Articulated Foodservice Robots Market Size (2024 – 2030)

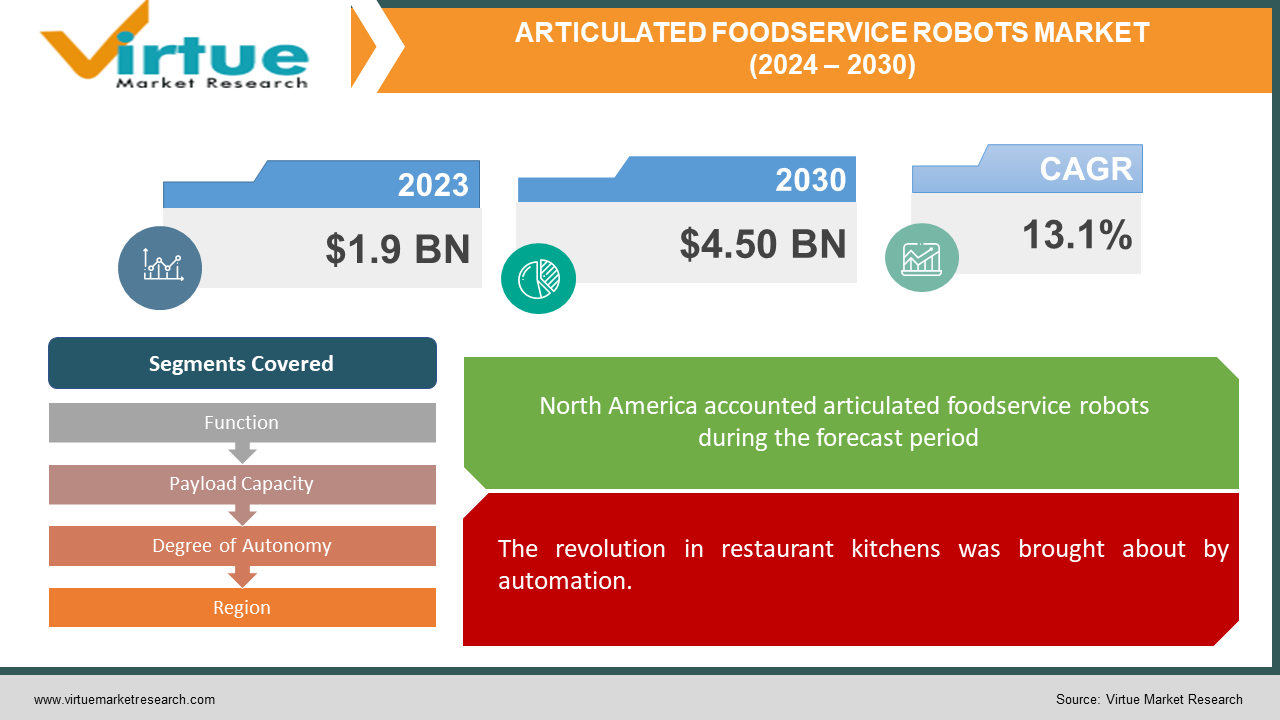

The Global Articulated Foodservice Robots market size was exhibited at USD 1.9 billion in 2023 and is projected to hit around USD 4.50 billion by 2030, growing at a CAGR of 13.1% during the forecast period from 2024 to 2030.

Robots having jointed arms that can imitate human arms in movement and manipulation are known as articulated food service robots. They are being used more frequently in the food service sector to automate a variety of jobs, such as flipping hamburgers, packing ingredients, serving food, carrying orders to tables, and even busing tables. These robots have several possible advantages they can operate continuously and maybe do tasks more quickly, which increases efficiency; they can also precisely manage cooking, which improves food quality; they can lower labour costs; and they can handle hazardous duties like handling boiling oil, which improves safety. Nevertheless, there are disadvantages as well, such as the expensive cost of ownership and upkeep for these robots, their restricted ability to adjust to shifting cooking conditions, and the possibility of employment displacement in the food service sector. All things considered, articulated food service robots are an exciting new technology that could revolutionise food preparation and service. But before choosing to utilise them in restaurants, it is important to carefully weigh the potential advantages and disadvantages.

Key Market Insights:

The market for articulated food service robots is expected to increase significantly worldwide. This growth is being driven by factors such as a lack of labour, an increasing acceptance of automation, and the increased awareness of hygiene following the COVID-19 pandemic. There are still issues, such as the high initial expenses of robots, their technological constraints, and changing legal frameworks. Notwithstanding these obstacles, developments in cloud robotics, AI, and customisation promise more intelligent and flexible robots, opening intriguing new possibilities in the future. Prominent players in this dynamic market include automation firms, food service robot inventors, and established industrial robot manufacturers. Some of the themes influencing this industry's bright future include cooperation between robots and human workers, branching out into new duties like dishwashing, and emphasising sustainability using energy-efficient robots and less food waste.

