Antiscalants Market Size (2025 – 2030)

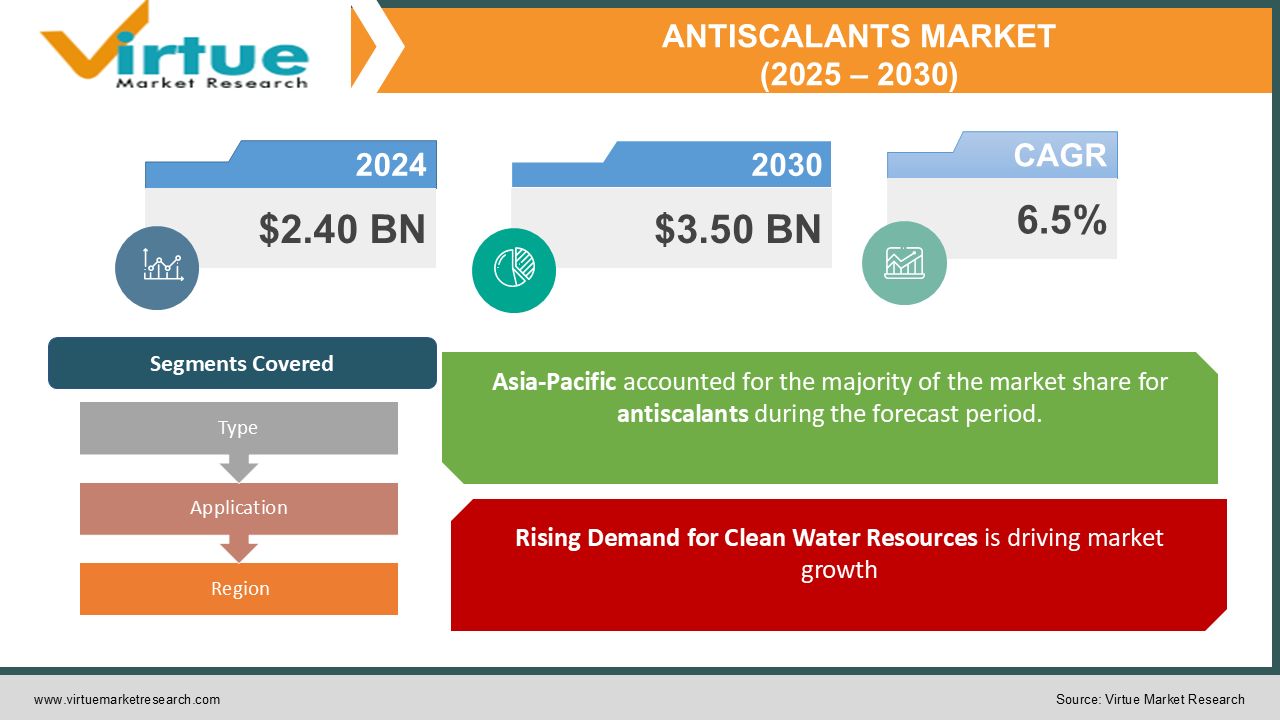

The Global Antiscalants Market was valued at USD 2.40 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 3.50 billion by 2030.

The Antiscalants Market focuses on specialized chemical agents designed to prevent the formation and deposition of scale in water systems, such as boilers, cooling towers, and desalination plants. With increasing industrialization and urbanization, coupled with a growing focus on water conservation and reuse, the demand for antiscalants is experiencing significant growth. These agents are vital for maintaining operational efficiency and reducing maintenance costs across industries like power generation, oil and gas, and water treatment.

Key Market Insights

-

The power generation industry is one of the leading consumers of antiscalants, accounting for over 25% of the total market share in 2024.

-

Asia-Pacific emerged as the dominant region, contributing nearly 40% of global revenue, due to rapid industrialization and stringent water management regulations.

-

Phosphonate-based antiscalants are the most popular product type, representing 35% of the market in 2024 due to their superior performance in high-pressure applications.

-

Increasing investments in desalination projects are projected to boost the adoption of antiscalants, especially in the Middle East and Africa, whereas, challenges such as environmental regulations and fluctuating raw material prices may impact market growth.

-

The municipal water treatment sector is expected to witness the fastest growth, with a CAGR of 7.1% during the forecast period.

Global Antiscalants Market Drivers

Rising Demand for Clean Water Resources is driving market growth:

The growing global population and rapid industrialization have amplified the need for clean and reusable water. Water treatment facilities are increasingly adopting antiscalants to prevent scale formation, ensuring efficient system operations and reducing downtime. Desalination plants, which process seawater into potable water, are particularly reliant on antiscalants. For example, the desalination sector has seen a 15% increase in capacity in the past decade, directly boosting antiscalant consumption. Additionally, governments and organizations are emphasizing water sustainability initiatives, driving the adoption of advanced treatment technologies. These factors collectively underline the pivotal role of antiscalants in addressing global water scarcity challenges.

