Artificial Flavors Market Size (2024 – 2030)

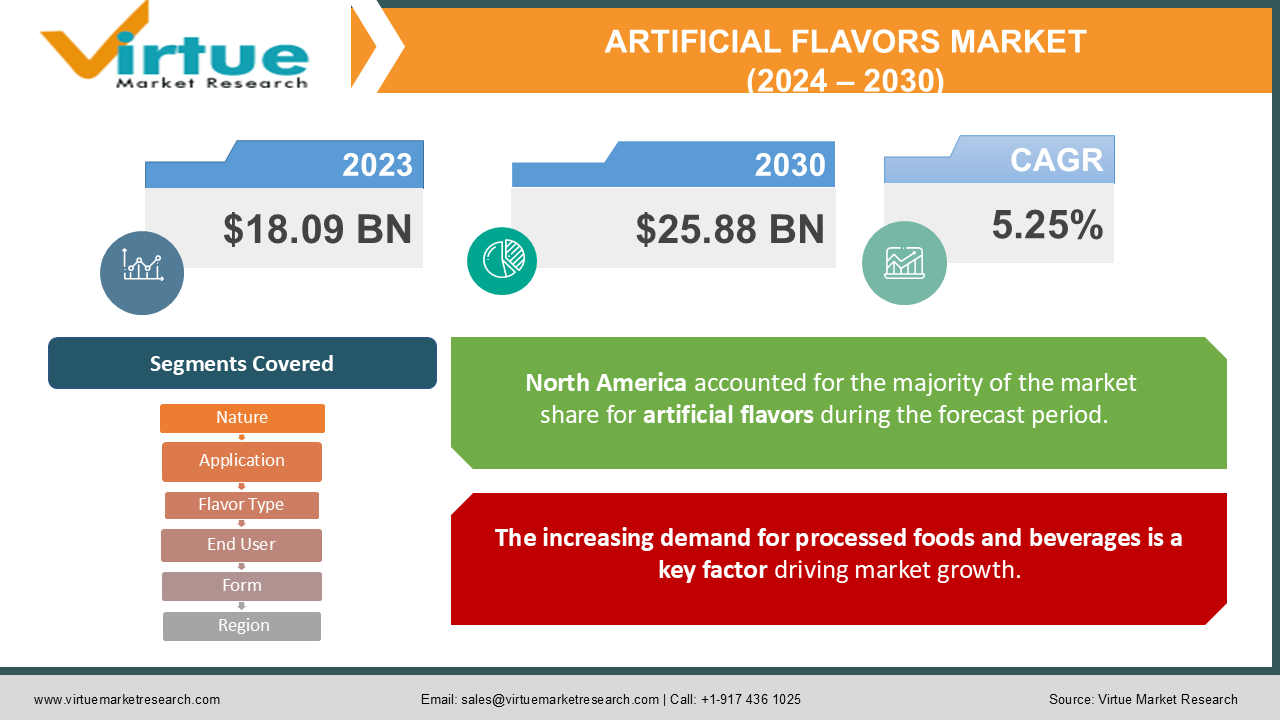

The Artificial Flavors Market was valued at USD 18.09 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 25.88 billion by 2030, growing at a CAGR of 5.25%.

Flavors serve as added sensory experiences for both edible and non-edible products, discernible through the chemical senses of taste and smell. Artificial flavors, also known as synthetic flavors, consist of high-performance additives crafted from proprietary chemical formulas developed by flavor companies. Chemists or flavorists within these manufacturing firms strive to create innovative flavors characterized by unique aromas and tastes. The specific formulations are closely guarded secrets, typically utilized across a variety of product lines. A team of chemical experts collaborates to develop these novel flavors, employing a selection of safe, food-grade ingredients within established limits. The goal of artificial flavors is to closely mimic the natural ingredients they replicate, ensuring that consumers experience a taste reminiscent of natural products, often without realizing the presence of synthetic additives.

Key Market Insights:

The global artificial flavor market is expected to experience significant growth, fueled by a rising demand for artificial flavors across various edible and non-edible applications. The ongoing expansion of food scent and coloring agents, along with a strong desire for novel taste experiences and substantial innovations in flavoring agents, is anticipated to drive growth in the food flavor sector. Additionally, changing lifestyles and rapid urbanization have led to increased demand for food products and beverages, further propelling the industry forward.

