Arak Market Size (2024 – 2030)

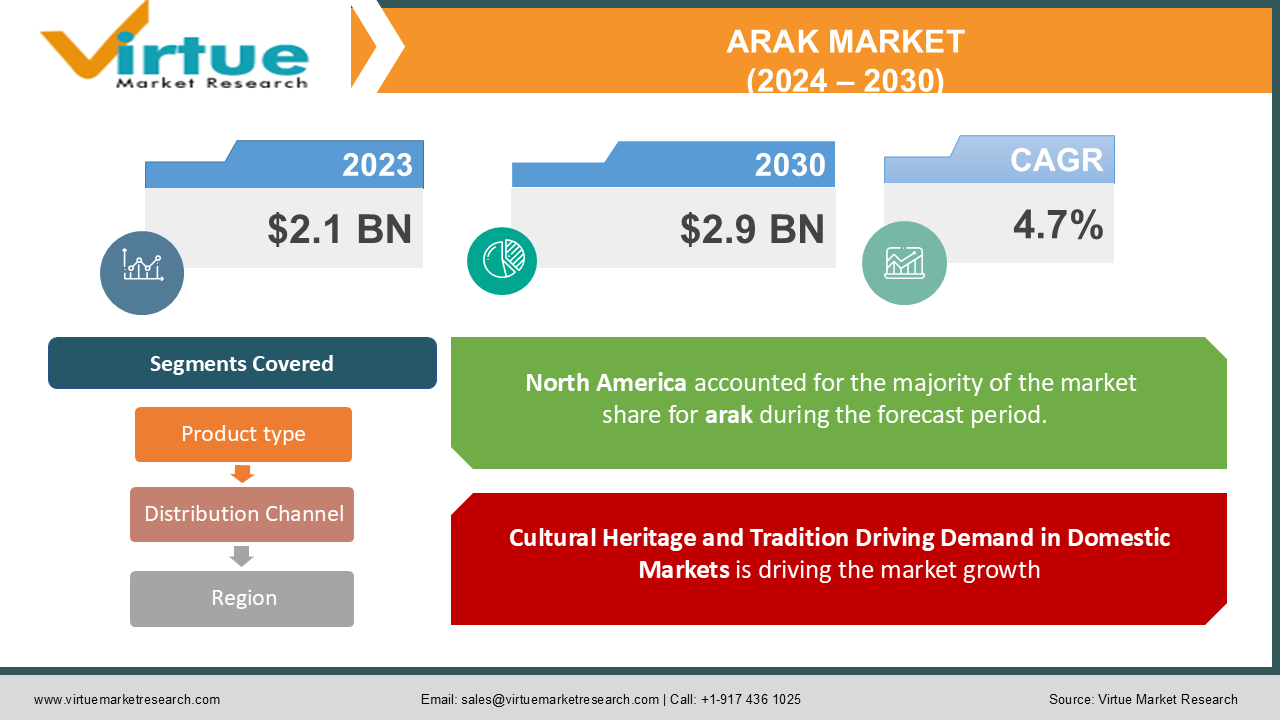

The Global Arak Market was valued at USD 2.1 billion in 2023 and is expected to grow at a CAGR of 4.7% from 2024 to 2030, reaching a market value of USD 2.9 billion by 2030.

Arak is a traditional Levantine alcoholic beverage that holds cultural and historical significance in countries like Lebanon, Syria, Jordan, and Israel. It is an anise-flavored distilled spirit made from grapes or dates, often consumed with water and ice. The market for arak is driven by its deep-rooted cultural importance, increasing global interest in traditional and artisanal alcoholic beverages, and growing demand from international markets seeking unique spirits. While traditionally consumed in the Middle East and Mediterranean regions, arak is finding new opportunities in niche markets in Europe, North America, and Asia-Pacific, as consumers seek new and exotic alcoholic experiences.

Key Market Insights:

In 2023, the unflavored arak segment held the dominant share, accounting for 65% of the total market due to its traditional appeal and authenticity.

The flavored arak segment is projected to grow faster at a CAGR of 5.2% from 2024 to 2030, as producers experiment with new infusions like herbal and fruity flavors to attract younger consumers and international markets.

Supermarkets and hypermarkets remain the leading distribution channels, holding 45% of the market share in 2023, driven by convenience and the growing availability of arak in mainstream retail outlets.

Online retail is rapidly growing, expected to account for 20% of arak sales by 2030, with e-commerce platforms expanding their alcoholic beverage portfolios and catering to global consumers seeking authentic regional products.

The Middle East remains the largest consumer market for arak, representing 60% of the global market in 2023, driven by cultural consumption patterns and regional production dominance.

