Ancillary Revenue Management Market Size (2024 – 2030)

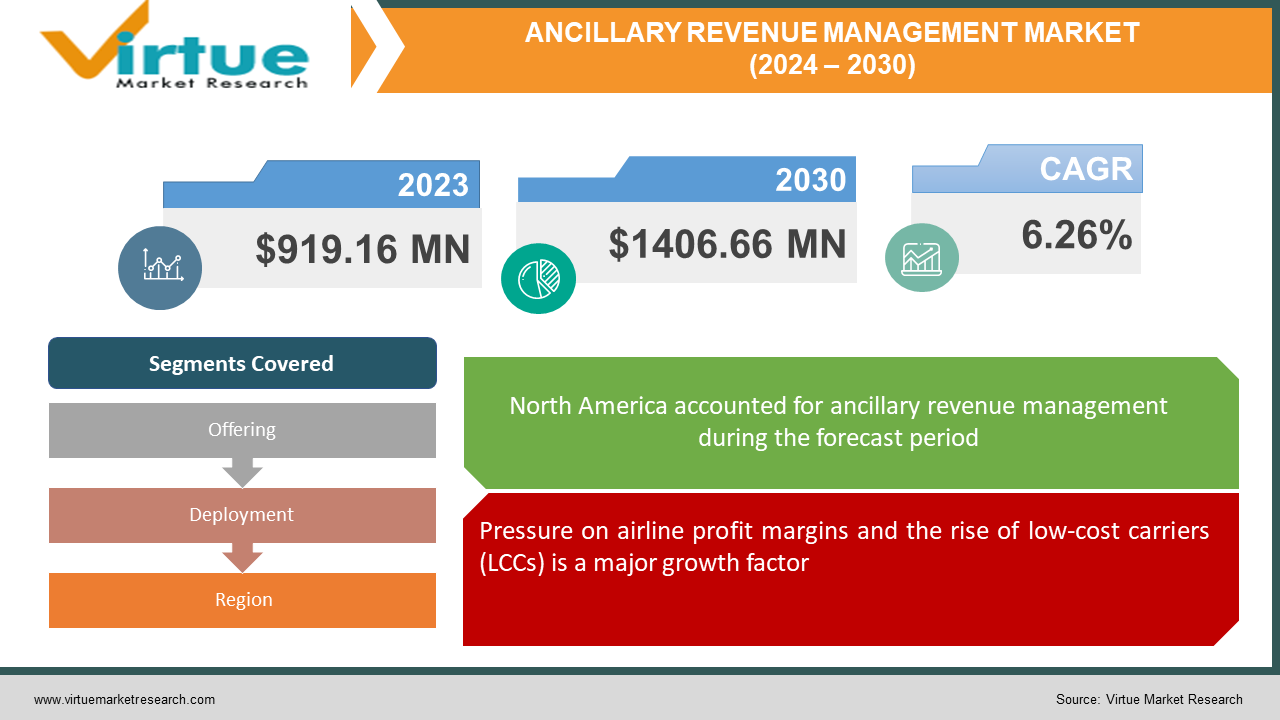

The global ancillary revenue management market was valued at USD 919.16 million in 2023 and is projected to reach a market size of USD 1406.66 million by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 6.26%.

The strategic approach used by companies, especially those in the travel and hospitality sectors, to create income streams outside of their main offerings is known as ancillary revenue management. When it comes to airlines, ancillary revenue refers to the money made by selling customers extra services and goods on top of the base ticket price. In recent years, ancillary revenue management has grown rapidly, moving from a side source of additional income to a core tactic for increasing profitability in the travel and hospitality sectors. Ancillary revenue used to mostly come from charges for extra services like luggage and seat preference. However, in the current environment, technological and data analytics breakthroughs have allowed companies to adopt more complex pricing schemes and customized offerings, broadening the definition of ancillary revenue to include a variety of goods and services catered to specific consumer preferences. Prospects show that ancillary revenue management will only grow as companies continue to hone their approaches and use technology like AI and machine learning to predict and satisfy changing customer demands.

