Aneuploidy Syndrome Diagnostic Services Market Size (2024 – 2030)

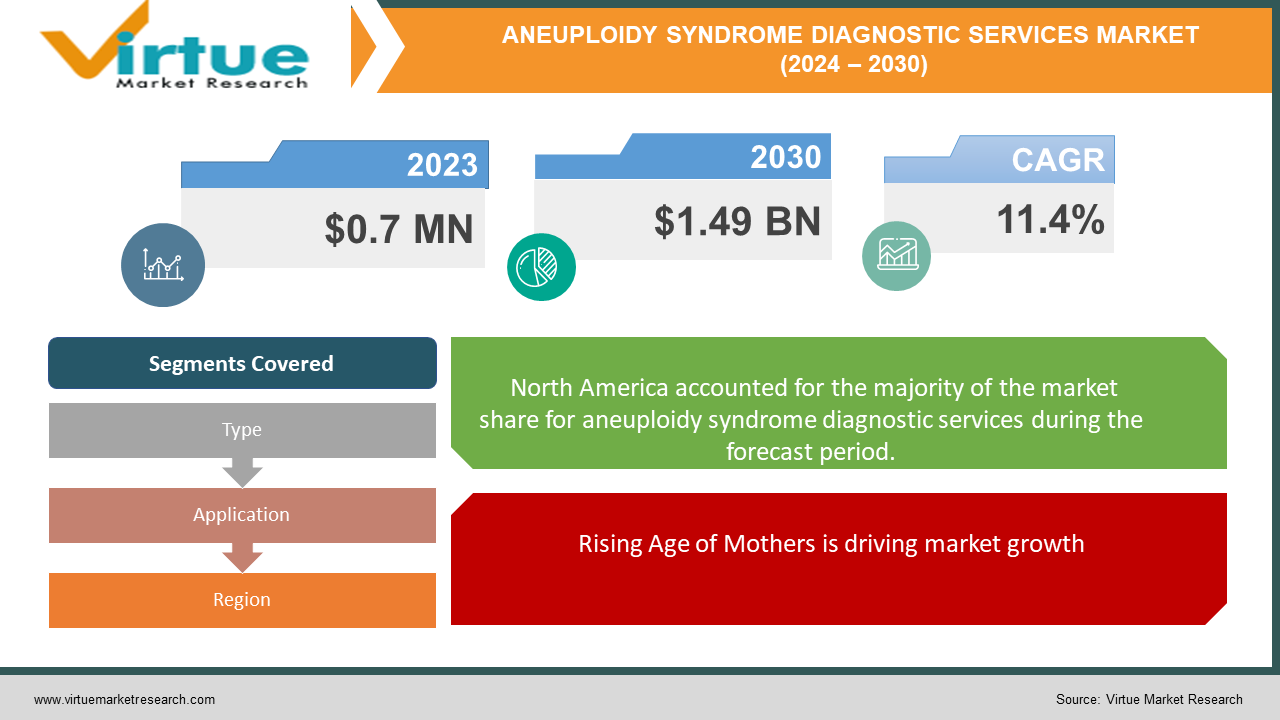

The Global Aneuploidy Syndrome Diagnostic Services Market was valued at USD 0.7 million in 2023 and will grow at a CAGR of 11.4% from 2024 to 2030. The market is expected to reach USD 1.49 billion by 2030.

The Aneuploidy Syndrome Diagnostic Services Market is a segment of the broader Preimplantation Genetic Testing (PGT) market. PGT focuses on identifying genetic abnormalities in embryos created through In Vitro Fertilization (IVF) before implantation. While a specific market size for Aneuploidy Syndrome Diagnostic Services isn't available, the global Preimplantation Genetic Testing market is projected to reach $1.2 billion by 2028, indicating the growth potential of this area.

