A.

- Burkert GmbH & Co. KG

- Cipriani Harrison Valves Corp. (CHVC)

- Definox SAS

- Evoguard GmbH

- GEA Group AG

- Gebr. Rieger GmbH & Co. KG

- GEMu Gebr. Muller Apparatebau GmbH & Co. KG

Chapter 1. Aseptic and Hygienic Valve Market Segmentation– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Aseptic and Hygienic Valve Market Segmentation– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Aseptic and Hygienic Valve Market Segmentation– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Aseptic and Hygienic Valve Market Segmentation- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Aseptic and Hygienic Valve Market Segmentation- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Aseptic and Hygienic Valve Market Segmentation– By Valve Type

6.1. Diaphragm

6.2. Ball

6.3. Butterfly

6.4. Others

Chapter 7. Aseptic and Hygienic Valve Market Segmentation– By End-User

7.1. Pharmaceutical

7.2. Food and Beverage

7.3. Healthcare

7.4. Others

Chapter 8. Aseptic and Hygienic Valve Market Segmentation– By Material

8.1. Stainless Steel

8.2. Plastic

8.3. Titanium

8.4. Others

Chapter 9. Aseptic and Hygienic Valve Market Segmentation– By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. Rest of the world

Chapter 10. Aseptic and Hygienic Valve Market Segmentation– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Alfa Laval

10.2. Bosch Rexroth

10.3. Danaher

10.4. Festo

10.5. Georg Fischer

10.6. SPX Flow

10.7. Swagelok

10.8. Integra LifeSciences

10.9. Parker Hannifin

10.10. Saint-Gobain

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aseptic and Hygienic Valve Market was estimated to be worth USD 7.89 Billion in 2022 and is projected to reach a value of USD 11.05 Billion by 2030, growing at a CAGR of 4.3 % during the forecast period 2023-2030.

The Segments under the Global Aseptic and Hygienic Valve Market by End-user are processed food, Dairy, Alcoholic Beverages, Non-Alcoholic Beverages, Pharmaceuticals, and Others

Some of the top industry players in the Aseptic and Hygienic Valve Market are Alfa Laval AB, Armaturenwerk Hotensleben GmbH, Bardiani Valvole S.p.A., Burkert GmbH & Co. KG, Cipriani Harrison Valves Corp. (CHVC), etc.

The Global Aseptic and Hygienic Valve market is segmented based on Valve Type, Operation Type, End-user, and Region.

Asia-Pacific region held the highest share in the Global Aseptic and Hygienic Valve market.