APAC Dropshipping Market Size (2024-2030)

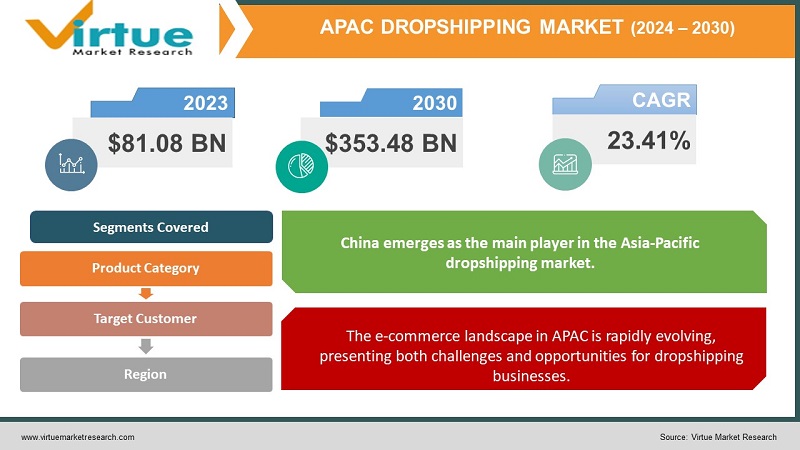

The APAC Dropshipping Market is valued at USD 81.08 Billion in 2023 and is projected to reach a market size of USD 353.48 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 23.41%.

The dropshipping business model is at the forefront of the e-commerce revolution that is taking place in the Asia Pacific (APAC) region. With this innovative retail strategy, business owners may sell goods online without keeping any inventory. Rather, they collaborate with vendors who take care of customer-direct shipping, packaging, and storage. The APAC dropshipping market is becoming more and more dynamic as a result of this low entry barrier approach. With internet access becoming increasingly affordable and widespread across APAC, a vast pool of potential customers is now online and ready to shop. This creates a fertile ground for online businesses, including dropshipping stores. APAC boasts the highest mobile phone penetration rate globally. Consumers are comfortable shopping and researching products on their smartphones, making dropshipping stores easily accessible.

Key Market Insights:

The average order value in APAC dropshipping is expected to hover around $68 in 2024, reflecting a preference for smaller, more frequent purchases.

Over 75% of e-commerce purchases in APAC are projected to be conducted via mobile devices in 2024, highlighting the importance of mobile-friendly dropshipping stores.

Digital wallets like Alipay and WeChat Pay are expected to dominate payment processing in APAC dropshipping, with an estimated 80% of transactions projected to occur through these platforms in 2024.

The average dropshipping business in APAC is estimated to allocate around 12% of its revenue towards marketing activities in 2024, emphasizing the importance of effective customer acquisition strategies.

Customer acquisition costs in APAC dropshipping are expected to average around $25 in 2024, highlighting the competitive nature of the market.

Approximately 30% of customer complaints in APAC dropshipping are likely to be related to slow or unreliable delivery in 2024, underlining the need for efficient logistics partnerships.

Product return rates in APAC dropshipping are projected to be around 10% in 2024, necessitating clear return policies and efficient reverse logistics processes.

Environmentally conscious consumers are driving demand for sustainable packaging and ethically sourced products in APAC dropshipping, with an estimated 20% of consumers willing to pay a premium for eco-friendly options in 2024.

Subscription box models offering curated product selections are anticipated to gain traction in APAC dropshipping, reaching an estimated market value of $5 billion by 2027.

Asia Pacific Dropshipping Market Drivers:

The APAC region boasts the highest mobile phone penetration rate globally. This translates to a generation of consumers who are comfortable shopping and researching products on their smartphones.