Global Arak Market Drivers:

Cultural Heritage and Tradition Driving Demand in Domestic Markets is driving the market growth

Arak is deeply embedded in the cultural and social fabric of the Middle East and Mediterranean regions, where it is traditionally consumed during meals, especially with mezze (a spread of appetizers). Its cultural significance has made it a staple in both casual gatherings and formal celebrations in countries like Lebanon, Syria, and Israel. The beverage is often associated with family traditions, hospitality, and local craftsmanship, particularly in rural areas where small-scale, artisanal production is common. The domestic demand for arak in these regions remains robust, as consumers continue to favor locally produced beverages over imported alternatives. Traditional consumption patterns, along with a strong sense of national pride in regional specialties, have preserved arak's relevance across generations. In Lebanon, for instance, arak is often considered the national drink and is produced using time-honored methods passed down through generations. Producers, both small and large, emphasize the use of local grapes and anise, which adds to the authenticity and distinctiveness of the product.

Rising Global Interest in Artisanal and Heritage Spirits is driving the market growth

Over the past decade, there has been a growing trend of consumers seeking out authentic, handcrafted, and unique alcoholic beverages that reflect a sense of place and tradition. This global interest in artisanal spirits has significantly benefitted the arak market, as international consumers explore lesser-known, culturally rich beverages like arak. In this context, arak is positioned as a niche yet premium product in Western markets, offering a unique flavor profile compared to more common spirits like vodka or gin. The rise of specialty bars and restaurants that focus on craft cocktails and regional liquors has introduced arak to new consumer groups. Bartenders and mixologists are experimenting with arak in cocktails, combining it with citrus and herbal elements to create contemporary drinks that appeal to a wider audience. This creative use of arak has helped break down traditional consumption barriers and attract younger, adventurous drinkers in global markets. In addition, growing consumer preference for natural ingredients and the clean-label movement has also contributed to the demand for authentic, minimally processed beverages like arak. Many arak producers emphasize the simplicity and purity of their products, often distilled using only natural ingredients such as grapes and anise seeds, which aligns well with consumer preferences for transparency and quality in their purchases. The ability to market arak as a heritage spirit with a strong backstory and cultural significance has further enhanced its appeal in international markets.

Expansion of Online Retail and E-commerce Platforms is driving the market growth

The increasing penetration of e-commerce and online alcohol delivery platforms has opened up new avenues for the global arak market. Traditionally, arak was predominantly sold in domestic markets through specialty stores, supermarkets, and regional distributors. However, with the rise of digital retail channels, consumers now have access to a wider variety of arak brands and styles, regardless of their geographical location. Online platforms, such as Drizly, ReserveBar, and even specialized Middle Eastern beverage websites, have begun offering arak to international consumers. The convenience of online shopping, coupled with global shipping capabilities, has made it easier for consumers to explore and purchase arak from producers based in Lebanon, Syria, and other countries, without having to visit the region. This has allowed smaller, artisanal producers to reach a global audience, where demand for niche products continues to grow.

Global Arak Market Challenges and Restraints:

Limited Awareness and Familiarity in Non-Traditional Markets is restricting the market growth

One of the key challenges for the global arak market is the limited awareness and familiarity with the product outside of its traditional markets in the Middle East and Mediterranean regions. While arak has a strong cultural presence in countries like Lebanon, Syria, and Israel, it remains relatively unknown in Western markets compared to other anise-flavored spirits such as ouzo (Greece) or pastis (France).

This lack of familiarity presents a barrier to entry into new markets, as consumers may be hesitant to try a product they are unfamiliar with. The distinctive anise flavor of arak, which can be polarizing, may also limit its appeal to certain consumer segments. Additionally, arak is often consumed in a specific way – mixed with water and ice – which may not align with the drinking habits of consumers in non-traditional markets, where spirits are typically consumed neat or in cocktails. To overcome this challenge, producers, and distributors must invest in marketing and educational campaigns to raise awareness of arak and its cultural significance. This can include partnerships with restaurants, bars, and influencers to introduce arak to new audiences through tastings, events, and cocktail promotions. However, building brand recognition and consumer familiarity with arak will require time and resources, particularly in competitive markets where consumers have access to a wide variety of alcoholic beverages.

Regulatory and Import Challenges in Global Markets are restricting the market growth

The global alcohol industry is highly regulated, with different countries imposing varying restrictions on the production, distribution, and sale of alcoholic beverages. This presents a challenge for arak producers looking to expand into international markets, as they must navigate complex regulatory environments and comply with import duties, labeling requirements, and alcohol content restrictions.

In some countries, the alcohol content of arak – which typically ranges between 40-60% ABV (alcohol by volume) – may exceed legal limits for spirits, requiring producers to adjust their formulations to comply with local regulations. Additionally, certain countries may impose higher taxes or tariffs on imported alcoholic beverages, making arak less competitively priced compared to domestically produced spirits.