Key Market Insights:

With women delaying childbearing, the risk of chromosomal abnormalities like aneuploidy increases. This fuels demand for PGT, including aneuploidy screening.Growing public awareness about genetic conditions and PGT options is driving market growth.Advancements in techniques like next-generation sequencing (NGS) are improving the accuracy and affordability of PGT, leading to wider adoption.While a specific breakdown for aneuploidy diagnostics isn't available, chromosomal abnormalities held a dominant position within the PGT market in 2022, accounting for over 20% of the value share.

Global Aneuploidy Syndrome Diagnostic Services Market Drivers:

Rising Age of Mothers is driving market growth:

The trend of women delaying childbearing is a double-edged sword when it comes to pregnancy. While it allows for career advancement, education, or personal fulfillment before starting a family, it also coincides with a natural decline in egg quality. As women age, their eggs are more likely to undergo errors during cell division, leading to chromosomal abnormalities like aneuploidy in the developing embryos. These abnormalities can cause devastating genetic conditions like Down syndrome. This biological reality directly fuels the demand for Preimplantation Genetic Testing (PGT) services, including aneuploidy screening. PGT allows doctors to analyze embryos created through In Vitro Fertilization (IVF) for chromosomal abnormalities before implantation. By identifying embryos with the correct number of chromosomes, PGT increases the chances of a healthy pregnancy and reduces the risk of miscarriage or having a child with aneuploidy syndrome. This technology offers peace of mind and hope for couples who choose to delay childbearing but still desire a healthy family.

Increased Public Awareness is driving market growth:

The veil of secrecy surrounding genetic conditions is lifting, replaced by a wave of public awareness and open dialogue. Gone are the days of hushed tones and limited information. Today, conversations about genetic diseases, carrier screening, and even advanced reproductive options like Preimplantation Genetic Testing (PGT) are becoming increasingly common. This openness empowers couples to make informed decisions about their reproductive health. No longer are they left in the dark, forced to navigate complex choices without proper understanding. Now, through educational resources, online communities, and media discussions, couples can access a wealth of information about genetic risks and available options like PGT. This newfound knowledge allows them to explore the possibility of PGT, a procedure that analyzes embryos created through In Vitro Fertilization (IVF) for chromosomal abnormalities before implantation. By understanding the benefits of PGT, couples can proactively increase their chances of a healthy pregnancy and reduce the risk of miscarriage or having a child with a genetic disorder. This shift towards informed decision-making is a crucial driver for the Aneuploidy Syndrome Diagnostic Services market, a segment of PGT specifically focused on identifying these chromosomal abnormalities. As public awareness continues to rise, so too will the utilization of PGT and its sub-specialties, empowering couples to build their families with greater confidence.

Technological Advancements are driving market growth:

The landscape of genetic testing is undergoing a revolution, with advancements like next-generation sequencing (NGS) playing a pivotal role. NGS is a powerful technique that can analyze vast amounts of genetic material with incredible speed and accuracy. This has transformed the field of Preimplantation Genetic Testing (PGT), particularly in the area of aneuploidy syndrome diagnostics. Previously, PGT procedures were limited by less sophisticated techniques, leading to higher costs and potential for errors. NGS has significantly improved the game. By offering a more precise and efficient method for analyzing embryos for chromosomal abnormalities, NGS has driven down the cost of PGT, making it a more accessible option for a wider range of couples. This wider accessibility directly translates to a rise in the utilization of aneuploidy syndrome diagnostics, a sub-specialty of PGT. With NGS, couples now have a more affordable and reliable way to identify embryos with the correct number of chromosomes, increasing their chances of a healthy pregnancy and reducing the risk of miscarriage or a child with aneuploidy syndrome. This technological leap forward empowers couples with greater control over their reproductive health and offers a brighter future for families.