Growth in Power Generation Sector is driving market growth:

The power generation industry, a major consumer of water, relies heavily on antiscalants to maintain equipment efficiency. Cooling towers and boilers in power plants are susceptible to scaling, which can reduce thermal efficiency and increase operational costs. With the global energy demand projected to rise by 25% by 2030, the power sector’s reliance on effective scale management solutions is set to intensify. Countries like China, India, and the United States are investing in new power infrastructure, further augmenting the demand for antiscalants. Innovations in renewable energy projects, such as concentrated solar power, also contribute to market growth.

Technological Advancements and Product Innovations is driving market growth:

The development of innovative and eco-friendly antiscalant formulations is a significant growth driver. Manufacturers are focusing on creating biodegradable and phosphate-free products to comply with stringent environmental regulations. For instance, hybrid antiscalants with dual functionalities, such as scale inhibition and corrosion prevention, are gaining popularity. Additionally, advanced monitoring systems integrated with antiscalants allow for real-time adjustment of chemical dosing, optimizing water treatment processes. These technological advancements are enhancing the performance and applicability of antiscalants across various industries, solidifying their market presence.

Global Antiscalants Market Challenges and Restraints

Environmental Regulations and Compliance Costs is restricting market growth:

Strict environmental regulations regarding the disposal of chemicals used in water treatment processes pose a challenge for the antiscalants market. Many regions, including Europe and North America, have implemented stringent laws to reduce the environmental impact of water treatment chemicals. Manufacturers are required to develop environmentally friendly formulations, which often involve high research and development costs. Additionally, compliance with regulatory standards increases the operational costs for end-users. These factors can limit market growth, particularly for small and medium-sized enterprises with constrained budgets.

Volatility in Raw Material Prices is restricting market growth:

The production of antiscalants relies on raw materials such as phosphates and polymers, which are subject to price fluctuations due to supply chain disruptions, geopolitical tensions, and environmental policies. For example, restrictions on phosphate mining in certain countries have led to supply shortages, impacting production costs. Such volatility directly affects the pricing of antiscalants, making it challenging for manufacturers to maintain profitability. End-users may also seek alternative solutions, potentially reducing the market demand for antiscalants.

Market Opportunities

The antiscalants market offers significant growth opportunities, particularly in emerging economies where industrialization and urbanization are accelerating. Countries in Asia-Pacific, such as India and China, are investing heavily in infrastructure development, including water treatment facilities and power plants. These investments are creating a robust demand for efficient scale management solutions. Additionally, the increasing adoption of desalination technologies in arid regions like the Middle East and Africa is driving market expansion. Innovative product offerings, such as hybrid and biodegradable antiscalants, present opportunities for manufacturers to cater to environmentally conscious customers. Collaborations between industry players and research institutions to develop advanced formulations can further enhance market prospects. As industries prioritize sustainability, the antiscalants market is poised to capitalize on the growing emphasis on water conservation and resource efficiency.

ANTISCALANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Kemira Oyj, Ecolab Inc., Veolia Water Technologies, Solenis LLC, BWA Water Additives, Avista Technologies Inc., Clariant AG, Dow Chemical Company, Kurita Water Industries Ltd. |

Antiscalants Market Segmentation - By Type

-

Phosphonate-based antiscalants

-

Carboxylate-based antiscalants

-

Sulfonate-based antiscalants

-

Polymer-based antiscalants

-

Others

Phosphonate-based antiscalants are the dominant segment in the market, accounting for 35% of the total share in 2024. Their effectiveness in high-pressure and high-temperature environments, along with compatibility across various industries, has solidified their market leadership. These antiscalants are particularly preferred in desalination plants and power generation facilities for their superior scale prevention capabilities.

Antiscalants Market Segmentation - By Application

-

Water treatment

-

Power generation

-

Oil and gas

-

Mining

-

Desalination

-

Others

The water treatment segment is the most dominant application, representing 40% of the market share in 2024. This is driven by the rising need for clean water in both industrial and municipal settings. The adoption of advanced water treatment technologies and the growing emphasis on water reuse and recycling have amplified the demand for antiscalants in this segment.

Antiscalants Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region in the antiscalants market, contributing nearly 40% of global revenue in 2024. The region’s rapid industrialization, urbanization, and stringent water management regulations have driven the adoption of antiscalants across various industries. Countries like China and India are leading the charge, with significant investments in infrastructure development and water treatment facilities. The region’s growing focus on sustainable water management practices and the proliferation of desalination projects further bolster its market position.

