Aramid fiber FRP Pipe Market Size (2024 – 2030)

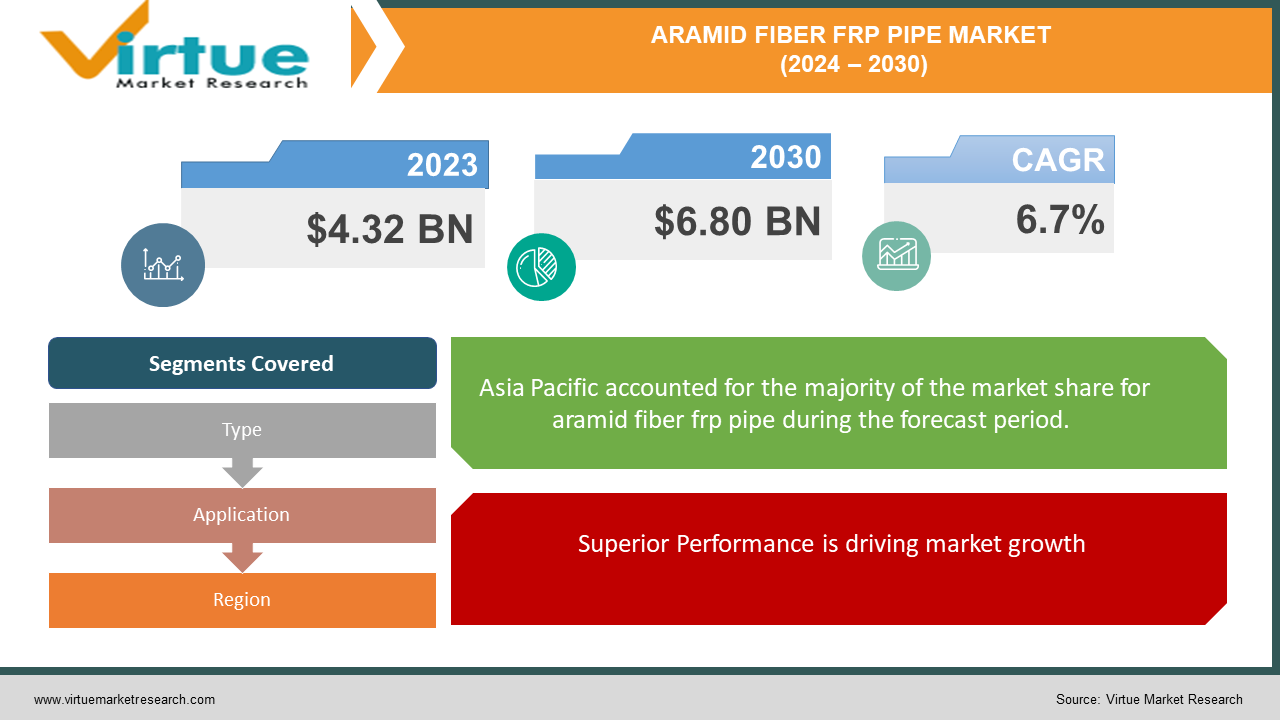

The Global Aramid Fiber FRP Pipe Market was valued at USD 4.32 billion in 2023 and will grow at a CAGR of 6.7% from 2024 to 2030. The market is expected to reach USD 6.80 billion by 2030.

The Aramid fiber FRP pipe market is a niche segment of the overall FRP pipe industry that utilizes Aramid fibers for reinforcement. These pipes offer superior strength, durability, and corrosion resistance compared to glass fiber alternatives, but at a higher cost. Though specific market size data is scarce, the broader FRP pipe market is experiencing steady growth due to its application in various sectors like oil & gas, water & wastewater, and construction.

Key Market Insights:

Aramid fibers offer a significantly higher strength-to-weight ratio, 60% stronger.5x More Corrosion Resistant, Aramid excels in withstanding harsh chemicals.The Aramid fiber FRP pipe market presents an exciting niche with promising growth potential driven by its superior properties. While data limitations exist, the projected growth of the FRP market suggests a positive future for Aramid fiber pipes in specific high-performance applications.

Global Aramid Fiber FRP Pipe Market Drivers:

Superior Performance is driving market growth:

Aramid fibers revolutionize FRP pipes by offering a trifecta of advantages over traditional glass fibers. Firstly, their exceptional strength-to-weight ratio makes them the ultimate champion for high-pressure applications. Imagine pipes that are remarkably strong yet surprisingly lightweight – perfect for withstanding the intense forces in oil and gas exploration. Secondly, Aramid fibers boast unparalleled corrosion resistance. They shrug off a wide range of chemicals and harsh environments like superheroes, ensuring the pipe's longevity and protecting the integrity of the transported fluids. Finally, Aramid fibers bring a welcome light to the game. Compared to glass, they create pipes that are significantly easier to transport and install, reducing costs and simplifying logistics. This combination of high strength, superior corrosion resistance, and lightweight design makes Aramid fiber FRP pipes the ideal choice for demanding applications where performance and efficiency are paramount.

