Anode Binders Market Size (2025-2030)

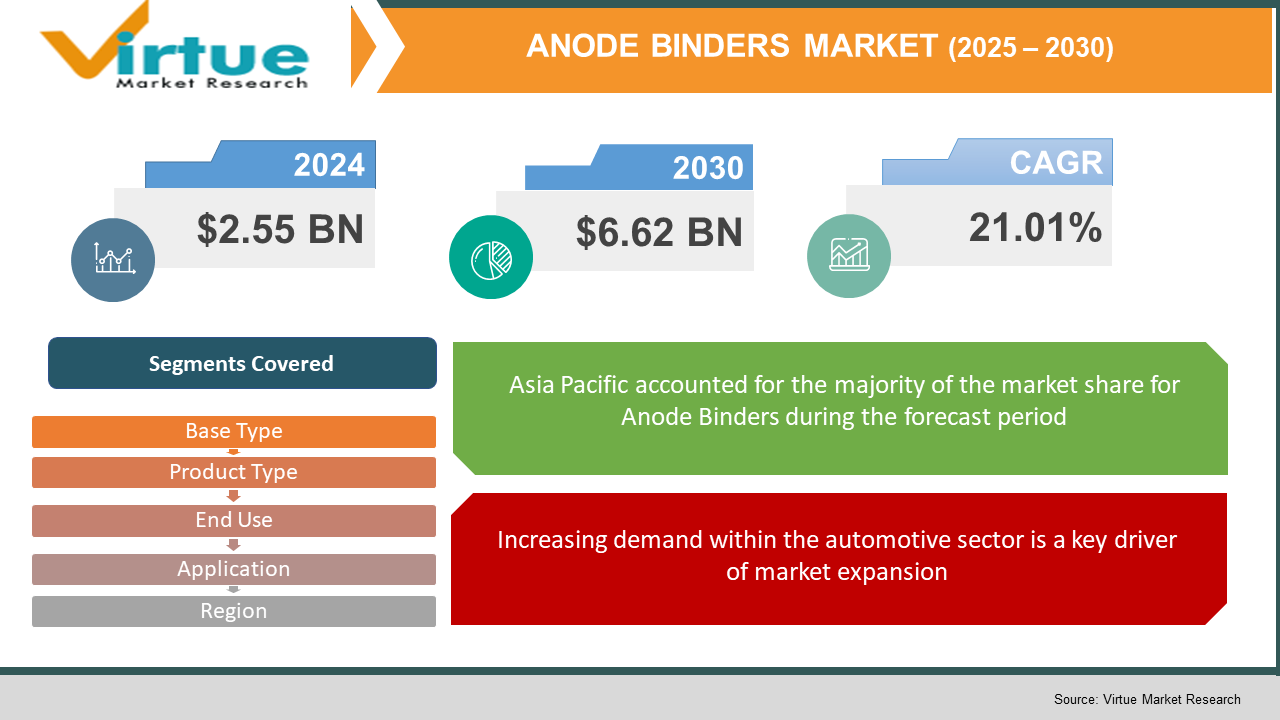

The Anode Binders Market was valued at USD 2.55 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 6.62 billion by 2030, growing at a CAGR of 21.01%.

Key Market Insights:

The growing emphasis on advanced energy storage solutions is driving the demand for high-performance batteries, which in turn is fueling the need for specialized materials such as anode binders. These binders are essential in reinforcing the structural stability and enhancing the electrochemical properties of battery electrodes, thereby contributing significantly to overall battery efficiency and lifespan.

As the market continues to advance, a comprehensive understanding of its dynamics becomes increasingly important for industry participants. The expansion of the anode binder market is influenced not only by rising consumer needs but also by innovations in technology and supportive regulatory policies aimed at promoting sustainable energy practices. Anode binder technology stands out as a critical component in this space, emphasizing the enhancement of battery performance and safety, particularly in applications requiring high energy capacity. This technology addresses the distinct requirements of both battery manufacturers and end-users, ensuring that materials used are effective, reliable, and environmentally sustainable.

Anode Binders Market Drivers:

Increasing demand within the automotive sector is a key driver of market expansion.

The electric vehicle market is projected to witness significant growth in the coming years, primarily driven by the implementation of stringent environmental regulations and emission control standards.

Rising environmental awareness and the increasing preference for clean and sustainable fuel alternatives have contributed to the growing demand for electric vehicles.

In battery technology, the choice of anode material plays a critical role in determining charging speed and, with higher energy density, contributes to extending the vehicle’s driving range per charge.

The automotive sector's shift toward electrification is encouraging manufacturers to innovate and develop advanced binder materials such as polyvinylidene fluoride (PVDF), which enhance battery performance and dependability. Furthermore, the growing focus on renewable energy sources and energy storage solutions continues to drive the demand for premium-quality binders capable of supporting the evolving landscape of sustainable energy technologies.

The increasing adoption of renewable energy sources is a significant factor contributing to market growth.

