Amorphous Graphite Market Size (2024 – 2030)

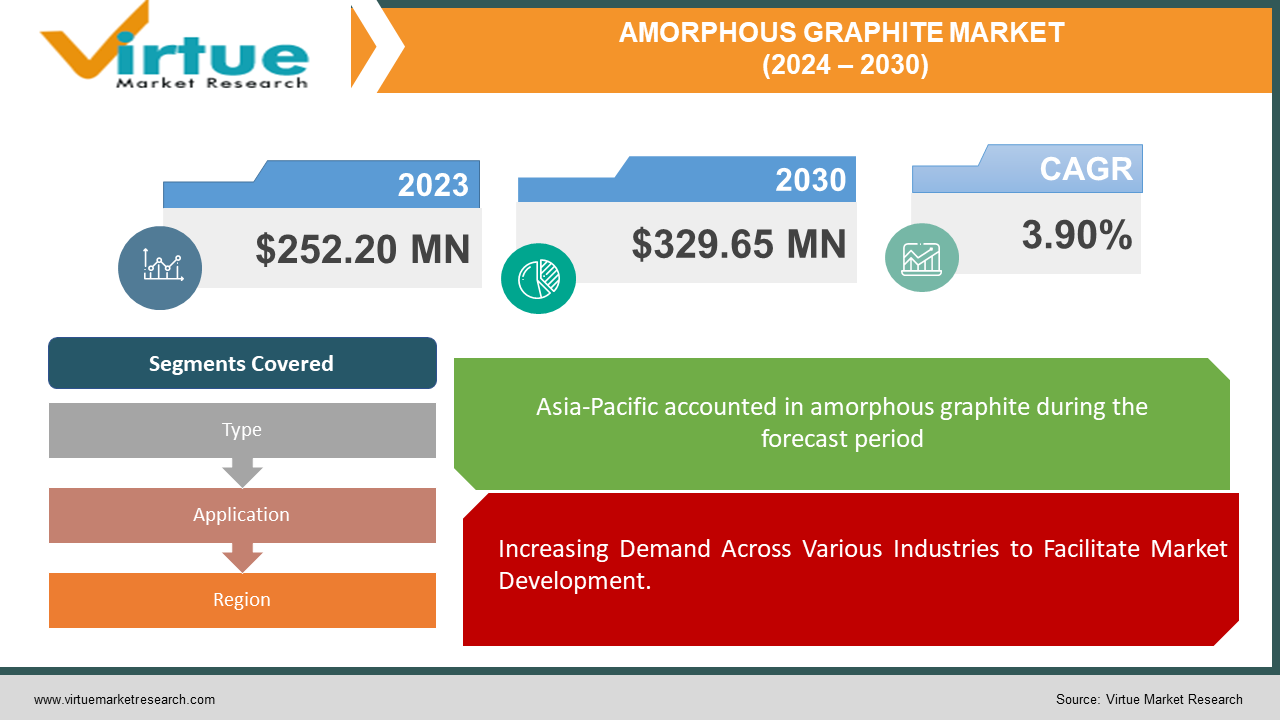

The Amorphous Graphite Market was valued at USD 252.20 million in 2023 and is projected to reach a market size of USD 329.65 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.90%.

Amorphous graphite is a vein mineral, not a vein mineral. It is produced by the metamorphism of existing anthracite coal seams. Seam graphite contains more cash than other types of graphite. It is also considered to be the least "graphitic" among the forms of natural graphite. Whether large or small grains, it is less reflective and, therefore, has a darker color than all other minerals. It has a stable carbon content ranging from 60% to 85%. It is the most common form of graphite and is found in a variety of lubricants such as grease and lubricants.

This type of graphite is suitable for applications requiring high ash and low carbon content. This is a great advantage for engineering applications that require cheap graphite.

Amorphous graphite is so named because graphite crystals are invisible to the human eye, so they have an amorphous shape. In the recycling industry, it is used to create crucibles, molds, ladles, nozzles, and throughs that can withstand high temperatures, especially when metal is pressed. This type of graphite is used to make electrodes for many electrical applications, including arc furnaces used in metallurgy.

Key Market Insights:

The amorphous graphite market is poised to witness significant growth due to its important role in green technology and manufacturing. With the increasing demand for high conductivity events, this promises great opportunities for investors. The demand for amorphous graphite has increased by 30% in the last 10 years.

Amorphous Graphite Market Drivers:

Increasing Demand Across Various Industries to Facilitate Market Development.

The demand and use of amorphous graphite products, from honey to industrial use for the production of heat-resistant products, will increase the market size. Apart from refractories, it is also used in brake linings, seals, and many others. In addition, it is made from low-quality amorphous graphite, which is imported from China. The continued demand for large end-use companies, due to rapid industrial expansion in developed and developing countries, will increase the supply of goods.

