Aramid Fibre Reinforced Polymer Composites Market Size (2024-2030)

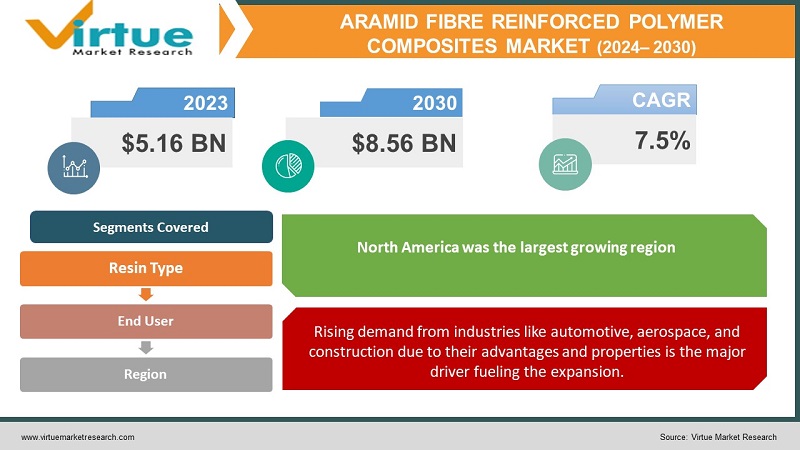

The Global Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.16 billion and is projected to reach a market size of USD 8.56 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.5%.

The aramid fiber-reinforced polymer composites market has experienced significant growth over the years. It finds its applications in a wide range of industries because of the exceptional properties it offers propelling the demand. Recent trends and adaption towards sustainability, R&D of bio-based composites, advancements in industries, and developing economies are expected to boost the continuous growth of the industry thereby creating more career opportunities over the next decade. During the forecast period, this market is anticipated to show a notable growth.

Key Market Insights:

In 2021, an approximate annual growth of around 8% was seen in the aerospace industry regarding the usage of aramid fiber-reinforced polymer composites.

According to the OCIA, 80.14 million vehicles will be produced worldwide in 2021. Production capacity increased by 3% in comparison to 2020. As a result, a rise in automotive vehicle manufacturing and aviation deliveries is expected to enhance demand for fiber-reinforced polymer composite materials.

The composites market in general has an approximate share of 90-100 billion in the market. In 2020, aramid fiber-reinforced polymer composites were estimated to contribute around 3% of the total composites. However, a drastic increase of around 7-9% is predicted by 2025.

There has been an increasing focus on research activities by around 6-10% in this industry in the past 3 years. This has increased the employment opportunities as well.

Experts predict that this market will show promising growth in the future for renewable energy, electric vehicles, and the agricultural sector for various machinery.

Few industries like aerospace, automotive, building & construction, etc. are facing issues concerning costs, durability, and certification. As a result, larger firms and companies are heavily investing in developing suitable properties and reducing costs by optimizing the manufacturing process, along with a focus on recycling challenges.

Aramid Fibre Reinforced Polymer Composites Market Drivers:

Rising demand from industries like automotive, aerospace, and construction due to their advantages and properties is the major driver fueling the expansion.

Lightweight materials help in fuel efficiency, reduce CO2 emissions, and enhance range. Additionally, they offer high strength and durability. They are known for their strength-to-weight ratio. Moreover, they have advantages like long-lasting, weather-resistant, fatigue-resistant, insulation, low moisture absorption, chemical resistance, easy maintenance, and energy absorption associated with them. Furthermore, with the increasing usage and demand for electric vehicles, this market is expected to show tremendous growth. All these factors play a huge role in propelling the growth of this market.

Growing awareness towards the implementation of sustainable and eco-friendly solutions is acting as a driver boosting the market growth.

There have been a lot of research and developmental activities toward the creation of sustainable and bio-based products that have no impact on the environment. Materials that have a lesser carbon footprint, higher efficiency, and recycling properties are being developed. These eco-friendly alternatives are predicted to help in boosting the growth of the market. This shift towards greener alternatives will help the market for aramid composites to profit from the increased demand for eco-conscious materials and technology as sustainability is becoming a significant driver in numerous sectors.