The ongoing shift toward renewable energy sources, including solar and wind, is significantly increasing the demand for efficient energy storage systems, thereby contributing to the growth of the anode binders market.

Steer-by-wire technology, which operates entirely through electronic controls, enables enhanced flexibility and allows for tailored steering responses. This system is anticipated to transform vehicle design by reducing overall weight and enhancing driving dynamics, especially in the context of electric and autonomous vehicles.

As steer-by-wire technology continues to advance, it offers a strategic opportunity for industry players to lead in innovation within the evolving automotive landscape.

Anode Binders Market Restraints and Challenges:

Elevated raw material costs act as a barrier to market expansion.

The fluctuating prices of raw materials, especially carbon-based compounds utilized in the production of anode binders, pose a significant challenge for the industry. This volatility can result in elevated manufacturing costs, which may adversely affect profit margins for producers.

In addition, increasing concerns regarding the environmental footprint of certain raw materials have led to heightened regulatory oversight. As a result, manufacturers are under growing pressure to explore and implement more sustainable alternatives in their production processes.

Intense market competition serves as a constraint on overall market growth.

The anode binder market is characterized by intense competition among manufacturers, often resulting in price wars that exert pressure on profit margins.

Moreover, the technological intricacies associated with developing advanced anode binder formulations can impede the pace of innovation. Companies must also contend with a complex regulatory environment, which varies widely across regions and presents additional challenges in terms of market entry and product compliance.

To remain competitive, it is essential for manufacturers to stay informed about evolving regulatory standards and shifting consumer preferences, both of which play a critical role in shaping the future of the anode binder industry.

Anode Binders Market Opportunities:

The innovation and development of environmentally sustainable binder materials are becoming increasingly important to meet the growing demand for clean energy solutions. Industry players are making substantial investments in research and development to design binders that deliver high performance while remaining cost-effective and eco-friendly.

For example, the rising emphasis on utilizing carboxymethyl cellulose (CMC) and styrene butadiene copolymer (SBR) in battery manufacturing presents a significant opportunity for companies to expand their market presence. This trend is particularly prominent in regions like Asia-Pacific, where the demand for electric vehicles and energy storage systems is rapidly accelerating.

ANODE BINDERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

21.01% |

|

Segments Covered |

By Product Type, base type, application, end use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arkema, Synthomer PLC and LG Chem. |

Anode Binders Market Segmentation:

Anode Binders Market Segmentation By Base Type:

- Water Based Type

- Solvent Based Type

The water-based segment accounted for a substantial portion of the market and is expected to maintain this dominance throughout the forecast period.

Additionally, the rising sales of consumer electronics are projected to further support the expansion of the water-based segment within the anode binder market during the forecast timeframe.

Anode Binders Market Segmentation By Product Type:

- Silicon-based Anodes

- Graphite-based Anodes

The graphite-based anode segment maintains a significant market share, a position projected to continue over the forecast period. Graphite has consistently been recognized as a premier anode material, holding a dominant role in the lithium-ion battery (LIB) industry since its early development. This dominance is due to graphite’s exceptional balance of low cost, abundance, high energy and power density, and extended cycle life. Recent studies suggest that the lithium storage capabilities of graphite can be further enhanced, underscoring its promising role in the future development of advanced LIBs for electric vehicles and large-scale energy storage applications.

The significant market share of the graphite-based anode segment can be attributed to its widespread use in commercial lithium-ion batteries. Furthermore, growing demand from the electronics manufacturing sector is expected to bolster the growth of this segment during the forecast period. Although alternative anode materials, such as silicon, are emerging, graphite is projected to maintain a dominant position in the anode binder market, primarily due to its continued extensive use in lithium-ion battery production.

Silicon (Si) is recognized as a promising anode material for next-generation lithium-ion batteries owing to its high theoretical capacity. However, silicon experiences substantial volumetric expansion during lithiation, which results in cracking, pulverization, and diminished long-term electrochemical stability. To address these challenges, various innovative strategies have been proposed, leading to a rapidly growing and diverse field of research aimed at overcoming these limitations.

Anode Binders Market Segmentation By End Use:

- Li-ion Battery

- NI-MH Battery

- Others

The lithium-ion battery segment captured a notable share of the market, and this trend is anticipated to persist over the forecast period. This substantial market share is primarily driven by the expanding use of lithium-ion batteries in consumer electronics. Consequently, this growth is anticipated to support the increasing demand for anode binders tailored specifically for lithium-ion battery applications during the forecast timeframe.

The electrochemical reaction at the positive electrode in nickel-metal hydride (NiMH) batteries closely resembles that of nickel–cadmium (NiCd) cells, as both utilize nickel oxide hydroxide (NiOOH).

The ‘others’ segment is projected to experience substantial compound annual growth rate (CAGR) during the forecast period, driven by the expanding applications of anode binders across various battery technologies. Specifically, the NiMH battery segment is expected to hold a notable share of the anode binder market, supported by its increasing adoption in energy storage solutions.

