Antibodies Market Size (2024-2030)

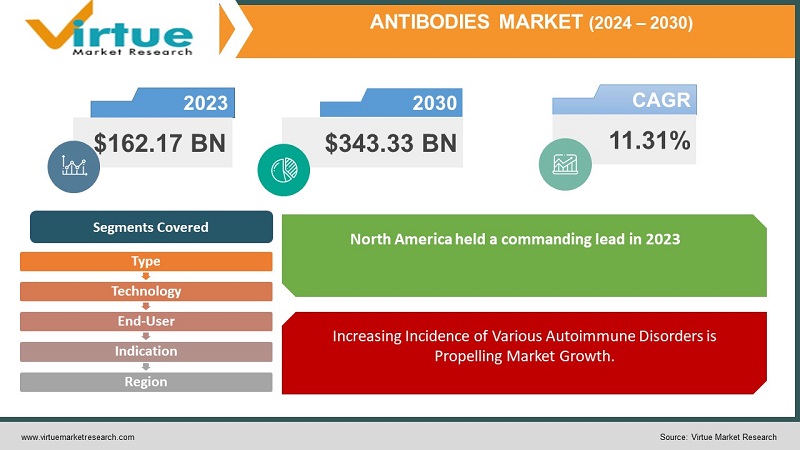

The Global Antibodies Market reached USD 162.17 Billion in 2023 and is projected to witness lucrative growth by reaching up to USD 343.33 Billion by 2030. The market is growing at a CAGR of 11.31% during the forecast period (2024-2030).

A substance referred to as an antibody, also known as immunoglobulin, is generated by plasma cells in response to specific antigens. These antibodies possess the potential to address various conditions, including malignancies, autoimmune disorders, inflammatory and infectious diseases, and others, in addition to serving diagnostic purposes. Therapeutic monoclonal antibodies find extensive applications in the fields of oncology, neurology, autoimmunology, and cardiology. The global antibody market is projected to expand with the increasing prevalence of chronic diseases. For instance, global reports from the World Health Organization in 2018 revealed 9.6 million fatalities and 18.1 million new cases of cancer. Antibodies are instrumental in treating cancer, autoimmune diseases, and various neurological problems. Autoimmune disorders affect approximately 4% of the world's population, as reported by the National Stem Cell Foundation (NSCF), with prevalent conditions such as diabetes, multiple sclerosis, Crohn's disease, and rheumatoid arthritis. As the occurrence of autoimmune diseases rises, the demand for antibodies is expected to grow. The escalating prevalence of cancer, coupled with its high mortality rate, has amplified the need for targeted treatments like antibody therapy. Recent technological advancements, such as targeting tumor antigens and enhancing immune cells' anti-tumor capabilities, contribute to the growth of antibody-based therapies. The antibody therapy market is poised to expand due to rapid technological progress and product development in cancer treatment.

Key Market Insights:

The antibody market is anticipated to witness growth in the upcoming years, and the demand for these services is expected to remain stable in emerging economies due to favorable economic conditions. The pharmaceutical industry's robust growth, particularly in developing economies, is creating numerous opportunities in this market. Additionally, increased research activities in life sciences industries, along with the expanding fields of proteomics and genomics research, are projected to drive market growth. Antibodies find diverse applications in autoimmune disorders, oncology, central nervous system disorders, neurobiology, cardiovascular disease, and other research areas, contributing to the market's stable growth globally. The market is further supported by an increase in research funding and growing investments from pharmaceuticals and biotechnology companies. Rapid growth in developing nations and a rising demand for personalized therapeutics are expected to provide substantial growth opportunities for market players in the forecast period.

Global Antibodies Market Drivers:

The Growth of the Antibodies Market is Being Fueled by the Availability of Cost-Effective Biosimilar Therapeutic Antibodies.

The availability of cost-effective biosimilar therapeutic antibodies is contributing significantly to the expansion of the Antibodies Market. This trend is linked to an increase in the rate of treatment seeking and greater patient acceptance. There is a rising demand for therapeutic antibodies, including both monoclonal and polyclonal types. Antibodies, being the primary biopharmaceuticals, target abnormal cells with precision. Consequently, numerous pharmaceutical and biotechnology companies are concentrating on the development of sophisticated antibodies for the treatment of chronic diseases such as cancer, rheumatic heart disease, and arthritis. A biosimilar version of Remicade received EU approval in 2013 and has since become globally available. The EU recently authorized two biosimilar antibodies for rheumatoid arthritis, and Novartis AG has tapped into significant market potential in the 28 EU member states. Advances in production technologies have reduced manufacturing costs, and the high price of drugs has become a critical factor in managing healthcare expenses. This trend is projected to bolster the growth of the Antibodies Market from 2024 to 2030.