Global Smart Articulated Foodservice Robots Drivers:

The revolution in restaurant kitchens was brought about by automation.

Restaurants are adopting automation as a trend! A growing number of robots are being used in kitchens because of labour shortages and a need for increased efficiency. These incredibly hardworking individuals take on monotonous jobs, freeing up human workers for higher-value responsibilities like creating delectable dishes or engaging with clients. There are tantalising advantages: expedited meal preparation results in reduced wait times for famished customers and the capacity to process a higher volume of requests during peak hours. Another essential component is consistency; robots adhere to recipes with uncompromising accuracy, guaranteeing that every dish has the same portion sizes and quality and eliminating any possibility of human error. Since robots replace human labour and do not require perks or breaks, long-term cost savings are also put on hold. However, some robots are data wizards that gather and analyse kitchen data to pinpoint problem areas and streamline workflows. They do more than just flip burgers and chop vegetables. Restaurants can use this data to make informed decisions about inventory, staffing, and menus. Robots will work alongside human cooks in the kitchen of the future to produce a more productive and efficient space that will ultimately provide guests with an improved eating experience.

Detailed Foodservice In a post-pandemic world, robots are revolutionising kitchen hygiene.

From COVID-19, restaurants now place a high premium on hygiene. Thankfully, talking food service robots are becoming the kitchen's unsung heroes of hygienic practices. Robots can be trained for rigorous disinfection, in contrast to human staff members who may have uneven cleaning schedules. This guarantees that every surface the robot meets is completely sanitised, thereby lowering the possibility of cross-contamination and the transmission of allergens or pathogens in the hectic kitchen setting. Robots can also perform a lot of jobs that formerly required humans to encounter food, which reduces the possibility of mistakes being made by people or of pathogens being accidentally touched. Certain robots are even outfitted with advanced cleaning instruments, such as UV light disinfection or specific solutions, which enable automated surface and utensil sanitization. These tireless defenders of hygiene fit in perfectly with the current cleaning protocols, freeing up human workers to concentrate on high-touch areas or jobs that need human judgment. Furthermore, certain robots offer data-driven insights regarding the efficacy of cleaning. By tracking hygiene trends and identifying areas that require particular care, this useful information helps restaurants maintain a consistently clean and secure environment for food preparation. To put it succinctly, articulated food service robots are transforming kitchen hygiene and enhancing consumer safety and comfort.

The Restaurant Industry Is Being Saved by Articulated Foodservice Robots

Restaurants are struggling to keep up with the surge in takeaway business. The glittering knights in stainless steel tasked with optimising back-of-house operations are articulated food service robots. These industrious labourers are particularly good at monotonous jobs that slow down kitchens during takeaway rushes. Imagine never having to worry about portioning ingredients precisely or flipping burgers again! These jobs are performed with unchanging precision by robots, allowing human cooks to concentrate on more complex meals or customer service. Robots are also speed devils, constantly churning out food to satisfy the highest takeaway demand. Customers will benefit from shorter wait times and hot meals when they arrive. Still, that's not all! Because robots are designed to be consistent, every takeaway order they process will have the same amount and quality of food, which will cut down on errors and satisfy customers. They may even help with labour expenses and scalability, which would enable eateries to run with a smaller workforce during periods of high takeaway demand. In the fast-paced world of takeout, hygiene finally takes the stage thanks to robots that are configured for exacting cleaning processes that minimise contamination hazards. Put simply, articulated food service robots are revolutionising the takeaway industry by turning kitchens into well-oiled machines that satisfy customers while delivering efficiency and quality.

Global Smart Articulated Foodservice Robots Restraints and Challenges:

There are challenges in the promising field of intelligent articulated food service robots. These robots can be very expensive to buy and install upfront, which can be a big barrier for smaller eateries or those with little funding. Technical constraints also come into play because existing robots may find it difficult to perform delicate jobs or adjust to unforeseen circumstances in the kitchen. Another issue is safety since it takes appropriate procedures and training to ensure safe integration and operation alongside human personnel. Businesses thinking about implementing robots face additional uncertainty due to the constantly changing legislation about food safety, robot operation, and data privacy. Since some consumers might not feel comfortable having robots handle their food, it is important to establish trust with them. The expense of operating these robots is increased by the need for routine maintenance. Lastly, the extensive use of robots may result in employment losses in the food service sector, raising moral and societal questions. It will be necessary to overcome these obstacles through developments in robot technology, cost savings, more transparent regulations, and open customer relations before the global foodservice robot market adopts intelligent articulated robots.