Aramid Fibre Reinforced Polymer Composites Market Restraints and Challenges:

Associated costs, recycling solutions, technological advancements, and adhering to standards are the major issues the market is currently facing.

The cost factor can be a major barrier to the industry. Production processes and raw materials consume a lot of finances which can demotivate small firms and companies. Secondly, these materials are not easily recyclable. This can create pollution and other environmental problems. Tackling the trash and finding waste management solutions can cause a hindrance to growth. Thirdly, technological advancements require upskilling of the labor force which can be neglected causing repercussions. Furthermore, adherence to rules, regulations, and certifications hampers the progress.

Aramid Fibre Reinforced Polymer Composites Market Opportunities:

In the renewable energy sector, the wind and tidal energy sector presents the market with an ample number of opportunities. Aramid composites may be used to make durable and efficient turbine blades and components. They help in the generation of more electricity and lower the maintenance costs that are required. A lot of nations are embracing this shift to preserve the other fuels. Secondly, they are being used in the medical industry for various implants because of their lightweight. In the coming years, with an increased focus on R&D, Government initiatives, investments, and funds this market is anticipated to show significant growth.

ARAMID FIBRE REINFORCED POLYMER COMPOSITES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Resin Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Teijin Limited , Hexcel Corporation , Toray Industries, Inc., Solvay S.A. , Mitsubishi Chemical Corporation , Hyosung Corporation , SGL Carbon, Owens Corning , Kordsa Teknik Tekstil A.S. , DuPont |

Aramid Fibre Reinforced Polymer Composites Market Segmentation:

Aramid Fibre Reinforced Polymer Composites Market Segmentation: By Resin Type:

- Thermoset Composites

- Thermoplastic Composites

Based on segmentation by resin type, thermoset composites are the largest growing segment. They hold an approximate share of 70%. They are estimated to grow at a CAGR of 5.8% during the forecast period according to a report. Thermoset composites, unlike thermoplastic composites, do not distort when heated. Hence, they are employed in the fabrication of permanent components. They are used in a lot of industries due to their properties of durability, chemical and temperature resistance, structural integrity, and lightweight. This makes them a popular choice in the market. Thermoplastic composites are the fastest growing segment owing to reduced CO2 emissions, range, lightweight, recycling properties, and shorter processing time. They hold around 30% of the total market share and are expected to experience good growth in the forecast period.

Aramid Fibre Reinforced Polymer Composites Market Segmentation: By End-Use Industry:

- Building & Construction

- Automotive

- Electrical & Electronics

- Aerospace & Defense

- Sporting goods

- Wind Energy

- Others

Based on the end-use industry, Aerospace and defense is the largest growing in the market. According to a report, it is estimated to grow at a CAGR of 7.5% through the forecast period. It holds a share of around 60-70%. This is owing to factors like lightweight, durability, security, performance, extended flight range, longevity, corrosion resistance, and the strength it offers. Wind Energy is the fastest-growing end-use industry holding an approximate share of 25%. They are mainly used for construction purposes of wind turbines and blades. Transition and adaptation towards renewable energy sources prevent the depletion of non-renewable sources and strengthen the country’s economy. Governmental bodies are encouraging and are providing finances in the form of investments as well as funds to promote the industry. Additionally, properties like strength-to-weight ratio, resistance, durability, and environmental factors make them a suitable choice.

Aramid Fibre Reinforced Polymer Composites Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Based on region, North America was the largest growing region. This is due to the developed economy, technological advancements, and the presence of key players, investments, and funds. Additionally, the demand from end-user industries, especially aerospace & defense, and construction acts as a major driver for the significant share of the market. This holds around 33% of the total market share. The USA and Canada are the regions at the forefront. Asia Pacific is the fastest-growing region in this market holding a share of around 25%. Rising investments in research and developmental activities are playing a huge role. Furthermore, escalating demand, establishing companies, industrialization, rising incomes, and Government initiatives as well as schemes are creating an upward trajectory. Countries like China and Japan are among the leading regions.