Global Aneuploidy Syndrome Diagnostic Services Market challenges and restraints:

Ethical Considerations is a significant hurdle for Aneuploidy Syndrome Diagnostic Services:

The power of PGT, particularly aneuploidy diagnostics, to identify and potentially eliminate embryos with chromosomal abnormalities presents a double-edged sword. While it offers hope for a healthy pregnancy, it also ignites a firestorm of ethical concerns. The ability to select embryos based on genetic makeup sparks debates about "designer babies," a term suggesting the creation of children with predetermined traits. Critics fear a slippery slope toward eugenics, manipulating future generations towards specific characteristics. Additionally, the ability to choose healthy embryos raises questions about the sanctity of human life and the fate of those deemed "undesirable." These ethical considerations are not merely philosophical musings. They can translate into real-world limitations. Regulatory bodies and some healthcare institutions grapple with establishing guidelines and restrictions on PGT practices. This cautious approach, while understandable, can restrict access to these services and ultimately hinder market growth for aneuploidy diagnostics.

High Costs is throwing a curveball at the Aneuploidy Syndrome Diagnostic Services market:

While advancements like next-generation sequencing (NGS) have chipped away at the cost of PGT, the reality is that these procedures remain a significant financial hurdle for many couples. The entire In Vitro Fertilization (IVF) process, which often serves as the foundation for PGT with aneuploidy screening, can be a hefty price tag. The cost can encompass medication, lab fees, doctor consultations, and the PGT procedure itself. This financial burden acts as a major barrier to entry, restricting market growth for aneuploidy diagnostics. For many couples struggling with infertility, the added cost of PGT with aneuploidy screening can feel like a heartbreaking luxury they simply cannot afford. This financial strain can lead to difficult choices, forcing couples to weigh their desire for a healthy pregnancy against the significant financial investment required. As a result, the market for these services remains limited to those with the financial means, hindering wider adoption and potentially delaying advancements in affordability and accessibility.

Limited Insurance Coverage is a growing nightmare for Aneuploidy Syndrome Diagnostic Services:

The landscape of insurance coverage for PGT is a patchwork quilt, lacking uniformity across countries and even within healthcare providers themselves. This inconsistency creates a significant barrier for couples considering PGT. In many cases, insurance plans offer little to no coverage, leaving hopeful parents to grapple with the entire financial burden. This burden can be substantial, encompassing the IVF process itself along with the additional costs of PGT and aneuploidy screening. The lack of insurance coverage can be a crushing blow for couples already facing the emotional and physical challenges of infertility. It forces them to make a difficult decision: move forward with PGT, potentially draining their savings and jeopardizing financial security, or proceed with IVF without the genetic screening, accepting a higher risk of miscarriage or a child with a genetic disorder. This financial pressure undoubtedly deters many couples from even considering PGT, hindering the potential benefits this technology offers and limiting market growth for these valuable diagnostic services.

Market Opportunities:

The Aneuploidy Syndrome Diagnostic Services market, a niche within the growing Preimplantation Genetic Testing (PGT) market, presents exciting opportunities at the intersection of medical innovation and evolving societal trends. The rising age of mothers, driven by career pursuits and delayed childbearing, creates a natural demand for PGT services like aneuploidy screening. This allows couples to increase their chances of a healthy pregnancy by identifying embryos with chromosomal abnormalities. Public awareness about genetic conditions and PGT options is on the rise, empowering couples with informed decision-making about their reproductive health. Technological advancements like next-generation sequencing (NGS) are making PGT procedures more accurate, affordable, and accessible, potentially expanding the market reach. However, to fully tap into this potential, challenges need to be addressed. Ethical concerns surrounding embryo selection and designer babies can lead to restrictions on PGT practices. The high cost of PGT procedures, encompassing IVF and aneuploidy screening, remains a significant barrier for many couples. Patchwork insurance coverage, with limited to no support for PGT in many regions, adds another layer of financial strain. Additionally, navigating the emotional and psychological impact of PGT, alongside limited public awareness in certain areas, can deter couples from considering these services. Overcoming these challenges presents further opportunities. Open discussions about the ethical considerations surrounding PGT can help establish clear guidelines without stifling innovation. Continued advancements in technology and wider adoption of NGS can bring down costs, making PGT more accessible. Advocacy efforts can push for broader insurance coverage, easing the financial burden on couples. Finally, increasing public education about genetic conditions, PGT options, and the benefits of aneuploidy screening can empower more couples to make informed decisions about their reproductive health. By addressing these challenges and capitalizing on the existing opportunities, the Aneuploidy Syndrome Diagnostic Services market is poised for significant growth, offering couples a brighter future for building healthy families.

