Anticoccidial Drugs Market Size (2024-2030)

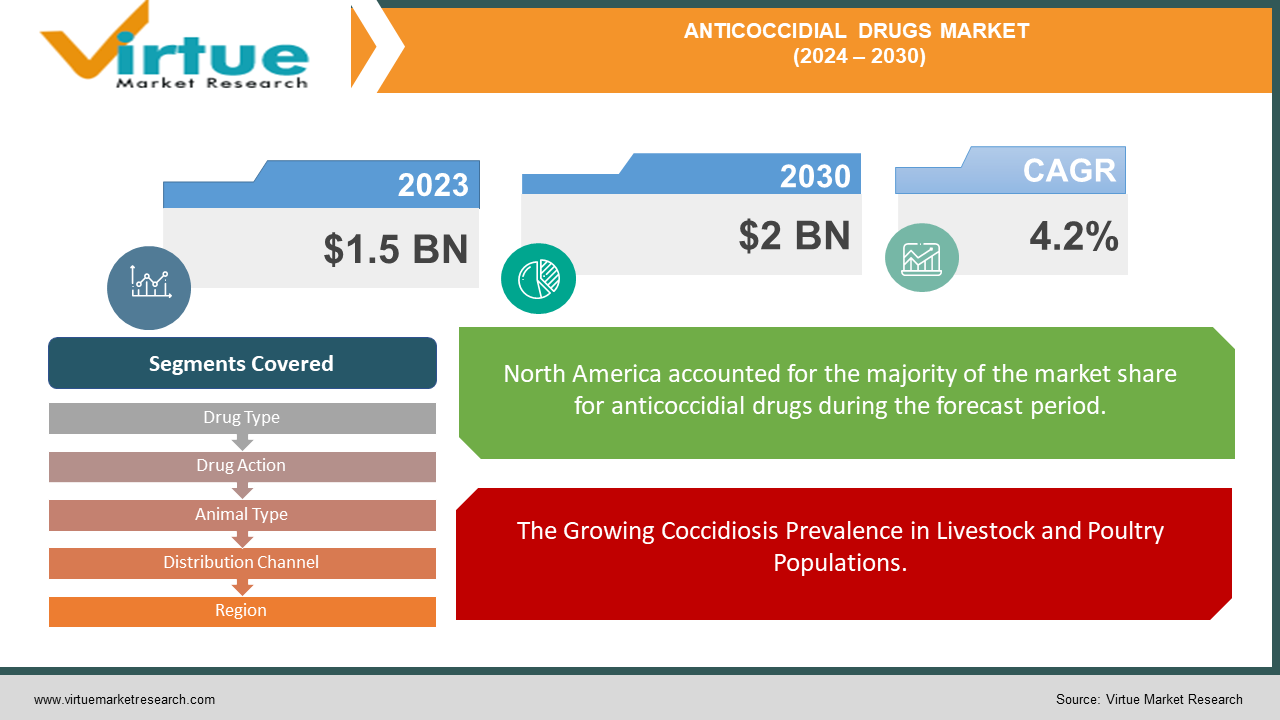

The Anticoccidial Drugs Market was valued at USD 1.5 billion in 2023 and is projected to reach a market size of USD 2 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 4.2%.

The global anticoccidial drugs market is experiencing growth driven by the increasing prevalence of coccidiosis, primarily in poultry. These drugs are crucial for preventing and treating this parasitic disease, which significantly impacts livestock productivity. Key factors driving market expansion include rising demand for poultry products, intensification of farming practices, and the development of new and effective anticoccidial compounds. The market is segmented based on drug type, animal type, and geographic region, with poultry dominating the animal segment.

Key Market Insights:

With almost 80% of the market, the poultry industry continues to be the biggest user of anticoccidial medications. This is explained by the fact that coccidiosis is very common in chickens and can result in large financial losses.