COVID-19 Impact Analysis on the Global Aramid Fibre Reinforced Polymer Composites Market:

The emergence of COVID-19 took a toll on the market. It resulted in stricter restrictions in almost all sectors to avoid the spread of the virus. Lockdowns, social isolation, and movement restrictions were the new norm. This affected the supply chain, production routine, and the import-export trade causing an economic slowdown. Around 85% of companies faced supply chain disruption. The closure of industries and manufacturing units created a setback. Furthermore, the lack of laborers caused an obstacle in carrying out various processes. However, post-pandemic, the industry is gradually picking up with the relaxation of rules and the upliftment of lockdowns.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heftily on the development of improved products and greener alternatives alongside maintaining competitive pricing. This has further resulted in increased government engagement and further enlargement.

Many industries like marine, agriculture, and consumer electronics have started implementing the use of aramid fiber-reinforced polymer composites owing to their advantageous properties. The need for developing sustainable alternatives having less or no impact is further predicted to expand the applications. Moreover, prominence is being given to R&D activities to widen human knowledge.

Key Players:

- Teijin Limited

- Hexcel Corporation

- Toray Industries, Inc.

- Solvay S.A.

- Mitsubishi Chemical Corporation

- Hyosung Corporation

- SGL Carbon

- Owens Corning

- Kordsa Teknik Tekstil A.S.

- DuPont

- In January 2020, Hexcel Corporation and Woodward, Inc., announced a merger that was intended to become a leading provider of integrated solutions for the aerospace and industrial sectors, with an emphasis on innovative materials and composites.

- In November 2020, Solvay, a multinational chemical firm, was awarded a new long-term enterprise agreement by Boeing, one of the world's top aircraft companies. For Boeing's airplane components, Solvay offered sophisticated composites, including aramid-reinforced materials.

Chapter 1. Global Aramid Fibre Reinforced Polymer Composites Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Aramid Fibre Reinforced Polymer Composites Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Aramid Fibre Reinforced Polymer Composites Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Aramid Fibre Reinforced Polymer Composites Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Aramid Fibre Reinforced Polymer Composites Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Aramid Fibre Reinforced Polymer Composites Market – By Resin Type

6.1. Introduction/Key Findings

6.2. Thermoset Composites

6.3.Thermoplastic Composites

6.4. Y-O-Y Growth trend Analysis By Resin Type

6.5. Absolute $ Opportunity Analysis By Resin Type, 2023-2030

Chapter 7. Global Aramid Fibre Reinforced Polymer Composites Market – By End User Industry

7.1. Introduction/Key Findings

7.2. Building & Construction

7.3. Automotive

7.4. Electrical & Electronics

7.5. Aerospace & Defense

7.6. Sporting goods

7.7. Wind Energy

7.8. Others

7.9. Y-O-Y Growth trend Analysis By End User Industry

7.10 . Absolute $ Opportunity Analysis By End User Industry, 2023-2030

Chapter 8. Global Aramid Fibre Reinforced Polymer Composites Market , By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Resin Type

8.1.3. End User Industry

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By By Resin Type

8.2.3. End User Industry

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By By Resin Type

8.3.3. End User Industry

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By By Resin Type

8.4.3. End User Industry

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Resin Type

8.5.3. End User Industry

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Global Aramid Fibre Reinforced Polymer Composites Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Teijin Limited

9.2. Hexcel Corporation

9.3. Toray Industries, Inc.

9.4. Solvay S.A.

9.5. Mitsubishi Chemical Corporation

9.6. Hyosung Corporation

9.7. SGL Carbon

9.8. Owens Corning

9.9. Kordsa Teknik Tekstil A.S.

9.10. DuPont

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.16 billion and is projected to reach a market size of USD 8.56 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.5%.

Rising demand from industries like automotive, aerospace, and construction due to their advantages and properties and growing awareness towards implementation of sustainable and eco-friendly solutions are acting as the major drivers boosting the Global Aramid Fibre Reinforced Polymer Composites Market.

Based on the end-use industry, the Global Aramid Fibre fiber-reinforced polymer Composites Market is segmented into Building and construction, Automotive, Electrical and electronics, Aerospace and Defense, Sporting goods, Wind Energy, and Others.

North America is the most dominant region for the Global Aramid Fibre Reinforced Polymer Composites Market

Teijin Limited, Hexcel Corporation, and Toray Industries, Inc. are the key players operating in the Global Aramid Fibre Reinforced Polymer Composites Market.