The distribution of arak can also be affected by the availability of import licenses, particularly in regions with strict alcohol importation laws or where the sale of alcohol is restricted to government-controlled outlets. For example, in some Middle Eastern countries where alcohol consumption is limited or prohibited, the import and sale of arak may be tightly regulated, limiting market expansion opportunities.

Overcoming these regulatory and import challenges requires producers to work closely with local distributors, regulatory bodies, and importers to ensure compliance with all relevant laws and regulations. Additionally, building strong relationships with international distributors and retailers can help arak producers navigate the complexities of global alcohol markets and establish a foothold in new regions.

Market Opportunities:

The global arak market presents several key opportunities for growth and expansion, particularly as consumer preferences continue to evolve towards more authentic and culturally rich alcoholic beverages. One of the primary opportunities lies in the premiumization of arak. As with other spirits categories, there is a growing consumer demand for premium and artisanal products that offer a unique drinking experience. Producers can capitalize on this trend by offering high-quality, small-batch arak made using traditional methods and organic ingredients. Positioning arak as a premium product with a strong cultural heritage can appeal to consumers who value craftsmanship and authenticity in their alcohol choices. Another opportunity is the introduction of flavored arak, which can help attract younger consumers and those who may be less familiar with the traditional anise flavor. By experimenting with flavors such as mint, citrus, or even floral infusions, producers can create new and innovative arak offerings that cater to diverse palates. These flavored variants can also be marketed as versatile ingredients for cocktails, further expanding arak's appeal to the growing cocktail culture. The expansion of sustainable and eco-friendly production practices also presents an opportunity for arak producers to differentiate themselves in the market. As consumers become more environmentally conscious, there is increasing demand for products that are produced using sustainable farming methods, ethical sourcing, and eco-friendly packaging. By adopting sustainable practices, arak producers can not only reduce their environmental impact but also appeal to a growing segment of conscious consumers who prioritize sustainability in their purchasing decisions. Additionally, the rise of tourism in the Middle East and Mediterranean regions presents an opportunity for arak producers to introduce international visitors to the beverage. Tourists often seek out local food and drink experiences as part of their travel, and arak offers a unique and authentic taste of the region's cultural heritage. By partnering with hotels, restaurants, and tourist attractions, producers can create arak tasting experiences that educate visitors about the drink and encourage them to bring bottles back to their home countries, thereby supporting market expansion.

ARAK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By Product type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Domaine des Tourelles, Chateau Ksara, Haddad Distilleries, Eagle Distilleries Co., Kassatly Chtaura, Lebanese Arak Corporation, Massaya Arak, Clos St. Thomas, Karak Arak |

Arak Market Segmentation: By Product Type

-

Unflavored Arak

-

Flavored Arak

Unflavored arak continues to dominate the global arak market, holding over 65% of the market share in 2023. Unflavored arak is traditionally consumed in the Middle East and Mediterranean regions and is preferred for its pure, authentic flavor derived from the distillation of grapes and anise seeds. This classic version of arak has strong cultural ties to family traditions, religious gatherings, and festive occasions, particularly in Lebanon, Syria, and Jordan. The ritual of mixing unflavored arak with water and ice creates a unique visual effect as the liquid turns milky white, adding to its cultural significance. Due to its deep-rooted heritage and symbolic importance, unflavored arak continues to be the most popular choice among consumers, especially in its domestic markets.

Arak Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Online Retail

Supermarkets and hypermarkets hold the largest market share, accounting for over 45% of the global arak market in 2023. These large retail outlets offer consumers the convenience of one-stop shopping, where they can find a wide range of alcoholic beverages, including arak. Supermarkets and hypermarkets typically stock both mass-market and premium arak brands, giving consumers the option to choose based on their preferences and budget. The accessibility and availability of arak in mainstream retail channels have contributed to its widespread consumption, particularly in the Middle East and North Africa. Additionally, promotional discounts and in-store marketing efforts help drive impulse purchases, further supporting the dominance of this distribution channel.

Arak Market Segmentation: By Region

-

Middle East and Africa

-

Europe

-

North America

-

Asia-Pacific

-

South America

The Middle East and Africa remain the dominant regions for arak consumption, accounting for over 60% of the global market share in 2023. Arak is a staple beverage in many Middle Eastern countries, where it is deeply ingrained in cultural and social traditions. Lebanon, in particular, is known for producing some of the finest arak, with numerous local distilleries dedicated to preserving the craft of arak production. The region's strong demand is driven by its historical consumption patterns, with arak being a popular choice during large family gatherings, holidays, and festive occasions. Additionally, arak is often enjoyed with traditional mezze, enhancing its appeal in Middle Eastern cuisine. Despite increasing global interest, the Middle East remains the core market for arak, with consistent demand from local consumers and expatriates alike.

