Global Artificial Color & Flavours for Beverage Market Size (2024 - 2030)

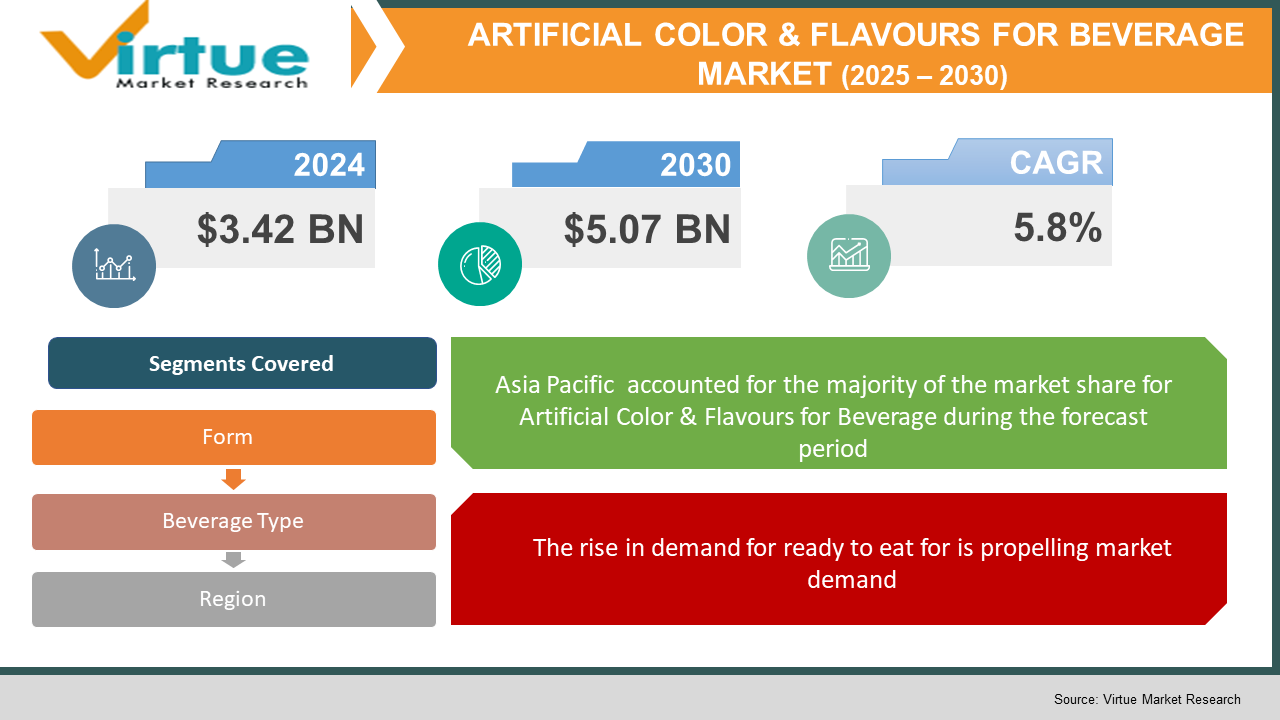

Global Artificial Color & Flavours for Beverage Market is valued at USD 3.42 billion in 2023 and is projected to reach a market size of USD 5.07 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.8%.

INDUSTRY OVERVIEW

The synthetic or man-made unique chemical formulae used to make artificial colour and artificial taste are high-performance edible or non-edible additives that are the property of the flavour corporations. When creating synthetic formulations, chemists or flavorists from various flavour manufacturing firms strive to invent new flavours and colours with distinctive aromas or tastes. The manufacturing corporations often employ distinctive formulae, which are kept completely secret, in the production of different product lines. The need for artificial flavours and colours in a variety of edible and non-edible applications is estimated to considerably boost the worldwide artificial flavours and colour industry. The market for food flavours is anticipated to rise as a result of the constant development of food scent & colouring agents, the rising demand for novel tastes, and the significant innovation in flavouring agents.

Ingredients added to foods to enhance and heighten the perception of flavour, colour, texture, and scent are referred to as food flavours and colours. Some of the typical variations of food colours and tastes are natural, synthetic, and natural identical. They are produced with the use of glycerol, propylene glycol, organic acids, salts, synthetic organic compounds, and essential oils. Sauces, dairy products, cereals, drinks, soups, marinades, bread goods, bars, snacks, and confectionery items all often utilise food flavours and colours. These tastes, which include sour, bitter, sweet, and meaty, are added to food items to provide a distinctive flavour and maintain the flavour after processing.