Growing Demand in Specific Industries is driving market growth:

Aramid fiber FRP pipes don't just excel in general applications – they truly shine in sectors with unforgiving demands. In the high-pressure world of oil and gas exploration, Aramid fibers become the knight in shining armor. Their exceptional strength ensures the pipes can withstand the immense pressure encountered deep underground, while their impressive corrosion resistance protects against the harsh chemicals often present. Chemical processing plants also find Aramid fibers to be a game-changer. Here, the superior ability to resist a wide range of corrosive materials becomes paramount. Aramid pipes become a reliable barrier, safeguarding the integrity of the transported chemicals and preventing costly leaks or equipment damage. Even the demanding world of aerospace takes advantage of Aramid's unique properties. The exceptional strength-to-weight ratio allows for the creation of lightweight yet incredibly strong pipes, a crucial factor for optimizing aircraft performance and fuel efficiency. From the depths of the earth to the skies above, Aramid fiber FRP pipes are proving their worth in these demanding sectors.

Increasing Infrastructure Development is driving market growth:

The global infrastructure boom is fueling a hidden demand for high-performance pipes. With projects surging in water & wastewater management and power generation, the need for durable and corrosion-resistant solutions is becoming ever more critical. This is where Aramid fiber FRP pipes stand to gain significant traction. Unlike traditional options that succumb to wear and tear or chemical degradation, Aramid fibers offer exceptional strength and longevity. They can handle the constant flow of water and wastewater without succumbing to pressure or erosion, ensuring reliable and long-lasting infrastructure. Furthermore, power generation plants often utilize harsh chemicals and face demanding environmental conditions. Aramid's superior corrosion resistance makes it an ideal choice, safeguarding pipes from deterioration and preventing leaks that could disrupt power generation or pose environmental hazards. As infrastructure development continues to accelerate, Aramid fiber FRP pipes are poised to become a weapon of choice in the fight for sustainable and resilient infrastructure projects.

Global Aramid fiber FRP Pipe Market challenges and restraints:

Higher Cost is a significant hurdle for Aramid fiber FRP Pipe:

Cost remains the Achilles' heel of Aramid fiber FRP pipes. Compared to the widely used glass fibers, Aramid presents a significant price hurdle. This factor acts as a major roadblock, especially for projects with tight budgets. In sectors where high pressure, extreme corrosion, or lightweight design aren't critical, the lower cost of glass fibers makes them the more attractive option. For example, a non-critical irrigation system might prioritize affordability over the superior strength of Aramid. This cost barrier becomes even more pronounced in developing regions where budget constraints are often tighter. Therefore, overcoming this price challenge is crucial for Aramid fiber FRP pipes to gain wider adoption. Manufacturers need to explore cost-reduction strategies, potentially through optimizing production processes or utilizing alternative Aramid sources. Ultimately, narrowing the price gap between Aramid and glass fibers will be essential for Aramid to become a more compelling choice across a wider range of applications.

Limited Awareness is throwing a curveball at the Aramid fiber FRP Pipe market:

Aramid fibers are a hidden gem in the FRP pipe market. Despite boasting superior performance compared to traditional glass fibers, their true potential remains unrealized due to a lack of general awareness. Many potential users across industries, from engineers to construction companies, might not be fully informed about the advantages Aramid offers. This knowledge gap hinders wider adoption. Imagine a scenario where a chemical processing plant requires robust pipes to handle corrosive materials. If they're unaware of Aramid's exceptional corrosion resistance compared to glass, they might default to the more familiar option. This lack of awareness can also lead to underestimating the value proposition of Aramid. While the initial cost might be higher, Aramid's superior strength often translates to longer lifespans and lower maintenance needs. The key lies in educating potential users. Manufacturers and industry associations can play a crucial role by organizing workshops, disseminating informative materials, and highlighting successful case studies where Aramid fibers have demonstrably outperformed glass alternatives. By bridging the knowledge gap, the Aramid fiber FRP pipe market can unlock its true potential and become the go-to choice for applications demanding exceptional performance.