Anode Binders Market Segmentation By Application:

- Automotive

- Consumer Electronics

- Telecommunication

- Industrial

- Other

The automotive sector commands the largest share within the application segment, propelled by advancements in dry battery electrode technology that underscore ongoing innovation in this field.

Additionally, the consumer electronics and energy storage sectors are experiencing rapid growth, driven by increasing demand for batteries with extended lifespans in devices such as smartphones, laptops, and renewable energy systems. This diversification across various applications is expected to sustain the overall growth momentum of the market.

Anode Binders Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Asia Pacific held a significant share of the global market and is expected to witness strong and sustained growth over the forecast period.

North America is expected to maintain a significant market share during this timeframe, supported by increased investments in research and development as well as the presence of established manufacturers specializing in batteries and related chemical products.

In Europe, the expanding automotive sector alongside the growing energy storage and consumer electronics industries are anticipated to drive growth in the anode binder market during the forecast period.

COVID-19 Pandemic: Impact Analysis

Adverse conditions resulting from the COVID-19 pandemic hindered market growth in the previous year, with numerous end-user industries experiencing significant disruptions that constrained overall market expansion. However, by 2022, the situation began to stabilize, and the market has since shown steady recovery and consistent growth.

Latest Trends/ Developments:

BASF has expanded its portfolio of lithium-ion anode binders to support the production of Li-ion batteries. Its Licity 2698 X F, a second-generation styrene-butadiene rubber (SBR) binder, enables the incorporation of silicon content exceeding 20%. This binder enhances battery capacity, increases the number of charge/discharge cycles, and reduces charging times, while retaining the established performance characteristics of the Licity product family.

In addition, Licity 2698 X F is produced using BASF’s biomass balance method, which involves incorporating renewable biomass into the production process and allocating it specifically for binder manufacturing. From the procurement of raw materials to the final delivery, BASF demonstrates a strong commitment to integrating environmental sustainability and social responsibility into its operational practices.

Moreover, the American chemical manufacturer Ashland has developed an innovative waterborne binder designed specifically for high-performance silicon-based anodes in lithium-ion battery applications. The Soteras MSi anode binder can increase the capacity of lithium-ion batteries by up to 30% when combined with silicon. This technology holds significant potential, especially for cell manufacturers serving the electric vehicle market, as it aims to enhance energy density.

Key Players:

These are top 10 players in the Anode Binders Market :-

Chapter 1. Anode Binders Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Anode Binders Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Anode Binders Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Anode Binders Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Anode Binders Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Anode Binders Market– By Base Type

6.1 Introduction/Key Findings

6.2 Water Based Type

6.3 Solvent Based Type

6.4 Y-O-Y Growth trend Analysis By Base Type

6.5 Absolute $ Opportunity Analysis By Base Type, 2025-2030

Chapter 7. Anode Binders Market– By Product Type

7.1 Introduction/Key Findings

7.2 Silicon-based Anodes

7.3 Graphite-based Anodes

7.4 Y-O-Y Growth trend Analysis By Product Type

7.5 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 8. Anode Binders Market– By End-User

8.1 Introduction/Key Findings

8.2 Li-ion Battery

8.3 NI-MH Battery

8.4 Others

8.5 Y-O-Y Growth trend Analysis End-User

8.6 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 9. Anode Binders Market– By Application

9.1 Introduction/Key Findings

9.2 Automotive

9.3 Consumer Electronics

9.4 Telecommunication

9.5 Industrial

9.6 Other

9.7 Y-O-Y Growth trend Analysis Application

9.8 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 10. Anode Binders Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Base Type

10.1.3. By End-User

10.1.4. By Product Type

10.1.5. Application

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Base Type

10.2.3. By End-User

10.2.4. By Product Type

10.2.5. Application

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Base Type

10.3.3. By Application

10.3.4. By Product Type

10.3.5. End-User

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Application

10.4.3. By Product Type

10.4.4. By Base Type

10.4.5. End-User

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By End-User

10.5.3. By Application

10.5.4. By Product Type

10.5.5. Base Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. ANODE BINDERS MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 Arkema

11.2 Synthomer PLC

11.3 LG Chem

11.4 SUMITOMO SEIKA CHEMICALS CO., LTD

11.5 KUREHA CORPORATION

11.6 DAIKIN INDUSTRIES, Ltd.

11.7 ZEON CORPORATION

11.8 Resonac Holdings Corporation

11.9 ENEOS Corporation

11.10 TORAY INDUSTRIES, INC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growing emphasis on advanced energy storage solutions is driving the demand for high-performance batteries, which in turn is fueling the need for specialized materials such as anode binders.

The top players operating in the Anode Binders Market are - Arkema, Synthomer PLC and LG Chem

Adverse conditions resulting from the COVID-19 pandemic hindered market growth in the previous year, with numerous end-user industries experiencing significant disruptions that constrained overall market expansion

Its Licity 2698 X F, a second-generation styrene-butadiene rubber (SBR) binder, enables the incorporation of silicon content exceeding 20%.

Asia Pacific is the fastest-growing region in the Anode Binders Market.