AR and VR Collaboration Tools Market Size (2024 – 2030)

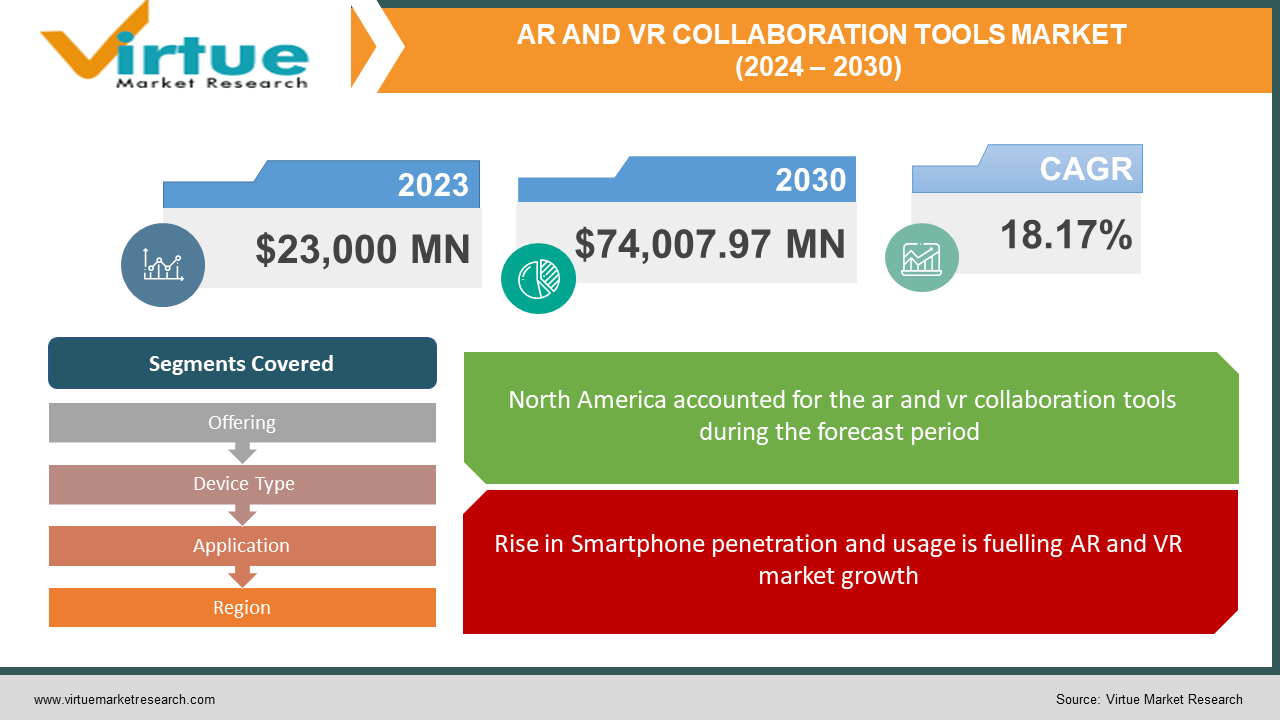

The AR and VR Collaboration Tools Market was valued at USD 23,000 million in 2023 and is projected to reach a market size of USD 74,007.97 million by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 18.17%. The AR and VR Collaboration Tools Market is primarily attributed to the surging adoption of these technologies in the gaming, entertainment, education, tourism, retail, and healthcare sectors.

Additionally, governments worldwide are supporting the adoption of various automation and new technologies for the development of the manufacturing industry and the development of industrial enterprises. Also, industrial and enterprise utilisations are enhancingly dependable on AR technology for on-site advancements and digitization. Thus, such elements are responsible for the market expansion. Moreover, the enhancing demand for gesture and haptic control is supporting the development of the industry. The haptic technology is used to create a sense of touch that consumers feel in the form of applied forces, motions, or vibrations, whereas gesture recognition algorithms control devices and applications, specifically with their body movements. With these technologies, consumers can touch a virtual object, as if in the real world. The enhancing popularity of these technologies has added a new dimension to these devices, thereby propelling their adoption in the virtual reality market.

Key Market Insights:

-

Virtual cinemas revolutionize movie-watching by transporting the audience into virtual theatres. Within these immersive environments, consumers can enjoy films on a virtual big screen, complete with theatre ambiance and seating, all from the comfort of their own space. This creative cinematic experience not only contributes novelty to movie consumption but also opens new possibilities for social interactions, letting friends and family watch movies together in a shared virtual space, regardless of physical distance.

