GLOBAL ANTI-REFLECTION OPTICAL COATINGS MARKET SIZE (2024 - 2030)

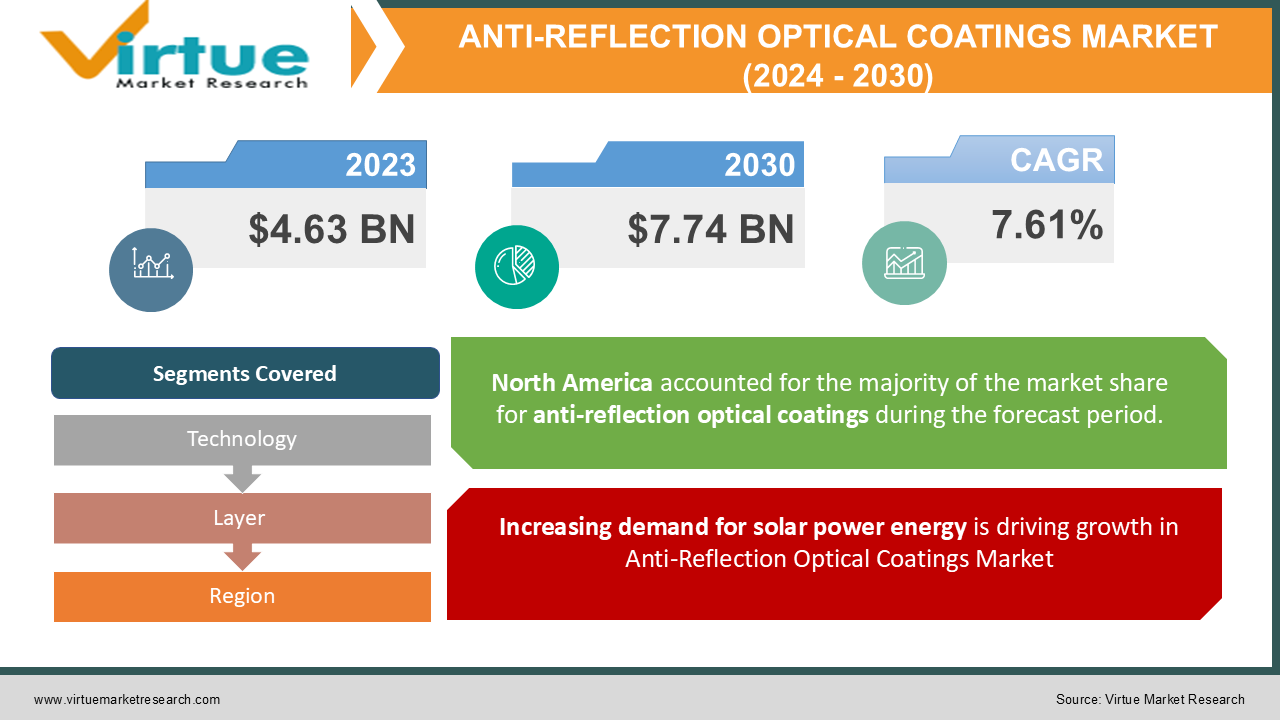

According to the report published by Virtue Market Research Global Anti-Reflection Optical Coatings market was valued at USD 4.63 Billion in 2023 and is projected to reach a market size of USD 7.74 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.61%.

Industry Overview:

Optically coated surfaces with anti-reflection properties lessen reflections from the optical surface. When applied to both simple imaging systems and complicated systems like telescopes and solar panels, these coatings improve visibility and contrast. Additionally, it effectively raises the lens surface's transmittance. Eyewear with anti-reflective coatings offers a clear view and is scratch, water, and dust resistant. When using a computer for prolonged periods of time, anti-reflective eyewear shields your eyes from glare, preventing eye strain and tiredness. The product's high cost is a significant roadblock to this market. The market for anti-reflective coatings has a tremendous chance to grow thanks to advancements in already-existing application technology.

COVID-19 Impact:

The electronics sector makes extensive use of infrared and Anti-Reflection Optical Coatings because to the increased demand for improved optical display and impact resistant capabilities. Over the projection period, it is anticipated that the expanding semiconductor sector and technological improvements would increase demand for these optical coatings. The demand for consumer electronics items is being impacted by the global reduction in discretionary expenditure for COVID-19. It is additionally projected that this will reduce consumer electronics product need for optical coatings. Due to its great impact and abrasion resistance, it is utilised in speedometer displays in the automotive industry. Over the course of the forecast period, it is predicted that increasing use of optical coatings in a variety of automotive components, including as headlight lenses, car windows, windshields, and gear knob tops, will propel market expansion. The vehicle sector also uses coatings for components that are UV and abrasion resistant.

