Animation and VFX Market Size (2024 – 2030)

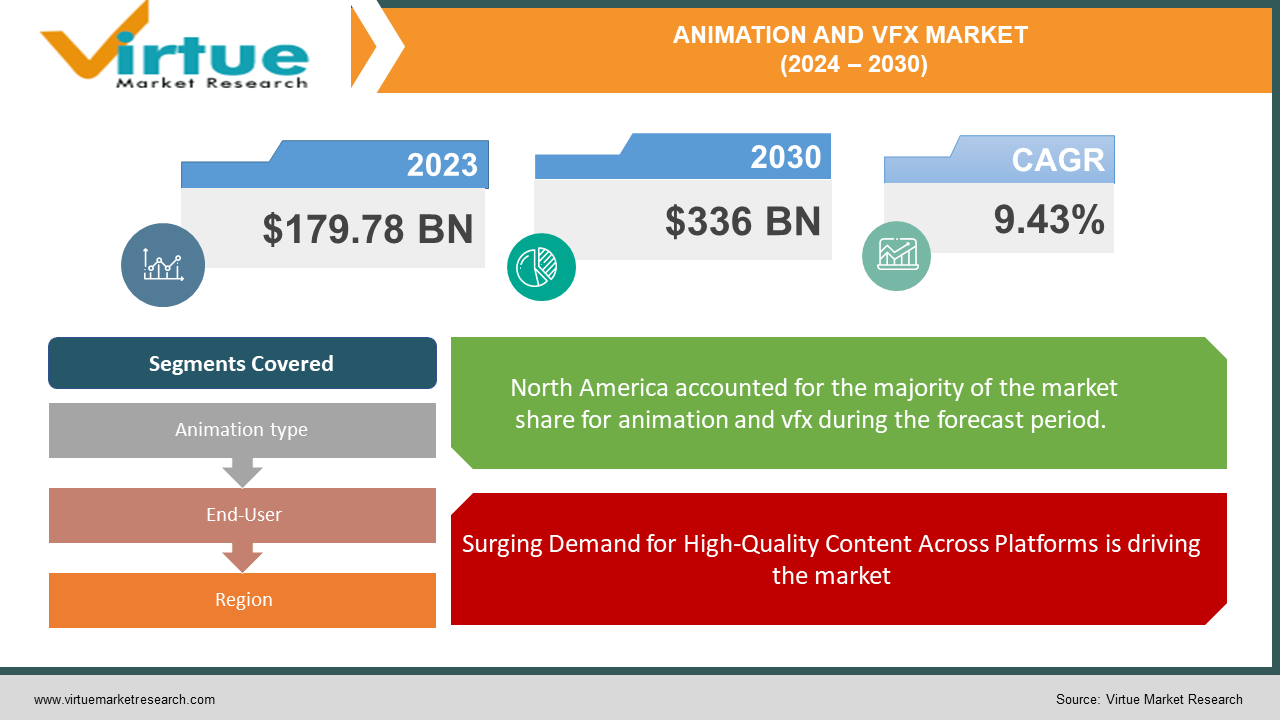

The Global Animation and VFX Market was valued at USD 179.78 billion in 2023 and will row at a CAGR of 9.43% from 2024 to 2030. The market is expected to reach USD 336 billion by 2030.

The animation and VFX market caters to the creation of visually engaging content across various platforms. It encompasses the production of both animated films and cartoons, as well as the special effects that bring live-action movies and video games to life. This market is fueled by the ever-growing demand for immersive entertainment experiences and is expected to see significant growth due to factors like the rise of streaming services and the increasing popularity of animation across all age groups.

Key Market Insights:

The rise of Netflix, Disney+, and other streaming platforms has created a constant need for fresh and engaging animation.Virtual reality (VR) and augmented reality (AR) are opening doors for immersive experiences that heavily rely on animation and VFX.Asia Pacific with 33.7% market share leads the charge, driven by rising disposable income and a surge in demand for local contentVideo games are a major driver of VFX growth. Studios are increasingly incorporating fancy visuals to create immersive gaming experiences

Global Animation and VFX Market Drivers:

Surging Demand for High-Quality Content Across Platforms is driving the market

The appetite for captivating visual experiences is stronger than ever. The rise of streaming services like Netflix, Disney+, and HBO Max has fueled a demand for high-quality animation and VFX-laden content. Viewers are no longer satisfied with simple visuals; they crave immersive experiences that transport them to fantastical worlds or enhance the realism of films and documentaries. This has led to increased investment in animation and VFX studios, propelling the overall market growth.

Exponential Growth of Online Video Viewers and Mobile Device Penetration is driving the market

The global internet landscape is witnessing explosive growth, with billions of users consuming online video content daily. This surge is fueled by the increasing affordability and accessibility of high-speed internet connections. Furthermore, the widespread adoption of smartphones and tablets allows viewers to enjoy animation and VFX-rich content on the go. This convenience factor further amplifies the demand for captivating visuals, creating a lucrative market for animation and VFX studios.