Global Articulated Foodservice Robots Market Opportunities:

The global market for articulated food service robots is full of intriguing prospects. The industry's severe labour shortage is one of the most important issues it confronts. These robots can take over physically taxing and repetitive jobs, freeing up human workers for more complex or customer-facing work. Additionally, by carefully regulating the cooking parameters, robots improve food safety and quality, resulting in consistently excellent meals and a greater reputation for the brand. Because of their diligent work ethic and quick task completion, robots also increase efficiency and productivity, which can lead to speedier service and possibly higher revenue. Reaching out to new markets such as automated kitchens or robot deliveries allows for the exploration of unexplored revenue sources. Furthermore, the significant data that robots generate on kitchen operations enables data-driven decision-making concerning staff scheduling, menus, and resource allocation. Another benefit is better working conditions since robots handle risky jobs and make restaurants safer places for employees to work. With features designed for certain food service applications, the market for customised robots is expected to expand and provide solutions that are ideal for the distinct requirements of different types of restaurants. Ultimately, the limits of present models will be overcome by increasingly more complex robots with higher flexibility and agility thanks to developments in AI, vision systems, and sensor technologies. The global articulated food service robots market has the potential to transform food preparation and service, benefiting companies and customers alike if it takes advantage of these prospects.

ARTICULATED FOODSERVICE ROBOTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.1% |

|

Segments Covered |

By Function, Payload Capacity, Degree of Autonomy, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB Group, Bear Robotics, Fanuc Corporation, Kawasaki Heavy Industries Ltd., KUKA AG, Miso Robotics, Omron Corporation, Rockwell Automation Inc., Starship Technologies, Yaskawa Electric Corporation |

Global Articulated Foodservice Robots Market Segmentation: By Function

-

Food Preparation

-

Food Handling

-

Food Service

Food handling and preparation. Both have room to grow significantly. Robots that prepare food can do jobs like grilling, portioning, and flipping burgers, which increases kitchen productivity. They are fuelled by the growing need for automation to deal with labour shortages and repetitive jobs. Further developments in robot dexterity and design are also making more complex food preparation tasks possible. Robots that handle food are mostly used for loading ovens, setting up plates and packaging takeaway orders. Faster and more efficient food handling is essential in the expanding takeaway and delivery sector, which benefits this segment. Furthermore, since the pandemic, restaurants have found that the constant and hygienic handling of food by robots is particularly appealing.

Global Articulated Foodservice Robots Market Segmentation: By Payload Capacity

-

Low Payload

-

Medium Payload

-

High Payload

The agile ninjas of the kitchen, low payload robots are skilled at managing simpler jobs like cutting boards and fragile food. They are perfect for smaller kitchens or restaurants that emphasise finer handling because of their flexibility and price. Their expansion is also fuelled by the growing need for automation of various food prep operations, such as portioning and plating. The most adaptable workhorses are the medium payload robots. They can expedite operations like dish transporting and delivery management by handling heavier things like prepared meals and beverages. Their steady rise can be attributed to their capacity to adjust to a variety of kitchen needs due to their balance between manoeuvrability and payload. Robots with a high payload capacity are the strongest; they can move heavy objects, such as full bins or large pots.

Global Articulated Foodservice Robots Market Segmentation: By Degree of Autonomy

-

Fully Autonomous

-

Semi-Autonomous

-

Tele-operated

Although fully autonomous robots are autonomous, the dynamic nature of kitchens may pose a challenge for this emerging technology. Currently, the most prevalent kind of robots, semi-autonomous ones, need human assistance for some activities. They may be used for a greater variety of jobs because of this harmony between automation and control. Tele-operated robots are controlled from a distance, which is advantageous for complex jobs requiring human decision-making in real time. Although there isn't yet a single leading market for semi-autonomous robots, this trend is probably going to continue soon. Due to improvements in control interfaces, teleoperated robots are expected to grow rapidly, while completely autonomous robots may see a long-term boom as artificial intelligence and sensor technology advance.

Global Articulated Foodservice Robots Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

There are two major competitors in the regionally divided worldwide articulated food service robot market: North America and Asia-Pacific. North America currently has the biggest market share, because of its robust infrastructure and early adoption of robotics. On the other hand, the fastest-growing region is Asia-Pacific. This increase is the result of a growing population that has a greater need for quick and easy meal options like delivery and takeout areas where robots shine. A favourable environment for the use of robots is also being created in the area by growing labour costs and government backing for automation technology. In the upcoming years, Asia-Pacific is expected to emerge as the worldwide leader in the articulated foodservice robots market due to its strong technology improvements and tolerance to automation in culture.