MARKET DRIVERS

Increasing demand for solar power energy is driving growth in Anti-Reflection Optical Coatings Market

The solar power generating and telecommunications sectors' growing demand is anticipated to be the main driver of growth for the Anti-Reflection Optical Coatings industry. Optical thin film coatings called Anti-Reflection Optical Coatings work to cut down on reflections from a range of surfaces. These coatings decrease light loss due to reflection, increasing transmission. Nearly 4% of light striking glass at a perpendicular angle is lost due to reflection at the point where glass and air come into contact. With an increase in the light's incidence angle, more light is lost in these situations. Light that is reflected is wasted light, especially for solar panels.

Rise in adoption of anti-reflective coating in various industries is driving growth in Anti-Reflection Optical Coatings Market

The global market is being driven by the expansion of anti-reflective coating applications in products like eyewear, solar, cars, and electronics. The eyeglass industry is now the largest user of Anti-Reflection Optical Coatings and is anticipated to continue ranking among the market's most promising end-use segments in the coming years. The market shows a demand for Anti-Reflection Optical Coatings for lenses and eyeglasses with comfortable frames and strong light transmission.

MARKET RESTRAINTS

Supply chain issues is restraining growth in Anti-Reflection Optical Coatings Market

Due to supply chain disruptions and a complete cessation of company operations in the worldwide Anti-Reflection Optical Coatings industry, the global coronavirus pandemic has had an effect on practically all industries and business operations. Players in the global market for Anti-Reflection Optical Coatings are facing difficulties brought on by the epidemic. The market for Anti-Reflection Optical Coatings is anticipated to expand significantly during the next years.

ANTI-REFLECTION OPTICAL COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.61% |

|

Segments Covered |

By Technology, Layer and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Essilor International, Carl Zeiss AG, E. I. du Pont de Nemoursand Company, Koninklijke DSM N.V., Honeywell International, PPG Industries, Hoya Corporation, Viavi Solutions, Inc., Optical Coatings Japan, Rodenstock GmbH , Eksma Optics, Evaporated Coatings, Inc., Torr Scientific Limited, Optics Balzers, Enki Technology |

This research report on the global Anti-Reflection Optical Coatings Market has been segmented and sub-segmented based on technology, layer, and region.

Anti-Reflection Optical Coatings market segmentation – By Technology

1. Vacuum Deposition

2. Electronic Beam

3. Evaporation

4. Sputtering

5. Others

The market for antireflective optical coatings worldwide is dominated by the vacuum deposition segment. A number of procedures are used in vacuum deposition technology to deposit layers of the necessary material onto the optical surface. At temperatures below the atmospheric pressure, vacuum deposition is effective. Due to its exceptionally low environmental effect and greatest versatility, vacuum deposition technology is generally employed for the application of Anti-Reflection Optical Coatings. Vacuum deposition has a number of benefits, such as making the environment for the procedure ecologically sound and repeatable. The technology-segmented anti-reflective optical coating market's overall share is most influenced by evacuation. This is a result of this technology's rising use in anti-reflective coating applications. Demand is anticipated to increase as a result of factors like more affordable coating technology and uniform anti-reflective optical coating application. Vacuum deposition uses little coating time and exemplifies how flexible coating processes may be. These elements present an excellent chance to use this technology

Anti-Reflection Optical Coatings market segmentation – By Layer

1. Single Layered

2. Multi Layered

The market for antireflective optical coatings worldwide is dominated by the single layer category. A single layer of anti-reflective optical coating that only covers a small portion of the visible spectrum is included in single layer coatings. The primary reason for its supremacy is that it is less expensive than multi-layered coatings and has comparable hardness and endurance. Impact evaluation for COVID-19 Global trade has been devastated by COVID-19, which has also had disastrous consequences on households, businesses, financial institutions, industrial enterprises, and infrastructural firms. It is anticipated that the market's short-term demand will be constrained by restrictions on international trade and tightening rules on the activities of the chemicals sector. Since the pandemic knocked on the doors of numerous worldwide marketplaces, the market has slowed significantly. The government's lockdown caused a significant halt of market activity, and participants were forced to bear the consequences in the form of losses, a shortage of skilled personnel, unavailability of raw materials for production, and much more. Only operating during the permissible hours, the market was unable to meet demand and, as a result, disrupted the supply chain mechanism during the time period.

