Architectural Coatings Market Size (2024 – 2030)

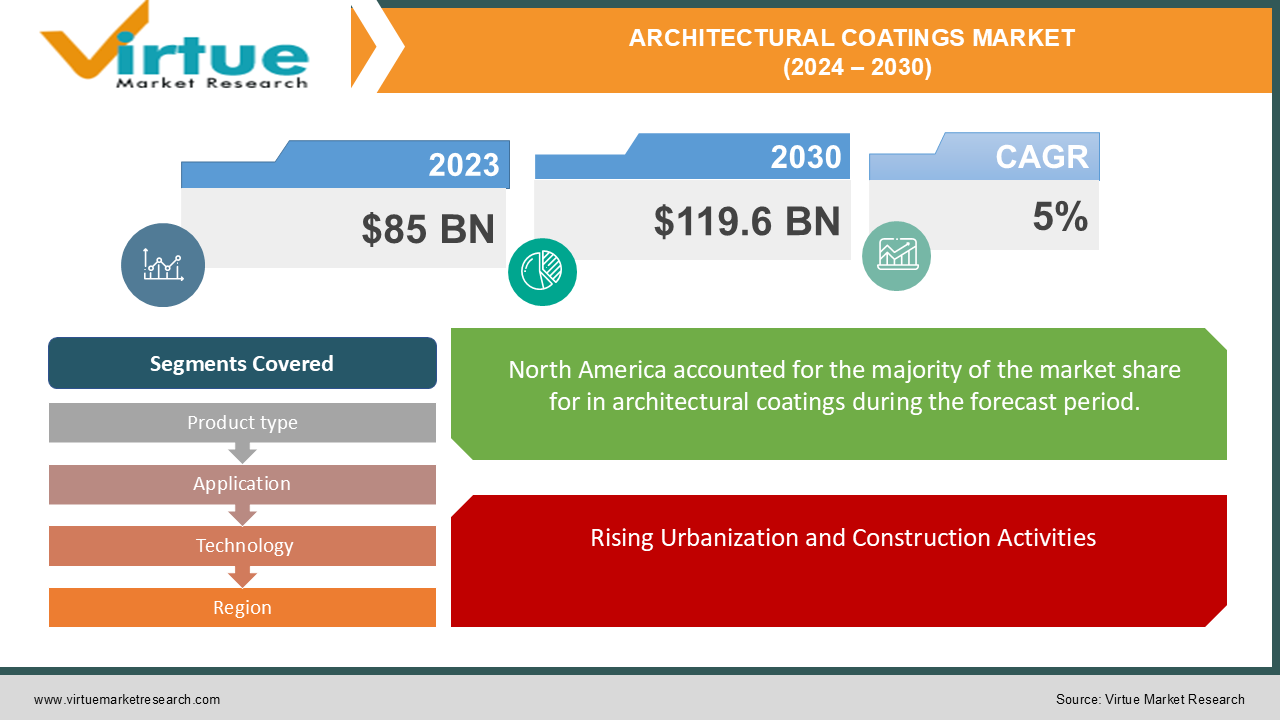

The Global Architectural Coatings Market was valued at USD 85 billion in 2023 and is projected to reach a market size of USD 119.6 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5% between 2024 and 2030.

The Global Architectural Coatings Market is a dynamic and essential segment of the broader coatings industry, driven by the increasing demand for aesthetically pleasing, durable, and environmentally friendly products. Architectural coatings, including paints, primers, varnishes, and sealers, are widely used in residential, commercial, and industrial buildings to enhance both the appearance and protection of surfaces. The market has been growing steadily due to urbanization, rising construction activities, and the global emphasis on sustainable building practices. Additionally, the shift towards eco-friendly and low-VOC (volatile organic compounds) coatings has gained momentum, as consumers and regulatory bodies push for products that are safer for both humans and the environment. Innovations in technology have also spurred the development of advanced coatings that offer benefits such as improved durability, weather resistance, and enhanced energy efficiency. With the growing popularity of smart homes and green building initiatives, the demand for architectural coatings that contribute to energy conservation and offer aesthetic flexibility is on the rise. Manufacturers are increasingly focusing on developing customizable and technologically advanced products to meet the evolving needs of modern construction. As construction activities in emerging markets expand, the global architectural coatings market is expected to witness significant growth in the coming years.

Key Market Insights:

Water-based coatings account for over 50% of the market due to environmental concerns.

Around 40% of architectural coatings are used in residential construction projects.

