Global Anti-Pigmentation Product Market Size (2023 – 2030)

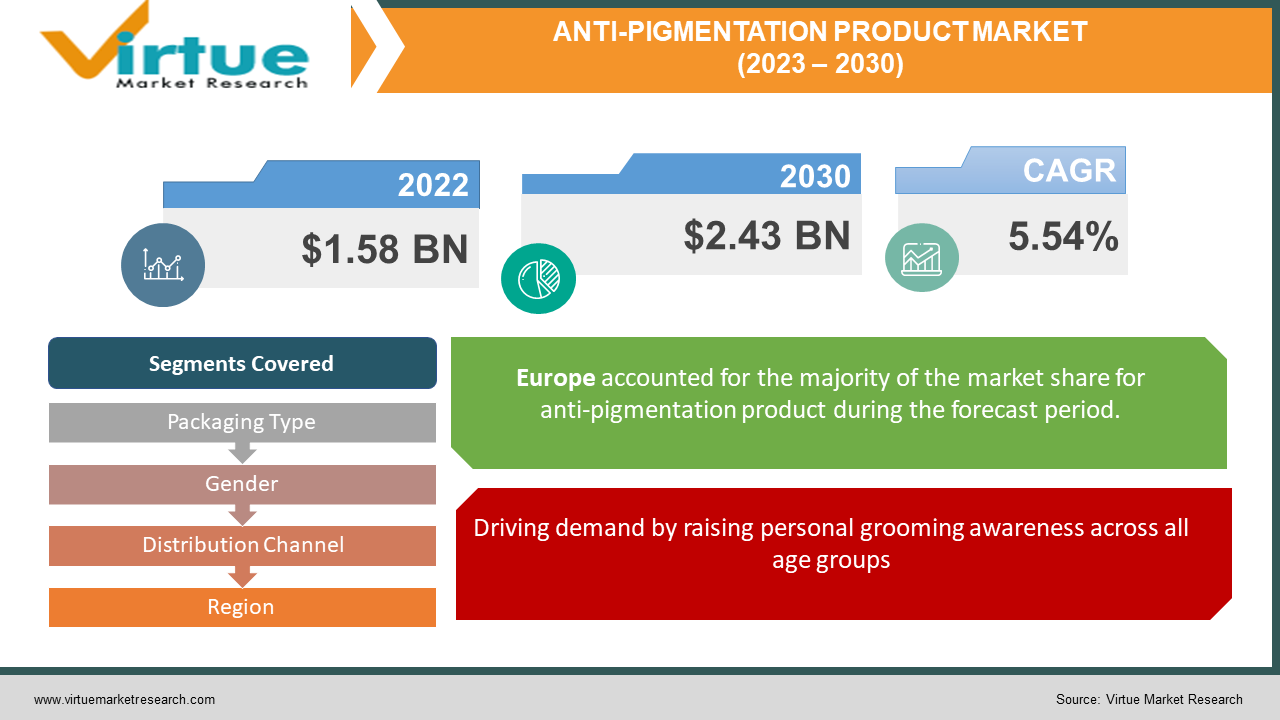

In 2022, the Global Anti-Pigmentation Product Market was valued at $1.58 billion, and is projected to reach a market size of $2.43 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 5.54%. Consumers are becoming more motivated to use skin care products early on due to increased knowledge of skin conditions and accessible treatments, which is assisting the market's expansion.

The look of human skin is improved and maintained with the help of skincare products. Alpha-hydroxy acids, beta-hydroxy acids, and retinol are among the main constituents in several products that are sold on the market, including cleansers, toners, body lotions, oils and serums, and creams. These solutions support the normal replacement of the skin's ageing cells and fight wrinkles, fine lines, and age spots while preserving the skin's general health. Due to regional variations and the broad variety of skin types found worldwide, the market for skin care products is very diverse globally.