Dropshipping stores built with a mobile-first approach ensure a seamless shopping experience for customers. Easy navigation, optimized product pages for smaller screens, and secure mobile payment options are crucial for capturing sales in the APAC market. In Asia, social media sites like Instagram and TikTok are used for more than just amusement. These are effective resources for internet buying and product research. These channels can be used by dropshipping companies to highlight their items through visually engaging content, influencer marketing initiatives, and mobile-specific advertising. Mobile shopping readily facilitates impulse purchases. The convenience of one-click buying and the ability to browse through products while commuting or during leisure time can lead to increased sales for dropshipping businesses with mobile-friendly stores.

The e-commerce landscape in APAC is rapidly evolving, presenting both challenges and opportunities for dropshipping businesses.

APAC's logistics infrastructure is being significantly enhanced. Drop-shipped products may now be delivered more quickly and effectively thanks to the development of faster and more dependable delivery networks, which is essential for ensuring customer satisfaction. Dropshipping companies profit from this trend since it enables them to provide competitive delivery times and maybe reach farther-flung locations. The APAC region's governments are actively attempting to streamline laws pertaining to international trade. This can facilitate the sourcing of products from multiple vendors within the region for dropshipping enterprises, thereby providing clients with an increased range of possibilities. But it's crucial to be informed about evolving rules and make sure you're complying. Retail is becoming more and more merged into online and offline spaces. In order to provide click-and-collect alternatives or exhibit their products in real spaces, dropshipping companies may want to consider forming alliances with physical retailers. In addition to possibly reaching a larger customer base, this can increase brand awareness.

APAC Dropshipping Market Restraints and Challenges:

Since many dropshipping companies provide comparable goods, pricing is frequently the deciding factor in competitiveness. Price wars may result from this, reducing profit margins and making it challenging for new competitors to make a name for themselves. In a crowded market, making an impression with a distinctive brand identity and a compelling value proposition is essential. Uninspired product options in generic dropshipping stores make it difficult to draw in customers and win their commitment. Sourcing products from overseas suppliers can lead to quality control concerns. Receiving inconsistent or defective products can damage your brand reputation and lead to customer dissatisfaction. Dropshipping businesses rely on their suppliers for accurate inventory information. Outdated or inaccurate inventory data can lead to order fulfillment issues and customer frustration. Integrating secure payment gateways that cater to different currencies and customer preferences is crucial. Dealing with cross-border transactions can involve additional fees and complexities compared to domestic sales.

APAC Dropshipping Market Opportunities:

APAC's sizable and varied customer base offers dropshipping companies a special chance to serve specialized markets. Dropshipping business owners can establish a lucrative niche by concentrating on a certain consumer segment with clearly defined wants and preferences. Use social listening technologies, analyze consumer trends, and pinpoint unmet needs in particular demographics to gain insight into the preferences of customers in your targeted market. Subscription boxes delivering curated product selections are gaining traction in the APAC market. Develop subscription boxes targeting specific customer interests, hobbies, or demographics. This could be anything from a monthly beauty box with curated cosmetics to a pet care subscription box delivering treats and accessories. Subscription boxes foster customer loyalty by providing a sense of surprise and delight with each delivery. This can lead to recurring revenue streams for your dropshipping business. Partner with relevant social media influencers to showcase your products. Run targeted ad campaigns on these platforms and utilize engaging content formats like product demonstrations or customer testimonials.

APAC DROPSHIPPING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

23.41% |

|

Segments Covered |

By Product Category, target customer and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China , Japan , South Korea, India , Australia & New Zealand, Rest of Asia-Pacific |

|

Key Companies Profiled |

Alibaba.com, Shopify , Shopee , Spocket, SaleHoo, CJ Dropshipping, Oberlo , Inventory Source, Doba , Lazada, Tokopedia |

APAC Dropshipping Market Segmentation:

APAC Dropshipping Market Segmentation: By Product Category:

- Fashion (Clothing, Footwear, Accessories)

- Electronics (Smartphones, Gadgets, Consumer Electronics)

- Homeware & Furniture

- Beauty & Personal Care (Cosmetics, Skincare, Wellness)

- Toys & Hobby Supplies

- Other Categories (Sports Equipment, Pet Supplies, Stationery)

In APAC dropshipping, the fashion (clothing, footwear, and accessories) segment is king thanks to a growing middle class with increasing disposable money and a populace that is fashion-savvy. Fashion is a powerful force because of its enormous selection of styles and dropshipping models' affordable prices. There are many people in the APAC area who are very interested in fashion trends. This desire is fueled by social media and an increasing emphasis on personal style. Dropshipping enables companies to provide a large assortment of apparel, accessories, and shoes at affordable costs. This serves a wide range of clients with various budgets and styles.

