Aquafeed Market Size (2024-2030)

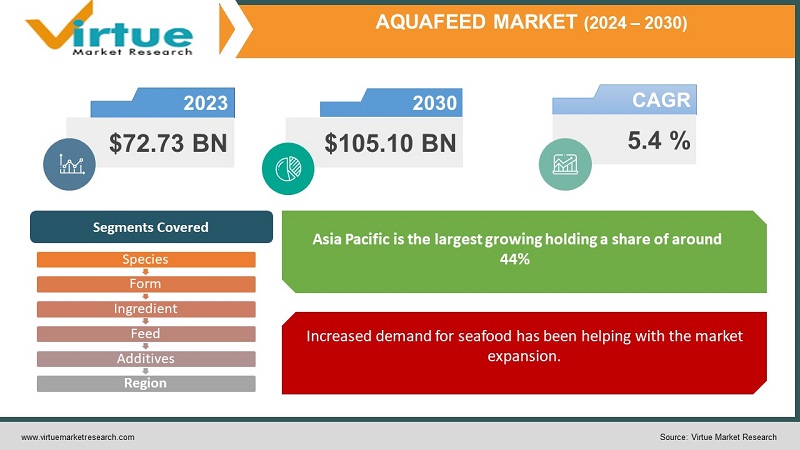

The Global Aquafeed Market was valued at USD 72.73 billion and is projected to reach a market size of USD 105.10 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.4 %.

Any food provided to aquatic farm animals is referred to as an aquafeed. The aquafeed market has seen tremendous growth over the years. In the past, it was widely used and had fish oil and fish meal. But presently, a lot of innovations, as well as creativity, have helped the market to customize the feed with various nutrient alternatives to enhance aqua animals’ growth. In the future, with a rising focus on sustainability and research activities being carried out on other alternatives, this market is predicted to show significant progress. During the forecast period, this market will see notable growth.

Key Market Insights:

In the EU, aquaculture accounts for approximately 25% of seafood consumption.

Asia Pacific aquafeed market will grow by 6.0% annually with a total addressable market cap of $289.9 billion over 2021-2030.

The world’s production of aquafeed increased by 3.7% in 2021, showing more growth than most other feed sectors, according to the annual Agri-Food Outlook report from animal nutrition group Alltech.

Fish farming is growing faster (10% per year) in Africa than in any other continent.

Fish oil and fish meal are often overused exceeding more than 50% leading to environmental and depletion challenges affecting the fish and feed industry. To address this, prominence is being given to developing alternatives with better nutritional values.

Aquafeed Market Drivers:

Increased demand for seafood has been helping with the market expansion.

Seafood has been associated with numerous health benefits. It is known to improve eye, brain, and heart health. Various studies have proved that humans have to consume seafood at least twice a week. It is known to help pregnant women by providing nutrients for fetal development. Additionally, they help with the lowering of blood pressure and prevent diseases like Alzheimer's. Other foods like fish are rich in omega-3 fatty acids, vitamins like D and B12, calcium, protein, and phosphorous. Salmon is known to enhance immunity, help with the functioning of the nervous system, and provide energy. Shrimp is known for its selenium content, which protects the cells, and is a rich source of protein and minerals. All these health advantages along with its taste increase consumption. This helps the market to develop by raising as well as breeding more aqua animals thereby providing the necessary feed for their maintenance.

Rising environmental awareness has helped in the market growth.

A highly controlled environment provided by aquaculture allows for the regulation of feeding practices to promote sustainability. Aquafeed helps with animal digestion as well. Due to the continuous development of aquafeed, the pollution rate is minimized. They are designed in a way that helps to produce less waste and excretion of ammonia as well as phosphorous in the water. These chemicals are essential for the growth of aquatic plants like algae. Ammonia acts as a fertilizer for plant growth. These environmental advantages make it appealing helping the market to generate more revenue.

Aquafeed Market Restraints and Challenges:

Price range, knowledge about the feed, veganism, and lifestyle changes are the major hindrance which is being faced by the market.

