Architectural Lighting Market Size (2024-2030)

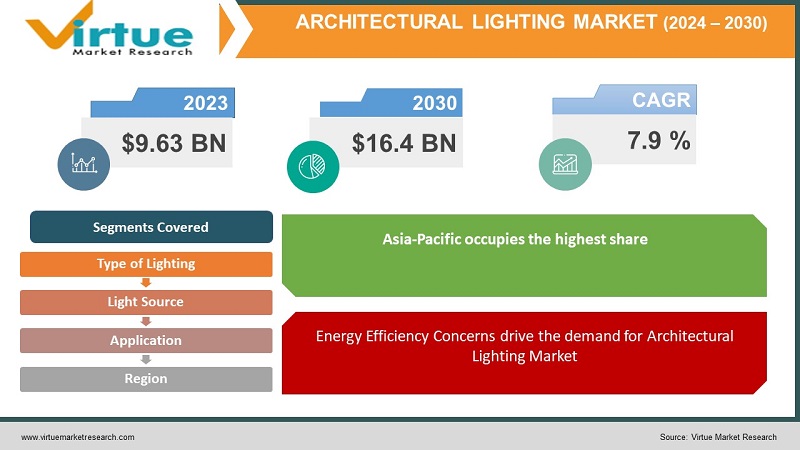

The Global Architectural Lighting Market was valued at USD 9.63 billion and is projected to reach a market size of USD 16.4 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.9 %.

The Architectural Lighting Market is expected to grow significantly in the coming years due to increasing emphasis on energy efficiency, advancements in LED technology, and a growing focus on smart lighting solutions. Light-emitting diode (LED) technology continued to dominate the architectural lighting market due to its energy efficiency, long lifespan, and versatility. The major well-established key players in the Architectural Lighting Market are Philips Lighting (Signify), Osram GmbH, Cree Inc., Acuity Brands Inc., and Zumtobel Group.

Key Market Insights:

Urbanization, infrastructure development, and an increasing focus on creating aesthetically pleasing environments are propelling the Architectural Lighting Market. Emerging economies are witnessing a rise in construction activities, contributing to the demand for architectural lighting solutions.

Architectural LED lighting is recognized as the most energy-efficient lighting, converting 80% of consumed energy into visible light while losing only 20% as heat. LED lighting boasts an impressive projected operational time of 50,000 hours, making it 25 times more durable than traditional incandescent and halogen alternatives. The restraints to the Architectural Lighting Market include the high initial costs, technical complexity, and regulatory compliance. Asia-Pacific occupies the highest share of the Architectural Lighting Market and Asia-Pacific is also the fastest-growing segment during the forecast period.

Architectural Lighting Market Drivers:

Energy Efficiency Concerns drive the demand for Architectural Lighting Market

There is an increasing recognition of the environmental impact of energy consumption. This has led to a heightened focus on energy-efficient lighting solutions. LED technology has become the preferred choice over traditional lighting sources. LED is known for its energy efficiency and longer lifespan. Governments worldwide have implemented regulations and standards promoting energy-efficient lighting technologies. Businesses and consumers are drawn to energy-efficient lighting for environmental reasons and also due to the potential for reduced operational costs over time. The driver Energy Efficiency Concerns have led to widespread adoption of LED lighting solutions in both residential and commercial spaces.

Smart and Connected Lighting Solutions are propelling the Architectural Lighting Market

The integration of smart technologies, sensors, and IoT leads to the development of sophisticated lighting control systems. Users can control and manage lighting remotely through mobile devices or automation systems. This enhances convenience and flexibility. Smart lighting systems allow for real-time monitoring and data analysis. This optimizes energy consumption and contributing to sustainability goals.The trend towards smart buildings also drives the demand for lighting solutions that seamlessly integrate with other intelligent building systems. The ability to customize lighting scenarios and automate lighting adjustments has become a key selling point. This caters to the desire for personalized and adaptive environments

The demand for smart lighting solutions has grown across various sectors such as, residential, commercial, and industrial.

Architectural Lighting Market Restraints and Challenges

The major challenge faced by the Architectural Lighting Market is the initial cost of implementing advanced lighting technologies, especially energy-efficient and smart lighting solutions. This can act as a barrier for budget-conscious consumers and businesses. This slows down the widespread adoption of more advanced lighting systems. The technical complexity of smart lighting systems includes installation and maintenance. This can be a barrier for end-users. Ensuring compatibility between different lighting products and control systems can be a challenge in smart lighting setups.

Architectural Lighting Market Opportunities:

The Architectural Lighting Market has various opportunities in the market.The rising demand for smart home and building automation systems such as integration with IoT, voice-activated controls, and the ability to create personalized lighting scenarios presents a significant opportunity for the growth of the smart lighting market. The development of smart cities creates opportunities for architectural lighting to be integrated into urban planning and infrastructure. Other Opportunities in the market include increasing demand for smart lighting, the focus on human-centric lighting, advancements in LED technology, energy efficiency initiatives, customization trends, e-commerce expansion, and the emphasis on wellness in commercial spaces.