ANEUPLOIDY SYNDROME DIAGNOSTIC SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.4% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Illumina, Inc., Natera, Inc., CooperGenomics (CooperSurgical Fertility Companies), Thermo Fisher Scientific Inc., Myriad Genetics, Inc., Laboratory Corporation of America Holdings, PerkinElmer Inc., Genesis Genetics, Reprogenetics, LLC, BGI Group (China) |

Aneuploidy Syndrome Diagnostic Services Market Segmentation - By Type

-

Conventional PGT for Aneuploidy

-

Next-Generation Sequencing

Within the Aneuploidy Syndrome Diagnostic Services market, a segment of the Preimplantation Genetic Testing (PGT) market, Next-Generation Sequencing (NGS) is rapidly becoming the most prominent sector. While the traditional method, Conventional PGT for Aneuploidy (karyotyping), offers a lower cost, its limited analysis of chromosomes leads to lower accuracy in detecting abnormalities. NGS, on the other hand, analyzes the entire chromosomal makeup of the embryo, providing a far more comprehensive picture. This superior accuracy, despite a higher price tag, is driving the shift towards NGS as the preferred technology for aneuploidy syndrome diagnostics. As NGS becomes more widely adopted due to its precision, the conventional karyotyping method is likely to play a diminishing role in this market.

Aneuploidy Syndrome Diagnostic Services Market Segmentation - By Application

-

PGT-A

-

PGT-M

Within the Aneuploidy Syndrome Diagnostic Services Market, Preimplantation Genetic Testing for Aneuploidy (PGT-A) is the dominant sector by a significant margin. While PGT-M focuses on identifying specific, single-gene disorders, PGT-A specifically targets chromosomal abnormalities responsible for well-known conditions like Down syndrome. This focus on a broader range of potential issues makes PGT-A the more crucial service for couples seeking to avoid these common and serious chromosomal issues in their offspring. As a result, the market for PGT-A diagnostics dwarfs that of PGT-M, which caters to a more specific and less prevalent set of genetic conditions.

Aneuploidy Syndrome Diagnostic Services Market Segmentation - Regional Analysis

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

While specific market size data isn't available for individual regions within the Aneuploidy Syndrome Diagnostic Services market, North America currently holds the dominant position. This is likely due to a combination of factors: established infrastructure for advanced reproductive technologies like PGT, higher disposable income levels allowing couples to access these services, and growing awareness about genetic conditions and PGT options. However, the Asia Pacific region is experiencing rapid growth in this market due to rising disposable incomes, increasing awareness, and a large population base. The future landscape might see a shift towards the Asia Pacific becoming a major player in Aneuploidy Syndrome Diagnostic Services.

COVID-19 Impact Analysis on the Global Aneuploidy Syndrome Diagnostic Services Market

The COVID-19 pandemic delivered a shockwave to the Aneuploidy Syndrome Diagnostic Services market, a segment of the Preimplantation Genetic Testing (PGT) industry. Disruptions in elective medical procedures, including IVF cycles which often serve as the foundation for PGT, led to a temporary decline in demand for these services. Additionally, anxieties surrounding the pandemic and its potential impact on pregnancy might have caused couples to delay family planning, further impacting the market. However, the landscape is shifting. As the pandemic wanes and healthcare systems bounce back, the Aneuploidy Syndrome Diagnostic Services market is experiencing a rebound. The growing demand for genetic testing and a potential rise in fertility procedures post-pandemic could propel the market forward. Telehealth consultations and virtual support systems might emerge as valuable tools for genetic counselors and patients navigating PGT in the new normal. Overall, the COVID-19 pandemic's short-term impact was undeniable, but the long-term outlook for the Aneuploidy Syndrome Diagnostic Services market remains positive, driven by the underlying factors influencing PGT adoption.

