Animal Parasiticides Market Size (2025-2030)

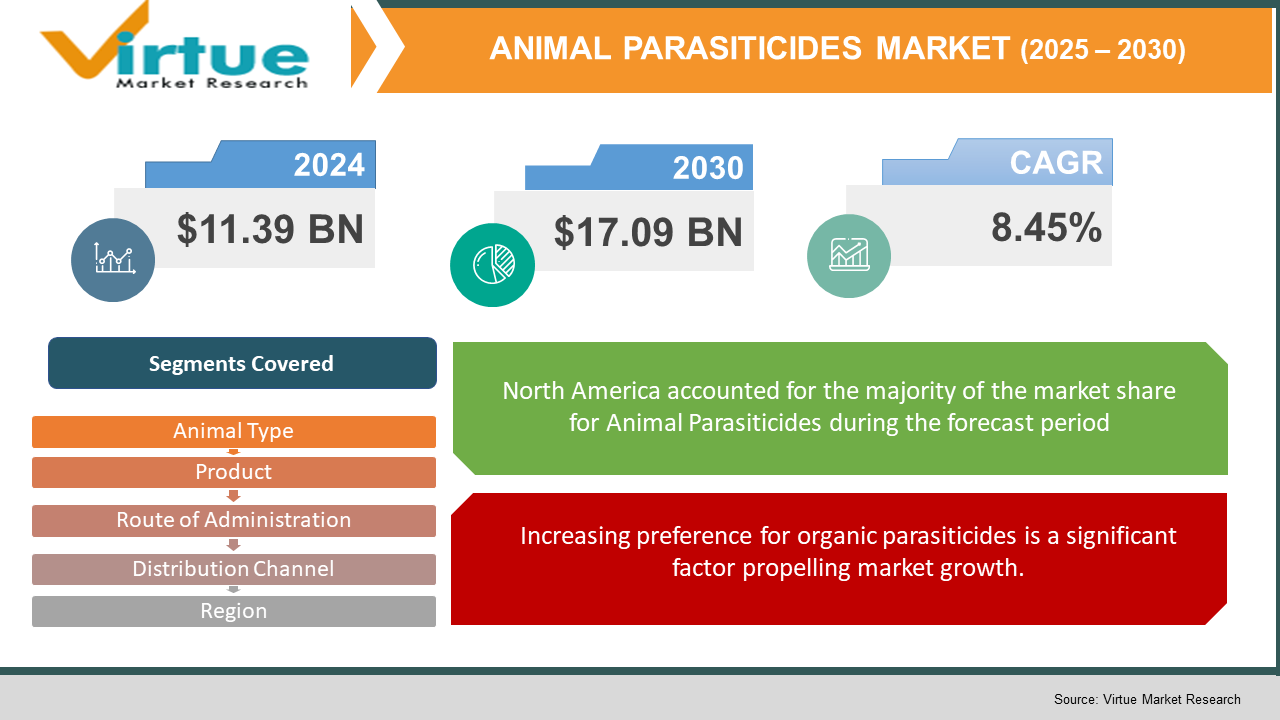

The Animal Parasiticides Market was valued at USD 11.39 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 17.09 billion by 2030, growing at a CAGR of 8.45%.

Key Market Insights:

Key factors contributing to market expansion include the increasing incidence of parasitic infections in animals, the growing emphasis on regulated usage of parasiticides, the rising trend of animal healthcare. In the field of veterinary healthcare, parasiticidal drugs are commonly administered to treat and prevent infestations caused by parasites such as ticks, fleas, and worms. Their application in animals also supports public health by mitigating the risk of diseases that can be transmitted from animals to humans (zoonotic diseases).

Animal Parasiticides Market Drivers:

Increasing preference for organic parasiticides is a significant factor propelling market growth.

The growing shift toward environmentally friendly and chemical-free alternatives is emerging as a key driver of market growth. Concerns among pet owners regarding the adverse effects of synthetic chemicals on animal health have contributed to this trend.

Animal Parasiticides Market Restraints and Challenges:

Evaluating the broader impact of U.S. tariffs on parasiticide trade presents a challenge to market growth.