Due to exposure to outside causes including ultraviolet (UV) radiation and pollution, the skin is one of the organs that sustains the most damage. As a result, there has been a rise in the general public's propensity to maintain a regular skin care regimen, making it a crucial component of personal well-being. Due to this, a variety of products with diverse chemical and herbal components have been developed to improve and maintain overall healthy skin. Due to increased disposable income, intense marketing campaigns, and the introduction of novel items by producers, urban regions in particular have seen an increase in customers' preference for various skin care products. More and more women are choosing anti-ageing products, which make up a significant portion of the skin care products industry, which is another factor driving the market.

MARKET DRIVERS:

Driving demand by raising personal grooming awareness across all age groups

The need for skin nutrition products has grown as a result of growing worries about skin nourishment brought on by a variety of issues, including the rise in acne, black spots, scars, dullness, and tanning. The younger population is more in need of skin-brightening products, toners, and scrubs, while the older population is becoming more and more in need of wrinkle-relieving goods and treatments that treat cracked heels. It is anticipated that shifting consumer purchasing habits and lifestyles would boost the market's overall expansion. Furthermore, as people become more aware of the negative consequences of prolonged sun exposure, the demand for anti-pigmentation lotions and creams is expanding. For instance, a poll by Unilever in February 2021 of 10,000 participants from nine nations, including the U.S., India, and China, revealed that 74% of the respondents preferred the beauty and personal care business, which places a greater emphasis on improving people's feelings. Additionally, the growing popularity of men's grooming goods, aggressive marketing campaigns by manufacturers, and the move toward digitization have raised consumer awareness of skin care products. Due to these considerations, male end consumers had a greater desire for goods like fairness creams and aftershave creams.

Market expansion is anticipated to be fueled by rising consumer demand for sustainable goods

With the usage of skin-nourishing products, consumers are now concentrating on their wellness and are also attracted to utilize ecologically friendly goods. For instance, plastic beads included in exfoliating skincare products pose a significant threat to plastic pollution, thus customers are more likely to choose alternatives. Initiatives are being taken by businesses like BioPowder to create biodegradable microbeads that will be utilized in exfoliating products without creating any trash. Additionally, businesses are concentrating on lowering their carbon footprint by using new production techniques that use less energy and resources. Additionally, there is a big desire for new, environmentally friendly product packaging that is recyclable or refillable. Additionally, consumer demand has changed toward vegan ingredients, which are solely sourced from plant-based products, as a result of growing awareness of animal rights. As a result, industry participants are concentrating on creating vegan items to draw in more customers and boost their profits.

MARKET RESTRAINTS:

Misuse and excessive usage may harm cells and impede growth

Regular use of anti-pigmentation products over a lengthy period can harm the skin, causing rashes, discoloration, burning sensations, and accelerated ageing of skin cells. Some skin nutrition products, including those for dry or oily skin, are specifically designed to be used on specific skin types. However, people frequently neglect other product features in favor of the brand name when making purchases, which harms their skin. Few items can also cause allergic responses and the emergence of pimples because they include chemicals that are inappropriate for the specific user. Additionally, heavy usage might cause serious problems like skin cancer and melanoma. These are some of the main restraints that are to blame for impeding market expansion.

ANTI-PIGMENTATION PRODUCT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.54% |

|

Segments Covered |

By Packaging Type, Gender, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

THE PROCTER & GAMBLE COMPANY (OLAY), THE ESTÉE LAUDER COMPANIES INC., L'ORÉAL S.A., BEIERSDORF AG,SHISEIDOCOMPANYLIMITED, HINDUSTAN UNILEVER LIMITED (LAKME),COLGATE-PALMOLIVE COMPANY, JOHNSON & JOHNSON INC., KAO CORPORATION, REVLON, INC |

Segmentation Analysis

ANTI-PIGMENTATION PRODUCT MARKET – BY PACKAGING TYPE:

- Tube

- Bottle

- Jar

- Others

Based on the packaging type, the anti-pigmentation product market is segmented into tubes, bottles, Jars and Others. Tubes are anticipated to account for a sizable portion of the market since they are easy to use and handle and are small. They are easily transported since they are lightweight, take up less room than bottles, and make product application easier than jars and bottles. When the lid of a jar is opened, the contents of the jar may often be exposed to air and light, which might cause contamination or the product's active components to degrade. This is not the case with tubes. Bottles are most suited for liquid items including serum, oils, and toner. The tube, however, may be utilized for the majority of items and is a safer and more sanitary option. Another prediction is that the skincare market share of the bottle packaging category will increase noticeably. The producers concentrate on creating distinctive, appealing lotion and serum bottles with recyclable and biodegradable materials. The bottle packaging increases the shelf life of the stored goods since it is durable. The jars, which come in a variety of sizes and forms, are also frequently used to package cosmetic goods. They provide enough room to hold lotions and serums and are either constructed of glass or plastic.

