Architectural Services Market Size (2025 – 2030)

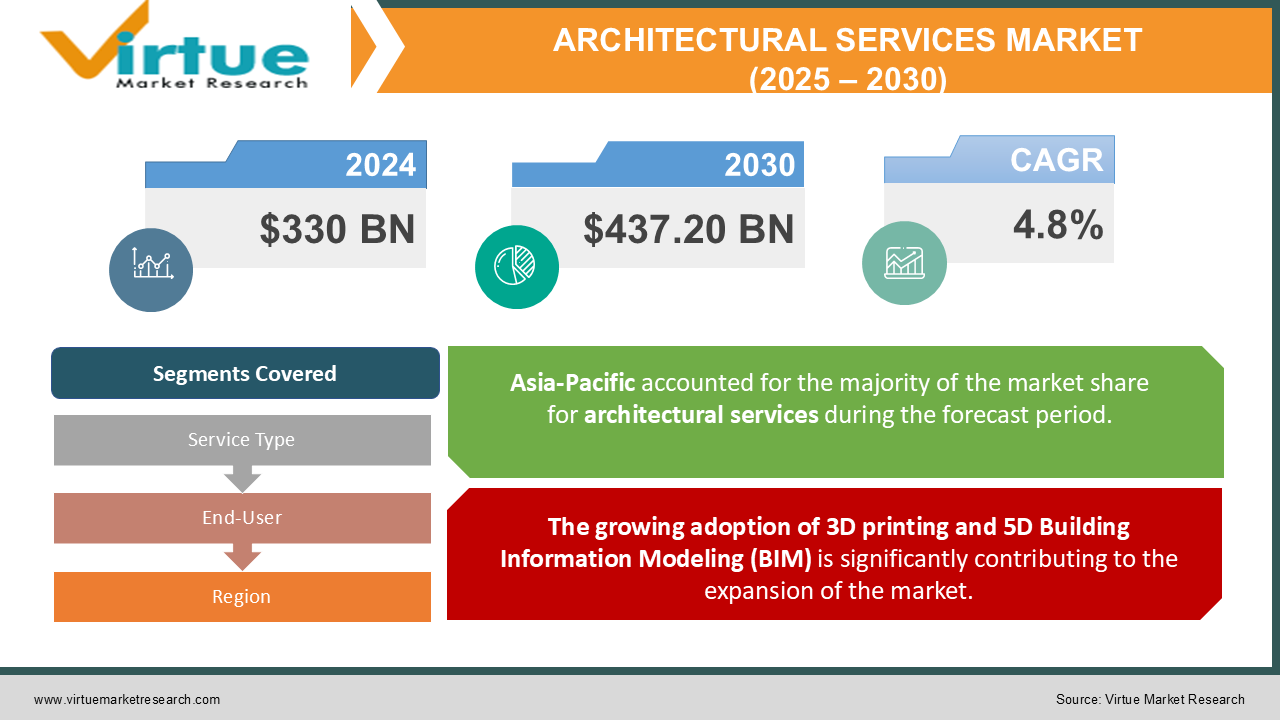

The Architectural Services Market was valued at USD 330 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 437.20 billion by 2030, growing at a CAGR of 4.8%.

Architectural services encompass the design and development of building structures and interior spaces, ensuring compliance with zoning laws, regulations, and safety protocols. These services cover a wide range of activities, including program development, interior design, feasibility studies, site selection, project management, property assessments, renderings, marketing collateral, on-site project oversight, and contract administration. The key sectors within architectural and engineering consulting include engineering services, architectural design, surveying and mapping, geophysical assessments, laboratory testing, building inspections, and drafting services. Engineering services pertain to the planning, assembly, and deployment of systems or products that align with the specific requirements of material specifications, design considerations, and project scale, applicable across diverse sectors such as pipeline systems, ports, airports, roads, and railways.

Key Market Insights:

-

The architectural services sector is experiencing a major digital shift, fueled by advancements in design technologies, computer-assisted fabrication, and interconnected systems.

-

Building Information Modeling (BIM) has become a fundamental technology, allowing professionals to generate detailed, geometric virtual representations of complete buildings and their components.

-

The incorporation of virtual reality (VR) and augmented reality (AR) into BIM is transforming project visualization and management, providing stakeholders with the ability to engage with designs before the construction process commences.

Architectural Services Market Drivers:

The growing adoption of 3D printing and 5D Building Information Modeling (BIM) is significantly contributing to the expansion of the market.

3D printing technology is steadily gaining traction in the architectural services sector. It enables architects to create various models of proposed structures, offering up to 75% in cost savings and reducing project turnaround time from several days to just a few hours. In addition to time and cost efficiency, 3D printing can be seamlessly integrated with in-house CAD applications, expanding design possibilities and providing enhanced perspectives with visually appealing, scaled models. A notable example of this innovation is the Office of the Future in Dubai, recognized as the world’s first 3D-printed office.