Key Market Insights:

The global ancillary revenue management market is experiencing significant growth due to the increasing demand for in-flight connectivity services. Passengers are increasingly seeking internet access, live TV, and other entertainment options while traveling. Airlines are recognizing the importance of personalization in maximizing ancillary revenue. By leveraging passenger data and preferences, airlines can tailor offers for checked baggage, seat selection, meals, and other ancillary products. The growth of LCCs is creating new opportunities in the ancillary revenue management market. LCCs typically offer lower base fares but rely heavily on ancillary revenue to generate profits. This has led to a more sophisticated approach to ancillary revenue management, with LCCs offering a wider range of unbundled services and employing dynamic pricing strategies.

Ancillary Revenue Management Market Drivers:

Pressure on airline profit margins and the rise of low-cost carriers (LCCs) is a major growth factor.

Traditional airlines face shrinking profit margins due to factors like fuel costs and competition. This has led them to explore alternative revenue streams, making ancillary revenue management a critical tool. Additionally, the rise of LCCs, which rely heavily on ancillary revenue to offset lower base fares, intensifies competition and drives innovation in this market.

Shifting consumer preferences and demand for in-flight experiences are driving market growth.

Travelers today expect a more personalized and connected travel experience. This includes in-flight Wi-Fi, entertainment options, and the ability to customize their journey with services like seat selection and pre-ordered meals. Ancillary revenue management helps airlines cater to these evolving preferences by optimizing pricing and offerings for these in-flight experiences.

Technological advancements and data-driven strategies are giving the market a boost.

Advancements in data analytics and artificial intelligence are allowing airlines to personalize offers and employ dynamic pricing strategies for ancillary products. This data-driven approach helps airlines maximize revenue by understanding customer preferences and tailoring offerings accordingly. Additionally, improved technology streamlines the sale and delivery of ancillary services, further boosting revenue potential.

Market Restraints and Challenges:

Balancing revenue optimization with customer perception is a challenge for the market.

Airlines need to strike a delicate balance between maximizing ancillary revenue and maintaining customer satisfaction. Overly aggressive pricing or a complex web of fees can lead to customer frustration and brand erosion. Finding the right price point and ensuring transparency in ancillary offerings are crucial for long-term success.

Integration with legacy systems and technological hurdles are major challenges.

Implementing effective ancillary revenue management strategies can be hampered by limitations of existing IT infrastructure. Integrating new ancillary offerings with legacy booking and reservation systems can be complex and time-consuming. Additionally, airlines need to invest in robust technology solutions for data analytics, dynamic pricing, and personalized marketing, all of which are essential for optimizing ancillary revenue.

The evolving regulatory landscape and potential for backlash are restricting market growth.

The rise of ancillary revenue has drawn scrutiny from regulators concerned about consumer protection and unfair practices. Airlines need to navigate a complex regulatory landscape that can vary by region. Additionally, excessive reliance on ancillary fees can lead to customer backlash and calls for stricter regulations. Finding the right balance is essential for sustainable growth in the ancillary revenue market.

Market Opportunities:

Expansion beyond traditional airlines is opening new doors for the market.

The ancillary revenue management market is poised for growth beyond that of traditional airlines. Low-cost carriers (LCCs) are already heavily reliant on ancillary revenue, but the concept can be applied to other travel sectors like railways, cruises, and ride-sharing services. These companies can leverage ancillary revenue management to optimize pricing for add-on services like priority boarding, baggage fees, reserved seating, and even bundled packages with meals or entertainment.

Personalization and data-driven upselling with AI and machine learning are major opportunities.

Advancements in artificial intelligence (AI) and machine learning can unlock new opportunities for personalization and upselling in the ancillary revenue management market. By analyzing customer data and preferences, airlines and travel companies can tailor offers for ancillary products in real time. AI recommending in-flight entertainment options based on a passenger's past viewing habits or suggesting travel insurance based on their destination and risk profile is possible. This level of personalization can significantly increase conversion rates and ancillary revenue.