Technological Advancements and Democratization of Tools are driving the market

The animation and VFX industry is undergoing a technological revolution. Advancements in areas like 3D animation, artificial intelligence (AI), and real-time rendering are pushing the boundaries of what's possible. These advancements not only enhance the quality and realism of animation and VFX but also streamline workflows, potentially reducing production costs and timelines. Additionally, the emergence of user-friendly animation and VFX software is making these tools more accessible to independent creators and smaller studios. This democratization of tools fosters innovation and injects fresh perspectives into the industry, further stimulating market growth.

Global Animation and VFX Market challenges and restraints:

High Cost of Cutting-Edge Technology is restricting the market growth

The high cost of technology casts a long shadow on the Animation and VFX industry. Leading software licenses can cost tens of thousands of dollars per seat annually, creating a barrier to entry for smaller studios and independent artists. Furthermore, rendering the stunning visuals audiences crave requires top-of-the-line workstations with powerful processors and graphics cards, adding a significant hardware burden. As if that wasn't enough, the exciting new frontiers of virtual and augmented reality storytelling demand further investment in specialized equipment and software, pushing overall production costs even higher. This confluence of factors can stifle creativity and innovation, especially for smaller players in the market.

Balancing Creativity with Piracy is challenging

The animation and VFX industry, despite its brilliance, grapples with the dark side of piracy. Stolen movies, shows, and video games featuring these stunning visuals not only rob studios of revenue, but also devalue the immense effort poured in by artists and animators. This lost income creates a ripple effect - studios have less to invest in groundbreaking new projects, investors become wary due to the risk of piracy eating into profits, and artists themselves can feel discouraged seeing their work readily available through illegal channels. This piracy problem threatens to stifle the very creativity that fuels the animation and VFX industry.

Market Opportunities:

The Animation and VFX Market can unleash its true potential by embracing a future fueled by innovation and strategic partnerships. The surging demand for high-quality content from streaming giants presents a golden opportunity for studios that can deliver captivating stories with cutting-edge visuals. Here's where emerging technologies like artificial intelligence come into play. By automating repetitive tasks like animation rigging and scene cleanup, AI can free up valuable time and resources for artists to focus on creative endeavors. Furthermore, the rise of virtual and augmented reality opens doors to immersive storytelling experiences, creating a new frontier for animation and VFX. Studios that can effectively integrate these technologies will be well-positioned to captivate audiences. However, talent remains a crucial factor. Collaboration between established studios and promising new talent will be key to fostering a vibrant creative ecosystem. By nurturing talent, adopting innovative technologies, and forging strategic partnerships, the Animation and VFX Market can continue to enthrall audiences and generate blockbuster results.

ANIMATION AND VFX MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.43% |

|

Segments Covered |

By Animation type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Adobe Inc., Autodesk Inc., Toon Boom Animation Inc., Epic Games Inc. (Unreal Engine), The Foundry (Visionmongers Ltd), Walt Disney Animation Studios,Pixar Animation Studios, Industrial Light & Magic (ILM), Weta Digital, DNEG (formerly Double Negative) |

Animation and VFX Market segmentation - by Animation type

-

2D Animation

-

3D Animation

-

Motion Graphics

-

Stop Motion

3D animation reigns supreme in the Animation and VFX market's due to its remarkable versatility. From mind-blowing special effects in blockbuster films to captivating characters in educational content, 3D animation's ability to adapt to diverse projects fuels its dominance. Technological advancements have made 3D animation software and hardware more accessible, allowing smaller studios and independent creators to leverage its power. Furthermore, 3D animation paves the way for immersive experiences in virtual and augmented reality, perfectly positioning itself for future growth as these technologies gain momentum.

Animation and VFX Market segmentation - By End-User

-

Media & Entertainment

-

Gaming

-

Others

The dominant segment within the Animation and VFX market's is likely a close race between Media & Entertainment and Gaming. While both sectors rely heavily on animation and VFX to create engaging experiences, the sheer volume of content produced for Media & Entertainment might give it a slight edge. This includes animated movies, TV shows, documentaries with VFX enhancements, and even theme park attractions. Gaming, on the other hand, is experiencing explosive growth, with increasingly complex and visually stunning titles pushing the boundaries of animation and VFX. The rise of mobile gaming further fuels this demand for captivating visuals. Ultimately, the "dominant" segment might depend on the specific market research you consult, but both Media & Entertainment and Gaming are undeniable powerhouses driving the Animation and VFX market forward.