COVID-19 Impact Analysis on the Antiscalants Market

The COVID-19 pandemic had a dual impact on the antiscalants market. Initially, disruptions in supply chains and a temporary slowdown in industrial activities led to a brief decline in market growth. Many sectors, especially those reliant on heavy manufacturing and infrastructure development, experienced a slowdown, which in turn affected the demand for antiscalants. However, as the pandemic continued, there was a shift in priorities that positively impacted certain segments of the market. The heightened global focus on hygiene, sanitation, and health led to increased demand for water treatment solutions, including antiscalants, to maintain a clean and reliable water supply. In particular, the water treatment industry saw a surge in the use of antiscalants, as they are essential in preventing scale formation in water systems, ensuring that the supply of clean water remained uninterrupted. This was especially crucial for residential areas and healthcare facilities, where access to water is critical. The pandemic also accelerated the adoption of technologies and solutions that could improve water efficiency and reduce wastage, further boosting the market for antiscalants. As lockdowns eased and infrastructure projects resumed, the antiscalants market regained momentum. Construction activities, including the development of new water treatment plants, led to a renewed demand for antiscalants. Moreover, the pandemic highlighted the importance of sustainable water management practices, positioning the antiscalants market for long-term growth. Moving forward, the market is expected to expand due to increased awareness about water conservation, the need for efficient water treatment solutions, and the adoption of environmentally friendly technologies in industrial applications.

Latest Trends/Developments

The antiscalants market is undergoing significant transformations driven by several key trends and developments. One of the most prominent trends is the growing emphasis on sustainability, which has led to the introduction of eco-friendly and biodegradable antiscalant formulations. These environmentally conscious products are gaining traction among industries that aim to reduce their environmental impact and meet stricter regulatory standards. As industries become more focused on green practices, the demand for sustainable antiscalants is expected to increase. In addition, advancements in technology are playing a pivotal role in optimizing antiscalant performance. Real-time chemical dosing systems are being integrated with antiscalants to provide more precise control over application, improving overall efficiency. These technologies help minimize waste, reduce operational costs, and ensure the optimal performance of antiscalants in various water treatment processes. Another key driver of the market is the rise of desalination projects, particularly in water-scarce regions where access to freshwater is limited. As desalination technologies evolve, there is a growing need for high-performance antiscalants capable of preventing scale formation in seawater treatment plants. This has spurred innovation, with manufacturers developing specialized antiscalant solutions to meet the unique challenges of desalination. Furthermore, strategic partnerships and acquisitions among major players in the antiscalants industry are reshaping the competitive landscape. These collaborations are enabling companies to leverage complementary expertise and resources, fostering the development of innovative solutions tailored to meet specific industrial needs. This dynamic environment is propelling the market forward, ensuring continued growth and the introduction of cutting-edge technologies in water treatment processes.

Key Players

-

BASF SE

-

Kemira Oyj

-

Ecolab Inc.

-

Veolia Water Technologies

-

Solenis LLC

-

BWA Water Additives

-

Avista Technologies Inc.

-

Clariant AG

-

Dow Chemical Company

-

Kurita Water Industries Ltd.

Chapter 1. Antiscalants Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Antiscalants Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Antiscalants Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Antiscalants Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Antiscalants Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Antiscalants Market – By Type

6.1 Introduction/Key Findings

6.2 Phosphonate-based antiscalants

6.3 Carboxylate-based antiscalants

6.4 Sulfonate-based antiscalants

6.5 Polymer-based antiscalants

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Antiscalants Market – By Application

7.1 Introduction/Key Findings

7.2 Water treatment

7.3 Power generation

7.4 Oil and gas

7.5 Mining

7.6 Desalination

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Antiscalants Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Antiscalants Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Kemira Oyj

9.3 Ecolab Inc.

9.4 Veolia Water Technologies

9.5 Solenis LLC

9.6 BWA Water Additives

9.7 Avista Technologies Inc.

9.8 Clariant AG

9.9 Dow Chemical Company

9.10 Kurita Water Industries Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Antiscalants Market was valued at USD 2.4 billion in 2024 and is projected to reach USD 3.7 billion by 2030, growing at a CAGR of 6.35

The market is driven by rising demand for clean water resources, growth in the power generation sector, and technological advancements in eco-friendly product formulations.

The market is segmented by type (phosphonate-based, carboxylate-based, sulfonate-based, polymer-based, and others) and by application (water treatment, power generation, oil and gas, mining, desalination, and others).

Asia-Pacific is the dominant region, contributing nearly 40% of global revenue in 2024.

Leading players include BASF SE, Kemira Oyj, Ecolab Inc., Veolia Water Technologies, and Solenis LLC.