ANCILLARY REVENUE MANAGEMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.26% |

|

Segments Covered |

By Offering, Deployment, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ACCELYA, Amadeus IT Group, BONFLITE, Book4Time Inc., Bravo Passenger Solutions Pte Limited, Cendyn, Deutsche Lufthansa AG, Farel Inc., FLYR, Inc., Guestlogix Inc. |

Ancillary Revenue Management Market Segmentation: By Offering

-

Full-Service Carrier

-

Low-Cost Carrier

Low-cost carriers are the largest and fastest-growing offering in this market. Over the past few decades, low-cost airlines have significantly increased their market share in the aviation sector. These airlines have a no-frills business strategy, which allows them to offer lower rates than full-service carriers. Extra services like luggage, priority boarding, meals, and seat selection are sometimes charged individually. Low-cost airlines (LCCs) are appealing to both leisure and budget-conscious travelers due to their simplified service offerings and reasonable pricing. A broader range of travelers may now more easily access air travel due to the emergence of low-cost carriers (LCCs). Furthermore, LCCs are increasingly using technology and data analytics to optimize pricing, personalize products, and maximize income from ancillary services as they innovate and diversify their supplementary revenue sources.

Ancillary Revenue Management Market Segmentation: By Deployment

-

On-Cloud

-

On-Premises

The deployment model for ancillary revenue management solutions is also shaping the market landscape. Cloud-based solutions are the largest and fastest-growing category. They are gaining significant traction due to several advantages. Cloud deployment offers scalability, flexibility, and lower upfront costs compared to on-premises solutions. This is particularly attractive for LCCs and smaller airlines that may not have the resources to invest in and maintain complex on-premises IT infrastructure. Additionally, cloud-based solutions enable airlines to access advanced analytics capabilities and leverage real-time data for dynamic pricing and personalization, which are crucial for maximizing ancillary revenue. While on-premises solutions may still be preferred by some larger airlines with concerns about data security or control, the overall market trend is shifting toward cloud adoption. This growth indicates the increasing preference for cloud-based solutions that offer scalability, cost-efficiency, and advanced functionalities to airlines of all sizes.

Ancillary Revenue Management Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The ancillary revenue management market exhibits significant growth variations across different regions. North America is the largest growing market. Ancillary revenue management is a thriving sector of the aviation business in North America, where airlines take advantage of a developed market and creative approaches to optimize supplementary revenue sources. Ancillary income programs have been effectively adopted by major airlines, including low-cost and legacy carriers. These airlines provide a wide range of add-on services, including baggage fees, seat selection, and onboard sales. North American airlines continuously improve their auxiliary products to meet the diverse demands of customers, resulting in higher revenue and improved overall profitability. They do this by placing a significant focus on customer segmentation and data analytics. Due to airlines' provision of specialized services and high-end benefits intended for business travelers, the region's thriving business travel sector also supports the rise of ancillary income. Asia-Pacific is the fastest-growing, driven by factors like a burgeoning middle class with rising disposable income and a growing appetite for travel. This region is also home to several major LCCs that have been pioneers in leveraging ancillary revenue streams. Countries like China, Singapore, and India are at the forefront. Europe is also expected to witness steady growth due to the presence of established airlines and a mature travel market. This region is likely to focus on personalization and data-driven strategies to optimize ancillary revenue. While South America and the Middle East & Africa represent smaller markets currently, they hold immense potential for future growth due to rising travel demand and increasing internet penetration. The growing adoption of cloud-based solutions, which offer lower upfront costs and scalability, can further accelerate market expansion in these regions.