Although this market has a lot of advantages, there are a few barriers that are being faced. Firstly, the price volatility of raw materials has been challenging. This can demotivate the producers and manufacturers. Additionally, the ongoing inflation is contributing to the losses. Secondly, there can be a lack of awareness about feeding the animals. The diet can lack certain nutrients or in some cases can cause a lot causing health issues for the aqua animals. Moreover, the availability of nutrients and aquaculture contribute as well. Thirdly, the growing popularity of incorporating plant-based diets has been a concern. Vegan food contains plant-based products and alternatives. This helps the environment but can raise challenges for the meat industry. Furthermore, despite the health advantages, overconsumption is associated with a lot of health risks. With the prediction of an increase in diabetic patients by 2030, many people are leaning towards including simple foods with less sugar and fat.

Aquafeed Market Opportunities:

Governmental regulations have been providing the market with an ample number of opportunities. Various practices regarding planning, monitoring, and funding have helped the market to grow especially in Asian countries. Initiatives are being taken to increase the aquaculture raising through various research activities. Increasing investments from shareholders, investors, and companies have further propelled the market growth rate. Feeds used are continuously being improved and developed to have more nutritional content. Moreover, sustainability is being prioritized. This includes the usage of better alternatives for protein, meals, and other single-cell proteins. Furthermore, studies from various renowned scholars, institutes, and universities have been helping to broaden human understanding.

AQUAFEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Species, Form, Ingredient, Feed, Additives, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Alltech, Ridley Corporation Limited, BioMar Group, Archer Daniels Midland, Skretting, Avanti Feeds Limited, Charoen Pokphand Group, Purina Animal Nutrition, Norel Animal Nutrition |

Aquafeed Market Segmentation:

Aquafeed Market Segmentation: By Species:

- Fish

- Carps

- Tilapias

- Catfish

- Salmon

- Others

- Crustaceans

- Mollusks

- Others

Based on species, the fish segment is the largest and fastest growing in the market. The Carps segment is the dominating category holding a share of more than 25%. One of the main reasons is the increase in fish consumption over the years. Additionally, the creativity and tastes also add up. Carps are known to be a rich source of omega-3 fatty acids, essential amino acids, and zinc. Consumption of these helps to improve immunity, strength, and heart health. They help in preventing and treating atherosclerosis, anti-cancer, and reducing fat in the blood. Catfish are the second largest popular category. Catfish is high in lean protein, good fats, vitamins, and minerals yet low in calories. Vitamin B12, B6, and selenium are very abundant in it. Tilapia are among the fastest-growing categories in the fish segment. It is rich in vitamin B12, which is essential for our body's production of red blood cells, nervous system maintenance, and DNA synthesis. It is a nutritious complement to any meal because it is low in fat, saturated fat, omega-3 fatty acids, calories, carbs, and salt.

Aquafeed Market Segmentation: By Form:

- Dry

- Wet

Based on form, the dry segment is the largest as well as fastest growing in the market. As per a report, it holds a total share of 42.70% of the overall revenue and is estimated to grow at a CAGR of 4.7%. This is owing to their ability to improve the feed conversion ratio of fish. They are known to improve fish performance due to their efficiency and taste. They have a good shelf life attracting the producers. Moreover, they are very easy to transport and store. They can be purchased in bulk quantities due to this advantage. Along with this, they are extremely cost effective making them an attractive option. Furthermore, they are available with a lot of choices having a good amount of nutritional content and ingredients in them.

Aquafeed Market Segmentation: By Feed:

- Starter Feed

- Grower Feed

- Finisher Feed

- Brooder Feed

Based on feed, grower feed is the largest growing segment in the market holding a share of more than 35.35% as per a report. The success of this segment is due to advantages like feed conversion, growth rate, and overall performance. They contain an enormous amount of protein essential for these animals to meet their nutritional need. Starter feed is the fastest-growing segment. This is crucial for an animal during its early life stages. It contains a lot of protein content which helps aquaculture. Furthermore, it is packed with nutrients that are vital during growth.