In the APAC dropshipping market, the beauty and personal care category is growing at the fastest rate. A growing number of middle-class consumers with more disposable income are buying personal hygiene goods. Social media and the beauty influencer industry are driving consumer interest in cosmetics, skincare, and wellness products. The APAC region is home to a diverse population with unique skin tones and hair types. Dropshipping businesses can cater to this demand by offering a wider variety of beauty products.

APAC Dropshipping Market Segmentation: By Target Customer:

- Millennials (26-41 years old)

- Gen Z (8-25 years old)

- Gen X (42-57 years old)

- Baby Boomers (58-76 years old)

Millennials (26-41 years old) form the dominant customer base, accounting for an estimated 45% of the market. Tech-savvy and comfortable with online shopping, Millennials are early adopters of trends and value convenience. Dropshipping businesses must prioritize a mobile-friendly shopping experience with easy navigation, optimized product pages, and secure mobile payment options. Millennials value brands that resonate with their values and social consciousness. Positive customer reviews, influencer endorsements, and transparent brand messaging are crucial for building trust. Millennials are price-conscious but also fashion-forward. Dropshipping businesses can cater to this segment by offering trendy products at competitive prices. Millennials appreciate personalized recommendations and experiences. Utilizing customer data to suggest relevant products or offering customizable options can enhance their shopping journey.

Gen Z is the future of the APAC dropshipping market, and understanding their preferences is crucial for sustainable growth. Gen Z thrives on visual content. High-quality product images, engaging video demonstrations, and leveraging popular social media platforms like TikTok and Instagram are essential for reaching this audience. Gen Z is environmentally and socially conscious. Dropshipping businesses that promote eco-friendly packaging, ethically sourced products, and transparent production practices can resonate with this segment. Gen Z values novelty and exclusivity. Dropshipping businesses can capitalize on this by offering limited-edition drops, flash sales, or subscription boxes with surprise elements.

APAC Dropshipping Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

With a substantial market share and unmatched development potential, China emerges as the main player in the Asia-Pacific dropshipping market. Online shopping has surged dramatically in this massive e-commerce market due to the fast-growing middle class, better logistics infrastructure, and the widespread adoption of mobile technologies. China is a desirable location for drop shippers from all over the world due to its enormous market size and purchasing power. Because of its strong supply chain networks and extensive manufacturing capabilities, the nation is becoming a major global hub for product distribution and sourcing.

India is the nation with the quickest rate of growth in this area. India's population growth, increasing disposable incomes, and quick adoption of smartphones and internet access have increased demand for dropshipping services and online shopping. The change to online shopping has been spearheaded by major businesses like Flipkart, Amazon India, and Snapdeal, which have contributed to the phenomenal expansion of the Indian e-commerce market in recent years. Drop shippers can benefit greatly from the growing demand for specialized products and distinctive shopping experiences brought about by the nation's middle class and shifting consumer tastes. Better payment and logistics infrastructure, along with customer-friendly laws, have further fueled the dropshipping sector's expansion in India.

COVID-19 Impact Analysis on the APAC Dropshipping Market:

Strict lockdowns across APAC countries initially hampered product sourcing and logistics, leading to stockouts and delayed deliveries. This disrupted the smooth flow of dropshipping operations. With a focus on essential goods and tightened budgets, consumer demand for non-essential items like fashion apparel or electronics dipped initially. Dropshipping businesses with a heavy reliance on these categories faced challenges. Social distancing measures and lockdown restrictions fueled a surge in online shopping across APAC. This presented an opportunity for dropshipping businesses with a strong online presence and adaptable product offerings. Stuck at home, consumers gravitated towards products that enhanced their living spaces and well-being. Dropshipping businesses offering homeware, fitness equipment, or self-care products saw a rise in demand. With increased screen time, social media platforms emerged as vital tools for product discovery and online shopping. Dropshipping businesses leveraged social media marketing and influencer collaborations to reach a wider audience.