The amorphous graphite market is driven by several key factors that promise to shape its position in the coming years. With the increasing focus on sustainable energy solutions, the demand for lithium-ion batteries, which rely on amorphous graphite as the main material, continues to rise. In addition, the expansion of the electronics industry, especially in emerging economies, is driving the need for advanced graphite in consumer electronics and industrial applications. In addition, advancements in graphene technology and its various applications in areas such as aerospace, automotive, and healthcare are increasing the demand for amorphous graphite, driving the market further.

Amorphous Graphite Market Restraints and Challenges:

Rising Steel Demand and Price Fluctuations to Hamper Market Prospects

The increasing demand of the lithium-ion battery industry and the large-scale production of iron from graphite electrodes are driving the global graphite market. The increase in graphite export activity in China and the decrease in the price of natural graphite are the major factors restraining the growth of the global amorphous graphite market in the forecast year. Declining demand for steel in other countries, including India and China, has also affected the market.

Many health problems have also been reported in some parts of the world due to prolonged exposure to graphite, which causes asthma and many other problems in children, which is also one of the main reasons for the decline in sales.

Despite its promising applications, the amorphous graphite market faces many obstacles and problems. A significant obstacle is graphite price volatility due to factors such as supply chain disruptions and geopolitical conflicts in graphite-producing regions. Additionally, the market faces environmental concerns related to graphite mining and processing, as well as regulatory pressure to adhere to strict sustainability standards. The technological limitations of the refining process and the need for continuous innovation also pose challenges. In addition, competition from other materials and the complexities of integrating amorphous graphite into existing manufacturing processes add to the industry's challenges. Overcoming these obstacles will require a concerted effort from stakeholders across the board.

Amorphous Graphite Market Opportunities:

The amorphous graphite market offers a huge opportunity amid the growing demand for durable and high-performance materials. With its unique characteristics of high density, thermal stability, and rotation, amorphous graphite finds applications in various industries including electronics, energy storage, and petroleum. As the world transitions to renewable energy and electric mobility, demand for amorphous graphite is expected to increase, driving innovation and investment in production technology. In addition, progress in the field of nanotechnology and material science opens up new ways to improve the properties and applications of amorphous graphite, placing it as a key player in the future of sustainable manufacturing and technology.

AMORPHOUS GRAPHITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.90% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

South Graphite, Botai Graphite Grafitbergbau Kaisersberg G.m.b.H, Fortune Graphite, Asbury Carbons, Ulanqab Darsen Graphite New Materials |

Amorphous Graphite Market Segmentation: By Type

-

Carbon Content Below 80%

-

Carbon Content Above 80%

In 2023, Carbon content below 80% in amorphous graphite has a great impact on the world market. This phase of amorphous graphite, characterized by its low carbon purity, is highly desirable for several reasons. First, industries such as steel and foundry are increasingly looking for low-grade graphite as a cheaper alternative to carbon and refractories. In addition, the expansion of emerging markets and infrastructure development projects are driving the demand for low-grade graphite in the construction and automotive sectors. In addition, the rise of renewable energy technologies, including wind power and solar panels, is increasing the need for graphite in battery applications, where the variety is low. However, this practice poses a challenge to traditional producers of high-purity graphite, requiring a revolutionary process. This transition to low-grade graphite highlights the company's dynamic nature, prompting stakeholders to explore new avenues of market expansion and product diversification, thus enabling stability and competition in the global region and the evolution of the amorphous graphite market.

With a carbon content of over 80%, amorphous graphite is emerging as a major player in the global market, offering many opportunities and shaping the industry's strengths. Many factors contribute to its growth. First, the growing demand for high-purity carbon materials in energy storage systems, such as lithium-ion batteries, increases the demand for amorphous graphite. Second, its applications in petroleum, refractories, and raw materials contribute to market expansion, which is boosted by the thriving automotive, aerospace, and construction industries. In addition, the increasing adoption of renewable energy sources requires efficient energy storage solutions, thus increasing the demand for amorphous graphite in battery technology. However, market growth is not without challenges, as environmental regulations and sustainability concerns drive the exploration of alternatives. Nevertheless, technological advances and research efforts focused on improving the properties of amorphous graphite demonstrate its continued importance and potential to redefine the global industrial landscape.

Amorphous Graphite Market Segmentation: By Application

-

Iron and Steel

-

Coating

-

Refractory Material

-

Carbon Additive

In 2023, The iron and steel industry stand as the backbone of modern civilization, infrastructure development, manufacturing, and technological progress. Global population growth, urban development trends, and infrastructure projects in emerging economies are fueling the demand for iron and steel. In addition, innovations in construction, automobile manufacturing, and renewable energy resources are also contributing to the increase in demand. However, traditional iron and steel production processes often pose environmental challenges due to their large carbon footprint. This has led to a shift to other green methods, such as electric power plants and hydrogen-based steel systems, aimed at reducing emissions and improving sustainability.