Concern is emerging over the rising incidence of antibiotic resistance (AMR) in coccidia. This is causing a change in focus toward coccidiosis prevention techniques and increasing demand for substitute anticoccidial drugs.

There is a moderate degree of market consolidation in the anticoccidial medication business, with a small number of key companies controlling sizable market shares. As businesses prioritize growing their product lines and geographic reach, this tendency is probably here to stay.

Anticoccidial Drugs Market Drivers:

The Growing Coccidiosis Prevalence in Livestock and Poultry Populations.

A major danger to animal health and productivity worldwide is coccidiosis, a parasite infection that mostly affects poultry and animals. Because of the disease's elevated death rates, decreased feed conversion efficiency, and slower growth rates, significant economic losses result. The escalating prevalence of coccidiosis, resulting from several factors like intensive farming methods, inadequate sanitation, and the rise of drug-resistant strains, has stimulated the market demand for efficacious anticoccidial medications.

The Increasing Need for Meat and Poultry Products.

The demand for foods high in protein, such as meat and poultry, has surged due to the growing worldwide population and rising disposable incomes. Livestock output has increased in response to this soaring demand, leading to crowded and unhygienic conditions that are perfect for the growth of coccidia. Anticoccidial medication is therefore becoming increasingly necessary to preserve animal health and avoid production losses, which is propelling market growth.

Stringent Government Regulations and Focus on Animal Welfare.

Governments worldwide are implementing stricter regulations to ensure the safety and well-being of livestock. The emphasis on preventing diseases, promoting animal welfare, and ensuring food safety has compelled livestock producers to adopt preventive measures, including the use of anticoccidial drugs. Moreover, the growing consumer awareness regarding animal welfare and food safety has indirectly influenced the demand for these drugs, as farmers strive to comply with regulatory standards and maintain consumer trust.

Innovation in the Creation of Anticoccidial Products.

Novel anticoccidial medications with improved safety profiles, decreased environmental impact, and increased efficacy has been introduced as a result of ongoing research and development activities. The creation of these cutting-edge products has given cattle producers more treatment alternatives, which has fueled market expansion. Further propelling market expansion is the focus on creating drug-resistant strains, which has increased demand for novel and potent anticoccidial medicines.

Anticoccidial Drugs Market Restraints and Challenges:

The effectiveness of current anticoccidial medications is seriously threatened by the growth of drug-resistant coccidia strains, which makes ongoing research and development of novel and potent chemicals necessary. Moreover, obstacles to new product launches and market entry are imposed by the strict regulatory environment around medicinal approvals and residual restrictions. For pharmaceutical companies, one of the biggest challenges is the high expense of research and development that comes with finding and creating novel anticoccidial medications. Reduced profit margins and price erosion might result from fierce competition among market participants. Alternative coccidiosis preventive strategies are in demand due to consumers' growing preference for natural and organic products; this could have an effect on the market for anticoccidial medications based on chemicals.

Furthermore, the profitability of companies that produce anticoccidial drugs may be impacted by changes in the global economy, including changes in the cost of raw materials and currency exchange rates. Furthermore, the use of several anticoccidial medications has raised environmental concerns, which have resulted in heightened scrutiny and possible limitations that could impede market expansion. The industry depends heavily on the availability of trained labor and knowledge in research and development; shortages in these areas can impede the development of new products and extend development timetables.

Anticoccidial Drugs Market Opportunities:

The market for anticoccidial medications offers a number of encouraging expansion prospects. The need for effective coccidiosis control strategies is being driven by the growing emphasis on animal welfare and preventative healthcare. Furthermore, there is a large market potential in developing economies due to the growing cattle and poultry industries. New market niches may be created by the creation of innovative anticoccidial substances with enhanced safety and effectiveness profiles. Furthermore, there is a rising market for natural and organic anticoccidial medications as an alternative to chemical-based ones, which presents prospects for the production of bio-based goods. Additionally, improved market penetration may result from the increased use of precision livestock farming technologies, which can improve disease management and maximize the use of anticoccidial medications.

