Artificial Intelligence in Radiotherapy Market Size (2024 -2030)

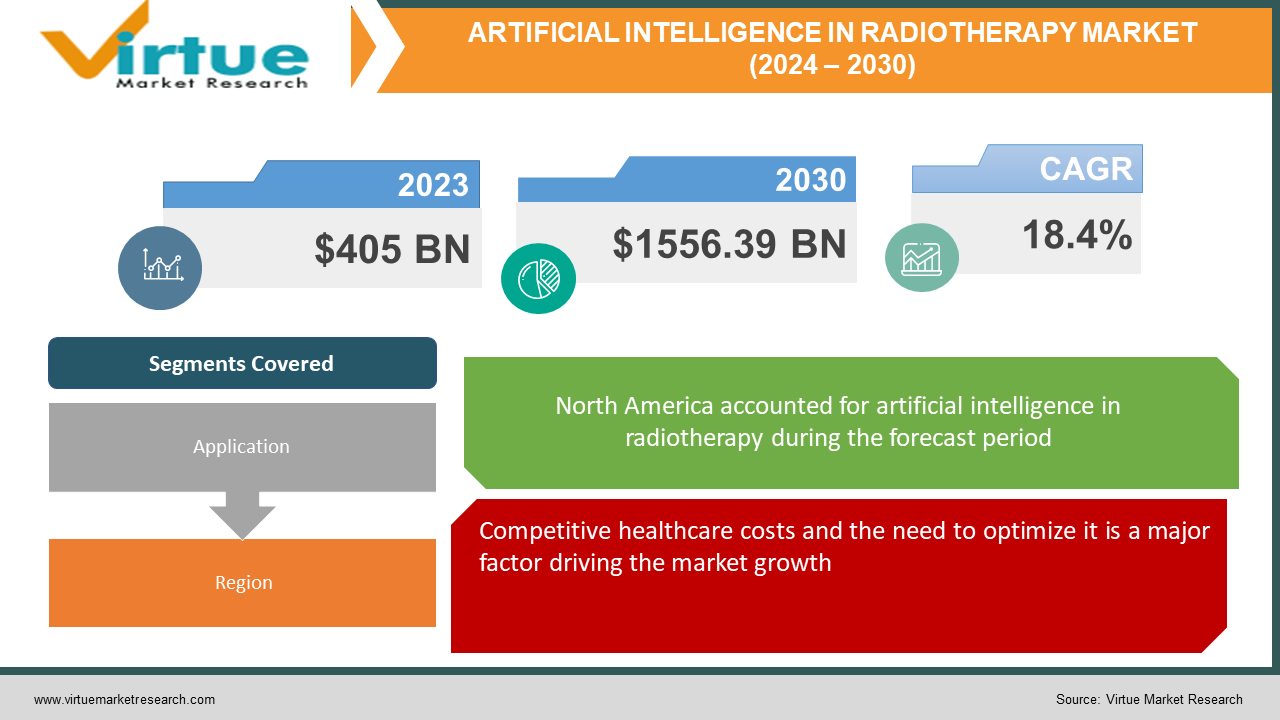

In 2023, the Global Artificial Intelligence in Radiotherapy Market was valued at $405 Billion, and is projected to reach a market size of $1556.39 Billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 18.4%.

INDUSTRY OVERVIEW

The radiotherapy (RT) workflow is a complicated procedure with several time-consuming processes that affect the effectiveness of the treatment and, in turn, the patient's result. By automating and streamlining workflows, artificial intelligence (AI) has been proposed as a technique to improve the consistency, speed, and quality of these stages, ultimately resulting in more accurate and safe radiation administration. A simplified process is essential in daily clinical practice, particularly with the introduction of adaptive radiotherapy (ART). Machine learning (ML) and deep learning (DL) are two subdomains of AI that are classified as a set of algorithms that execute tasks connected with human thinking or intelligence. Artificial Intelligence (AI) is currently being introduced into different domains, including medicine. Specifically, in radiation oncology, machine learning models allow automation and optimization of the workflow.