Increasing Incidence of Various Autoimmune Disorders is Propelling Market Growth.

The rising incidence of various autoimmune disorders is contributing to the growth of the Antibodies Market. Autoimmune diseases attack healthy cells, organs, and tissues, potentially impacting any body part, weakening bodily functions, and becoming life-threatening. These diseases often have no cure and may require ongoing treatment to alleviate symptoms. Women are more susceptible to autoimmune disorders than men. This rising incidence is expected to drive the growth of the Antibodies Market through the forecast period of 2024-2030.

Patent Expiry of Key Monoclonal Antibodies is a Significant Market Growth Driver.

In the coming years, the patent expiry of several successful monoclonal antibodies, such as Avastin, Herceptin, and Mabthera, is anticipated to be a major factor driving market growth. For example, the patent for Herceptin (trastuzumab) expired in Europe in July 2014 and is set to expire in the United States in June 2019. Numerous companies, including Amgen Inc., Synthon, Biocon, and Pfizer Inc., are in the process of developing trastuzumab biosimilars, which is expected to stimulate the demand for antibody-producing products.

Global Antibodies Market Restraints and Challenges:

Adverse Effects of Antibodies May Restrict Market Expansion.

Market growth in the Antibodies sector could be constrained by adverse reactions associated with antibody therapies, such as allergic responses, complications related to infusions, and the potential for immunogenicity. These negative effects generate safety concerns, influencing patient adherence and market reception. Additionally, the possibility of developing resistance and the issue of cross-reactivity may further limit the effectiveness and sustainable use of antibody-based treatments, thereby impacting market development.

Expensive Therapeutic Antibodies and Concerns Over Quality and Reproducibility May Impede Market Growth.

Several factors that may hinder the expansion of the Antibodies Market include the high cost of therapeutic antibodies, concerns regarding their quality, and inconsistencies in achieving reproducible results. Discrepancies in antibody methodologies have led to insufficiently reproducible outcomes. There is a lack of standardized validation processes for reproducibility across various antibody products. These variations in antibodies can affect the outcomes of both research and clinical diagnostic tests. The process of developing monoclonal antibodies is both complex and time intensive. A significant challenge is that this technology requires extensive bioreactors and filtration systems for antibody production, which could hamper the global market for antibodies. The intricate and lengthy development process for monoclonal antibodies, compounded by the absence of established standards for validation reproducibility, is expected to restrain market growth during the forecast period from 2024 to 2030.

Global Antibodies Market Opportunities:

Amid the global upswing in healthcare expenditure, the Antibodies Market is encountering promising opportunities. Various countries are allocating significant resources to strengthen their healthcare systems, leading to an increased demand for advanced therapeutic solutions, including antibodies. The rising investment in healthcare infrastructure, coupled with a growing emphasis on personalized and targeted treatments, positions the Antibodies Market for substantial expansion. The augmented funding in research and development acts as a catalyst for innovation, facilitating the creation of novel antibody-based therapies. The upsurge in healthcare spending indicates a shift towards more effective and tailored healthcare solutions, providing a favorable environment for the Antibodies Market to flourish and make substantial contributions to enhancing patient outcomes across diverse therapeutic applications.

ANTIBODIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.31% |

|

Segments Covered |

By Type, Technology, End User, Indication, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abcam Plc., Merck KGaA, Thermo Fisher Scientific, Inc., Cell Signalling Technology, Inc., Santa Cruz Biotechnology Inc., PerkinElmer, Inc., Becton, Dickinson and Company, Bio-Techne Corporation, Proteintech Group, Inc., Jackson Immuno Research Inc. |

Global Antibodies Market Segmentation:

Global Antibodies Market Segmentation: By Type

- Monoclonal Antibodies [mAbs]

- Oncology,

- Autoimmune Diseases,

- Infectious Diseases

- Antibody-drug Conjugates [ADCs]

Monoclonal Antibodies [mAbs] {Oncology, Autoimmune Diseases, Infectious Diseases} and Antibody-drug Conjugates [ADCs] comprise the global market for antibodies. With a market share of 65% and a revenue of 2.9 million, the monoclonal antibodies [mAbs] {oncology, autoimmune disorders, infectious illnesses} category dominated the market. Monoclonal antibodies are commonly employed in the fields of neurology, cardiology, cancer, and autoimmunity. Monoclonal antibodies are employed in the creation and discovery of novel cancer treatment regimens, and their utilisation is linked to the rise in research endeavours requiring sophisticated genetic platforms.