ARCHITECTURAL LIGHTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.9% |

|

Segments Covered |

By Type of lighting, light source, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Philips Lighting (Signify), Osram GmbH, Cree Inc., Acuity Brands Inc., Zumtobel Group, Hubbell Incorporated, Eaton Corporation, General Electric (Current, powered by GE), Lutron Electronics Co. Inc., Schneider Electric |

Architectural Lighting Market Segmentation

Architectural Lighting Market Segmentation: By Type of Lighting

- Interior Lighting

- Exterior Lighting

- Specialty Lighting

In 2023, based on market segmentation by Type of Lighting, "Interior Lighting" occupies the highest share of the Architectural Lighting Market. This is due to the high demand for lighting solutions in residential, commercial, and institutional interiors.

However, Specialty Lighting is also the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 11%. This is due to the increasing demand for unique and aesthetically pleasing lighting designs in both residential and commercial settings. The specialty lighting includes customized and application-specific solutions such as accent lighting, task lighting, and decorative lighting.

Architectural Lighting Market Segmentation: By Light Source

- LED Lighting

- Fluorescent Lighting

- Incandescent Lighting

- Halogen Lighting

In 2023, based on market segmentation by Light Source, the LED lighting segment occupies the highest share of the Architectural Lighting Market. This is mainly due to its energy efficiency, long lifespan, and versatility. LEDs are popular choice for various applications.

LED lighting is also the fastest-growing segment during the forecast period. This is mainly due to the ongoing advancements in LED technology and the increasing emphasis on energy efficiency and sustainability.

Architectural Lighting Market Segmentation: By Application

- Commercial Buildings Lighting

- Residential Buildings Lighting

- Industrial Facilities Lighting

- Outdoor Spaces Lighting

In 2023, based on market segmentation by Application, the Commercial Buildings Lighting segment occupies the highest share of the Architectural Lighting Market. This is mainly due to the extensive use of architectural lighting in offices, retail spaces, hospitality establishments, and other commercial structures.

However, Residential Buildings Lighting is the fastest-growing segment during the forecast period. This is mainly due to the increased focus on home aesthetics, interior design, and the adoption of smart lighting solutions.

Architectural Lighting Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, based on market segmentation by region, Asia-Pacific occupies the highest share of the. It has a market share of 45%. This growth is due to rapid urbanization, infrastructure development, and increasing construction activities. China is a major player in the architectural lighting market, contributing significantly to both production and consumption. Countries like China, India, and Japan, have significant market share due to increasing urban populations resulting in greater demand for residential, commercial, and public lighting solutions. LED lighting has widespread adoption in the Asia-Pacific region due to its energy efficiency, longer lifespan, and versatility. The adoption of smart lighting solutions is also on the rise. This is driven by increased connectivity, IoT integration, and the demand for intelligent lighting control systems in both residential and commercial applications.

Asia-Pacific is also the fastest-growing segment during the forecast period. This is mainly due to the region's economic growth, coupled with a focus on energy-efficient solutions and smart building technologies. The Asia-Pacific region is undergoing extensive infrastructure development. This includes the construction of commercial buildings, public spaces, and smart cities. This fuels the demand for modern and energy-efficient lighting systems.

COVID-19 Impact Analysis on the Global Architectural Lighting Market :

The COVID-19 pandemic had a significant impact on the Architectural Lighting Market. There were lockdowns, travel restrictions, social distancing, and other measures. This led to disruptions in global supply chains. This affected the production and distribution of lighting components and fixtures. Delays impacted project timelines and deliveries. The pandemic resulted in delays or cancellations of construction and infrastructure development. The architectural lighting market experienced a slowdown. The pandemic accelerated the adoption of remote work which influenced consumer preferences for lighting solutions. There was an increased focus on home office lighting and adaptable lighting setups. The pandemic accelerated the adoption of smart lighting technologies.

Latest Trends/ Developments:

There is an increasing trend and focus on human-centric lighting design, which considers the impact of lighting on human health, well-being, and productivity. There is a growing integration of advanced controls and automation in lighting systems. The rise of smart lighting technologies with motion sensors, occupancy detection, and personalized control through mobile apps or voice commands. There is an exploration of Li-Fi (Light Fidelity) technology for wireless communication through light in addition to illumination. The growing integration of Internet of Things (IoT) technologies in lighting systems is another latest development. There is an ongoing trend in the use of horticultural lighting for indoor farming and urban agriculture. There is continued emphasis on sustainability and energy efficiency. The adoption of LED technology and compliance with green building standards reduce environmental impact.