ANTI-PIGMENTATION PRODUCT MARKET – BY GENDER:

- Men

- Women

Based on gender the anti-pigmentation product market is segmented into Men and Women. The demand for products is increasing as a result of the female population's increased awareness of the many items on the market for various uses. For instance, the Benchmarking company's 2018 U.S.-focused study found that more than 50% of women in the 18–24 age range wished to incorporate anti-pigmentation products into their daily regimen for skin hydration. But reasons including shifting customer preferences and a rise in men's knowledge of and desire to care for their skin and appearance have prompted the creation and introduction of new products.

Due to rising awareness of personal grooming and health care, the male market is also anticipated to occupy a sizeable position. The market expansion for such items has been aided by the growing interest in facial products. This is due to the important importance that men's appearances now play in their life. As a result, the skin care business now has more room to flourish.

ANTI-PIGMENTATION PRODUCT MARKET - BY DISTRIBUTION CHANNEL:

- Cosmetic stores

- Supermarkets/Hypermarkets

- Online Channel

- Others

Based on the distribution channel the anti-pigmentation product market is segmented into Cosmetic stores, Supermarkets/Hypermarkets, Online channels and Others. Cosmetic stores are specialty shops where all cosmetic items are offered and clients may physically inspect the product information. These shops supply clients with personalized kits that come with a variety of cosmetic goods bundled together and are offered at a discounted price to entice customers. Compared to hypermarkets and supermarkets, cosmetic stores are more likely to carry the newest goods. Additionally, cosmetic store employees receive training so they can assist customers in selecting the right goods for their needs. Therefore, it is anticipated that these variables would accelerate the segment's expansion of cosmetic retailers.

Due to the large availability of several categories of personal care items under one roof, supermarkets and hypermarkets are also predicted to contribute a sizeable portion of the market. The simplicity and convenience of purchasing such items from supermarkets and hypermarkets are anticipated to boost sector growth. Due to the widespread availability of branded skin support goods on online shopping platforms like Myntra, Amazon, Flipkart, etc., online channels also play a significant part in the segment's growth. The items are easily accessible on several purchasing platforms with cheap offers, are covered by cashback policies, and have simple return procedures, all of which are beneficial to the segment's expansion.

ANTI-PIGMENTATION PRODUCT MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Anti-Pigmentation Product Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. Due to the region's improving standard of living, expanding working-class population, and rising purchasing power of the people, Asia Pacific is predicted to occupy a sizeable part of the market. For example, THE India Brand Equity Foundation study on FMCG, which was released in May 2018, stated that overall consumer spending in India was USD 1,595 billion in 2018 and that this amount is estimated to increase to USD 3,600 billion in the coming few years. In addition, people in nations like China, India, Japan, and others are spending more money on personal care and wellness goods due to changing lifestyles and rising disposable income, which will raise demand for the items. Additionally, increased availability of a broad variety of brands and rising awareness of skin nutrition products are likely to drive the anti-pigmentation skincare market growth in the Asia Pacific. For instance, the Japan Cosmetics Industry Association reports that among all shipments of cosmetics reported in Japan, skincare products held the largest market share, accounting for 50.1% of total shipments.

On the international market, Europe is anticipated to have a sizable market share. Both men and women in Europe are more focused on enhancing their overall skin condition because they care more about how they seem. Additionally, the stronger presence of important competitors operating in the market and the larger purchasing power of the local population in the area are both contributing to the industry's growth.

ANTI-PIGMENTATION PRODUCT MARKET - BY COMPANIES

Some of the major players operating in the Anti-Pigmentation Product Market include:

-

THE PROCTER & GAMBLE COMPANY (OLAY)

-

THE ESTÉE LAUDER COMPANIES INC.

