Anthocyanin based Natural Food Colorants Market Size (2024 – 2030)

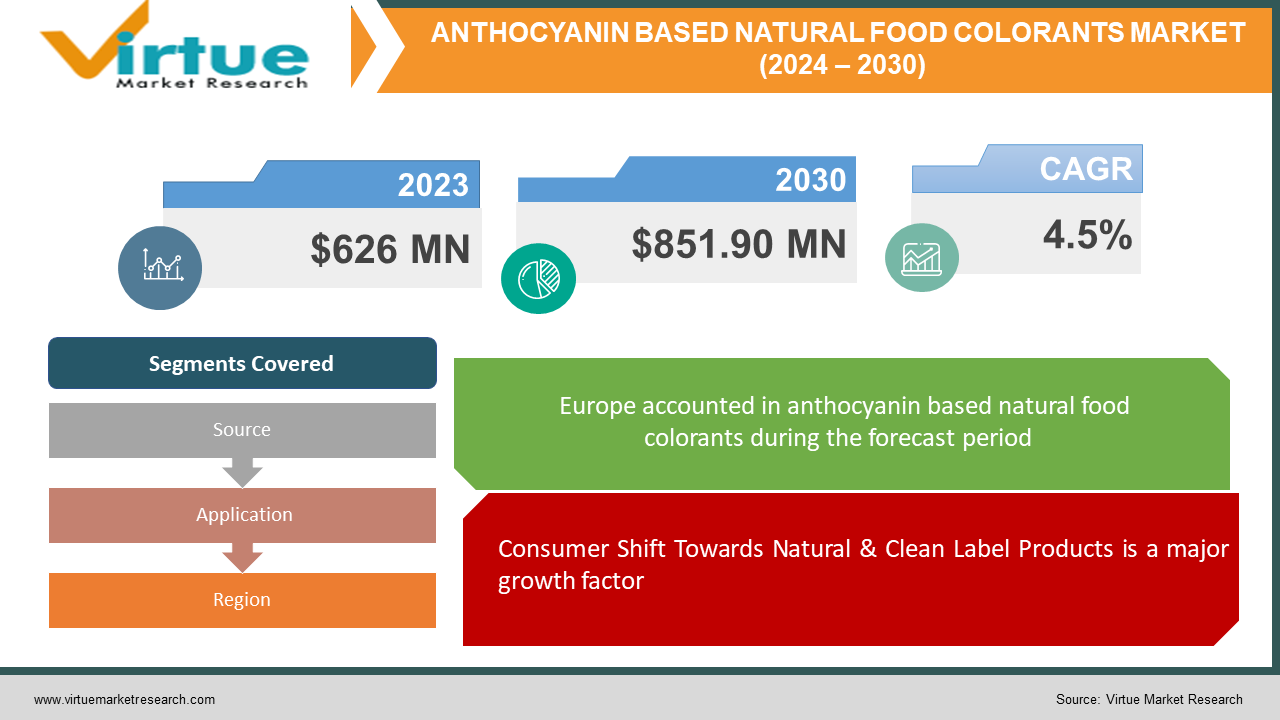

The Global Anthocyanin based Natural Food Colorants Market was valued at USD 626 million in 2023 and is projected to reach a market size of USD 851.90 million by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 4.5%.

Key Market Insights:

Anthocyanins are finding applications beyond traditional food and beverage products. Their antioxidant and health benefits are leading to their use in the nutraceutical and pharmaceutical industries. The market for anthocyanin-based colorants shows regional variations. Europe and North America are currently the leading markets due to stricter regulations on synthetic food colorants and a higher consumer awareness of natural ingredients. However, the Asia Pacific region is expected to witness the fastest growth due to a rising middle class with increasing disposable income and a growing demand for processed food products.

Market Drivers:

Consumer Shift Towards Natural & Clean Label Products is a major growth factor.

Fueled by a growing health-conscious population, the demand for natural and clean-label ingredients is surging. Anthocyanin-based colorants, derived from natural sources like berries and grapes, perfectly align with this trend. They offer vibrant colors without synthetic additives or perceived side effects, driving market growth. The market for Anthocyanin food colorants has witnessed a significant rise due to this increasing consumer awareness and preference.

Consumer Shift Towards Natural & Clean Label Products is driving the market growth

The booming popularity of plant-based and vegan diets is creating a significant market driver for anthocyanin colorants. These natural colorants provide a viable alternative to synthetic dyes that may not be vegan-friendly. They cater to the growing demand for plant-derived options in food and beverage products, expanding the market reach of anthocyanin colorants.

Technological Advancements in Extraction & Formulation is giving market a boost.

Advancements in extraction techniques and formulation methods are improving the stability and performance of anthocyanin colorants. This allows for a wider range of applications and overcomes some limitations that previously hindered their use. These advancements are opening new possibilities for anthocyanin colorants in the food industry, propelling market growth.