Animation and VFX Market segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America reigns supreme in the Animation and VFX market, boasting a powerful combination of established industry leaders, a thriving media and entertainment landscape, and a culture of technological innovation. Studios like Pixar and a strong Hollywood presence fuel demand for top-tier animation and VFX talent, creating a robust ecosystem for the industry. However, the crown isn't guaranteed. Asia Pacific is a rising star, with animation powerhouses in China, Japan, and South Korea experiencing rapid growth. This, coupled with a burgeoning domestic market for animation and VFX content, positions Asia Pacific as a potential future leader in this ever-evolving market.

COVID-19 Impact Analysis on the Global Animation and VFX Market

The COVID-19 pandemic wasn't kind to the Animation and VFX industry, disrupting workflows and forcing studios to adapt. While some segments thrived, others faced challenges. Production delays were a major hurdle. Lockdowns and social distancing measures made in-person collaboration difficult, impacting projects with heavy reliance on physical studios. This also highlighted the pre-existing talent gap, as the remote work environment strained communication and project management. However, the crisis also spurred innovation. Studios embraced remote working tools and cloud-based solutions to keep projects moving. The increased demand for content from streaming services during lockdowns presented an opportunity for some studios, with animation particularly well-suited for remote production. The pandemic also accelerated the use of automation tools, freeing up artists to focus on complex tasks. Looking ahead, the global Animation and VFX market is expected to rebound. The skills shortage remains a concern, but studios are likely to continue investing in talent development and remote working infrastructure. Furthermore, the growing popularity of streaming services and the rise of VR/AR experiences ensure a bright future for the industry, provided it can address talent challenges and leverage the power of technology. The pandemic served as a catalyst for change, pushing the Animation and VFX market to become more agile and adaptable, paving the way for a future filled with captivating stories and groundbreaking visuals.

Latest trends/Developments

The industry is embracing a wave of innovation fueled by cutting-edge technology and audience cravings for immersive experiences. Real-time rendering engines are speeding things up, letting directors see final visuals instantly for on-the-fly adjustments. Artificial intelligence is becoming a powerful ally, automating repetitive tasks and freeing up artists for creative magic. Virtual production is blurring the lines between real and virtual, with actors performing in front of LED walls that display digital landscapes, perfect for animation and VFX-heavy projects. The future gets even more captivating with augmented and virtual reality – imagine experiencing a movie scene from within or interacting with animated characters. And in a move for a sustainable future, the industry is looking at eco-friendly practices like optimizing rendering processes and utilizing cloud solutions to minimize its environmental footprint. With these trends leading the way, the animation and VFX industry is poised to create breathtaking visuals, captivating stories, and unforgettable experiences for audiences worldwide.

Key Players:

-

Adobe Inc.

-

Autodesk Inc.

-

Toon Boom Animation Inc.

-

Epic Games Inc. (Unreal Engine)

-

The Foundry (Visionmongers Ltd)

-

Walt Disney Animation Studios

-

Pixar Animation Studios

-

Industrial Light & Magic (ILM)

-

Weta Digital

-

DNEG (formerly Double Negative)

Chapter 1. Animation and VFX Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Animation and VFX Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Animation and VFX Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Animation and VFX Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Animation and VFX Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Animation and VFX Market – By animation type

6.1 Introduction/Key Findings

6.2 2D Animation

6.3 3D Animation

6.4 Motion Graphics

6.5 Stop Motion

6.6 Y-O-Y Growth trend Analysis By animation type

6.7 Absolute $ Opportunity Analysis By animation type, 2024-2030

Chapter 7. Animation and VFX Market – By End-User

7.1 Introduction/Key Findings

7.2 Media & Entertainment

7.3 Gaming

7.4 Others

7.5 Y-O-Y Growth trend Analysis By End-User

7.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Animation and VFX Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By animation type

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By animation type

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By animation type

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By animation type

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By animation type

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Animation and VFX Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Adobe Inc.

9.2 Autodesk Inc.

9.3 Toon Boom Animation Inc.

9.4 Epic Games Inc. (Unreal Engine)

9.5 The Foundry (Visionmongers Ltd)

9.6 Walt Disney Animation Studios

9.7 Pixar Animation Studios

9.8 Industrial Light & Magic (ILM)

9.9 Weta Digital

9.10 DNEG (formerly Double Negative)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Animation and VFX Market was valued at USD 179.78 billion in 2023 and will row at a CAGR of 9.34% from 2024 to 2030. The market is expected to reach USD 336 billion by 2030.

Surging Demand for High-Quality Content Across Platforms, Exponential Growth of Online Video Viewers and Mobile Device Penetration these are the reasons which is driving the market.

Based on animation type it is divided into four segments – 2D Animation, 3D Animation, Motion Graphics, Stop Motion

North America is the most dominant region for the Animation and VFX Market.

Adobe Inc., Autodesk Inc., Toon Boom Animation Inc., Epic Games Inc