-

L'ORÉAL S.A.

-

BEIERSDORF AG

-

SHISEIDO COMPANY, LIMITED

-

HINDUSTAN UNILEVER LIMITED (LAKME)

-

COLGATE-PALMOLIVE COMPANY

-

JOHNSON & JOHNSON INC.

-

KAO CORPORATION

-

REVLON, INC

COVD-19 IMPACT ON THE ANTI-PIGMENTATION PRODUCT MARKET

The market for beauty and personal care products experienced the same turmoil as other industries during the COVID-19 pandemic. Lockdown laws were enacted by several countries throughout the world, and factories and manufacturing facilities in various industries stopped operating. Due to the lockdown procedures being followed by numerous firms, the supply chain was severely interrupted. Throughout the pandemic, the market for cosmetics and personal care items saw a sharp decrease. For instance, the worldwide cosmetics market had a loss of 8% year over year in 2020, according to L'Oréal, a leader in the beauty and personal care business. According to BAIRD, an American international independent investment bank, this was most impacted during the pandemic's early phases, when cosmetic retail sales declined by 32%. The bulk of the world's population has received vaccinations, though, and countries are enhancing lockdown procedures as a result. As a result, over the projected period of 2022–2030, the market for personal care and beauty products is anticipated to expand considerably.

NOTABLE HAPPENING IN THE ANTI-PIGMENTATION PRODUCT MARKET

-

PRODUCT LAUNCH- KVD beauty, a division of LVMH, introduced New Good Apple Lightweight Full-Coverage Concealer in 2022. The concealer's ultra-concentrated InterLace Pigments mix seamlessly into the skin for coverage that resists creasing and has the most brightness.

-

PRODUCT LAUNCH- Beiersdorf introduced the Personalized Face Care New Brand O.W.N. in 2021. Exclusively What's Needed" - O.W.N only employs components created especially for each customer's unique skincare requirements.

-

ACQUISITION- L'Oréal announced a deal to buy California-based American skincare firm Youth of the People on December 8, 2021. A company called Youth of the People creates and sells high-performance skincare products using formulae that combine science with premium vegan mixes of superfood ingredients.

-

PRODUCT LAUNCH- A subsidiary of Kao Corporation, e'quipe, LTD., stated in December 2019 that its new brand, 'athletic,' will debut on February 19, 2020. The skincare line will sell items like the "tune & charge," "active & go," and "breathe & sleep" rings.

Chapter 1. ANTI-PIGMENTATION PRODUCT MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ANTI-PIGMENTATION PRODUCT MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. ANTI-PIGMENTATION PRODUCT MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. ANTI-PIGMENTATION PRODUCT MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. ANTI-PIGMENTATION PRODUCT MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ANTI-PIGMENTATION PRODUCT MARKET – By Packaging Type

6.1. Tube

6.2. Bottle

6.3. Jar

6.4. Others

Chapter 7. ANTI-PIGMENTATION PRODUCT MARKET – By Gender

7.1. Men

7.2. Women

Chapter 8. ANTI-PIGMENTATION PRODUCT MARKET – By Distribution Channel

8.1. Cosmetic store

8.2. Supermarkets/Hypermarkets

8.3. Online Channel

8.4. Others

Chapter 9. ANTI-PIGMENTATION PRODUCT MARKET – By Region

9.1. North America

9.2. Europe

9.3. The Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. ANTI-PIGMENTATION PRODUCT MARKET – By Companies

10.1. THE PROCTER & GAMBLE COMPANY (OLAY)

10.2. THE ESTÉE LAUDER COMPANIES INC.

10.3. L'ORÉAL S.A.

10.4. BEIERSDORF AG

10.5. SHISEIDO COMPANY, LIMITED

10.6. HINDUSTAN UNILEVER LIMITED (LAKME)

10.7. COLGATE-PALMOLIVE COMPANY

10.8. JOHNSON & JOHNSON INC.

10.9. KAO CORPORATION

10.10. REVLON, INC

Download Sample

Choose License Type

2500

4250

5250

6900