The consumer demand for great and unique flavours in food and beverages has increased, which has fueled the market for artificial flavourings and colours. Synthetic food additives that give any meal the desired flavour are known as artificial flavouring ingredients. In contrast to natural tastes, desirable and more precise flavours may be infused thanks to artificial flavourings, which are produced in chemical laboratories. This is attributable to the introduction of several distinctive flavours by major worldwide producers of artificial flavouring agents, which draws in a sizable customer base. Even though petroleum and crude oil, which are inedible, are the source of artificial flavouring ingredients, these ingredients are subject to strict safety regulations. In contrast to artificial flavouring chemicals, even artificial flavouring substances can occasionally be hazardous. For instance, the bitter almond flavour known as benzaldehyde can include quantities of cyanide. One of the main elements contributing to the market's optimistic outlook is the rising demand for ready-to-eat (RTE) food items throughout the world. To preserve flavour and last in acidic environments, food flavours are frequently added to packaged food items. Additionally, the extensive use of the product in bakery and confectionery goods including pretzels, rolls, pies, cakes, and cookies is encouraging market expansion. In addition, several product improvements, such as the addition of innovative, fusion tastes, such as fruits, chocolate, and nuts, to give edible items a natural scent, are bolstering market expansion. However, regulatory organisations like the Food and Drug Administration, the European Food Safety Authority, and others control and require the labelling of artificial flavouring ingredients. This guarantees the safety of artificial flavourings for ingestion by people. Due to all of these factors, it is predicted that throughout the forecast period, the worldwide artificial flavouring compounds market would expand both in terms of value and volume.

COVD-19 IMPACT ON THE ARTIFICIAL COLOR & FLAVOURS OF THE BEVERAGE MARKET

The worldwide coronavirus pandemic is anticipated to have an impact on the existing industry (COVID-19). Since the majority of the world's nations went into lockdown, consumer buying power has had a detrimental influence on the development of processed food goods. There has been a slight decline in the sales of various foods and beverages as a result of rules and regulations imposed by various governments regarding the gathering of people in places like all types of markets (hypermarkets, supermarkets, convenience stores, and others) for the purchase of food products. A challenge to the market has emerged from fewer stocks of food goods and fewer production workers in several undeveloped nations. On the other side, this market has been adversely impacted by the closure of hotels, restaurants, and other businesses. Nevertheless, the industry is projected to grow at a steady rate over the future years as a result of the frequent use of packaged food items.

MARKET DRIVERS:

Artificial colouring and flavour act as a substitute for natural agents which is propelling the market growth

Due to their widespread availability, accessibility, and low cost, artificial tastes are becoming more and more popular among consumers all over the world. Since almost all natural flavouring ingredients, including speciality varieties like vanilla, saffron, and others, are imparted by artificial flavourings, consumers are more interested in purchasing these exotic flavours, which have been the main factors driving the global artificial colour flavouring substances market. Because artificial flavourings are produced in laboratories and are more concentrated than natural ones, they can be used with much less concentration to enhance food flavour. This has led to an increase in the use of artificial flavourings by a variety of food and beverage processors, which has been linked to the expansion of the global artificial colour and flavourings market.

The rise in demand for ready to eat for is propelling market demand

Due to urbanisation and quickly growing incomes, interest in fast food and packaged items has surged. Since packaged goods require high flavouring loadings to maintain flavour that is lost during mass manufacturing, these variables are predicted to boost demand for food and beverages. It is projected that the food and beverage industry will continue to play a significant role in the market for food flavours. The market for food and drinks has experienced rapid growth, and it is estimated that this growth will continue in the years to come. As efforts are made to reduce the number of calories, salt, and fat in food, it is also projected that the demand for tastes to improve the flavour of products would increase.

The use of artificial Flavours and colours in the pharmaceutical sector to boost market

Pharmaceutical businesses use artificial flavours to mimic the scent, colour, and flavours of diverse natural compounds. Syrups, chewable pills, suspensions, gums, and spray, among others, are some of the medicinal goods for internal and exterior use that necessitate the use of artificial flavours during processing. In prior years, the medical sub-segment held a substantial market share.

MARKET RESTRAINTS:

Stringent Regulations to Constraint Market Growth

Several legal requirements and standards imposed by regulatory affairs must be followed by this industry. The regulation requirements differ from nation to nation, but the preservation of flavour quality is the overarching objective. These rules guarantee accurate ingredient labelling and proper flavour essence utilisation in eatables. These standards and guidelines established by various regulatory organisations will restrain market expansion since they cause producers to delay the introduction of new products or their development, which will result in product recalls. Therefore, the strict laws implemented by numerous countries may hurt the market for food flavours worldwide.

ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Form, Beverage Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GIVAUDAN SA, SENSIENT FLAVORS LLC , T. HASEGAWA CO., LTD., ROBERTET SA, MCCORMICK & COMPANY, SYNERGY FLAVORS, INC, ARCHER DANIELS MIDLAND COMPANY , FRUTAROM INDUSTRIES LTD., SYMRISE AG, MANE INC., RFI Ingredients, Inc. |

This research report on the Artificial colours & Flavours for the Beverage market has been segmented and sub-segmented based on Form, By Beverage Type and By Region.

ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET – BY FORM

-

Dry

-

Liquid

Based on the form, the artificial colour and flavour for the beverage market are segmented into Dry and Liquid. With a revenue share of over 73.7% in 2021, the liquid form category dominated the market for beverage flavouring and colour systems. Over the foreseeable period, the category is estimated to continue to rule. Its dominance in the market for beverage flavouring systems is partly due to the simplicity of processing connected with the liquid flavours. The beverage manufacturers favour it because of the greater stability that this simple mixing capability delivers. From 2023 - 2030, the liquid market is predicted to increase at the quickest rate (CAGR), 5.4%. The market's rapidly rising demand for beverages is a factor in the sector for beverage flavouring systems growing at the quickest rate. The variety of drinks and their corresponding essences, extracts, and emulsions are driving the industry's quickest growth in the next years.

ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET - BY BEVERAGE TYPE

-

Alcoholic

-

Non-alcoholic

Based on the beverage type, the artificial colour and flavour for the beverage market are segmented into Alcoholic and Non-alcoholic. In 2021, the non-alcoholic sector maintained a commanding 75.9% revenue share of the market for beverage flavouring systems. A large variety of items falling within the non-alcoholic categories, including juices, flavoured milk, flavoured water, mocktails, and energy drinks, are helping this category to dominate its market. The market segment's greatest revenue share in the market for beverage flavouring systems is further supported by the expanding variations of the aforementioned product kinds under non-alcoholic beverages. Another key reason for promoting segmental expansion is the advantages of non-alcoholic beverages over alcoholic ones. These drinks can enhance cardiovascular health, lower the risk of osteoporosis, increase copper metabolism, encourage better sleep, lessen anxiety and stress, and aid in post-exercise recovery. Growing public awareness of the health advantages of non-alcoholic beverages, particularly among young people, is helping the sector expand. Additionally, the demand for energy drinks and sports drinks is being supported by the growing population of health nuts throughout the world. Over the anticipated period, the sector for alcoholic drinks is projected to grow at the quickest rate. The quickest increase is anticipated to be supported by the rising demand for flavoured alcoholic beverages such as rose-flavoured vodka, gin, and beer throughout the anticipated timeframe. Manufacturers are concentrating on creating new and distinctive tastes in alcoholic drinks, which is driving the segment's growth.

ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Artificial Color & Flavours for Beverage market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. The Asia Pacific area is anticipated to develop at the quickest pace, 6.1%, between 2022 and 2030. Due to the widespread use of artificial flavours in beverage applications, North America is anticipated to have a considerable share of the market. China has the largest market share globally while the United States has the most market participants. By 2030, Europe is anticipated to maintain a commanding position in the market, rising at a CAGR of 4.7%. Some of the most important players in this area are from France and Switzerland. With a market share of 25.7% by 2030 and a CAGR of 5.8% throughout the forecast period, North America is estimated to have considerable expansion in the entire market. In this area, the US holds the largest market share and some of the key industry players.

ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET - BY COMPANIES

Some of the major players operating in the Artificial Color & Flavours for Beverage include:

-

GIVAUDAN SA

-

SENSIENT FLAVORS LLC

-

T. HASEGAWA CO., LTD.

-

ROBERTET SA

-

MCCORMICK & COMPANY

-

SYNERGY FLAVORS, INC

-

ARCHER DANIELS MIDLAND COMPANY

-

FRUTAROM INDUSTRIES LTD.

-

SYMRISE AG

-

MANE INC.

-

RFI Ingredients, Inc.

NOTABLE HAPPENING IN THE ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET

-

ACQUISITION- Griffith Foods' major supplier of savoury flavour ingredients, Innova Foods, has been acquired by Synergy Flavors, Inc.

-

ACQUISITION - November 2019: The maker of flavours, perfumes, and speciality ingredients located in the United States, Ungerer & Company, has announced that Givaudan SA would purchase it. This will make it possible for the corporation to grow its taste business internationally.

Chapter 1. ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET – By Form

6.1. Dry

6.2. Liquid

Chapter 7. ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET – By Beverage Type

7.1. Alcoholic

7.2. Non Alcoholic

Chapter 8. ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET – By Region

8.1. North America

8.2. Europe

8.3. Asia-P2acific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. ARTIFICIAL COLOR & FLAVOURS FOR BEVERAGE MARKET – By Companies

9.1. GIVAUDAN SA

9.2. SENSIENT FLAVORS LLC

9.3. T. HASEGAWA CO., LTD.

9.4. ROBERTET SA

9.5. MCCORMICK & COMPANY

9.6. SYNERGY FLAVORS, INC

9.7. ARCHER DANIELS MIDLAND COMPANY

9.8. FRUTAROM INDUSTRIES LTD.

9.9. SYMRISE AG

9.10. MANE INC.

9.11. RFI Ingredients, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900