The introduction and subsequent escalation of tariffs by the United States in 2025 on active pharmaceutical ingredients, excipients, and finished parasiticide products have triggered widespread disruptions throughout global supply chains. The resulting increase in raw material costs has driven contract manufacturers to explore alternative sourcing options or invest in domestic production facilities to safeguard profit margins.

Exporters from regions heavily impacted by the tariff measures have started redirecting their shipments toward markets with more favorable trade conditions. This shift is altering traditional distribution pathways and prompting a reassessment of regional pricing strategies. These realignments have led to temporary overcapacity in certain areas, highlighting the critical need for supply chain diversification to ensure consistent product availability.

Animal Parasiticides Market Opportunities:

An increasing emphasis on the development of advanced formulations is opening new avenues for market opportunities.

The growing demand for broad-spectrum protection against multiple parasites, aimed at simplifying treatment protocols for pet owners, is contributing positively to market expansion. By integrating multiple active compounds, these formulations minimize treatment frequency and support consistent parasite management. This trend is having a favorable impact on the animal parasiticides market outlook. In July 2024, a clinical assistant professor from the Texas A&M School of Veterinary Medicine and Biomedical Sciences emphasized the significance of controlling external parasites and outlined strategies to mitigate health risks posed by common farm pests.

ANIMAL PARASITICIDES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.45% |

|

Segments Covered |

By Product, animal Type, route of administration, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Zoetis, Merck & Co. Inc. and Boehringer Ingelheim. |

Animal Parasiticides Market Segmentation:

Animal Parasiticides Market Segmentation By Animal Type:

- Production Animal

- Cattle

- Swine

- Poultry

- Others

- Companion Animal

- Canine

- Feline

- Equine

- Others

The production animal segment represented the highest revenue share within the market. The application of veterinary parasiticides in livestock management has gained increased attention due to the global emphasis on food safety and sustainable agricultural practices. This trend is driven by the need to meet the nutritional demands of a growing global population, which significantly depends on animal-derived protein sources. Ensuring the health of production animals through the prevention and treatment of parasitic infections has become essential. In developed regions, rising expenditure on animal healthcare has further supported the adoption of parasiticides and the use of production animals in efficient food systems.

The companion animal segment is projected to register the highest growth during the forecast period. This growth is fueled by the rising rate of pet ownership, increased awareness of pet health, and growing demand for advanced animal care, driven in part by the recognized health benefits of human-animal interactions. As pets—particularly dogs and cats—are increasingly viewed as family members, spending on their healthcare has surged. The growing use of veterinary pharmaceuticals, including parasiticides, to ensure the well-being of companion animals is a key factor propelling segment growth.

Animal Parasiticides Market Segmentation By Product:

- Ectoparasiticides

- Endoparasiticides

- Endectocides

The ectoparasiticides segment captured the highest revenue share in the market. This preference over endectocides stems from their targeted effectiveness against external parasites such as ticks, fleas, and lice, combined with their cost-efficient profile. Ectoparasiticides are available in diverse formulations, including sprays, powders, ointments, creams, and spot-on applications. This variety offers flexibility for animal owners and veterinary practitioners to select the most appropriate treatment method based on specific disease conditions.

Furthermore, the external application of ectoparasiticides reduces the likelihood of adverse effects on non-target organisms and treated animals, as these agents do not enter systemic circulation. The high prevalence of external parasites, in both livestock and companion animals, further supports the strong demand for these treatments, solidifying the segment’s dominant position in the market.

Animal Parasiticides Market Segmentation By Route of Administration:

- Oral

- Injectable

- Topical

The topical segment held the dominant position in the market. This can be attributed to its widespread use in treating external parasites such as ticks, fleas, and worms in animals through the application of ectoparasiticides. Topical administration targets parasites residing on the skin and fur without directly interacting with the animal’s internal systems, thereby reducing the risk of adverse side effects. Additionally, topical treatments are available in a variety of formulations—including creams, ointments, sprays, shampoos, and powders—enhancing their versatility and appeal for both pet owners and veterinary professionals.