Monoclonal antibodies are proteins produced in laboratories that replicate the functions of the immune system to combat dangerous diseases like viruses. As the prevalence of chronic diseases rises, the global market for antibodies is expected to grow. Furthermore, it is projected that the introduction of reasonably priced biosimilar antibody treatments will encourage market growth. For example, the World Health Organization (WHO) prequalified trastuzumab, a monoclonal antibody used to treat early-stage breast cancer, in December 2019. Trastuzumab typically costs $20,000 USD. Contrarily, trastuzumab biosimilars are usually 65% less costly than the original medication.

Global Antibodies Market Segmentation: By Technology

- Western Blotting

- Flow Cytometry

- Immunohistochemistry

- Immunofluorescence

- Immunoprecipitation

- Others

In the Antibodies Market, Western Blotting is the leading segment and is projected to expand at a compound annual growth rate (CAGR) of 11.1% over the forecast period. This is explained by the rise in the frequency of illnesses for which there are few effective treatments. Due to its higher accuracy, Western blotting is chosen for HIV antibody detection over alternative technologies like flow cytometry. Among other things, immunohistochemistry allows for the identification of antigens, tumours, enzymes, and the proliferation of tumour cells. In addition to rising healthcare costs, rising patient and professional awareness is driving up demand for high sensitivity and productivity, which is driving the segment's expansion. According to estimates, immunohistochemistry will grow at the fastest rate between 2024 and 2030.

Global Antibodies Market Segmentation: By End-User

- Hospitals

- Specialty Centers

- Research Institute

- Diagnostics laboratories

The antibodies market is divided into four categories based on the end-user: hospitals, specialty centres, research institutes, and diagnostic labs. With a market value of 2.7 million, the hospitals segment held the biggest market share of 60%. Hospitals often have an emergency department or trauma centre to handle life-threatening emergencies in addition to treating a wide range of illnesses and injuries.

Global Antibodies Market Segmentation: By Indication

- Cancer

- Autoimmune Diseases

- Infectious Diseases

- Cardiovascular Diseases

- CNS Disorders

- Others (Inflammatory, Microbial Diseases, & Others)

The cancer section holds the largest share during the predicted period, according to the indication. The body's aberrant cells have grown out of control over time, which has led to an increase in cancer cases. This is driving the cancer indication market to a considerable degree. However, it is projected that in the upcoming years, the market's growth rate would be dominated by the autoimmune diseases sector.

Global Antibodies Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

At 39.7% of the global antibody market, North America held a commanding lead in 2023. This is explained by the expansion of proteomics and genomics research as well as the presence of important figures from the biopharmaceutical and biotechnology industries. The market in this region is expanding due to a number of factors, including rising rates of cardiovascular disease, rising demand for antibodies for research reproductivity, government investments in higher healthcare spending, and rising development efforts to create efficient diagnostic treatments. Yet, due to rising investment in pharmaceuticals, bettering healthcare infrastructure, and an increase in research activities, Asia Pacific is predicted to develop at a faster CAGR between 2024 and 2030.

COVID-19 Impact Analysis on the Global Antibodies Market:

The COVID-19 pandemic has had a threefold impact on the economy, particularly affecting the pharmaceutical sector. It directly influenced drug production and demand, disrupted distribution networks, and exerted financial pressure on businesses and markets. The transportation of medications has been significantly hindered in various countries, including China, India, Saudi Arabia, the UAE, and Egypt, due to widespread lockdowns. However, this period has seen a favorable effect on the growth of the antibody market. For example, in January 2022, Biomed Central, a publisher of open access content, reported that the development and approval of vaccines and neutralizing antibodies (nAbs) for COVID-19 were expedited remarkably, thanks to global scientific collaboration. In a notable instance of rapid vaccine procurement, the U.S. government secured an early order of 100 million doses of Pfizer's BNT162b2 mRNA vaccine for a total of $1.95 billion on July 22, 2020. This was followed by additional orders, bringing the total to 500 million doses within a year.