The way medicine is practiced might radically change as a result of artificial intelligence (AI). AI platforms are excellent at spotting intricate patterns in medical data and offer a quantitative assessment of clinical issues rather than a merely qualitative one. The multidimensional and highly technical nature of radiation, which heavily relies on digital data processing and computer software, suggests that AI might have particularly disruptive implications in this sector of medicine. AI has the promise of enhancing the effectiveness, precision, efficiency, and general quality of radiation therapy for cancer patients. For radiotherapy, commercial vendors and university organizations have developed AI tools, however, these techniques have not yet been widely incorporated into clinical practice. Additionally, various conversations have sparked thorough considerations concerning AI's effect on the development of radiation treatment. A lack of knowledge and interpretation of these AI models can hold back widespread and full deployment into clinical practice.

COVD-19 IMPACT ON THE ARTIFICIAL INTELLIGENCE IN THE RADIOTHERAPY MARKET

Every element of the medical device business, including radiation devices, has been affected by the COVID-19 epidemic on a global scale. The treatment of radiation operations during the COVID-19 epidemic varies significantly from place to region. According to COVID-19, the burden of cancer will increase by 20% worldwide. This can be attributable to the temporary deferral of several elective procedures while governments and authorities work to guarantee that resources are available for COVID-19 patients. In comparison to the same months in 2019, the mean weekly radiation courses in 2020 decreased by 19.9% in April, 6.2% in May, and 11.6% in June. Attendances fell more dramatically than other metrics (29.1 % in April, 31.4 % in May, and 31.5 % in June). To lessen the burden on the healthcare system, minimize disease transmission, and preserve personal protective equipment, several governments have set recommendations for elective procedures (PPE). The number of emergency patients seeking treatment at centers has decreased, despite the availability of radiation emergency services in practically all of them. Supply chains have been affected by lockdown-related factory closures, and fewer participants in clinical trials may slow the market growth for radiation equipment overall in 2020.

MARKET DRIVERS:

Competitive healthcare costs and the need to optimize it is a major factor driving the market growth

Healthcare expenditure is continuing to rise worldwide as a result of factors like the soaring demand for healthcare services, the rapid emergence of various costly prescription drugs and medical technologies, the growing prevalence of chronic diseases and operational inefficiencies, and the rate of hospital readmissions and medical errors. In this situation, healthcare professionals must continuously optimize the allocation of resources and assets. This can relate to the distribution of medical equipment, the employment of healthcare providers, and other crucial parts of operations. The Organization for Economic Cooperation and Development (OECD) believes that 20 % of worldwide healthcare spending is wasted; the United States Institute of Medicine estimates this expenditure to be around 29 %. The World Health Organization estimates that worldwide healthcare spending in 2020 will be USD 8.3 trillion, or 10% of the global GDP (USD 84.5 trillion). By decreasing manual work and minimizing inefficiencies brought on by inadequate care, overtreatment, and incorrect care delivery, AI technology can help reduce healthcare expenditure. The provision of more accurate and individualized healthcare services to patients has been made possible by recent advancements in supercomputing and AI. The adoption of AI frameworks for lowering healthcare expenses while preserving or enhancing treatment quality is supported by pertinent studies. Therefore, the deployment of AI-based radiotherapy equipment has the potential to save money for several healthcare sector end users, including patients, healthcare payers, and care providers. In the ensuing years, this would greatly raise their demand.

The growing potential of AI-based tools for elderly care is boosting the market growth

The incidence of numerous age-related disorders is predicted to rise globally as the elderly population grows. Governments in several nations are placing an increasing emphasis on using innovative technology to combat this and effectively manage the growing demand for their healthcare systems. Radiography is one such area. One such technology is artificial intelligence (AI), which offers improved services including real-time patient data gathering and monitoring for emergency treatment as well as makes advice for preventative healthcare.

MARKET RESTRAINTS:

The lack of trained AI personnel and unclear regulatory guidelines for medical software is hampering the market growth

Since AI is a complicated system, businesses need employees with a certain set of skills to design, manage, and implement AI systems. For instance, individuals working with AI systems have to be knowledgeable about technologies like deep learning, cognitive computing, ML, and machine intelligence. Additionally, it is a difficult undertaking that necessitates considerable data processing to replicate human brain function to integrate AI technologies into current systems. Even a small mistake might cause a system to crash or negatively impact the intended outcome. Additionally, the development of AI is being constrained by the lack of professional standards and qualifications in AI/ML technology. The deployment and maintenance of AI service providers' solutions on the premises of their client’s present additional difficulties. The lack of technological understanding and the dearth of AI specialists are to blame for this.