Low-VOC and eco-friendly coatings are growing at a rate of 6% annually.

The Asia-Pacific region holds approximately 45% of the global market share.

Demand for premium and decorative coatings has increased by 15% over the past 5 years.

The use of technologically advanced coatings in smart homes has grown by 10% annually.

Global Architectural Coatings Market Drivers:

Rising Urbanization and Construction Activities.

The Global Architectural Coatings Market is significantly driven by the rising levels of urbanization and increased construction activities worldwide. As more people move to cities, the demand for new residential, commercial, and infrastructural projects continues to surge. This rapid urbanization fuels the need for durable and aesthetically appealing coatings that enhance the appearance of buildings while offering protection from environmental elements. In developing economies, construction activities are expanding at an unprecedented rate, especially in the Asia-Pacific and Middle Eastern regions, creating a substantial demand for architectural coatings. Additionally, the renovation and refurbishment of existing buildings in developed economies contribute to the market's growth, as these projects often require specialized coatings that improve energy efficiency and weather resistance.

Shift Towards Eco-Friendly and Low-VOC Coatings.

A growing awareness of environmental sustainability and the health impacts of traditional coatings has led to a significant shift towards eco-friendly and low-VOC (volatile organic compounds) products in the architectural coatings market. Consumers, regulatory bodies, and industries alike are demanding products that emit fewer harmful chemicals into the air, reducing pollution and promoting healthier indoor environments. This shift has prompted manufacturers to develop water-based coatings and other sustainable alternatives that meet these regulatory standards while maintaining performance and aesthetic appeal. As governments around the world enforce stricter environmental regulations, the demand for green building materials, including eco-friendly architectural coatings, is expected to grow steadily, driving innovation and expanding market opportunities.

Global Architectural Coatings Market Restraints and Challenges:

The Global Architectural Coatings Market faces several restraints and challenges that could impact its growth trajectory. One of the key challenges is the fluctuating raw material prices, particularly for key components like titanium dioxide, pigments, and resins, which can significantly increase production costs for manufacturers. These price volatilities often lead to higher end-product costs, potentially deterring consumers and negatively impacting market demand. Additionally, the stringent environmental regulations imposed by various governments, particularly concerning VOC emissions, pose challenges for manufacturers. While there is a growing demand for eco-friendly and low-VOC products, developing these formulations can be costly and time-consuming, making it difficult for smaller players to compete. Furthermore, the architectural coatings market faces stiff competition from alternative building materials and technologies, such as prefabricated structures and self-cleaning or low-maintenance building surfaces, which may reduce the need for frequent coating applications. Economic uncertainties, especially in emerging markets, can also hamper construction activities and renovation projects, directly affecting the demand for architectural coatings. In addition, the market’s dependence on the construction industry makes it vulnerable to slowdowns in the global economy, which can lead to reduced spending on both new building projects and refurbishment efforts.

Global Architectural Coatings Market Opportunities:

The Global Architectural Coatings Market presents numerous opportunities for growth and innovation, driven by evolving consumer preferences and technological advancements. One significant opportunity lies in the increasing demand for eco-friendly and sustainable coatings, as consumers and businesses alike prioritize environmentally responsible choices. Manufacturers can capitalize on this trend by investing in the development of water-based, low-VOC, and biodegradable coatings that meet stringent regulatory standards while offering high performance. Additionally, the rise of smart homes and energy-efficient buildings presents a lucrative market for advanced coatings with functional properties, such as thermal insulation and self-cleaning capabilities. The renovation and remodeling sector is another area of opportunity, as aging infrastructure and changing interior design trends drive demand for decorative and protective coatings in both residential and commercial spaces. Furthermore, expanding construction activities in emerging economies, particularly in Asia-Pacific and Africa, offer a vast market potential for architectural coatings, as these regions undergo rapid urbanization and infrastructure development. Strategic partnerships and collaborations with construction companies and architects can enhance market reach and foster innovation. By leveraging these opportunities, manufacturers can position themselves for sustainable growth and maintain a competitive edge in the architectural coatings market.