Technological advancements, alongside a focus on innovation and sustainability, are expected to be key drivers of growth in the architectural services market. One of the latest innovations, 5D Building Information Modeling (BIM), is increasingly adopted by architectural firms to offer cost-effective services. 5D BIM introduces features such as efficient cost planning and real-time cost estimation, allowing for immediate comparison with target costs. This technology also supports the calculation of overall expenses at each stage of the construction process. The continued integration of innovative solutions and cutting-edge technologies is set to drive further market expansion in the coming years.

Architectural Services Market Restraints and Challenges:

The high costs associated with design and planning are a significant restraint on market growth.

One of the primary challenges facing architectural firms is managing budget-conscious clients. The pricing for design and planning services is typically determined by factors such as project requirements, location, and size, leading to variations in quotes between different projects. Additionally, the level of expertise of the architectural firm can influence pricing, making it uncommon for two firms to offer the same rate. An architectural project typically progresses through phases, including schematic design, design development, construction documentation, bidding and negotiation, and construction administration. As the design process extends, the associated costs increase. This makes it difficult for architectural service providers to offer cost-effective solutions while remaining competitive in their pricing, which in turn acts as a barrier to market growth.

Architectural Services Market Opportunities:

The growth in construction activities presents numerous opportunities for expansion in the architectural services market.

The growth of the real estate market is expected to play a key role in the development of the architectural services sector. Emerging markets in Asia are forecasted to be the fastest-growing regional markets, while urbanization will extend beyond these regions. Cities in developed economies are also becoming "smarter," driven by increased technological adoption and rapid growth. Additionally, continued urbanization and population growth are poised to further boost the construction market.

Significant expansion is anticipated in the construction of public infrastructure, residential housing, and commercial buildings. Government initiatives to develop infrastructure in emerging economies will also have a positive impact on the construction industry and contribute to the economic growth of these regions. As construction activities increase, construction companies are increasingly turning to architectural services to streamline and optimize their projects, creating substantial opportunities for market players to expand.

ARCHITECTURAL SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Service Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Jacobs Engineering Group, DP Architects Pte Ltd., Gensler, PCL Constructors Inc., Nikken Sekkei Ltd, HKS Inc., Foster + Partners, Perkins Eastman, Perkins, IBI Group |

Architectural Services Market Segmentation: By Service Type

-

Architectural Advisory Services

-

Construction and Project Management Services

-

Engineering Services

-

Urban Planning Services

-

Interior Design Services

-

Others

The growth of the real estate market is expected to play a key role in the development of the architectural services sector. Emerging markets in Asia are forecasted to be the fastest-growing regional markets, while urbanization will extend beyond these regions. Cities in developed economies are also becoming "smarter," driven by increased technological adoption and rapid growth. Additionally, continued urbanization and population growth are poised to further boost the construction market.

Significant expansion is anticipated in the construction of public infrastructure, residential housing, and commercial buildings. Government initiatives to develop infrastructure in emerging economies will also have a positive impact on the construction industry and contribute to the economic growth of these regions. As construction activities increase, construction companies are increasingly turning to architectural services to streamline and optimize their projects, creating substantial opportunities for market players to expand.

Architectural Services Market Segmentation: By End-User

-

Education

-

Government

-

Healthcare

-

Hospitality

-

Residential

-

Industrial

-

Retail

-

Others

The industrial sector holds the largest market share in the architectural services industry and is projected to experience continued growth at a compound annual growth rate (CAGR) during the forecast period. Industrial clients typically seek architectural services for the planning and design of corporate offices, manufacturing plants, warehouses, company buildings, corporate campuses, and other infrastructure. The dominance of the industrial sector can be attributed to rapid global industrialization, increased corporate acquisitions, and the construction of new factories. Additionally, the demand for architectural consultancy and interior design services is expected to rise, driven by growing environmental concerns and business owners’ increasing interest in developing sustainable, green buildings.

The residential sector is the largest end-user of architectural services, with key applications including houses, bungalows, and apartments. The growth of disposable income and the decline in home financing rates in emerging markets are anticipated to positively influence market expansion. Moreover, urbanization in tier-II cities in these regions is expected to further drive demand for architectural services over the forecast period. Architects are also likely to require additional services, such as urban planning and project management, to better manage the increasingly complex smart city projects emerging in various regions.

Architectural Services Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region holds the largest share of the global architectural services market and is expected to continue its growth throughout the forecast period. According to Forbes, this expansion is largely driven by the region's significant penetration in the real estate industry and the government's focus on developing smart cities. Moreover, an increasing number of new funds are showing interest in Asia-Pacific assets, suggesting that prices remain competitive and the region’s markets continue to present a wide range of investment opportunities, as noted by Mondaq. This growing interest is coming from both domestic and international institutional investors.