Latest Trends/ Developments:

Livestreaming platforms like Taobao Live in China and Shopee Live in Southeast Asia are gaining immense popularity. Dropshipping businesses can utilize these platforms to showcase products in real time, interact with potential customers, and answer questions directly. Partnering with relevant social media influencers can significantly boost brand awareness and sales. Micro-influencers with engaged followers in specific niches can be particularly effective for dropshipping businesses targeting specific customer segments. Leveraging customer data, dropshipping businesses can automate targeted email campaigns, social media ads, and personalized product recommendations. This data-driven approach ensures marketing efforts resonate with specific customer segments and drive higher engagement. Dropshipping businesses are opting for eco-friendly packaging materials like recycled cardboard or biodegradable alternatives. Additionally, they are sourcing products made from sustainable materials or promoting brands with strong environmental practices.

Key Players:

- Alibaba.com

- Shopify

- Shopee

- Spocket

- SaleHoo

- CJ Dropshipping

- Oberlo

- Inventory Source

- Doba

- Lazada

- Tokopedia

Chapter 1. APAC Dropshipping Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. APAC Dropshipping Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. APAC Dropshipping Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. APAC Dropshipping Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. APAC Dropshipping Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. APAC Dropshipping Market– By Product Category

6.1. Introduction/Key Findings

6.2. Fashion (Clothing, Footwear, Accessories)

6.3. Electronics (Smartphones, Gadgets, Consumer Electronics)

6.4. Homeware & Furniture

6.5. Beauty & Personal Care (Cosmetics, Skincare, Wellness)

6.6. Toys & Hobby Supplies

6.7. Other Categories (Sports Equipment, Pet Supplies, Stationery)

6.8. Y-O-Y Growth trend Analysis By Product Category

6.9. Absolute $ Opportunity Analysis By Product Category, 2024-2030

Chapter 7. APAC Dropshipping Market– By Target Customer

7.1. Introduction/Key Findings

7.2. Millennials (26-41 years old)

7.3. Gen Z (8-25 years old)

7.4. Gen X (42-57 years old)

7.5. Baby Boomers (58-76 years old)

7.6. Y-O-Y Growth trend Analysis By Target Customer

7.7. Absolute $ Opportunity Analysis By Target Customer, 2024-2030

Chapter 8. APAC Dropshipping Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Product Category

8.1.3. By Target Customer

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. APAC Dropshipping Market– Company Profiles – (Overview, Product CategoryPortfolio, Financials, Strategies & Developments)

9.1 Alibaba.com

9.2. Shopify

9.3. Shopee

9.4. Spocket

9.5. SaleHoo

9.6. CJ Dropshipping

9.7. Oberlo

9.8. Inventory Source

9.9. Doba

9.10. Lazada

9.11. Tokopedia

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

APAC boasts a rapidly growing internet user base, with a significant portion accessing the web through smartphones. This mobile-first approach fuels the convenience and accessibility of online shopping, making dropshipping a perfect fit for these consumers.

. Finding reliable dropshipping suppliers can be difficult, especially when dealing with overseas manufacturers. There's a risk of receiving poor-quality products, counterfeits, or items that don't meet safety standards

Alibaba.com, Shopify, Shopee, Spocket, SaleHoo, CJ Dropshipping, Oberlo,

Inventory Source, Doba, Lazada, Tokopedia

China has firmly established itself as the most dominant player in the Asia-Pacific market, commanding an impressive 55% market share.

. India emerges as the fastest-growing country in this sector. India's burgeoning population, rising disposable incomes, and the rapid adoption of smartphones and internet connectivity have fueled the demand for online shopping and, consequently, dropshipping services