COVID-19 Impact Analysis on the Global Ancillary Revenue Management Market:

The COVID-19 pandemic undeniably impacted the ancillary revenue management market significantly. The global travel industry experienced a sharp decline in passenger demand, leading to a corresponding drop in ancillary revenue. Airlines were forced to cancel flights, reduce capacity, and implement stricter hygiene protocols, all of which limited opportunities for offering in-flight services like meals or premium seating. While the initial impact was severe, the market has shown signs of recovery as travel restrictions ease and passenger confidence returns. Airlines are adapting their strategies to the post-pandemic landscape. The focus has shifted towards contactless services, with increased emphasis on pre-ordering meals and entertainment to minimize physical interaction onboard. Additionally, airlines are leveraging technology to offer flexible booking options and personalized offers to attract passengers and stimulate ancillary revenue generation. The long-term impact of COVID-19 on the market remains to be seen, but the industry is demonstrating resilience and adapting to the new travel environment.

Latest Trends/Developments:

Subscription-based ancillary revenue models have been helping with better revenue generation.

Airlines are exploring subscription-based models to generate recurring revenue from ancillary services. This could involve offering monthly or annual subscriptions for in-flight Wi-Fi access, priority boarding, baggage allowances, or bundled entertainment packages. This approach provides passengers with predictable costs and convenience, while airlines benefit from guaranteed revenue streams.

In-flight retail is being given prominence.

The concept of in-flight retail is evolving beyond traditional duty-free shopping. Airlines are partnering with e-commerce platforms to allow passengers to pre-order and pay for onboard purchases through mobile apps. This streamlines the buying process, reduces wait times, and opens doors for a wider selection of curated products tailored to specific routes and passenger demographics.

Key Players:

-

ACCELYA

-

Amadeus IT Group

-

BONFLITE

-

Book4Time Inc.

-

Bravo Passenger Solutions Pte Limited

-

Cendyn

-

Deutsche Lufthansa AG

-

Farel Inc.

-

FLYR, Inc.

-

Guestlogix Inc.

Chapter 1. ANCILLARY REVENUE MANAGEMENT MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ANCILLARY REVENUE MANAGEMENT MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ANCILLARY REVENUE MANAGEMENT MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ANCILLARY REVENUE MANAGEMENT MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ANCILLARY REVENUE MANAGEMENT MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ANCILLARY REVENUE MANAGEMENT MARKET – By Offering

6.1 Introduction/Key Findings

6.2 Full-Service Carrier

6.3 Low-Cost Carrier

6.4 Y-O-Y Growth trend Analysis By Offering

6.5 Absolute $ Opportunity Analysis By Offering, 2024-2030

Chapter 7. ANCILLARY REVENUE MANAGEMENT MARKET – By Deployment

7.1 Introduction/Key Findings

7.2 On-Cloud

7.3 On-Premises

7.4 Y-O-Y Growth trend Analysis By Deployment

7.5 Absolute $ Opportunity Analysis By Deployment, 2024-2030

Chapter 8. ANCILLARY REVENUE MANAGEMENT MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Offering

8.1.3 By Deployment

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Offering

8.2.3 By Deployment

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Offering

8.3.3 By Deployment

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Offering

8.4.3 By Deployment

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Offering

8.5.3 By Deployment

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. ANCILLARY REVENUE MANAGEMENT MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ACCELYA

9.2 Amadeus IT Group

9.3 BONFLITE

9.4 Book4Time Inc.

9.5 Bravo Passenger Solutions Pte Limited

9.6 Cendyn

9.7 Deutsche Lufthansa AG

9.8 Farel Inc.

9.9 FLYR, Inc.

9.10 Guestlogix Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global ancillary revenue management market was valued at USD 919.16 million in 2023 and is projected to reach a market size of USD 1406.66 million by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 6.26%.

Key drivers include the pressure on airline profit margins and the rise of low-cost carriers (LCCs), shifting consumer preferences and demand for in-flight experiences, technological advancements, and data-driven strategies.

North America dominates the market with a significant share of over 35%.

ACCELYA, Amadeus IT Group, BONFLITE, Book4Time Inc., Bravo Passenger Solutions Pte Limited, Cendyn, Deutsche Lufthansa AG, Farel Inc., FLYR, Inc., and Guestlogix Inc. are some leading players in the global ancillary revenue management market.

Advancements in artificial intelligence (AI) and machine learning can unlock new opportunities for personalization and upselling in the ancillary revenue management market.