Europe is also projected to experience growth during the forecast period. The region has made substantial contributions to the overall market revenue, primarily due to increased investments and the development of new infrastructure projects. The booming construction sector within the IT industry has played a key role in this market expansion. Additionally, the temporary suspension of data center construction due to the COVID-19 pandemic, coupled with the launch of new IT projects, is expected to influence the architectural services industry throughout the forecast period.

North America is experiencing significant growth in the architectural services market and is expected to remain highly active during the forecast period. The primary driver of demand for architectural services in this region is the ongoing infrastructure modernization and redevelopment efforts. This growth is further fueled by the rapid digitalization of the sector, supported by advanced end-to-end software and cutting-edge design tools that enhance project efficiency and innovation.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has negatively impacted market growth, as construction projects were delayed or halted due to labor shortages and funding disruptions. Both short-term and long-term infrastructure spending plans in several regions were postponed. However, as various sectors recover and supply chain operations stabilize with the decline in COVID-19 cases, the market is expected to see growth. The temporary suspension of data center construction during the pandemic has impacted the architectural services market, but the resumption of these projects, along with the initiation of new IT ventures, is expected to drive recovery.

The pandemic has also highlighted the importance of adequate housing and accommodation, further influencing market dynamics. In contrast to commercial architecture, there is a growing trend of increased investment in innovative housing solutions within the real estate sector, which is expected to further stimulate market growth.

Latest Trends/ Developments:

March 2024: AE Works Ltd (AE Works), a building design and consulting firm, announced the acquisition of WTW Architects, a renowned national provider of higher education design with a 65-year legacy of significant projects in Pittsburgh. This merger brought together over 100 professionals, establishing AE Works as one of the largest architectural firms in the region.

February 2024: Sheri Scott, Founder and Principal Architect at Springhouse Architects, and Todd Yoby, a licensed architect and Principal of Studiyo-b Architects, revealed the merger of their firms. The newly combined entity will continue under the name Springhouse Architects, serving the greater Cincinnati, Dayton, and Columbus areas. The firm will offer a range of architectural services, including residential, commercial, and multi-family design for homeowners, business owners, home builders, and developers.

January 2023: PCL Construction was awarded the Engineering, Procurement, and Construction (EPC) contract for the 400 MW Stubbo Solar project by ACEN Australia, a renewable energy company. PCL will oversee the detailed design, engineering, and procurement for the solar project, taking responsibility for the complete execution of all phases of the project.

Key Players:

These are top 10 players in the Architectural Services Market :- AEDAS

-

Jacobs Engineering Group

-

DP Architects Pte Ltd.

-

Gensler

-

PCL Constructors Inc.

-

Nikken Sekkei Ltd.

-

HKS Inc.

-

Foster + Partners, Perkins Eastman

-

Perkins

-

IBI Group

Chapter 1. Architectural Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Source

Chapter 2. Architectural Services Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Architectural Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Architectural Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Architectural Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Architectural Services Market – By Service Type

6.1 Introduction/Key Findings

6.2 Architectural Advisory Services

6.3 Construction and Project Management Services

6.4 Engineering Services

6.5 Urban Planning Services

6.6 Interior Design Services

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Service Type

6.9 Absolute $ Opportunity Analysis By Service Type, 2025-2030

Chapter 7. Architectural Services Market – By End-User

7.1 Introduction/Key Findings

7.2 Education

7.3 Government

7.4 Healthcare

7.5 Hospitality

7.6 Residential

7.7 Industrial

7.8 Retail

7.9 Others

7.10 Y-O-Y Growth trend Analysis By End-User

7.11 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 8. Architectural Services Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Service Type

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Service Type

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Service Type

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Service Type

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Service Type

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Architectural Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 AEDAS

9.2 Jacobs Engineering Group

9.3 DP Architects Pte Ltd.

9.4 Gensler

9.5 PCL Constructors Inc.

9.6 Nikken Sekkei Ltd.

9.7 HKS Inc.

9.8 Foster + Partners, Perkins Eastman

9.9 Perkins

9.10 IBI Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The architectural services sector is experiencing a major digital shift, fueled by advancements in design technologies, computer-assisted fabrication, and interconnected systems.

The top players operating in the Architectural Services Market are - Jacobs Engineering Group, DP Architects Pte Ltd. and Gensler.

The COVID-19 pandemic has negatively impacted market growth, as construction projects were delayed or halted due to labor shortages and funding disruptions. Both short-term and long-term infrastructure spending plans in several regions were postponed.

The growth of the real estate market is expected to play a key role in the development of the architectural services sector. Emerging markets in Asia are forecasted to be the fastest-growing regional markets, while urbanization will extend beyond these regions.

North America is the fastest-growing region in the Architectural Services Market.