Aquafeed Market Segmentation: By Ingredient:

- Soybean

- Fish Oil

- Fish Meal

- Corn

- Additives

- Others

Based on ingredients, soybean is the largest growing segment in this market. One of the greatest non-fish sources of nutritious proteins, unsaturated fats, and necessary omega-3 fatty acids is soy. Additionally, it is budget-friendly. As per a report, they are estimated to hold a share of 25.79%. However, additives are the fastest-growing segment. They are known to improve the growth performance and overall health of the fish. It also aids in physiological functions and weight gain. They hold a total share of around 11.4% in the market.

Aquafeed Market Segmentation: By Additives:

- Vitamins

- Antioxidants

- Amino Acids

- Enzymes

- Acidifiers

- Binders

Based on additives, amino acids are the largest growing in this market. As per a report, they accounted for the maximum share of more than 32.80% of the overall revenue. Amino acids are known to increase disease resistance, enhance immunity, help with the metabolic efficiency of the fish, improve larval performance, improve fillet taste, tolerance to environmental factors, and promote growth, and overall health. Moreover, customization of amino acid formulations due to advanced research helps to cater to the needs of specific species. Acidifiers are the fastest growing owing to their ability to prevent diseases from certain bacteria and viruses. As per a report, they are estimated to grow at a CAGR of 6.7%. They are known to improve the digestion and absorption of various minerals as well as nutrients. Additionally, they help in enhancing growth performance. Vitamins are also one of the most important in this market holding a considerable share. Vitamins maintain immunity, enhance reproduction, growth, and functioning making them an important segment.

Aquafeed Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East & Africa

Based on region, Asia Pacific is the largest growing holding a share of around 44%. This growth is attributed to the demand for consumption, advancements in aquaculture, the presence of key companies, research activities, nutrient formulations, the presence of aquatic species, and Governmental schemes and initiatives. Countries like China, India, Vietnam, and Indonesia are the top leaders. The Asia Pacific aquafeed market size surpassed USD 41 billion in 2021 and is expected to witness a 7% CAGR from 2022 to 2028. Europe is one of the fastest-growing regions with a share of around 22%. This is due to improvements in environmental management, rising investments in aquaculture, improvements in feed compositions, and emerging players. Countries like the United Kingdom, France, and Italy stand at the forefront.

COVID-19 Impact Analysis on the Global Aquafeed Market:

The outbreak of the virus took a toll on the market. Due to various rules and regulations, lockdowns, social isolation, and movement restrictions became the new norm. Unless categorized as essential workers, all the companies and manufacturing units had to be shut down. There were a lot of disruptions in the supply chain, transportation, and other logistics. This affected the import-export trade activities. Due to financial restrictions, many people lost their jobs. Moreover, the virus highlighted the importance of having a healthy lifestyle. This affected the meat industry in general because people were shifting towards the consumption of vegetarian, vegan, and other homemade food. Due to various closures, many meat units, restaurants, and hotels incurred losses. Furthermore, due to the decline in tourism because of various guidelines, seafood consumption saw a negative growth rate. All this started affecting the aquafeed market. As per a report, the latest estimates of global aquaculture production in 2020 suggested a drop of nearly 2% due to the COVID-19 pandemic. However, there was a shift towards digitalization. Online food delivery helped the market pick up. With the upliftment of lockdowns and other protocols, this market has started to rise steadily.

Latest Trends/ Developments:

Companies are also spending heftily to improve existing feed formulations alongside maintaining competitive pricing. There have been various startups in biotechnology and microbiology fields focusing on finding alternatives and sustainable farming practices. Organic feed is being given importance to improve health. Research and developmental activities on various insect-based foods have been helping the market.

Key Players:

- Cargill

- Alltech

- Ridley Corporation Limited

- BioMar Group

- Archer Daniels Midland

- Skretting

- Avanti Feeds Limited

- Charoen Pokphand Group

- Purina Animal Nutrition

- Norel Animal Nutrition

In September 2023, in a move to boost Oman’s fisheries and aquaculture sector, the Oman-based International Fish Feed Company (IFFC) is developing a high-tech aquafeed production facility. The IFFC aims to have its new aquafeed facility deployed and commercially active by the end of next year, with an estimated annual production capacity of 31,200 tonnes.

In May 2022, Deep Branch, and BioMar signed a long-term partnership to enhance aquafeeds.