-

In the real estate sector, VR has entered in a transformative era by offering virtual property tours, immersive 3D property visualizations, and augmented property data. These innovations have majorly elevated the property marketing and sales landscape, offering prospective buyers an unparalleled chance to explore and evaluate properties from the comfort of their own spaces. This immersive experience not only time-saving and resources but also enhances decision-making by permitting buyers to interact with properties as if they were physically present. Resultantly, the adoption of VR software in property marketing and sales has surged, becoming an important tool for real estate professionals, and redefining the way attributes are showcased and sold in the market.

AR and VR Collaboration Tools Market Drivers:

Rise in Smartphone penetration and usage is fuelling AR and VR market growth.

Smartphone usage and technology updation have enabled people to view virtual graphics embedded in real-world surroundings. Also, users may network with pictures and objects to engage with them by just utilizing a camera on their smartphones. Additionally, AR and VR technologies are becoming primary components of smartphones, and the need for these technologies is directed by the surging demand for such devices. Furthermore, smartphone manufacturers are currently working to make the next generation of revolutionary computing devices, which are expected to open up new potential for market growth.

Moreover, AR can be provided by smartphone alone, due to the inter-linking of location-based AR apps. Even though the acceptance of augmented reality is still in its initial phase, there are huge prospects for the widespread adoption of AR since the demand for smartphones is expected to increase rapidly in the next few years, especially in emerging countries like China and India. Thus, this is estimated to create several opportunities for businesses serving in this market.

Increased Technology adoption among Enterprises contributing to the market expansion.

The application potential of these technologies among enterprises is enormous, with all key players such as device manufacturers, app developers, and solution providers aiming at the industry. Furthermore, most Fortune 500 companies have begun experimenting with AR and VR technologies, and some of them have already initiated pilot projects with these technologies. The main aim of these pilot projects is to find out how these technologies can be beneficial in increasing productivity and cutting down the operational costs of organizations.

For example, The Boeing Company reduced its wiring production time by 20–25% and lowered the error rate to zero by applying smart glass displays. Besides, several logistics companies are deploying smart glasses to guide warehouse pickers in assembling shipments, thereby resulting in lower error rates. As more and more Companies are interested in these technologies in their operations, the market is estimated to witness an increase in demand for enterprise solutions shortly.

AR and VR Collaboration Tools Market Restraints and Challenges:

Restricted amount of content available for AR/VR

Content development is a crucial challenge in the AR/VR ecosystem due to the relatively restricted availability of diverse and compelling experiences. Gaining users and sustaining their interest hinges on having a rich variety of content. Insufficient content diversity can deter consumers from adopting AR/VR technology, as they obtain engaging applications and experiences that cater to their versatile preferences. This shortage necessitates a concerted effort from developers to create creative, high-quality content across various genres, from gaming and entertainment to education and training, to push user adoption and establish AR/VR as a mainstream platform.

High investment needed for AR/VR development

The high cost of AR/VR development and System-on-Chip (SoC) integration is a major impediment to the development of the augmented and virtual reality markets. Moreover, security compliance issues and increasing cyber-attacks owing to the absence of security standards are major factors challenging market dynamics. Also, lacking technical expertise will challenge market development, resulting in data manipulation, sniffing, spoofing, cyber-attacks, and man-in-the-middle attacks.

AR and VR Collaboration Tools Market Opportunities:

Increased remote work and collaboration through AR/VR software

The ascent of remote work and collaboration has strengthened AR/VR software into a transformative role in redefining the way teams interact and collaborate. AR/VR-enabled virtual meetings transcend the restrictions of traditional video conferencing, permitting colleagues to meet in lifelike virtual environments, and fostering a stronger sense of presence and network. Design collaboration takes on a new dimension, as teams can picture and interact with 3D models in real-time, increasing creativity and productivity. Furthermore, AR/VR facilitates immersive team-building experiences, facilitating remote teams to engage in team-building activities and training exercises as if they were personally present, ultimately strengthening bonds and collaboration.

AR AND VR COLLABORATION TOOLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.17% |

|

Segments Covered |

By Offering, Device Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Google LLC, Microsoft Corporation, Sony Corporation, Samsung Electronics Co. Ltd., Facebook Technologies LLC., HTC Corporation, Apple Inc., PTC Inc., Seiko Epson Corporation, Lenovo |

AR and VR Collaboration Tools Market Segmentation: By Offering

-

Hardware

-

Sensors

-

Cameras

-

Position Trackers

-

Displays and Projectors

-

Semiconductor Components

-

Software

-

Software Development Kits (SDKs)

-

Cloud-Based Services

-

AR Software Functions

-

VR Content Creation

The Hardware category held a dominating revenue share, of around 61%, in recent years, owing to a significant dip in the rates of hardware devices, their high popularity in the Gaming industry, and easy availability. In addition, it will create higher revenue in the future years as well. This will be due to the enhancing demand for high-quality entertainment content and the emphasis of companies on developing their display features and offering customized products to enterprises.