Artificial Flavors Market Drivers:

The increasing demand for processed foods and beverages is a key factor driving market growth.

The main catalyst for the growth of the global synthetic flavors market is the rising demand for processed foods and beverages. Increasing urban populations, evolving lifestyle patterns, and shifting living standards have led to a greater reliance on convenience foods. Processed products often contain artificial flavors to enhance their taste and aroma. Consequently, as more consumers gravitate toward these foods, this trend is likely to play a significant role in driving the artificial flavors market in the near future.

The growth of the food and beverage industry is a key driver of the market.

Another significant driver of the artificial flavors market is the expansion of the food and beverage sector. As disposable incomes rise and consumer preferences shift, new categories such as functional foods, sports drinks, and energy drinks have emerged. Artificial flavors are widely utilized in these products to enhance taste and appeal. The growth of the food and beverage industry presents substantial opportunities for expansion within the artificial flavors market.

Artificial Flavors Market Restraints and Challenges:

Rising health and wellness concerns pose a challenge to market growth.

Increasing health awareness is prompting consumers to be more discerning about their food and beverage choices. Many individuals hold negative perceptions of artificial flavors, viewing them as unhealthy and potentially unsafe. In response, the market has sought to meet consumer preferences by offering natural and organic alternatives.

Artificial Flavors Market Opportunities:

The emergence of hybrid flavors, where natural and artificial elements combine, is creating new opportunities in the market.

Consumers, especially millennials, are seeking variety and practical benefits alongside authenticity and naturalness. This has led to the introduction of hybrid flavors that blend synthetic ingredients with natural extracts. For example, chocolate can be enhanced with a cocoa butter replacer to reduce fat content, while berries may be elevated with tartaric acid to provide a more vibrant flavor. This trend fosters creativity in flavor development, catering to health-conscious individuals who also have adventurous taste preferences.

AI-driven taste tailoring is creating granular personalization opportunities in the market.

Today, artificial intelligence is being applied beyond self-driving cars; it is transforming flavor creation through the analysis of vast datasets on consumer preferences and sensory experiences. Imagine AI generating personalized taste profiles based on individual genetic predispositions or emotional states. This capability enables the development of highly customized food and beverage experiences, enhancing consumer engagement and fostering brand loyalty.

ARTIFICIAL FLAVORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.25% |

|

Segments Covered |

By Nature, Application, Flavor Type, Form, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Firmenich, Givaudan Symrise, Huabao Group Takasago , T.Hasegawa Synergy Flavor CFF-Boton, Hodia Flavor, Huayang Flavour and Fragrance |

Artificial Flavors Market Segmentation: By Nature

-

Natural

-

Synthetic

The natural flavors sub-segment holds a significant market share, driven by growing health consciousness among consumers and stringent regulations promoting the use of natural ingredients in food and beverage products. Although smaller in size, the synthetic flavors sub-segment is also expected to witness steady growth during the forecast period, addressing the demand for cost-effective and versatile flavor solutions across various industries. The growth of both natural and synthetic flavors is influenced by factors such as changing consumer preferences, technological advancements, and regulatory compliance. Key market players are concentrating on innovation and product development to cater to the diverse needs of customers in the food and beverage, pharmaceutical, and personal care sectors.

Artificial Flavors Market Segmentation: By Application

-

Food & Beverage

-

Dairy & Frozen Desserts

-

Bakery & Confectionery

-

Snacks

-

Beverage

-

Pharmaceuticals

The food and beverage sector dominates the artificial flavors market, accounting for a significant share due to the widespread use of artificial flavors to enhance taste and aroma in products. Following closely is the bakery and confectionery segment, driven by rising demand for flavored baked goods and sweets globally. The dairy and frozen desserts category also plays a notable role, as artificial flavors are commonly used to create appealing tastes in ice creams, yogurts, and other dairy products. Additionally, beverages, snacks, and pharmaceuticals are key sub-segments that are experiencing steady growth, fueled by the increasing popularity of flavored beverages, snacks, and pharmaceutical formulations.