COVID-19 Impact Analysis on the Arak Market:

The COVID-19 pandemic had a mixed impact on the global arak market. The initial phases of the pandemic saw disruptions in supply chains, particularly in the production and distribution of arak, as lockdowns and restrictions affected distilleries and retailers. In many Middle Eastern countries, where arak is primarily produced, distilleries face labor shortages and supply chain delays, leading to reduced output and availability of the product.

However, as the pandemic progressed and consumers adapted to new lifestyles, there was a noticeable shift toward home consumption of alcoholic beverages, including Arak. With social gatherings and dining out limited due to lockdown measures, many consumers turned to at-home experiences, recreating traditional meals and celebrations with family members. This shift boosted demand for arak in domestic settings, particularly in regions where the beverage is an integral part of cultural and social rituals. Additionally, the pandemic accelerated the growth of e-commerce and online alcohol sales, with many consumers opting to purchase arak through online platforms. This was particularly significant in regions where arak is not widely available in retail stores, as online channels provided consumers with access to a broader selection of arak brands and products. The growth of online sales helped mitigate some of the losses incurred by traditional retail channels during the pandemic.

Despite the challenges, the arak market demonstrated resilience during the pandemic, with consumption patterns adapting to the changing global landscape. As economies recover and social activities resume, the arak market is expected to regain momentum, with renewed interest in both domestic and international markets.

Latest Trends/Developments:

The global arak market is witnessing several trends and developments that are shaping its future growth. One of the key trends is the rising demand for premium and artisanal arak. As consumers become more discerning in their alcohol choices, there is a growing preference for high-quality, small-batch arak made using traditional methods. This trend is particularly evident in international markets, where consumers are willing to pay a premium for authentic, handcrafted spirits. Producers are responding by offering limited-edition arak, using organic ingredients, and emphasizing the cultural heritage and craftsmanship behind their products.

Another significant trend is the emergence of flavored arak, which is gaining popularity among younger consumers and those seeking new taste experiences. Flavored arak, infused with ingredients such as mint, citrus, or spices, is being marketed as a versatile spirit that can be enjoyed on its own or in cocktails. This innovation is helping to attract a broader audience and expand arak's appeal beyond its traditional consumer base. The expansion of online retail is another major development in the arak market. With the rise of e-commerce platforms, consumers now have easier access to a wide variety of arak brands and styles, regardless of their geographical location. This trend has been accelerated by the COVID-19 pandemic, which saw a surge in online alcohol sales as consumers sought convenient and safe ways to purchase their favorite beverages. Online platforms also allow producers to reach a global audience, providing an opportunity for smaller, artisanal brands to gain visibility in new markets. Sustainability is also playing an increasingly important role in the arak market, with consumers seeking out products that are produced using eco-friendly practices. Many arak producers are adopting sustainable farming methods, such as organic grape cultivation and water conservation techniques, to meet the growing demand for environmentally conscious products. In addition, eco-friendly packaging, such as recyclable glass bottles and biodegradable labels, is becoming more common in the arak market, as producers look to reduce their environmental footprint.

Key Players:

-

Domaine des Tourelles

-

Chateau Ksara

-

Haddad Distilleries

-

Eagle Distilleries Co.

-

Kassatly Chtaura

-

Lebanese Arak Corporation

-

Massaya Arak

-

Clos St. Thomas

-

Karak Arak

Chapter 1. Arak Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Arak Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Arak Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Arak Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Arak Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Arak Market – By Product Type

6.1 Introduction/Key Findings

6.2 Unflavored Arak

6.3 Flavored Arak

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Arak Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Specialty Stores

7.4 Online Retail

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Arak Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Arak Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Domaine des Tourelles

9.2 Chateau Ksara

9.3 Haddad Distilleries

9.4 Eagle Distilleries Co.

9.5 Kassatly Chtaura

9.6 Lebanese Arak Corporation

9.7 Massaya Arak

9.8 Clos St. Thomas

9.9 Karak Arak

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Arak Market was valued at USD 2.1 billion in 2023 and is expected to reach USD 2.9 billion by 2030, growing at a CAGR of 4.7% during the forecast period

Key drivers include the cultural heritage and traditional consumption of arak in the Middle East, rising global interest in artisanal and heritage spirits, and the expansion of online retail platforms.

The market is segmented by Product Type (Unflavored, Flavored) and by Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail).

The Middle East is the most dominant region, accounting for over 60% of the global market share in 2023.

Leading players include Domaine des Tourelles, Chateau Ksara, Haddad Distilleries, Eagle Distilleries Co., and Lebanese Arak Corporation.