COVID-19 Impact Analysis on the Global Articulated Foodservice Robots Market:

The global market for articulated food service robots faced a variety of obstacles and opportunities because of the COVID-19 epidemic. On the one hand, the pandemic caused supply chain disruptions, which delayed the deployment of robots and stopped their output. Changes in the labour market also had an impact, as some restaurants saw a less immediate need to automate during lockdowns due to temporary unemployment. Another barrier was hygienic concerns, which made some eateries wary of the possibility of virus spread from badly sanitised robots. But the pandemic also created opportunities for the market. Robots were appealing because of the increased emphasis on hygiene because they could clean well and consistently. Labour shortages returned stronger than ever as constraints loosened, rekindling interest in robots as a potential answer. Restaurants were more open to using robots for food prep and delivery duties because of the pandemic's drive for automation across all industries, particularly given the growing demand for efficient food prep from the takeaway and delivery industry. With the help of robots, restaurants were able to meet the demand for takeaway and delivery without compromising on quality or speed by managing back-of-house activities. In summary, the COVID-19 epidemic had a complicated impact on the global market for articulated food service robots, but in the end, it seems to have reinforced the long-term trend of automation adoption in the food service sector.

Recent Trends and Developments in the Global Articulated Foodservice Robots Market:

To broaden its range of robotic solutions, Mitsubishi (Japan) has expanded the use of its MELFA articulated arms and its SCARA robot products to include a line of triangle robots. An autonomous robotic station called Blended was introduced by 6d Bytes (US) to make delectable and healthful mixtures. This aided the business in diversifying its line of food robotics products. Together, Kawasaki Heavy Industries, Ltd. (Japan) and Softbank Group (Japan) have developed a humanoid robot named "Pepper" from Softbank and Kawasaki's duAro to accomplish a wider range of activities.

Key Players:

-

-

ABB Group

-

Bear Robotics

-

Fanuc Corporation

-

Kawasaki Heavy Industries Ltd.

-

KUKA AG

-

Miso Robotics

-

Omron Corporation

-

Rockwell Automation Inc.

-

Starship Technologies

-

Yaskawa Electric Corporation

-

Chapter 1. Articulated Foodservice Robots Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Articulated Foodservice Robots Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Articulated Foodservice Robots Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Articulated Foodservice Robots Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Articulated Foodservice Robots Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Articulated Foodservice Robots Market – By Function

6.1 Introduction/Key Findings

6.2 Food Preparation

6.3 Food Handling

6.4 Food Service

6.5 Y-O-Y Growth trend Analysis By Function

6.6 Absolute $ Opportunity Analysis By Function, 2024-2030

Chapter 7. Articulated Foodservice Robots Market – By Payload Capacity

7.1 Introduction/Key Findings

7.2 Low Payload

7.3 Medium Payload

7.4 High Payload

7.5 Y-O-Y Growth trend Analysis By Payload Capacity

7.6 Absolute $ Opportunity Analysis By Payload Capacity, 2024-2030

Chapter 8. Articulated Foodservice Robots Market – By Degree of Autonomy

8.1 Introduction/Key Findings

8.2 Fully Autonomous

8.3 Semi-Autonomous

8.4 Tele-operated

8.5 Y-O-Y Growth trend Analysis By Degree of Autonomy

8.6 Absolute $ Opportunity Analysis By Degree of Autonomy, 2024-2030

Chapter 9. Articulated Foodservice Robots Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Function

9.1.3 By Payload Capacity

9.1.4 By Degree of Autonomy

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Function

9.2.3 By Payload Capacity

9.2.4 By Degree of Autonomy

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Function

9.3.3 By Payload Capacity

9.3.4 By Degree of Autonomy

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Function

9.4.3 By Payload Capacity

9.4.4 By Degree of Autonomy

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Function

9.5.3 By Payload Capacity

9.5.4 By Degree of Autonomy

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Articulated Foodservice Robots Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ABB Group

10.2 Bear Robotics

10.3 Fanuc Corporation

10.4 Kawasaki Heavy Industries Ltd.

10.5 KUKA AG

10.6 Miso Robotics

10.7 Omron Corporation

10.8 Rockwell Automation Inc.

10.9 Starship Technologies

10.10 Yaskawa Electric Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Articulated Foodservice Robots Market size is valued at USD 1.9 billion in 2023.

The worldwide Global Articulated Foodservice Robots Market growth is estimated to be 13.1 % from 2024 to 2030.

The Global Articulateservice robotsts are segmented By Function (Food Preparation, Food Handling, Food Service); Payload Capacity (Low Payload, Medium Payload, High Payload); Degree of Autonomy (Fully Autonomous, Semi-Autonomous, Tele-operated) and Region.

With the development of artificial intelligence and customisation, articulated food service robots have a bright future. Anticipate seeing robots in the kitchen collaborating with people, taking on new projects, and encouraging sustainability.

The market for articulated food service robots was impacted by the COVID-19 outbreak in many ways. Changes in the labour market and supply chain disruptions were among the early difficulties. However, the pandemic also brought attention to issues with worker shortages and hygienic practices, which raised long-term interest in robotics.