Anatase Titanium Dioxide Market Size (2024 – 2030)

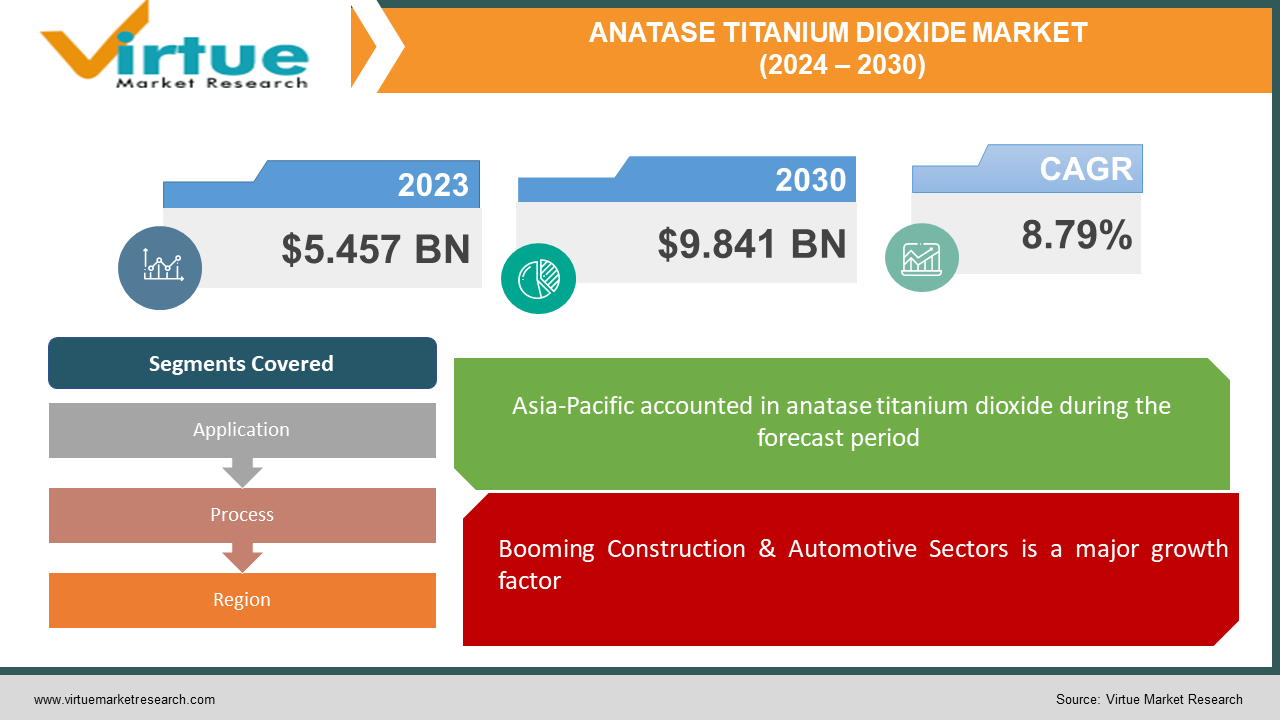

The Global Anatase Titanium Dioxide Market was valued at USD 5.457 billion in 2023 and is projected to reach a market size of USD 9.841 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 8.79%.

Key Market Insights:

The paint and coatings industry is the biggest driver of anatase titanium dioxide consumption, accounting for over half of the global market share in 2023. Traditionally, Europe and North America have been the leading consumers of anatase titanium dioxide. However, the trend is shifting towards the Asia Pacific region. Manufacturers are focusing on innovation is expected to create new application avenues for anatase titanium dioxide beyond traditional paints & coatings, such as plastics, rubber, and cosmetics.

Anatase Titanium Dioxide Market Drivers:

Booming Construction & Automotive Sectors is a major growth factor.

The global market for anatase titanium dioxide is on the rise, fuelled by the booming construction and automotive sectors. These industries are major consumers of the product. In construction, the demand for paints and coatings for both residential and commercial buildings is a key driver for anatase TiO2. Additionally, the trend towards light weighting in automobiles utilizes anatase TiO2 because it enhances the opacity and durability of plastics used in car parts. This growth in construction and the unique properties of anatase TiO2 for car parts are expected to continue to propel the demand for this material.

Growing Focus on Sun Protection is driving the market growth

Anatase titanium dioxide is a key ingredient in sunscreens, providing effective protection against harmful ultraviolet (UV) radiation. The growing awareness of skin cancer and the increasing demand for sun protection products are driving the use of anatase titanium dioxide in the cosmetics industry. This trend is expected to continue, with a report predicting the global sunscreen market to reach USD 21.7 billion by 2028. This signifies a bright future for anatase titanium dioxide as a vital component in sunscreens.

Urbanization and Rising Disposable Income is giving market a boost.