Market Restraints and Challenges:

Stability Issues and Color Variations is a challenge for the market

Anthocyanins are susceptible to degradation due to factors like pH, light, temperature, and presence of enzymes. This instability can lead to color fading and reduced functionality in food products, posing a challenge for manufacturers. Ensuring consistent color and extended shelf life requires careful processing, storage conditions, and potentially formulation strategies, which can add complexity and cost.

Limited Source Availability and Seasonal Variations is a major challenge

The natural sources of anthocyanins can be seasonal and geographically limited. This can lead to fluctuations in supply and pricing, making it difficult for manufacturers to secure consistent and cost-effective supplies of high-quality anthocyanin extracts. Additionally, the concentration of anthocyanins in source materials can vary depending on factors like weather conditions and agricultural practices, impacting color consistency.

Regulatory Landscape and Consumer Perception is restricting the market growth

The regulatory landscape for natural food colorants can vary by region. Obtaining regulatory approval for new anthocyanin sources or extraction methods can be a lengthy and complex process. Additionally, consumer awareness of anthocyanins is still developing in some regions. Educating consumers about the benefits and safety of these natural colorants can be crucial for market acceptance.

Market Opportunities:

Functional Food & Beverage Applications is opening new doors for the market

The growing consumer interest in functional foods and beverages that offer health benefits beyond basic nutrition presents a significant opportunity for anthocyanin colorants. Since anthocyanins possess well-documented antioxidant and potential anti-inflammatory properties, incorporating them into functional food and beverage products can create a win-win situation. Manufacturers can leverage the natural colorant properties while also appealing to health-conscious consumers seeking products with added functionality.

Novel Extraction & Processing Technologies is a major opportunity

Advancements in extraction and processing technologies hold the potential to unlock new opportunities for anthocyanin colorants. These advancements could lead to the development of more stable, concentrated, and cost-effective anthocyanin extracts. Additionally, research into encapsulation technologies could further improve the stability and functionality of anthocyanins in food applications, expanding their potential uses. By overcoming some of the existing limitations associated with anthocyanin colorants, these technological advancements can create exciting new market opportunities.

ANTHOCYANIN BASED NATURAL FOOD COLORANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Source, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Chr. Hansen A/S, Symrise, FMC Corporation, Archer Daniels Midlands Co., D. Williamson & Co. Inc., Kalsec Inc., BASF SE, DDW, Sensient Technology Corporation, WILD Flavors |

Anthocyanin based Natural Food Colorants Market Segmentation: By Source

-

Fruits

-

Vegetables

-

Legumes & Cereals

Fruits, vegetables, legumes, and even some cereals offer a vibrant tapestry of anthocyanin sources. Berries like blueberries, black currants, and açai are well-known powerhouses, alongside red grapes, cherries, and plums. Among vegetables, purple cabbage, red onions, and eggplant boast significant anthocyanin content. Black beans, red kidney beans, and certain colored corn varieties like purple corn also contribute to the diverse source pool.

This variety presents a strategic advantage. Manufacturers can leverage the unique color profiles of different sources. For instance, anthocyanins from red cabbage may impart a beautiful blue hue, while those from berries might offer a range of reds and purples. Additionally, some sources may hold potential health benefits beyond just color. Research suggests anthocyanins from berries may offer additional antioxidant properties, aligning perfectly with the growing demand for functional food products. However, challenges remain. Seasonal variations and limited source availability in certain regions can impact cost and consistency. Here, advancements in extraction and processing technologies like microencapsulation offer exciting opportunities to improve the stability and functionality of anthocyanins from a wider range of sources, unlocking their full potential in the food and beverage industry.

Anthocyanin based Natural Food Colorants Market Segmentation: By Application

-

Food & Beverages

-

Pharmaceutical Products

-

Personal Care

Traditionally, anthocyanins have reigned supreme as natural colorants in the food and beverage industry, currently holding a dominant share of over 40% according. Here, they bring vibrant hues to candies, yogurts, beverages, and other products, catering to the growing consumer preference for natural alternatives to synthetic dyes. But the story doesn't end there. Anthocyanins are increasingly recognized for their potential health benefits, opening doors to exciting new applications.

Their well-documented antioxidant properties and emerging research on anti-inflammatory and anti-cancer effects are propelling anthocyanins into the realm of pharmaceuticals and nutraceuticals. Studies suggest they may be valuable ingredients in functional foods and nutraceuticals aimed at boosting overall health and well-being. Similarly, the potential of anthocyanins to combat free radical damage and protect against UV rays holds promise for the personal care sector. Formulations that enhance anthocyanin stability and functionality in cosmetic products could unlock their full potential in the fight against visible signs of aging and promote healthy skin. This diversification of applications beyond food coloring signifies a significant shift in the anthocyanin market. As research into their health benefits continues, we can expect anthocyanins to play an increasingly prominent role in promoting health and wellness across various sectors.

Anthocyanin based Natural Food Colorants Market Segmentation: By Region

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

The global anthocyanin market exhibits significant regional variations. Currently, Europe holds the dominant position, accounting for roughly 43% of the market share as of 2023. This dominance can be attributed to stricter regulations on synthetic food colorants in Europe, coupled with a strong consumer preference for natural and clean-label products. North America follows closely behind, driven by a similar health-conscious consumer base and a well-established food and beverage industry that readily adopts natural ingredients.