Key Players:

- Philips Lighting (Signify)

- Osram GmbH

- Cree Inc.

- Acuity Brands Inc.

- Zumtobel Group

- Hubbell Incorporated

- Eaton Corporation

- General Electric (Current, powered by GE)

- Lutron Electronics Co. Inc.

- Schneider Electric

Market news:

- In August 2023, Signify Holding B.V. unveiled its largest LED lighting manufacturing facility globally in Jiujiang, China. This site is dedicated to producing high-quality branded LED lighting products, including those for the Philips brand, serving both the Chinese and global markets.

- In August 2023, Acuity Brands Lighting Inc. introduced the FieldSETTM Field-Programmable LED Drivers from eldoLED in 2023. This innovative product empowers electricians to set desired current levels and 0-10V minimum dimming levels, offering a customizable and flexible solution for lighting installations.

- In June 2022, IDEAL INDUSTRIES entered a partnership with RIVET Work, a leading provider of workforce management software, with the goal of providing electrical contractors transformative clarity, labor and supplies planning tools, and real-time leverage of business assets to enhance profit margins.

- In June 2022, Signify partnered with EDZCOM, a group of Cellnex and a European leader in Edge Connectivity solutions, to collaboratively initiate a creative and long-term personal network project. The objective of this partnership is to contribute to making the city a better place for its residents to live and work.

- In April 2022, Acuity Brands unveiled Verjure, a professional-grade horticultural LED fixture series designed for indoor applications. The Verjure series is engineered to support all phases of plant growth from vegetative to flowering stages, offering flexibility in various growing environments, including greenhouses, indoor warehouses, and vertical frames. The e Series, available in three different sizes, adds versatility to support different horticultural setups.

Chapter 1. GLOBAL ARCHITECTURAL LIGHTING MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL ARCHITECTURAL LIGHTING MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL ARCHITECTURAL LIGHTING MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL ARCHITECTURAL LIGHTING MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL ARCHITECTURAL LIGHTING MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL ARCHITECTURAL LIGHTING MARKET– BY TYPE OF LIGHTING

6.1. Introduction/Key Findings

6.2. Interior Lighting

6.3. Exterior Lighting

6.4. Specialty Lighting

6.5. Y-O-Y Growth trend Analysis By Type of Lighting

6.6. Absolute $ Opportunity Analysis By Type of Lighting , 2024-2030

Chapter 7. GLOBAL ARCHITECTURAL LIGHTING MARKET– BY LIGHT SOURCE

7.1. Introduction/Key Findings

7.2. LED Lighting

7.3. Fluorescent Lighting

7.4. Incandescent Lighting

7.5. Halogen Lighting

7.6. Y-O-Y Growth trend Analysis By LIGHT SOURCE

7.7. Absolute $ Opportunity Analysis By LIGHT SOURCE , 2024-2030

Chapter 8. GLOBAL ARCHITECTURAL LIGHTING MARKET– BY Application

8.1. Introduction/Key Findings

8.2. Commercial Buildings Lighting

8.3. Residential Buildings Lighting

8.4. Industrial Facilities Lighting

8.5. Outdoor Spaces Lighting

8.6. Y-O-Y Growth trend Analysis Application

8.7. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 9. GLOBAL ARCHITECTURAL LIGHTING MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By LIGHT SOURCE

9.1.3. By Type of Lighting

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By LIGHT SOURCE

9.2.3. By Application

9.2.4. By Type of Lighting

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By LIGHT SOURCE

9.3.3. By Type of Lighting

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By LIGHT SOURCE

9.4.3. By Type of Lighting

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By LIGHT SOURCE

9.5.3. By Type of Lighting

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL ARCHITECTURAL LIGHTING MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Philips Lighting (Signify)

10.2. Osram GmbH

10.3. Cree Inc.

10.4. Acuity Brands Inc.

10.5. Zumtobel Group

10.6. Hubbell Incorporated

10.7. Eaton Corporation

10.8. General Electric (Current, powered by GE)

10.9. Lutron Electronics Co. Inc.

10.10. Schneider Electric

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Architectural Lighting Market was valued at USD 9.63 billion and is projected to reach a market size of USD 16.4 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.9 %.

Increasing emphasis on energy efficiency, advancements in LED technology, and a growing focus on smart lighting solutions are the main market drivers of the Global Architectural Lighting Market.

.LED Lighting, Fluorescent Lighting, Incandescent Lighting, and Halogen Lighting are the segments under the Global Architectural Lighting Market by Light Source.

Asia-Pacific is the most dominant region for the Global Architectural Lighting Market.

Philips Lighting (Signify), Osram GmbH, Cree Inc., Acuity Brands Inc., and Zumtobel Group are the key players in the Global Architectural Lighting Market.