Another significant opportunity is the possibility of growing into new geographic markets, especially in areas with developing cattle sectors. Furthermore, combination treatments that target several coccidial species and offer a wider range of protection have room to be developed. Pharmaceutical businesses, academic organizations, and livestock farmers can work together to promote innovation and expedite the creation of new products. Industry participants can achieve sustained growth and fortify their positions in the industry by seizing these chances.

ANTICOCCIDIAL DRUGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By Drug Type, Drug Action, Animal Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Zoetis, Merck Animal Health, Elanco, Bayer, Boehringer Ingelheim CP-Pharma, Huvepharma, DSM, Cargill, Nutreco |

Anticoccidial Drugs Market Segmentation: By Drug Type

-

Ionophores

-

Antibiotics

-

Sulfonamides

-

Chemical Derivatives

-

Others

Ionophores is the largest segment in the Anticoccidial Drugs Market. Because they are widely used in chicken production and are effective and affordable, ionophores have historically had the most market share of any of these. They remain a cornerstone in chicken husbandry because of their capacity to control coccidiosis and promote feed efficiency. Nonetheless, the advent and dissemination of drug-resistant strains of coccidia have mandated the creation of substitute therapeutic approaches. Because of this, the market's fastest-growing section is now chemical derivatives. New compounds with various mechanisms of action that provide efficient management over drug-resistant microorganisms are credited with this increase.

Anticoccidial Drugs Market Segmentation: By Drug Action

-

Coccidiostatic

-

Coccidiocidal

Coccidiostatic is the largest segment in the Anticoccidial Drugs Market. The industry's main segment is made up of coccidiostatics, which prevent coccidia parasites from growing without actually killing them. They have become widely used in poultry production due to their preventative nature and capacity to sustain subclinical illnesses, which offers ongoing protection. Still, a change to other strategies is required due to the rise of drug-resistant coccidia strains. The fastest-growing market niche is now coccidiocidal, which kills coccidia parasites. These medications are in higher demand due to their capacity to quickly lower parasite populations, especially during acute epidemics.

Anticoccidial Drugs Market Segmentation: By Animal Type

-

Poultry

-

Livestock

-

Companion Animals

The biggest market for anticoccidial medications is the poultry industry. Because coccidiosis is so common and chicken production is so intensive, there is a significant need for these drugs. On the other hand, the cattle market is expanding quickly while being smaller overall. Anticoccidial treatments for cattle, swine, and other livestock species have been developed in response to growing worries about animal health, productivity, and food safety.

Anticoccidial Drugs Market Segmentation: By Distribution Channel

-

Veterinary Hospitals and Clinics

-

Retail Pharmacies

-

Online Sales

Veterinary hospitals and clinics represent the largest distribution channel for anticoccidial drugs. Professional diagnosis, prescription, and administration of these drugs are provided by these channels. Although this market is still dominated, retail pharmacies are the distribution channel that is expanding the fastest because they are more easily accessible and convenient for owners of livestock, and there is a growing trend of over-the-counter medication for common animal ailments.

Anticoccidial Drugs Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America has dominated the anticoccidial drugs market due to established livestock industries and advanced healthcare infrastructure. However, the Asia-Pacific region has emerged as the fastest-growing market, driven by rapid economic expansion, increasing livestock populations, and growing awareness of animal health and productivity.

COVID-19 Impact Analysis on the Anticoccidial Drugs Market:

The market for anticoccidial medications was greatly impacted by the COVID-19 epidemic. Drug manufacturing and delivery were initially hampered by manpower shortages and supply chain interruptions. However as the epidemic spread, the need for disease prevention was highlighted by the increased attention being paid to animal health and food security. As a result, the market for anticoccidial medications steadied and even grew, especially in the chicken industry. Market dynamics were also impacted by the move to digital platforms for e-commerce, remote consultations, and information sharing. Notwithstanding ongoing difficulties, the sector proved resilient and adaptive, eventually resolving the crisis with creative problem-solving and tactical changes.