However, the Asia-Pacific region is projected to witness the fastest growth in the coming years. This rapid growth is fueled by a burgeoning middle class with increasing disposable income and a growing demand for processed food products. Additionally, rising awareness of the health benefits associated with anthocyanins is expected to drive market expansion in this region. While South America and the Middle East & Africa currently hold a smaller market share, the increasing focus on natural ingredients and growing health concerns present promising opportunities for future development. As regulatory frameworks evolve and consumer awareness expands in these regions, the anthocyanin market is poised for significant growth on a global scale.

COVID-19 Impact Analysis on the Global Anthocyanin based Natural Food Colorants Market:

The COVID-19 pandemic caused a temporary disruption to the anthocyanin market. The initial lockdowns and restrictions on movement led to supply chain disruptions and labor shortages. This impacted the production and availability of anthocyanin extracts, particularly those derived from fresh fruits and vegetables. Additionally, the closure of restaurants and limitations on social gatherings caused a decline in demand for certain food and beverage products that utilize anthocyanin colorants.

However, the pandemic also presented some unforeseen opportunities. The heightened focus on health and immunity during COVID-19 led to increased consumer interest in functional foods and nutraceuticals.

Latest Trends/Developments:

Micronization and Encapsulation Technologies:

Traditionally, anthocyanins faced limitations due to their sensitivity to factors like light, heat, and pH. However, advancements in micronization and encapsulation technologies are offering promising solutions. These techniques involve creating tiny capsules around anthocyanin molecules, protecting them from degradation and improving their stability and functionality in food applications. This paves the way for a wider range of uses and potentially longer shelf life for anthocyanin-coloured products.

Exploration of Novel Sources:

While berries and grapes remain popular sources of anthocyanins, researchers are exploring alternative sources with unique colour profiles and potentially additional functionalities. For example, studies are investigating anthocyanins from purple sweet potatoes, black carrots, and even pigmented corn varieties. This diversification broadens the options available to manufacturers and allows them to potentially tailor anthocyanin use based on desired colour and potential health benefits associated with specific sources.

Focus on Sustainability and Clean Label Appeal:

The growing consumer demand for sustainable and clean-label ingredients is influencing the anthocyanin market. Manufacturers are increasingly seeking extraction methods that minimize environmental impact and utilize organic or non-GMO source materials. Additionally, research into upcycling food by-products rich in anthocyanins, such as pomace from wine production, is gaining traction. This focus on sustainability and clean label production aligns with consumer preferences and positions anthocyanins favourably in the marketplace.

Key Players:

-

Chr. Hansen A/S

-

Symrise

-

FMC Corporation

-

Archer Daniels Midlands Co.

-

D. Williamson & Co. Inc.

-

Kalsec Inc.

-

BASF SE

-

DDW

-

Sensient Technology Corporation

-

WILD Flavors

Chapter 1. Anthocyanin based Natural Food Colorants Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Anthocyanin based Natural Food Colorants Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Anthocyanin based Natural Food Colorants Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Anthocyanin based Natural Food Colorants Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Anthocyanin based Natural Food Colorants Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Anthocyanin based Natural Food Colorants Market – By Application

6.1 Introduction/Key Findings

6.2 Food & Beverages

6.3 Pharmaceutical Products

6.4 Personal Care

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Anthocyanin based Natural Food Colorants Market – By Source

7.1 Introduction/Key Findings

7.2 Fruits

7.3 Vegetables

7.4 Legumes & Cereals

7.5 Y-O-Y Growth trend Analysis By Source

7.6 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 8. Anthocyanin based Natural Food Colorants Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Source

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Source

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Source

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Source

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Source

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Anthocyanin based Natural Food Colorants Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Chr. Hansen A/S

9.2 Symrise

9.3 FMC Corporation

9.4 Archer Daniels Midlands Co.

9.5 D. Williamson & Co. Inc.

9.6 Kalsec Inc.

9.7 BASF SE

9.8 DDW

9.9 Sensient Technology Corporation

9.10 WILD Flavors

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Anthocyanin based Natural Food Colorants Market was valued at USD 626 million in 2023 and is projected to reach a market size of USD 851.90 million by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 4.5%.

Key drivers include the Consumer Shift Towards Natural & Clean Label Products, Plant-Based & Vegan Product Popularity, and Technological Advancements in Extraction & Formulation.

Europe dominates the market with a significant share of over 43%.

Chr. Hansen A/S, Symrise, FMC Corporation, Archer Daniels Midlands Co., D. Williamson & Co. Inc., Kalsec Inc., BASF SE, DDW, Sensient Technology Corporation, and WILD Flavors are some leading players in the Global Anthocyanin based Natural Food Colorants Market.

Anthocyanins are susceptible to degradation due to factors like pH, light, temperature, and presence of enzymes. This instability can lead to color fading and reduced functionality in food products, posing a challenge for manufacturers.