The lack of curated healthcare data is negatively influencing the market development

Data is an essential resource for creating a full and reliable AI system. Datasets were mostly organized and input manually in the past. The collection of a significant amount of data from wearables, linked health monitors, EHRs, and numerous other remotely connected healthcare machines/devices is a result of rising digital footprints and technology developments, such as IoT in healthcare. Text, speech, photos, and other types of information make up the majority of this unstructured data. The ability of developers to extract value is constrained by a complex internal structure. However, developers need high-quality labelled data and knowledgeable human trainers to teach machine learning algorithms. Unstructured data extraction and labelling need a sizable, skilled workforce as well as time. Additionally, patient data is very private and is bound to stringent government norms. For example, laws like the HIPAA (enacted in the US in 1996) and the HITECH Act (enacted in the US in 2003) mandate that organizations in charge of sensitive health information take specific steps to ensure its privacy and security. These organizations also have to notify patients when the privacy and security of their information are jeopardized. Due to security restrictions, record identification issues, and privacy considerations, this makes curated data difficult to access.

ARTIFICIAL INTELLIGENCE IN RADIOTHERAPY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

18.4% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nuance Communications, Inc., IBM Corporation, Microsoft, NVIDIA Corporation, Intel Corporation, DeepMind Technologies Limited |

ARTIFICIAL INTELLIGENCE IN THE RADIOTHERAPY MARKET - BY APPLICATION

-

Automating Equipment Maintenance

-

Auto Positioning

-

Emergency prescreening

-

Dose optimization

-

Automatic image slicing for MR

-

Other

Based on application, artificial intelligence in the radiotherapy market is segmented into Automating Equipment Maintenance, Auto Positioning, Emergency prescreening, Dose optimization, Automatic image slicing for MR and Other. Among these, AI is widely deployed for automating equipment upkeep. Automation of particular jobs, like AI-based CT scanner monitoring for probable x-ray tube failure, is one example of how equipment faults or the need for maintenance might be reported automatically. Since there is no early warning of a tube failure, this remote predictive maintenance gives technicians and department managers time to plan for maintenance concerns like tube replacement, saving money and preventing last-minute rescheduling of patient examinations.

By enabling the development of a patient-specific protocol and assessing radiation hazards of cumulative dosage, patient age, or other factors, AI might help radiologic technicians with dose optimization. AI systems might learn how to map ultralow-dose CT treatments and recreate the pictures at a better resolution using neural networks. Last but not least, AI might help optimize daily workflow by prioritizing inspections based on suitability criteria and other variables like emergency level. To increase productivity and workflow, AI also shows promise in the preprocessing processes that come right after picture acquisition.

Some positioning-related operations have been automated by AI technology, saving time on labor-intensive physical chores. Automated placement, for example, detects a patient's head rather than requiring the technician to place the patient's anatomy within crosshairs for CT scanning. By automating the patient positioning process, dosage optimization may be facilitated. The patient's body can be automatically positioned on the CT table by the prescribed protocol. Radiologic technicians must check the auto position and make any necessary adjustments, especially when imaging young patients or in unusual or traumatizing circumstances.

ARTIFICIAL INTELLIGENCE IN THE RADIOTHERAPY MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Enhanced water market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa.

The leading technology companies in the world, including Google, Microsoft, IBM, and Apple, have their headquarters in North America. These companies have been essential in the growth and development of the artificial intelligence sector in North America. The dominance of North America in the global artificial intelligence market is a consequence of increasing government measures to assist the development of artificial intelligence in radiation treatment as well as increased spending on research and development of the technology. One of the primary sectors in North America using artificial intelligence technologies is the healthcare sector. The market is growing tremendously due to the presence of top pharmaceutical and healthcare businesses in North America and the enormous demand among them for new products. Additionally, the region's advanced IT and telecommunications infrastructure is contributing to the expansion of the artificial intelligence sector. The greatest CAGR is anticipated to be seen in the Asia Pacific throughout the projection period. The Asia Pacific area has a sizable healthcare market, which is considerably driving the demand for artificial intelligence technologies in the radiotherapy industry. Healthcare-related sectors are concentrated in nations like China and India, and the market is expanding due to the increasing use of artificial intelligence in the healthcare industry.