AR and VR Collaboration Tools Market Segmentation: By Device Type

-

AR Devices

-

Head-Mounted Displays (HMDs)

-

Head-Up Displays (HUDs)

-

Handheld devices

-

VR Devices

-

Head-Mounted Displays (HMDS)

-

Gesture-Tracking Devices

-

Projector and Display Walls

Among these, HMDs dominate the AR devices market, accounting for 58% of revenue in recent years. The demand for HMDs is also expected to experience notable growth in the coming years, due to the growing need for lightweight displays, modernisations in technology, and the growing patent portfolio of companies. Also, AR-based HMDs are gaining traction in industries such as tourism, automotive, military, gaming, and education. Besides, the surging adoption of mobile AR and the escalating investments by large tech companies will push the demand for AR-based HMDs in the near future.

AR and VR Collaboration Tools Market Segmentation: By Application

-

Consumer

-

Gaming

-

Sports & Entertainment

-

Commercial

-

Offline Education & E-Learning

-

In-Store Retail & E-Commerce

-

Tourism

-

Enterprise

-

Healthcare

-

Automotive

-

Aerospace & Defence

The Consumer application category accounted for the biggest revenue share, of around 55.6%, in recent years, and it is estimated to retain its dominance in the market over the next few years. This is majorly attributed to the growing awareness of these advanced technologies and the burgeoning demand for more communicative and immersive games. In addition, the growing disposable income has expanded the sales of gaming systems, which, in turn, would boost the industry development in this category during the estimated period.

AR and VR Collaboration Tools Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominated the market, with a revenue share of around 35%, in the previous years. The governments of the U.S. and Canada are deploying heavily in the adoption of such technologies for various industries, including Aerospace & Defence, Healthcare, and Education, for training purposes, which is estimated to push the regional demand. In addition, the U.S. accounted for a bigger revenue share in the region, due to the high investment in these technologies and the presence of many leading technology companies such as Google LLC, Microsoft, and Apple Inc.

Whereas, the APAC market held a substantial share, of around 25%, in the past years, and it is estimated to face the fastest growth over the forecast period. This is due to the growing investments in the commercial and defence sectors, development in the healthcare and automotive industries, and rapid urbanisation in economies such as China, Japan, India, and South Korea. Being home to several developing countries and a large number of display panel manufacturers, the region is estimated to witness enhanced adoption of these technologies in the future years.

COVID-19 Impact Analysis on the AR and VR Collaboration Tools Market:

COVID-19 has escalated digitization and given technology adoption a much-required boost. These technologies have applications in several industries, including healthcare, education, tourism, and retail. The pandemic's behavioural alterations will last longer, if not forever, even after lockdown restrictions are lifted. People will remain socially far away while being virtually close, all credit to augmented reality, virtual reality, and extended reality market technologies. If AR/VR platforms are obtainable, businesses can run and develop despite the challenges posed by social distancing. Moreover, as internet linkage improves, more people can work from remote locations and smartphones, making it easier for the masses to work online.

Latest Trends:

Rising popularity of gaming

The attraction in gaming's popularity has led to enhanced demand for AR and VR software applications in the industry. As gamers ask for more immersive and interactive experiences, AR and VR technologies have proven to be a suitable fit, providing an unprecedented level of immersion and engagement. This alignment has given birth to the creation of a wide array of gaming content that leverages AR and VR software, widening the market's portfolio of offerings. Consequently, the growing popularity of gaming is not only strengthening the market within the gaming industry but also contributing to its wider acceptance and utilization across diverse domains, ultimately driving market development and technological advancement.

Key Players:

-

Google LLC

-

Microsoft Corporation

-

Sony Corporation

-

Samsung Electronics Co. Ltd.

-

Facebook Technologies LLC.

-

HTC Corporation

-

Apple Inc.

-

PTC Inc.

-

Seiko Epson Corporation

-

Lenovo

Recent Developments

-

Aug-2023: Magic Leap, Inc. collaborated with Microsoft Corporation, a leading developer of personal-computer software systems, and Qualcomm Technologies, Inc., an American multinational corporation. Under this agreement, the Mixed Reality Toolkit (MRTK) was introduced. The MRTK is a platform for AR/VR development framework and helps the developers in app creation.