The injectable segment is expected to experience the fastest growth rate throughout the forecast period. This route delivers the medication directly into the animal's body, allowing for faster onset of action and improved bioavailability. Injectable parasiticides are predominantly employed to treat internal parasites, providing efficient and dependable therapeutic results.

Animal Parasiticides Market Segmentation By Distribution Channel:

- Retail

- E-Commerce

- Hospital/ Clinic Pharmacy

- Others

The hospital and clinic pharmacy segment accounted for the highest revenue share in the market. This dominance can be attributed to the wide availability of parasiticides within these healthcare settings. Animals such as horses, dogs, cats, and livestock frequently visit veterinary hospitals and clinics for the treatment of various conditions. Following consultation and diagnosis, veterinarians prescribe the necessary medications, which animal owners can conveniently obtain directly from the on-site pharmacies. The consistently high volume of animal patients ensures that these pharmacies maintain well-stocked inventories of medications and related products, facilitating immediate access for pet owners.

The e-commerce segment is projected to register the fastest growth over the forecast period. This growth is driven by several advantages, including greater accessibility for consumers who may prefer not to purchase pharmaceuticals from traditional retail or hospital pharmacies. The ability to order medications in advance through online channels also simplifies maintaining a steady supply of necessary drugs. Factors such as increasing pet adoption rates and advancements in technology are key contributors to this trend. The expanding global smartphone user base, fueled by rising internet penetration, enhances customer convenience and satisfaction. Consequently, the popularity of e-commerce platforms has surged due to the integration of instant purchasing options, improved smartphone compatibility, and user-friendly website interfaces.

Animal Parasiticides Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The North American veterinary parasiticides market accounted for the largest revenue share and is projected to grow at a notable compound annual growth rate (CAGR) during the forecast period. This growth is largely driven by the region’s status as one of the leading meat producers globally, coupled with the highest rate of pet ownership worldwide. These factors collectively contribute to the rising demand for parasiticide products in North America.

The European veterinary parasiticides market is expected to expand rapidly, supported by ongoing research efforts advocating for the controlled and responsible use of parasiticides due to their environmental implications. Researchers are emphasizing the importance of conducting comprehensive Environmental Risk Assessments (ERA) during the product authorization process to mitigate ecological harm. This approach is anticipated to propel market growth in Europe by encouraging the adoption of sustainable and eco-friendly parasiticide solutions.

The Asia Pacific veterinary parasiticides market is experiencing the fastest growth, driven by increasing initiatives aimed at raising awareness regarding the diagnosis and treatment of veterinary parasitic infections. Recognizing the substantial disease burden posed by parasitic infections and their zoonotic potential, the World Organization for Animal Health (WOAH) has been actively organizing awareness programs. Notably, WOAH conducted two consecutive Tripartite seminars in 2018 and 2023, which have provided valuable guidance to countries in the region on addressing the challenges posed by parasitic infections in animals.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic led to a decline in demand for animal care services. Infection control protocols and statewide lockdowns significantly reduced the number of visits to veterinary hospitals and clinics. A study published in the Indian Journal of Animal Science in June 2022 reported notable decreases in case attendance during various lockdown phases across different animal species. Specifically, cases involving pets declined by 54.9%, followed by goats (35.3%), sheep (29.1%), cattle (25.5%), and buffalo (21.6%). Veterinary consultations declined by 27.3%, with farmer visits to veterinary clinics experiencing a more pronounced drop of 61.9%. Consequently, the market experienced disruption due to reduced veterinary consultations and shortages of veterinary pharmaceuticals during the pandemic. Looking ahead, increased veterinary visits and the reopening of clinics are anticipated to drive market growth.

According to the National Pet Owners Survey 2021-2022 conducted by the American Pet Products Association (APPA) in June 2021, 51% of pet owners expressed willingness to pay a premium for ethically sourced and environmentally friendly pet products. Furthermore, 35% of pet owners reported an increase in expenditures on pet supplies, wellness products, and other pet care items during the pandemic compared to prior years. These consumer behavior trends are anticipated to contribute positively to market growth over the forecast period.