Latest Trends/ Developments:

The market for anticoccidial medications is changing dramatically. Drug development and delivery technologies need to be continuously innovative due to the rise of drug-resistant strains of coccidia. The demand for environmentally friendly and residue-free anticoccidial products is being driven by an increasing focus on animal welfare and sustainable agricultural techniques. Furthermore, individualized treatment plans and enhanced disease monitoring are now possible because of developments in digital technologies and precision medicine. The market is evolving as a result of consumers' growing knowledge of animal health issues and the growing emphasis on food safety.

Key Players:

-

Zoetis

-

Merck Animal Health

-

Elanco

-

Bayer

-

Boehringer Ingelheim CP-Pharma

-

Huvepharma

-

DSM

-

Cargill

-

Nutreco

Chapter 1. Anticoccidial Drugs Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2.Anticoccidial Drugs Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Anticoccidial Drugs Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Anticoccidial Drugs Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Anticoccidial Drugs Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Anticoccidial Drugs Market – By Drug Type

6.1 Introduction/Key Findings

6.2 Ionophores

6.3 Antibiotics

6.4 Sulfonamides

6.5 Chemical Derivatives

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Drug Type

6.8 Absolute $ Opportunity Analysis By Drug Type, 2024-2030

Chapter 7. Anticoccidial Drugs Market – By Drug Action

7.1 Introduction/Key Findings

7.2 Coccidiostatic

7.3 Coccidiocidal

7.4 Y-O-Y Growth trend Analysis By Drug Action

7.5 Absolute $ Opportunity Analysis By Drug Action, 2024-2030

Chapter 8. Anticoccidial Drugs Market – By Animal Type

8.1 Introduction/Key Findings

8.2 Poultry

8.3 Livestock

8.4 Companion Animals

8.5 Y-O-Y Growth trend Analysis By Animal Type

8.6 Absolute $ Opportunity Analysis By Animal Type, 2024-2030

Chapter 9. Anticoccidial Drugs Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Veterinary Hospitals and Clinics

9.3 Retail Pharmacies

9.4 Online Sales

9.5 Y-O-Y Growth trend Analysis By Distribution Channel

9.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10. Anticoccidial Drugs Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Drug Type

10.1.2.1 By Drug ActionApplication

10.1.3 By Animal Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Drug Type

10.2.3 By Drug ActionApplication

10.2.4 By Animal Type

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Drug Type

10.3.3 By Drug ActionApplication

10.3.4 By Animal Type

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Drug Type

10.4.3 By Drug ActionApplication

10.4.4 By Animal Type

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Drug Type

10.5.3 By Drug ActionApplication

10.5.4 By Animal Type

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Anticoccidial Drugs Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Zoetis

11.2 Merck Animal Health

11.3 Elanco

11.4 Bayer

11.5 Boehringer Ingelheim CP-Pharma

11.6 Huvepharma

11.7 DSM

11.8 Cargill

11.9 Nutreco

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Anticoccidial Drugs Market was valued at USD 1.5 billion in 2023 and is projected to reach a market size of USD 2 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 4.2%.

The anticoccidial drugs market is driven by factors such as increasing poultry and livestock production, rising prevalence of coccidiosis, and growing concerns about food safety.

The anticoccidial drugs market is primarily segmented by drug type, including ionophores, antibiotics, sulfonamides, chemical derivatives, and others.

North America is the most dominant region in the anticoccidial drugs market due to advanced poultry and livestock industries, stringent regulations, and high adoption rates.

Zoetis, Merck Animal Health, Elanco, Bayer, Boehringer Ingelheim, CP-Pharma, Huvepharma, DSM, Cargill, Nutreco.