ARCHITECTURAL COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Product type, Application, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sherwin-Williams Company, PPG Industries, Inc., AkzoNobel N.V., BASF SE, RPM International Inc., Benjamin Moore & Co., Behr Process Corporation, Valspar Corporation (a subsidiary of Sherwin-Williams), Asian Paints Limited, Nippon Paint Holdings Co., Ltd., DuluxGroup Limited |

Global Architectural Coatings Market Segmentation: By Product Type

-

Interior Coatings

-

Exterior Coatings

-

Specialized Coatings

In 2023, based on market segmentation by Product Type, Interior Coatings had the highest share of the Global Architectural Coatings Market. The architectural coatings market is significantly driven by the residential construction sector, where interior coatings play a crucial role in painting walls, ceilings, and various other surfaces. As new homes are built, there is a steady demand for high-quality coatings that enhance both the aesthetics and durability of interiors. Furthermore, even in mature markets, renovations and remodeling activities contribute to a consistent demand for interior coatings, as homeowners seek to update and refresh their living spaces. This trend is amplified by aesthetic preferences, as consumers increasingly desire a wide variety of colors, finishes, and textures to create personalized environments that reflect their tastes. Additionally, health and wellness concerns have gained prominence, prompting a shift towards low-VOC (volatile organic compound) interior coatings that help improve indoor air quality and contribute to healthier living spaces. As awareness of the environmental and health impacts of traditional coatings grows, consumers are actively seeking solutions that balance aesthetics with safety, driving innovation in the formulation of interior coatings. Together, these factors create a dynamic landscape for the architectural coatings market, highlighting the importance of adaptability and responsiveness to consumer needs in this sector.

Global Architectural Coatings Market Segmentation: By Application

-

Residential

-

Commercial

-

Industrial

-

Infrastructure

In 2023, based on market segmentation by Application, Residential had the highest share of the Global Architectural Coatings Market. Housing market activity is a key driver of the architectural coatings market, with the residential construction and renovation sectors consistently fueling demand. Even in mature economies, there is a steady need for new housing development and updates to existing homes, which creates opportunities for coatings manufacturers. Additionally, the growing DIY culture among homeowners significantly contributes to the demand for residential coatings, as many individuals take on painting projects themselves, seeking out high-quality products for their renovations. Aesthetic preferences also play a vital role, as both interior and exterior coatings are used to enhance the visual appeal of homes, leading consumers to seek a wide variety of colors, finishes, and textures to personalize their living spaces. Furthermore, government incentives and programs in various regions that promote homeownership or renovations can further boost the demand for residential coatings, encouraging homeowners to invest in their properties. These factors collectively create a dynamic environment for the architectural coatings market, highlighting the importance of understanding consumer preferences and market trends to capitalize on growth opportunities within the residential segment.

Global Architectural Coatings Market Segmentation: By Technology

-

Solvent-Based Coatings

-

Water-Based Coatings

-

Powder Coatings

-

High-Solids Coatings

In 2023, based on market segmentation by Technology, Solvent-Based Coatings had the highest share of the Global Architectural Coatings Market. Solvent-based coatings continue to play a significant role in the architectural coatings market due to their traditional use and proven performance. These coatings have been utilized for many years, renowned for their durability, superior film formation, and exceptional gloss and color retention, making them a preferred choice for various applications. The well-established infrastructure for manufacturing, distribution, and application of solvent-based coatings contributes to their widespread availability across many regions, ensuring that consumers and professionals can easily access these products. Additionally, solvent-based coatings can often be more cost-effective to produce, particularly in large-scale industrial applications, where efficiency and cost savings are paramount. This cost advantage, coupled with their robust performance characteristics, makes solvent-based coatings an attractive option for both residential and commercial projects. While the market is witnessing a shift towards eco-friendly alternatives, the reliability and effectiveness of solvent-based coatings continue to ensure their relevance in specific applications where performance is critical. As the industry evolves, understanding the balance between traditional products and innovative, sustainable solutions will be essential for manufacturers and consumers alike.

Global Architectural Coatings Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, North America had the highest share of the Global Architectural Coatings Market. North America, particularly the United States, plays a crucial role in the architectural coatings market, primarily driven by a developed economy and robust construction activity. The region boasts a mature construction industry characterized by high levels of residential and commercial building projects, which significantly boosts the demand for architectural coatings. Furthermore, the market is well-established, supported by a strong infrastructure for production, distribution, and retail, facilitating the availability of a wide range of coating products. North American manufacturers are recognized for their commitment to innovation and product development, frequently introducing new coating technologies and formulations that cater to evolving market demands, including eco-friendly options. Additionally, while regulations surrounding VOC emissions and environmental protection are stringent, North America benefits from a relatively mature regulatory landscape for architectural coatings, which fosters a competitive and innovative market environment. This combination of factors ensures that the region remains a leader in the architectural coatings sector, continuously adapting to consumer preferences and regulatory requirements while driving advancements in coating technologies. As a result, North America is poised for sustained growth within the architectural coatings market, reinforcing its significance on the global stage.