Latest Trends/ Developments:

July 2024: A clinical assistant professor from the Texas A&M School of Veterinary Medicine and Biomedical Sciences highlighted the critical role of controlling external parasites in animal health.

April 2024: Boehringer Ingelheim launched NexGard SPECTRA® in India following approval by the Central Drugs Standard Control Organization (CDSCO).

February 2024: Elanco committed an investment of approximately US$1.3 billion to enhance its capacity for launching improved variants of animal parasiticides, thereby increasing the company’s operational flexibility.

Key Players:

These are top 10 players in the Animal Parasiticides Market :-

- Zoetis

- Merck & Co. Inc.

- Boehringer Ingelheim

- Elanco Animal Health

- Dechra Pharmaceuticals Plc.

- Virbac

- Ceva Sante Animale

- Vetoquinol

- Biogénesis Bagó

- Himalaya Wellness

Chapter 1. Animal Parasiticides Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Animal Parasiticides Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Animal Parasiticides Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Animal Parasiticides Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Animal Parasiticides Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Animal Parasiticides Market– By Product

6.1 Introduction/Key Findings

6.2 Ectoparasiticides

6.3 Endoparasiticides

6.4 Endectocides

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. Animal Parasiticides Market– By Animal Type

7.1 Introduction/Key Findings

7.2 Production Animal

7.2.1 Cattle

7.2.2 Swine

7.2.3 Poultry

7.2.4 Others

7.3 Companion Animal

7.3.1 Canine

7.3.2 Feline

7.3.3 Equine

7.3.4 Others

7.4 Y-O-Y Growth trend Analysis By Animal Type

7.5 Absolute $ Opportunity Analysis By Animal Type , 2025-2030

Chapter 8. Animal Parasiticides Market– By Route of Administration

8.1 Introduction/Key Findings

8.2 Oral

8.3 Injectable

8.4 Topical

8.5 Y-O-Y Growth trend Analysis Route of Administration

8.6 Absolute $ Opportunity Analysis Route of Administration , 2025-2030

Chapter 9. Animal Parasiticides Market– By Distribution Channel

9.1 Introduction/Key Findings

9.2 Retail

9.3 E-Commerce

9.4 Hospital/ Clinic Pharmacy

9.5 Others

9.6 Y-O-Y Growth trend Analysis Distribution Channel

9.7 Absolute $ Opportunity Analysis Distribution Channel , 2025-2030

Chapter 10. Animal Parasiticides Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Product

10.1.3. By Route of Administration

10.1.4. By Animal Type

10.1.5. Distribution Channel

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Product

10.2.3. By Route of Administration

10.2.4. By Animal Type

10.2.5. Distribution Channel

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Product

10.3.3. By Distribution Channel

10.3.4. By Animal Type

10.3.5. Route of Administration

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Distribution Channel

10.4.3. By Animal Type

10.4.4. By Product

10.4.5. Route of Administration

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Route of Administration

10.5.3. By Distribution Channel

10.5.4. By Animal Type

10.5.5. Product

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. ANIMAL PARASITICIDES MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 Zoetis

11.2 Merck & Co. Inc.

11.3 Boehringer Ingelheim

11.4 Elanco Animal Health

11.5 Dechra Pharmaceuticals Plc.

11.6 Virbac

11.7 Ceva Sante Animale

11.8 Vetoquinol

11.9 Biogénesis Bagó

11.10 Himalaya Wellness

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Concerns among pet owners regarding the adverse effects of synthetic chemicals on animal health have contributed to this trend.

The top players operating in the Animal Parasiticides Market are - Zoetis, Merck & Co. Inc. and Boehringer Ingelheim.

The COVID-19 pandemic led to a decline in demand for animal care services. Infection control protocols and statewide lockdowns significantly reduced the number of visits to veterinary hospitals and clinics

An increasing emphasis on the development of advanced formulations is opening new avenues for market opportunities.

Asia Pacific is the fastest-growing region in the Animal Parasiticides Market.