Chapter 1. Global Aquafeed Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Aquafeed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Aquafeed Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Aquafeed Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Aquafeed Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Aquafeed Market– By Species

6.1. Introduction/Key Findings

6.2. Fish

6.2.1. Carps

6.2.2. Tilapias

6.2.3. Catfish

6.2.4. Salmon

6.2.5. Others

6.3. Crustaceans

6.4. Mollusks

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Species

6.7. Absolute $ Opportunity Analysis By Species , 2023-2030

Chapter 7. Global Aquafeed Market– By Form

7.1. Introduction/Key Findings

7.2. Dry

7.3. Wet

7.4. Y-O-Y Growth trend Analysis By Form

7.5. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 8. Global Aquafeed Market– By Feed

8.1. Introduction/Key Findings

8.2. Starter Feed

8.3. Grower Feed

8.4. Finisher Feed

8.5. Brooder Feed

8.6. Y-O-Y Growth trend Analysis Feed

8.7. Absolute $ Opportunity Analysis Feed , 2024-2030

Chapter 9. Global Aquafeed Market– By Ingredient

9.1. Introduction/Key Findings

9.2. Soybean

9.3. Fish Oil

9.4. Fish Meal

9.5. Corn

9.6. Additives

9.7. Others

9.8. Y-O-Y Growth trend Analysis Ingredient

9.9. Absolute $ Opportunity Analysis Ingredient , 2024-2030

Chapter 10. Global Aquafeed Market– By Additives

10.1. Introduction/Key Findings

10.2. Vitamins

10.3. Antioxidants

10.4. Amino Acids

10.5. Enzymes

10.6. Acidifiers

10.7. Binders

10.8. Y-O-Y Growth trend Analysis Additives

10.9. Absolute $ Opportunity Analysis Additives , 2024-2030

Chapter 11. Global Aquafeed Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Species

11.1.3. By Form

11.1.4. By Ingredient

11.1.5. Feed

11.1.6. Additives

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Species

11.2.3. By Form

11.2.4. By Ingredient

11.2.5. Feed

11.2.6. Additives

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.2. By Country

11.3.2.2. China

11.3.2.2. Japan

11.3.2.3. South Korea

11.3.2.4. India

11.3.2.5. Australia & New Zealand

11.3.2.6. Rest of Asia-Pacific

11.3.2. By Species

11.3.3. By Form

11.3.4. By Ingredient

11.3.5. Feed

11.3.6. Additives

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.3. By Country

11.4.3.3. Brazil

11.4.3.2. Argentina

11.4.3.3. Colombia

11.4.3.4. Chile

11.4.3.5. Rest of South America

11.4.2. By Species

11.4.3. By Form

11.4.4. By Ingredient

11.4.5. Feed

11.4.6. Additives

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.4. By Country

11.5.4.4. United Arab Emirates (UAE)

11.5.4.2. Saudi Arabia

11.5.4.3. Qatar

11.5.4.4. Israel

11.5.4.5. South Africa

11.5.4.6. Nigeria

11.5.4.7. Kenya

11.5.4.11. Egypt

11.5.4.11. Rest of MEA

11.5.2. By Species

11.5.3. By Form

11.5.4. By Ingredient

11.6.5. Feed

11.5.6. Additives

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Global Aquafeed Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Cargill

12.2. Alltech

12.3. Ridley Corporation Limited

12.4. BioMar Group

12.5. Archer Daniels Midland

12.6. Skretting

12.7. Avanti Feeds Limited

12.8. Charoen Pokphand Group

12.9. Purina Animal Nutrition

12.10. Norel Animal Nutrition

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Aquafeed Market was valued at USD 72.73 billion and is projected to reach a market size of USD 105.10 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.4 %.

Increased demand for seafood and rising environmental awareness are the main factors fueling the Global Aquafeed Market

Based on Ingredients, the Global Aquafeed Market is segmented into Soybean, Fish Oil, Fish Meal, Corn, Additives, and Others

Asia Pacific is the most dominant region for the Global Aquafeed Market

Cargill, Alltech, and Ridley Corporation Limited are the key players operating in the Global Aquafeed Market