Anti-Reflection Optical Coatings market segmentation – By Region

1. North America

2. Europe

3. Asia-Pacific

4. South America

5. Middle East and Africa

Four geographic regions are used to assess the worldwide antireflective coatings market: North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America had the biggest market share of the overall revenue. Due to the region's rising consumer goods consumption, it is projected that the high adoption of antireflective optical coatings products will continue to support the market size for these products. The global market for antireflective optical coatings is dominated by the eyewear industry. Nearly 34 million Americans over the age of 40 have myopia, according to the U.S. Department of Health and Human Services. As of October 2021, the World Health Organization (WHO) estimates that 2.2 billion individuals worldwide have short- or long-range visual impairment. As more and more people have presbyopia, the need for progressive lenses has risen quickly. Presbyopia is a disorder that makes reading at close range challenging as the crystalline lens of the eye ages and grows tougher. An inexpensive alternative to decreasing glare reflected from computer screens, televisions, flat panel displays, and other electronic displays is to use anti-reflection lenses. Anti-Reflection Optical Coatings are used to offer low reflectivity and prevent glare. This lowers eye fatigue, making the display simpler to read, and enhances visual perception. A favourable chance for market growth is presented by the existence of general marketing circumstances. The antireflective optical coatings industry is dominated by North America, which includes nations including the United States, Canada, and Mexico. A profitable potential for the market's expansion has been generated in this area due to the rise in demand for Anti-Reflection Optical Coatings in eyewear applications and the expansion of their use in consumer products including smartphones, cameras, and flat panel displays. Another significant factor influencing the growth of the market in this area is the rise in consumer goods consumption. The market growth was accelerated by the existence of significant important players in this area and the demand for antireflective optical coatings across various manufacturing industries.

Anti-Reflection Optical Coatings market segmentation – By Company

1. Essilor International

2. Carl Zeiss AG

3. E. I. du Pont de Nemoursand Company

4. Koninklijke DSM N.V.

5. Honeywell International

6. PPG Industries

7. Hoya Corporation

8. Viavi Solutions, Inc.

9. Optical Coatings Japan

10. Rodenstock GmbH

11. Eksma Optics, Evaporated Coatings, Inc.

12. Torr Scientific Limited

13. Optics Balzers

14. Enki Technology

15. Zygo Corporation

16. Spectrum Direct Ltd.

17. Quantum Coating

18. Lumentum Operations LLC

19. Majestic Optical Coatings

20. Optimum RX Len

Specialists are among the other participants in the antireflective coatings industry value chain that are competing for market share through product launches, joint ventures, partnerships, and expansion of the product.

NOTABLE HAPPENINGS IN THE ANTI-REFLECTION OPTICAL COATINGS MARKET IN THE RECENT PAST:

• In October 2022, Tiya Lens launched eyeglasses which would provide drivers better vision in challenging circumstances.

• In September 2022, Optics Balzers launched high resolution spectrometer for high resolution image taking.

Chapter 1. ANTI-REFLECTION OPTICAL COATINGS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ANTI-REFLECTION OPTICAL COATINGS MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. ANTI-REFLECTION OPTICAL COATINGS MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. ANTI-REFLECTION OPTICAL COATINGS MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. ANTI-REFLECTION OPTICAL COATINGS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ANTI-REFLECTION OPTICAL COATINGS MARKET – By Technology

6.1. Vacuum Deposition

6.2. Electronic Beam

6.3. Evaporation

6.4. Sputting

6.5. Others

Chapter 7. ANTI-REFLECTION OPTICAL COATINGS MARKET – By Crop Type

7.1. Single Layered

7.2. Multi Layered

Chapter 8. ANTI-REFLECTION OPTICAL COATINGS MARKET – By Region

8.1. North America

8.2. Europe

8.3. Asia-P2acific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. ANTI-REFLECTION OPTICAL COATINGS MARKET – By Companies

9.1. Essilor International

9.2. Carl Zeiss AG

9.3. Koninklijke DSM N.V.

9.4. Honeywell International

9.5. PPG Industries

9.6. Hoya Corporation

9.7. Viavi Solutions, Inc.

9.8. Optical Coatings Japan

9.9. Rodenstock GmbH

Download Sample

Choose License Type

2500

4250

5250

6900