The global trend of rapid urbanization is creating a surge in demand for consumer goods. This includes paints and plastics used in construction, as well as personal care products. Anatase titanium dioxide, a key ingredient in these products, is benefiting from this trend. Furthermore, rising disposable income in developing economies is leading to increased consumer spending on these very goods. This further fuels the demand for anatase titanium dioxide, creating a positive feedback loop for the market.

Market Restraints and Challenges:

Fluctuating Raw Material Prices is a challenge for the market

The production of anatase titanium dioxide faces challenges due to fluctuating prices of raw materials like ilmenite and rutile. Geopolitical instability, import/export regulations, and environmental restrictions can all cause these variations. This price instability makes it difficult for manufacturers to maintain consistent profit margins and disrupts overall market stability.

Health and Environmental Concerns is a major challenge

Concerns exist regarding the potential health and environmental risks of anatase titanium dioxide nanoparticles, particularly in consumer products. Ongoing research investigates these concerns, but some consumers are already shifting towards products with alternative ingredients. Stringent regulations by governing bodies regarding the use of titanium dioxide could further impact market growth.

Competition from Alternative Opacifier is restricting the market growth

Anatase titanium dioxide faces competition from alternative opacifiers, like zinc oxide and certain clays, which are seen as potentially safer options. While anatase titanium dioxide often offers superior performance, the presence of these competitive alternatives challenges its market dominance, especially if consumer safety concerns escalate.

Market Opportunities:

Expanding Applications in High-Growth Sectors is opening new doors for the market

Anatase titanium dioxide's unique properties extend beyond traditional uses. The growing market for photocatalysis, where anatase TiO2 acts as a light-activated catalyst accelerating chemical reactions, presents a significant opportunity. This technology has potential applications in air and water purification, self-cleaning surfaces, and even solar energy generation. Additionally, the pharmaceutical and medical industries are exploring the potential of anatase titanium dioxide nanoparticles for drug delivery and medical imaging. While research is ongoing, the potential for future market expansion in these areas is significant.

Focus on Sustainability and Transparency is a major opportunity

As environmental consciousness grows, there's a rising demand for sustainable and eco-friendly products. Anatase titanium dioxide manufacturers can capitalize on this trend by focusing on sustainable production processes and developing eco-friendly grades of the product. Additionally, increasing transparency throughout the supply chain regarding sourcing, manufacturing practices, and safety measures can build consumer trust and address any lingering concerns. By demonstrating a commitment to sustainability and transparency, anatase titanium dioxide producers can position themselves favourably in the evolving market landscape.

ANATASE TITANIUM DIOXIDE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.79% |

|

Segments Covered |

By Application, Process, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Microsoft Chemours, Huntsman Corporation, Cristal, Kronos, Tronox, ISK, Lomon Henan Billions Chemicals, Shandong Doguide Group, Tayca |

Anatase Titanium Dioxide Market Segmentation: By Application

-

Paints & Coatings

-

Plastics

-

Papers

-

Inks

-

Others

Paints & Coatings dominate the Anatase Titanium Dioxide market, accounting for roughly 55% of the global market share in 2023. This dominance is driven by the pigment properties of anatase TiO2, enhancing brightness, opacity, and durability in paints. The rising demand for architectural coatings in the Asia Pacific region, particularly in developing countries like China and India, is expected to propel anatase TiO2 consumption in paints & coatings to new heights, with a projected CAGR of around 12.79% from 2023 to 2030.

While Paints & Coatings reign supreme, other application segments are experiencing significant growth as well. The plastics industry leverages anatase TiO2 for its excellent opacity and UV resistance, crucial for applications like plastic bottles, pipes, and automotive parts. The paper industry utilizes anatase TiO2 to enhance paper brightness and opacity, particularly in high-quality printing and packaging papers. Inks benefit from the pigmenting properties of anatase TiO2, while the "Others" segment encompasses a diverse range of applications including cosmetics (sunscreen, makeup), textiles, and rubber. This diversification across various industries highlights the versatility and strong market presence of anatase titanium dioxide.

Anatase Titanium Dioxide Market Segmentation: By Process

-

Chloride

-

Sulfate

The sulfate process reigns supreme in anatase titanium dioxide production, holding around 53.72% of the global market share in 2023. This dominance is attributed to several factors. The sulfate process is a well-established and mature technology, offering producers a reliable and efficient method for anatase TiO2 production. Additionally, it boasts a higher pigmentary content compared to other processes, making the resulting product ideal for applications demanding high performance, like paints and plastics.

However, the chloride process presents a viable alternative, particularly for cost-competitive production. While holding a smaller market share, the chloride process is experiencing growth due to advancements in technology that address environmental concerns previously associated with it. Furthermore, the chloride process is effective in utilizing lower-grade titanium feedstock, offering some producers a cost advantage. As environmental regulations tighten and the focus on cost-effectiveness grows, the chloride process for anatase titanium dioxide production is expected to gain traction in the coming years.