Standardization and Regulations are a growing nightmare for Aramid fiber FRP Pipe:

The Aramid fiber FRP pipe market faces a hurdle in the form of evolving standardization and regulations. Unlike their glass fiber counterparts, Aramid fiber pipes might not have well-established guidelines in all regions. This lack of clear regulations can create a grey area for engineers and contractors specifying materials for their projects. Imagine an engineer designing a high-pressure pipeline. Without clear guidelines outlining the performance benchmarks and testing procedures for Aramid FRP pipes, they might hesitate to adopt this relatively new technology. This uncertainty can lead to delays, and increased costs associated with additional testing, and ultimately hinder the wider acceptance of Aramid fibers. To overcome this challenge, collaboration between industry stakeholders, regulatory bodies, and research institutions is essential. Developing standardized testing procedures and performance criteria specifically for Aramid fiber FRP pipes will provide engineers and contractors with the confidence they need to specify this material with greater ease. Clear and well-defined regulations will pave the way for the broader adoption of Aramid fibers and unlock their full potential in the FRP pipe market.

Market Opportunities:

The Aramid fiber FRP pipe market presents a unique niche with exciting growth potential driven by its exceptional performance characteristics. While cost remains a key hurdle, several factors are converging to create significant opportunities. Firstly, the ever-increasing demand for high-performance pipes in specific sectors like oil & gas exploration, chemical processing, and aerospace perfectly aligns with Aramid's strengths. Their superior strength, corrosion resistance, and lightweight design make them ideal for withstanding extreme pressures, harsh chemicals, and weight limitations. As infrastructure development intensifies in water & wastewater management and power generation, the need for durable and corrosion-resistant pipes creates another lucrative opportunity for Aramid fibers, especially as awareness about their long-term cost-effectiveness through reduced maintenance needs grows. Technological advancements can further unlock market potential. Manufacturers exploring cost-reduction strategies through optimized production processes or alternative Aramid sources can make these pipes more competitive. Developing robust recycling methods for Aramid FRP pipes will not only enhance their environmental appeal but also potentially reduce costs associated with raw material sourcing. Finally, bridging the knowledge gap through industry-wide education initiatives can significantly boost adoption. By informing engineers, contractors, and potential users about Aramid's advantages compared to traditional glass fibers, the market can witness a shift towards specifying Aramid for applications demanding superior performance and long-term value. Collaboration between stakeholders to establish clear standardization and regulatory frameworks for Aramid fiber FRP pipes will further increase confidence in this technology. In conclusion, the Aramid fiber FRP pipe market is poised for significant growth by capitalizing on its performance strengths, overcoming cost challenges through innovation, and fostering wider industry awareness through targeted education and collaboration.

ARAMID FIBER FRP PIPE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DuPont (USA), Teijin Limited (Japan), Toray Industries Inc. (Japan), Kolon Industries Inc. (South Korea), Hyosung Corporation (South Korea), Sekisui Chemical Co. LTD (Japan), China National Building Material Company Limited (China), Saudi Arabian Amiantit Company (Saudi Arabia), Hobas Pipe USA (USA), Pipelife (Austria) |

Aramid fiber FRP Pipe Market Segmentation - By Type

-

Resin Type

-

Other Type

Within the Aramid fiber FRP pipe market segmentation by resin type, Epoxy Resin is likely the most prominent sector. This is because Aramid fibers themselves are high-performance materials, often used in demanding applications. Epoxy resin shares this characteristic, offering exceptional chemical resistance and high strength – a perfect match for Aramid's capabilities. This combination caters to sectors like oil & gas exploration and chemical processing, where both the fibers and resin excel in withstanding harsh environments and corrosive fluids. While other resin options like vinyl ester or polyester might be explored for cost-effectiveness in less demanding applications, the synergy between Aramid fibers and epoxy resin positions it as the dominant choice for maximizing the performance potential of Aramid fiber FRP pipes.

Aramid fiber FRP Pipe Market Segmentation - By Application

-

Oil & Gas Exploration

-

Chemical Processing

Determining the most prominent sector between Oil & Gas Exploration and Chemical Processing in the Aramid fiber FRP pipe market is difficult due to a lack of specific data. While both sectors benefit significantly from Aramid fiber FRP pipes, the prominence might depend on factors like regional trends, specific project requirements, and future industry developments. The oil & gas sector might have a historical advantage due to established applications, but the chemical processing industry's growing demand for high-performance materials could see it become equally prominent in the future.