Artificial Flavors Market Segmentation: By Flavor Type

-

Vanilla

-

Sweet

-

Chocolate

-

Fruit

-

Salty

Vanilla, celebrated for its classic and versatile taste, leads the segment with a significant market share. Chocolate, recognized for its rich and indulgent flavor, closely follows, capturing a notable portion of the market. Fruit flavors, such as strawberry, raspberry, and citrus, are also in high demand, providing natural and refreshing notes to various food and beverage products. Sweet flavors, including caramel, honey, and maple, enhance the indulgence factor, while salty flavors, such as cheese and bacon, deliver savory and umami experiences. The revenue of the artificial flavors market is projected to soar in the coming years, driven by the rising demand for processed foods, beverages, and confectionery items. Segmenting the market by flavor type offers valuable insights into consumer preferences, allowing manufacturers to customize their product offerings and seize growth opportunities.

Artificial Flavors Market Segmentation: By Form

-

Powder

-

Liquid

-

Paste

Liquid artificial flavors command the largest revenue share due to their ease of use and versatility across various applications. Following closely are paste and powder flavors, which are favored for their concentration and stability, making them ideal for situations that require a consistent flavor profile. Market data indicates that the liquid segment holds a significant share, attributed to its easy handling, uniform distribution, and capability to create precise flavor profiles. However, powder and paste forms provide benefits such as enhanced stability, cost-effectiveness, and longer shelf life, which are anticipated to drive their growth in the coming years.

Artificial Flavors Market Segmentation: By End User

-

Commercial

-

Household

Commercial applications represent a significant portion of the market, driven by rising demand for processed and packaged foods, beverages, and confectionery products. The food and beverage industry relies heavily on artificial flavors to enhance taste and create appealing offerings. In 2023, the commercial segment is valued at approximately USD 12.05 billion and is projected to grow to USD 18.45 billion by 2032, expanding at a CAGR of 5.5%. Meanwhile, the household segment is gaining momentum as consumers become increasingly health-conscious. The trend toward home-cooked meals, coupled with the availability of artificial flavors in convenient packaging, has further contributed to the growth of this segment.

Artificial Flavors Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America and Europe account for the largest market share, supported by the presence of major food and beverage companies and stringent food safety regulations. The Asia-Pacific (APAC) region is anticipated to experience the fastest growth during the forecast period, driven by increasing demand for processed and packaged food products. This growth is attributed to rising consumer demand for convenience foods, as well as the growing popularity of natural and organic artificial flavors.

Japan is known for its rich food culture, characterized by meticulous attention to detail, premium ingredients, and a diverse range of flavors. The demand for flavor ingredients in Japan is influenced by various factors, including cultural preferences, culinary traditions, health consciousness, and changing consumer tastes. The country offers a wide array of functional ingredients regulated by the Food for Specified Health Use (FOSHU) standards set by the Ministry of Health and Welfare. Japan's industrial landscape presents significant opportunities for manufacturers to introduce their products to emerging local industries and build a robust consumer base.

In Australia, food and beverage manufacturers are increasingly adopting food flavors, driven by several key factors. A significant influence is the multicultural population, which boasts diverse taste preferences. This rich diversity has fostered a growing appetite for a wide range of flavors, inspired by global culinary trends. As ethnic cuisines gain popularity, they shape mainstream food preferences, prompting manufacturers to broaden their flavor offerings.

COVID-19 Pandemic: Impact Analysis

The market has been significantly impacted by the global pandemic caused by COVID-19. Nationwide lockdowns in many countries have adversely affected consumers' purchasing power, hindering the growth of processed edible products. Restrictions imposed by governments on gatherings in markets and other food retail spaces have led to a decline in sales of various edibles and beverages. Additionally, reduced workforce availability in production facilities and limited stock of edible products in many underdeveloped nations pose challenges to the market.

The closure of restaurants, hotels, and food chains has further strained the industry. However, the market is expected to regain momentum in the coming years, driven by the consistent consumption of packaged food products.