-

Jun-2023: Hexagon AB joined hands with NVIDIA Corporation, an American multinational technology company. Under this partnership, the technologies of Hexagon were combined with NVIDIA to offer smooth multi-user workflows for process quality optimization, factory planning, and operations.

-

Mar-2023: NVIDIA Corporation collaborated with Amazon Web Services, Inc. (AWS), a subsidiary of Amazon.com, Inc. company. Under this agreement, the Amazon Elastic Compute Cloud (Amazon EC2) P5 was released. The new product provides 20 exaFLOPS of compute performance that assists in training and building deep learning models.

-

Jul-2022: Hexagon AB came into an agreement with Cantier Systems Pte. Ltd, a company offering cost-effective manufacturing solutions. Under this collaboration, the Cantier MES 4.0 was offered to Hexagon customers. The new product assisted Hexagon in taking authority over the plant floor for networking, visibility, and realising the expectations of Industry 4.0.

-

May 2022: Advanced Micro Devices, Inc. collaborates with Qualcomm Technologies, Inc., an American multinational corporation. Under this partnership, the Qualcomm FastConnect connectivity system was strengthened for the Qualcomm FastConnect 6900 system and the AMD Ryzen processor-based computing software.

-

Jan-2022: Microsoft Corporation joined hands with Qualcomm Technologies, Inc., an American multinational corporation. Through this collaboration, the companies broadened the use of augmented reality (AR) in the consumer as well as the enterprise sector.

Chapter 1. AR and VR Collaboration Tools Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. AR and VR Collaboration Tools Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. AR and VR Collaboration Tools Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. AR and VR Collaboration Tools Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. AR and VR Collaboration Tools Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. AR and VR Collaboration Tools Market – By Offering

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Sensors

6.4 Cameras

6.5 Position Trackers

6.6 Displays and Projectors

6.7 Semiconductor Components

6.8 Software

6.9 Software Development Kits (SDKs)

6.10 Cloud-Based Services

6.11 AR Software Functions

6.12 VR Content Creation

6.13 Y-O-Y Growth trend Analysis By Offering

6.14 Absolute $ Opportunity Analysis By Offering, 2024-2030

Chapter 7. AR and VR Collaboration Tools Market – By Device Type

7.1 Introduction/Key Findings

7.2 AR Devices

7.3 Head-Mounted Displays (HMDs)

7.4 Head-Up Displays (HUDs)

7.5 Handheld devices

7.6 VR Devices

7.7 Head-Mounted Displays (HMDS)

7.8 Gesture-Tracking Devices

7.9 Projector and Display Walls

7.10 Y-O-Y Growth trend Analysis By Device Type

7.11 Absolute $ Opportunity Analysis By Device Type, 2024-2030

Chapter 8. AR and VR Collaboration Tools Market – By Application

8.1 Introduction/Key Findings

8.2 Consumer

8.3 Gaming

8.4 Sports & Entertainment

8.5 Commercial

8.6 Offline Education & E-Learning

8.7 In-Store Retail & E-Commerce

8.8 Tourism

8.9 Enterprise

8.10 Healthcare

8.11 Automotive

8.12 Aerospace & Defence

8.13 Y-O-Y Growth trend Analysis By Application

8.14 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. AR and VR Collaboration Tools Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Offering

9.1.3 By Device Type

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Offering

9.2.3 By Device Type

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Offering

9.3.3 By Device Type

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Offering

9.4.3 By Device Type

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Offering

9.5.3 By Device Type

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. AR and VR Collaboration Tools Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Google LLC

10.2 Microsoft Corporation

10.3 Sony Corporation

10.4 Samsung Electronics Co. Ltd.

10.5 Facebook Technologies LLC.

10.6 HTC Corporation

10.7 Apple Inc.

10.8 PTC Inc.

10.9 Seiko Epson Corporation

10.10 Lenovo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The AR and VR Collaboration Tools Market was valued at USD 23,000 million in 2023 and is projected to reach a market size of USD 74,007.97 million by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 18.17%.

The increased penetration of smartphones and enhanced usage of technology in Enterprises is propelling the AR and VR Collaboration Tools Market.

The AR and VR Collaboration Tools Market is segmented based on Offering, Device Type, Application, and Region.

North America is the most dominant region for the AR and VR Collaboration Tools Market.

Google LLC, Microsoft Corporation, Sony Corporation, Samsung Electronics Co. Ltd., Facebook Technologies LLC, HTC Corporation, Apple Inc., and PTC Inc. are a few of the key players operating in the AR and VR Collaboration Tools Market.