ARTIFICIAL INTELLIGENCE IN THE RADIOTHERAPY MARKET - BY COMPANIES

Some of the major players operating in artificial intelligence in the radiotherapy market include:

-

Nuance Communications, Inc.

-

IBM Corporation

-

Microsoft

-

NVIDIA Corporation

-

Intel Corporation

-

DeepMind Technologies Limited

NOTABLE HAPPENING IN THE ARTIFICIAL INTELLIGENCE IN THE RADIOTHERAPY MARKET

-

PRODUCT LAUNCH- Siemens Healthineers, one of the top healthcare organisations in the world, is creating AI software for creating organ segmentations that enable precision radiation therapy on a supercomputing infrastructure powered by NVIDIA GPUs. With the Sherlock system, Siemens Healthineers, which has been engaged in machine learning since the 1990s, is utilising this AI capability. The company's vast data lake, which contains over 750 million curated photos, radiology reports, clinical data, and genetic information, is used by the supercomputer to learn. Siemens Healthineers employs single.via RT Image Suite, a piece of software that uses AI-assisted AutoContouring to automatically delineate organs, to aid oncologists in creating radiation treatment plans more quickly.

-

ACQUISITION- Varian Medical Systems, situated in California, will be acquired by Siemens Healthineers for around $16.4 billion, to acquire 100% interest. Progress has been made toward the clinical use of human-centred artificial intelligence (AI). With the aid of AI-based auto-contouring, Varian's software portfolio's EclipseTM TPS and AI Rad Companion Organs RT enable doctors to establish high-quality OAR (organs at risk) outlines more quickly.

Chapter 1. Artificial Intelligence in Radiotherapy Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Artificial Intelligence in Radiotherapy Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Artificial Intelligence in Radiotherapy Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Artificial Intelligence in Radiotherapy Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Artificial Intelligence in Radiotherapy Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Artificial Intelligence in Radiotherapy Market - BY APPLICATION

6.1 Introduction/Key Findings

6.2 Automating Equipment Maintenance

6.3 Auto Positioning

6.4 Emergency prescreening

6.5 Dose optimization

6.6 Automatic image slicing for MR

6.7 Other

6.8 Y-O-Y Growth trend Analysis BY APPLICATION

6.9 Absolute $ Opportunity Analysis BY APPLICATION, 2023-2030

Chapter 7. Artificial Intelligence in Radiotherapy Market, By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.2 BY APPLICATION

7.3 By Gender

7.4 BY APPLICATION

7.5 Countries & Segments - Market Attractiveness Analysis

7.6 Europe

7.6.1 By Country

7.6.1.1 U.K.

7.6.1.2 Germany

7.6.1.3 France

7.6.1.4 Italy

7.6.1.5 Spain

7.6.1.6 Rest of Europe

7.7 BY APPLICATION

7.8 By Gender

7.9 Countries & Segments - Market Attractiveness Analysis

7.10 Asia Pacific

7.10.1 By Country

7.10.1.1 China

7.10.1.2 Japan

7.10.1.3 South Korea

7.10.1.4 India

7.10.1.5 Australia & New Zealand

7.10.1.6 Rest of Asia-Pacific

7.11 BY APPLICATION

7.12 By Gender

7.13 Countries & Segments - Market Attractiveness Analysis

7.14 South America

7.14.1 By Country

7.14.1.1 Brazil

7.14.1.2 Argentina

7.14.1.3 Colombia

7.14.1.4 Chile

7.14.1.5 Rest of South America

7.15 BY APPLICATION

7.16 By Gender

7.17 Countries & Segments - Market Attractiveness Analysis

7.18 Middle East & Africa

7.18.1 By Country

7.18.1.1 United Arab Emirates

7.18.1.2 Saudi Arabia

7.18.1.3 Qatar

7.18.1.4 Israel

7.18.1.5 South Africa

7.18.1.6 Nigeria

7.18.1.7 Kenya

7.18.1.8 Egypt

7.18.1.9 Rest of MEA

7.19 BY APPLICATION

7.20 By Gender

7.21 Countries & Segments - Market Attractiveness Analysis

Chapter 8. Artificial Intelligence in Radiotherapy Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Nuance Communications, Inc.

8.2 IBM Corporation

8.3 Microsoft

8.4 NVIDIA Corporation

8.5 Intel Corporation

8.6 DeepMind Technologies Limited

Download Sample

Choose License Type

2500

4250

5250

6900