Latest trends/Developments

The Aneuploidy Syndrome Diagnostic Services market, a niche within the growing Preimplantation Genetic Testing (PGT) field, is experiencing a wave of exciting trends and developments. One major shift is the dominance of Next-Generation Sequencing (NGS) technology. NGS offers superior accuracy compared to traditional methods like karyotyping, providing a more comprehensive picture of an embryo's chromosomal makeup. This growing adoption of NGS is leading to a rise in the number of chromosomal abnormalities detected, potentially influencing future treatment options and counseling approaches. Additionally, advancements in non-invasive PGT techniques are on the horizon. These new methods, still under development, aim to analyze embryonic genetic makeup without directly biopsying the embryo, offering a less invasive approach. Furthermore, the rise of artificial intelligence (AI) in PGT holds promise for improved data analysis and interpretation, potentially leading to even more precise diagnoses. However, ethical considerations surrounding embryo selection and the high cost of PGT procedures remain challenges. Initiatives promoting public education about genetic conditions and PGT options are crucial to fostering informed decision-making among couples. As the market navigates these trends and developments, the future holds the potential for wider accessibility of aneuploidy syndrome diagnostics, empowering couples to make informed choices about their reproductive health and building healthier families.

Key Players:

-

Illumina, Inc.

-

Natera, Inc.

-

CooperGenomics (CooperSurgical Fertility Companies)

-

Thermo Fisher Scientific Inc.

-

Myriad Genetics, Inc.

-

Laboratory Corporation of America Holdings

-

PerkinElmer Inc.

-

Genesis Genetics

-

Reprogenetics, LLC

-

BGI Group (China)

Chapter 1. Aneuploidy Syndrome Diagnostic Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aneuploidy Syndrome Diagnostic Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aneuploidy Syndrome Diagnostic Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aneuploidy Syndrome Diagnostic Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aneuploidy Syndrome Diagnostic Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aneuploidy Syndrome Diagnostic Services Market – By Type

6.1 Introduction/Key Findings

6.2 Conventional PGT for Aneuploidy

6.3 Next-Generation Sequencing

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Aneuploidy Syndrome Diagnostic Services Market – By Application

7.1 Introduction/Key Findings

7.2 PGT-A

7.3 PGT-M

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Aneuploidy Syndrome Diagnostic Services Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Aneuploidy Syndrome Diagnostic Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Illumina, Inc.

9.2 Natera, Inc.

9.3 CooperGenomics (CooperSurgical Fertility Companies)

9.4 Thermo Fisher Scientific Inc.

9.5 Myriad Genetics, Inc.

9.6 Laboratory Corporation of America Holdings

9.7 PerkinElmer Inc.

9.8 Genesis Genetics

9.9 Reprogenetics, LLC

9.10 BGI Group (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aneuploidy Syndrome Diagnostic Services Market was valued at USD 0.7 million in 2023 and will grow at a CAGR of 11.4% from 2024 to 2030. The market is expected to reach USD 1.49 billion by 2030.

The rising Age of Mothers, Increased Public Awareness, and Technological Advancements are the reasons that are driving the market.

Based on Application it is divided into two segments – PGT-A, PGT-M.

North America is the most dominant region for the luxury vehicle Market.

Illumina, Inc., Natera, Inc., CooperGenomics (CooperSurgical Fertility Companies), Thermo Fisher Scientific Inc., Myriad Genetics, Inc.