Anatase Titanium Dioxide Market Segmentation: By Region

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

The global Anatase Titanium Dioxide market is experiencing a geographic shift, with the Asia-Pacific region emerging as the dominant player. By 2028, this region is projected to hold the largest market share due to a booming construction sector and rapid urbanization, particularly in developing countries like China and India. This translates to a high demand for paints & coatings, a key application segment for anatase titanium dioxide. Statistics indicate that the Chinese construction market is expected to reach a value of USD 9.2 trillion by 2023. This growth directly translates to an increased demand for anatase titanium dioxide in the Asia-Pacific region.

While Asia-Pacific surges forward, traditional powerhouses like North America and Europe are expected to witness a slower growth rate. However, these regions still hold significant market share due to their established infrastructure, technological advancements, and mature manufacturing capabilities. Furthermore, growing environmental consciousness in these regions is pushing the demand for sustainable production processes, which can be a competitive advantage for manufacturers who prioritize eco-friendly practices.

COVID-19 Impact Analysis on the Global Anatase Titanium Dioxide Market:

The COVID-19 pandemic delivered a temporary blow to the anatase titanium dioxide market. Lockdowns and restrictions on movement disrupted global supply chains, leading to shortages of raw materials and finished products. This, coupled with a slowdown in major end-use industries, dampened demand for anatase titanium dioxide in 2020. The construction industry, a key consumer, faced project delays and halts due to labour shortages and restrictions. Similarly, the demand for paints & coatings declined as non-essential construction projects stalled, and the production of consumer goods like automobiles dipped. This resulted in a decline in anatase titanium dioxide consumption across various application segments.

However, the market exhibited resilience and rebounded as the global economy recovered. pent-up demand in construction and other sectors fuelled a resurgence in anatase titanium dioxide consumption. Additionally, the growing focus on hygiene during the pandemic potentially boosted the use of anatase titanium dioxide in certain applications like paints with antimicrobial properties. While the pandemic caused a temporary setback, the long-term growth prospects for the anatase titanium dioxide market remain positive, driven by factors like rising urbanization and increasing disposable income in developing economies.

Latest Trends/Developments:

Nanotechnology and Performance Enhancement:

The market is witnessing a growing focus on nanotechnology to create improved anatase titanium dioxide grades. Manufacturers are developing nano-sized particles with superior properties like enhanced dispersion, whiteness, and weather resistance. These advancements cater to the demand for high-performance anatase TiO2 in various applications, pushing the boundaries of its functionality.

Sustainability in Production and Product Development:

Environmental consciousness is shaping the anatase titanium dioxide market. Manufacturers are increasingly adopting sustainable production processes to minimize environmental impact. This includes exploring the use of recycled raw materials and implementing energy-efficient technologies. Additionally, the development of eco-friendly grades of anatase titanium dioxide is gaining traction, catering to the growing demand for sustainable products.

Functionalization for Emerging Applications:

Research and development efforts are exploring the functionalization of anatase titanium dioxide nanoparticles. This involves modifying the surface properties of the particles to enable them for specific functionalities. For instance, functionalized anatase TiO2 shows promise in applications like self-cleaning surfaces, air and water purification, and even as a catalyst in fuel cells. This trend highlights the potential for anatase titanium dioxide to enter entirely new market segments beyond its traditional uses.

Key Players:

-

Microsoft Chemours

-

Huntsman Corporation

-

Cristal

-

Kronos

-

Tronox

-

ISK

-

Lomon

-

Henan Billions Chemicals

-

Shandong Doguide Group

-

Tayca

Chapter 1. Anatase Titanium Dioxide Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Anatase Titanium Dioxide Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Anatase Titanium Dioxide Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Anatase Titanium Dioxide Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Anatase Titanium Dioxide Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Anatase Titanium Dioxide Market – By Application

6.1 Introduction/Key Findings

6.2 Paints & Coatings

6.3 Plastics

6.4 Papers

6.5 Inks

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Anatase Titanium Dioxide Market – By Process

7.1 Introduction/Key Findings

7.2 Chloride

7.3 Sulfate

7.4 Y-O-Y Growth trend Analysis By Process

7.5 Absolute $ Opportunity Analysis By Process, 2024-2030

Chapter 8. Anatase Titanium Dioxide Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Process

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Process

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Process

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Process

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Process

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Anatase Titanium Dioxide Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Microsoft Chemours

9.2 Huntsman Corporation

9.3 Cristal

9.4 Kronos

9.5 Tronox

9.6 ISK

9.7 Lomon

9.8 Henan Billions Chemicals

9.9 Shandong Doguide Group

9.10 Tayca

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Anatase Titanium Dioxide Market was valued at USD 5.457 billion in 2023 and is projected to reach a market size of USD 9.841 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 8.79%.

Key drivers include the Booming Construction & Automotive Sectors, Growing Focus on Sun Protection, and Urbanization and Rising Disposable Income.

Asia-Pacific dominates the market with a significant share of over 44%.

Chemours, Huntsman Corporation, Cristal, Kronos, Tronox, ISK, Lomon, Henan Billions Chemicals, Shandong Doguide Group, and Tayca are some leading players in the Global Anatase Titanium Dioxide Market.