COVID-19 Impact Analysis on the Global Architectural Coatings Market.

The COVID-19 pandemic significantly impacted the Global Architectural Coatings Market, causing both disruptions and shifts in demand. During the initial phases of the pandemic, many construction projects were halted or delayed due to lockdowns and safety regulations, leading to a temporary decline in the consumption of architectural coatings. The reduced activity in the residential and commercial construction sectors resulted in decreased sales for manufacturers. However, as economies began to reopen and adapt to the new normal, the market saw a rebound fueled by increased home renovation and improvement projects. With more people spending time at home, there was a surge in demand for home improvement products, including paints and coatings, as homeowners sought to enhance their living spaces. Additionally, the pandemic accelerated the trend towards sustainable and eco-friendly coatings, as consumers became more health-conscious and environmentally aware. The emphasis on improving indoor air quality and using low-VOC products has driven manufacturers to innovate and expand their product lines. While the pandemic posed significant challenges, it also presented opportunities for growth, particularly in the residential segment, paving the way for a more resilient architectural coatings market in the post-COVID-19 era.

Latest trends / Developments:

The Global Architectural Coatings Market is witnessing several key trends and developments that are reshaping the industry landscape. One of the most prominent trends is the increasing demand for eco-friendly and sustainable coatings, driven by consumer awareness of environmental issues and stricter regulations on VOC emissions. Manufacturers are responding by developing water-based, low-VOC, and biodegradable products that meet green building standards. Additionally, innovations in technology are leading to the emergence of advanced coatings with enhanced functionalities, such as self-cleaning properties, antimicrobial features, and thermal insulation capabilities. The integration of smart technologies into architectural coatings is also gaining traction, allowing for real-time monitoring and improved performance. Another notable development is the growing popularity of decorative coatings, as consumers seek aesthetic solutions that enhance the visual appeal of their spaces. The expansion of e-commerce platforms has transformed the distribution landscape, providing consumers with greater access to a wide variety of coatings and DIY solutions. Moreover, the rising trend of urbanization and increased investment in infrastructure projects, particularly in emerging markets, is expected to fuel demand for architectural coatings. Overall, these trends reflect a shift towards innovation, sustainability, and consumer-centric solutions in the architectural coatings market.

Key Players:

-

Sherwin-Williams Company

-

PPG Industries, Inc.

-

AkzoNobel N.V.

-

BASF SE

-

RPM International Inc.

-

Benjamin Moore & Co.

-

Behr Process Corporation

-

Valspar Corporation (a subsidiary of Sherwin-Williams)

-

Asian Paints Limited

-

Nippon Paint Holdings Co., Ltd.

-

DuluxGroup Limited

Chapter 1. Architectural Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Architectural Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Architectural Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Architectural Coatings Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Architectural Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Architectural Coatings Market – By Product Type

6.1 Introduction/Key Findings

6.2 Interior Coatings

6.3 Exterior Coatings

6.4 Specialized Coatings

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Architectural Coatings Market – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Industrial

7.5 Infrastructure

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Architectural Coatings Market – By Technology

8.1 Introduction/Key Findings

8.2 Solvent-Based Coatings

8.3 Water-Based Coatings

8.4 Powder Coatings

8.5 High-Solids Coatings

8.6 Y-O-Y Growth trend Analysis By Technology

8.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 9. Architectural Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By Technology

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By Technology

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By Technology

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Technology

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By Technology

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Architectural Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Sherwin-Williams Company

10.2 PPG Industries, Inc.

10.3 AkzoNobel N.V.

10.4 BASF SE

10.5 RPM International Inc.

10.6 Benjamin Moore & Co.

10.7 Behr Process Corporation

10.8 Valspar Corporation (a subsidiary of Sherwin-Williams)

10.9 Asian Paints Limited

10.10 Nippon Paint Holdings Co., Ltd.

10.11 DuluxGroup Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Architectural Coatings market is expected to be valued at US$ 85 billion.

Through 2030, the Global Architectural Coatings market is expected to grow at a CAGR of 5%.

By 2030, the Global Architectural Coatings Market is expected to grow to a value of US$ 119.6 billion.

North America is predicted to lead the Global Architectural Coatings market.

The Global Architectural Coatings Market has segments By Product Type, application, technology, and Region.