Aramid fiber FRP Pipe Market Segmentation - Regional Analysis

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

Currently, the Asia Pacific region is likely the most dominant market for Aramid fiber FRP pipes. This is driven by a confluence of factors: a large population base with growing infrastructure needs, a booming oil & gas sector with increasing demand for high-performance pipes, and rising investments in chemical processing plants. These industries all benefit significantly from Aramid's superior strength and corrosion resistance. While North America and Europe also represent significant markets with established infrastructure, Asia Pacific's rapid development and focus on high-performance materials position it as the current leader in Aramid fiber FRP pipe adoption.

COVID-19 Impact Analysis on the Global Aramid Fiber FRP Pipe Market

The COVID-19 pandemic delivered a temporary blow to the Aramid fiber FRP pipe market. Lockdowns and project delays in sectors like oil & gas exploration and construction hampered demand for these high-performance pipes. Disruptions in global supply chains also posed challenges, potentially affecting the availability of Aramid fibers or resins. However, the long-term impact might be less severe. As infrastructure projects resume and industries like chemical processing continue to require robust pipes for harsh environments, the demand for Aramid fiber FRP could see a rebound. Furthermore, the focus on long-term value and life-cycle cost within infrastructure development might favor Aramid fibers due to their extended lifespans and reduced maintenance needs compared to traditional options. Overall, while the pandemic caused a temporary setback, the Aramid fiber FRP pipe market's inherent advantages position it for potential recovery and future growth as infrastructure development and focus on high-performance materials gain momentum.

Latest trends/Developments

The Aramid fiber FRP pipe market is on the cusp of exciting developments driven by innovation and growing awareness of its potential. Manufacturers are exploring cost-reduction strategies to make Aramid fibers more competitive. This includes optimizing production processes and potentially utilizing alternative Aramid sources. Sustainability is also gaining traction, with research focusing on developing robust recycling methods for Aramid FRP pipes. This not only enhances their environmental appeal but also has the potential to reduce costs associated with raw materials. On the application side, the focus is shifting towards educating engineers and contractors about Aramid's advantages. Industry-wide initiatives are aiming to bridge the knowledge gap and highlight successful case studies where Aramid fibers have demonstrably outperformed traditional glass fiber alternatives. Furthermore, collaboration between stakeholders is fostering the development of clear standardization and regulatory frameworks for Aramid fiber FRP pipes. This will increase confidence in this technology and pave the way for its wider adoption. In essence, the Aramid fiber FRP pipe market is moving beyond its niche status. By overcoming cost challenges, embracing sustainability practices, and fostering industry awareness, this market is poised for significant growth as its exceptional performance gains wider recognition.

Key Players:

-

DuPont (USA)

-

Teijin Limited (Japan)

-

Toray Industries Inc. (Japan)

-

Kolon Industries Inc. (South Korea)

-

Hyosung Corporation (South Korea)

-

Sekisui Chemical Co. LTD (Japan)

-

China National Building Material Company Limited (China)

-

Saudi Arabian Amiantit Company (Saudi Arabia)

-

Hobas Pipe USA (USA)

-

Pipelife (Austria)

Chapter 1. Aramid Fiber FRP Pipe Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aramid Fiber FRP Pipe Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aramid Fiber FRP Pipe Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aramid Fiber FRP Pipe Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aramid Fiber FRP Pipe Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aramid Fiber FRP Pipe Market – By Type

6.1 Introduction/Key Findings

6.2 Resin Type

6.3 Other Type

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Aramid Fiber FRP Pipe Market – By Application

7.1 Introduction/Key Findings

7.2 Oil & Gas Exploration

7.3 Chemical Processing

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Aramid Fiber FRP Pipe Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Aramid Fiber FRP Pipe Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 DuPont (USA)

9.2 Teijin Limited (Japan)

9.3 Toray Industries Inc. (Japan)

9.4 Kolon Industries Inc. (South Korea)

9.5 Hyosung Corporation (South Korea)

9.6 Sekisui Chemical Co. LTD (Japan)

9.7 China National Building Material Company Limited (China)

9.8 Saudi Arabian Amiantit Company (Saudi Arabia)

9.9 Hobas Pipe USA (USA)

9.10 Pipelife (Austria)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aramid Fiber FRP Pipe Market was valued at USD 4.32 billion in 2023 and will grow at a CAGR of 6.7% from 2024 to 2030. The market is expected to reach USD 6.80 billion by 2030.

Superior Performance, Growing Demand in Specific Industries, and Increasing Infrastructure Development are the reasons which is driving the market.

Based on Application it is divided into two segments – Oil & Gas Exploration, Chemical Processing.

Asia is the most dominant region for the luxury vehicle Market.

DuPont (USA), Teijin Limited (Japan), Toray Industries Inc. (Japan), Kolon Industries Inc. (South Korea), Hyosung Corporation (South Korea).