Latest Trends/ Developments:

April 2024: The Kerry Group launche Taste Sense Salt, an innovative solution that delivers a rich savory flavor without added sodium. This product maintains essential flavor characteristics, effectively replicating the salty impact, body, and lingering taste.

February 2024: The Kerry Group unveiled its 2024 global taste charts, which monitor flavor adoption and evolution worldwide. These charts provide a comprehensive analysis of the ingredients and trends expected to influence innovation in the food and beverage sector in the coming year.

Key Players:

These are top 10 players in the Artificial Flavors Market:-

-

Firmenich

-

Givaudan Symrise

-

Huabao Group Takasago

-

T.Hasegawa Synergy Flavor CFF-Boton

-

Hodia Flavor

-

Huayang Flavour and Fragrance

Chapter 1. ARTIFICIAL FLAVORS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2.ARTIFICIAL FLAVORS MARKET– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ARTIFICIAL FLAVORS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ARTIFICIAL FLAVORS MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ARTIFICIAL FLAVORS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ARTIFICIAL FLAVORS MARKET – By Nature

6.1 Introduction/Key Findings

6.2 Natural

6.3 Synthetic

6.4 Y-O-Y Growth trend Analysis By Nature

6.5 Absolute $ Opportunity Analysis By Nature, 2024-2030

Chapter 7. ARTIFICIAL FLAVORS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverage

7.3 Dairy & Frozen Desserts

7.4 Bakery & Confectionery

7.5 Snacks

7.6 Beverage

7.7 Pharmaceuticals

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. ARTIFICIAL FLAVORS MARKET – By Flavor Type

8.1 Introduction/Key Findings

8.2 Vanilla

8.3 Sweet

8.4 Chocolate

8.5 Fruit

8.6 Salty

8.7 Y-O-Y Growth trend Analysis By Flavor Type

8.8 Absolute $ Opportunity Analysis By Flavor Type, 2024-2030

Chapter 9. ARTIFICIAL FLAVORS MARKET – By End-User

9.1 Introduction/Key Findings

9.2 Commercial

9.3 Household

9.4 Y-O-Y Growth trend Analysis End-User

9.5 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. ARTIFICIAL FLAVORS MARKET – By Form

10.1 Introduction/Key Findings

10.2 Powder

10.3 Liquid

10.4 Paste

10.5 Y-O-Y Growth trend Analysis By Form

10.6 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 11. ARTIFICIAL FLAVORS MARKET, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Nature

11.1.2.1 By Application

11.1.3 By Flavor Type

11.1.4 By By Form

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Nature

11.2.3 By Application

11.2.4 By Flavor Type

11.2.5 By End-User

11.2.6 By By Form

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Nature

11.3.3 By Application

11.3.4 By Flavor Type

11.3.5 By End-User

11.3.6 By By Form

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Nature

11.4.3 By Application

11.4.4 By Flavor Type

11.4.5 By End-User

11.4.6 By By Form

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Nature

11.5.3 By Application

11.5.4 By Flavor Type

11.5.5 By End-User

11.5.6 By By Form

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. ARTIFICIAL FLAVORS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Firmenich

12.2 Givaudan Symris

12.3 Huabao Group

12.4 Takasago

12.5 T.Hasegawa

12.6 Synergy Flavor

12.7 CFF-Boton

12.8 Hodia Flavor

12.9 Huayang Flavour and Fragrance

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global artificial flavor market is expected to experience significant growth, fueled by a rising demand for artificial flavors across various edible and non-edible applications.

The top players operating in the Artificial Flavors Market are - Firmenich, Givaudan, Symrise, Huabao Group, Takasago, T.Hasegawa, Synergy Flavor, CFF-Boton, Hodia Flavor, Huayang Flavour and Fragrance.

The market has been significantly impacted by the global pandemic caused by COVID-19. Nationwide lockdowns in many countries have adversely affected consumers' purchasing power, hindering the growth of processed edible products.

Consumers, especially millennials, are seeking variety and practical benefits alongside authenticity and naturalness. This has led to the introduction of hybrid flavors that blend synthetic ingredients with natural extracts.

The Asia-Pacific (APAC) region is anticipated to experience the fastest growth during the forecast period, driven by increasing demand for processed and packaged food products.