Latest Trends/Developments:

March 2022 witnessed the announcement of a collaborative agreement between Sanofi, a prominent pharmaceutical and healthcare company, and Seagen Inc., a biotechnology firm. The partnership focuses on the design, development, and commercialization of antibody-drug conjugates (ADCs) targeting up to three cancer markers. The collaboration will leverage Sanofi's proprietary monoclonal antibody (mAb) technology and Seagen's proprietary ADC technology.

Key Players:

- Abcam Plc.

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Cell Signalling Technology, Inc.

- Santa Cruz Biotechnology Inc.

- PerkinElmer, Inc.

- Becton, Dickinson and Company

- Bio-Techne Corporation

- Proteintech Group, Inc.

- Jackson Immuno Research Inc.

Chapter 1. Global Antibodies Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Antibodies Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Antibodies Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Antibodies Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Antibodies Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Antibodies Market– By Type

6.1. Introduction/Key Findings

6.2. Monoclonal Antibodies [mAbs]

6.2.1. Oncology,

6.2.2. Autoimmune Diseases,

6.2.3. Infectious Diseases

6.2.4. Antibody-drug Conjugates [ADCs]

6.3. Y-O-Y Growth trend Analysis By Type

6.4. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Global Antibodies Market– By Technology

7.1. Introduction/Key Findings

7.2 Western Blotting

7.3. Flow Cytometry

7.4. Immunohistochemistry

7.5. Immunofluorescence

7.6. Immunoprecipitation

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Technology

7.9. Absolute $ Opportunity Analysis By Technology , 2024-2030

Chapter 8. Global Antibodies Market– By End-User

8.1. Introduction/Key Findings

8.2. Hospitals

8.3. Specialty Centers

8.4. Research Institute

8.5. Diagnostics laboratories

8.6. Y-O-Y Growth trend Analysis End-User

8.7. Absolute $ Opportunity Analysis Type, 2024-2030

Chapter 9. Global Antibodies Market– By Indication

9.1. Introduction/Key Findings

9.2. Cancer

9.3. Autoimmune Diseases

9.4. Infectious Diseases

9.5. Cardiovascular Diseases

9.6. CNS Disorders

9.7. Others (Inflammatory, Microbial Diseases, & Others)

9.8. Y-O-Y Growth trend Analysis Indication

9.9. Absolute $ Opportunity Analysis Indication , 2024-2030

Chapter 10. Global Antibodies Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By Technology

10.1.4. By Indication

10.1.5. End-User

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By Technology

10.2.4. By Indication

10.2.5. End-User

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Technology

10.3.4. By Indication

10.3.5. End-User

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Type

10.4.3. By Technology

10.4.4. By Indication

10.4.5. End-User

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Type

10.5.3. By Technology

10.5.4. By Indication

10.5.5. End-User

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Antibodies Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Abcam Plc.

11.2. Merck KGaA

11.3. Thermo Fisher Scientific, Inc.

11.4. Cell Signalling Technology, Inc.

11.5. Santa Cruz Biotechnology Inc.

11.6. PerkinElmer, Inc.

11.7. Becton, Dickinson and Company

11.8. Bio-Techne Corporation

11.9. Proteintech Group, Inc.

11.10. Jackson Immuno Research Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Antibodies Market reached USD 162.17 Billion in 2023 and is projected to witness lucrative growth by reaching up to USD 343.33 Billion by 2030. The market is growing at a CAGR of 11.31% during the forecast period (2024-2030).

The worldwide Global Antibodies Market growth is estimated to be 11.31% from 2024 to 2030.

The Global Antibodies Market is segmented by Type (Monoclonal Antibodies [mAbs] {Oncology, Autoimmune Diseases, Infectious Diseases}, and Antibody-drug Conjugates [ADCs]).

The growing use of monoclonal antibodies, customised treatment, and biotechnology developments are anticipated to be major trends in the global antibody market in the future. Opportunities to support further growth and innovation in the industry include the investigation of novel antibody forms, the development of biosimilars, and the expansion of therapeutic uses.

The global market for antibodies saw a notable increase as a result of the COVID-19 pandemic, mainly due to the pressing need for antibody-based treatments and diagnostics. During this time, monoclonal antibodies were developed and approved more quickly for use in both prevention and treatment, which led to a significant increase in investment and innovation in the field.