Coating technology plays an important role in a variety of industries, from automotive and aerospace to electronics and construction. The global coating market is witnessing strong growth, driven by factors such as increasing infrastructure development, automotive production, and demand for corrosion protection and cosmetic enhancement. In this context, the use of amorphous graphite as a core and coating material has attracted much attention. Its special properties, including high thermal conductivity and chemical inertness, make it a good addition for improving the performance of insulation. Amorphous graphite helps to improve the durability, conductivity, and corrosion resistance of coatings, expanding their application in critical areas. As companies prioritize sustainability and look for alternatives to traditional coatings with harmful environmental effects, the demand for environmentally friendly solutions such as graphite-based coatings is increasing. This trend is expected to boost the growth of the global amorphous graphite market, as manufacturers and end users increasingly adopt this new coating method to meet changing regulatory standards and consumer preferences.

Amorphous Graphite Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is at the forefront of the global amorphous graphite market, whose position is influenced by several growing factors. Rapid industrialization and urbanization in countries such as China, India, and Japan are fueling demand for amorphous graphite in a variety of applications, including steel production, electronics manufacturing, and automotive components. In addition, government initiatives promoting sustainable energy solutions and investment in infrastructure projects are increasing market growth in the region.

Furthermore, Asia Pacific's dominance in key sectors such as electronics and automobiles is shaping the dynamics of the global amorphous graphite market. The region's strong manufacturing capacity and technological advancements are contributing to the growth of amorphous graphite products. Additionally, the presence of market leaders and the emergence of new startups focused on graphene technology is driving market expansion. Overall, the Asia-Pacific region serves not only as a major consumer but also as a center of production and innovation, having a significant impact on the global amorphous graphite market.

North America is at the forefront of the global amorphous graphite market, poised to witness significant growth due to several key factors. The region's strong industrial infrastructure and technological advancements are driving the demand for amorphous graphite across various sectors including automotive, electronics, and renewable energy. In addition, increasing investment in research and development initiatives leads to innovation, leading to the development of advanced applications and processes using amorphous graphite.

The increasing adoption of electric vehicles (EV) and the growing focus on renewable energy solutions are driving the demand for amorphous graphite in North America. As governments implement stricter laws to reduce carbon emissions, there is a marked shift in clean energy sources and energy-efficient technologies, driving the need for advanced materials such as amorphous graphite.

COVID-19 Impact Analysis on the Amorphous Graphite Market:

The global COVID-19 pandemic has been unprecedented and shocking, with the amorphous graphite market experiencing lower-than-expected demand across all regions and used compared to the initial stage of the disease. The increase in CAGR is due to the growth of the amorphous graphite market and the return of demand to pre-pandemic levels once the pandemic subsides. COVID-19 has affected almost every industry and market around the world, slowing economic growth and changing consumer buying habits. Domestic and international travel has been restricted due to the lockdown imposed in many countries, which has disrupted the supply chain of many sectors across the world, thus widening the gap between supply and demand. As a result, the low availability of raw materials has hindered the production of amorphous materials, which has affected the market growth negatively.

Although the pandemic has affected the global market, an increase in demand after the epidemic is expected as industrial activity resumes.

Latest Trends/ Developments:

One of the trends in the market is the creation of new products by major players in response to the growing demand for new graphite products. One of the growing trends is the increase in graphite in the chemical industry for various reactions. Its equipment includes reaction tanks, absorption towers, heat exchangers, and chemical reactors. Also, the growing electronics market, resulting from the proliferation of electronic devices such as laptops, smartphones, tablets, etc., is expected to boost market growth. Graphite is used to manufacture rechargeable and long-lasting batteries for electronic devices.

Key Players:

-

South Graphite

-

Botai Graphite

-

Grafitbergbau Kaisersberg G.m.b.H

-

Fortune Graphite

-

Asbury Carbons

-

Ulanqab Darsen Graphite New Materials

Chapter 1. AMORPHOUS GRAPHITE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. AMORPHOUS GRAPHITE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. AMORPHOUS GRAPHITE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. AMORPHOUS GRAPHITE MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. AMORPHOUS GRAPHITE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. AMORPHOUS GRAPHITE MARKET – By Application

6.1 Introduction/Key Findings

6.2 Iron and Steel

6.3 Coating

6.4 Refractory Material

6.5 Carbon Additive

6.6 Y-O-Y Growth trend Analysis By Application

6.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. AMORPHOUS GRAPHITE MARKET – By Type

7.1 Introduction/Key Findings

7.2 Carbon Content Below 80%

7.3 Carbon Content Above 80%

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. AMORPHOUS GRAPHITE MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. AMORPHOUS GRAPHITE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 South Graphite

9.2 Botai Graphite

9.3 Grafitbergbau Kaisersberg G.m.b.H

9.4 Fortune Graphite

9.5 Asbury Carbons

9.6 Ulanqab Darsen Graphite New Materials

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Amorphous Graphite Market was valued at USD 252.20 million in 2023 and is projected to reach a market size of USD 329.65 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.90%.

Increased demand and use of products made from amorphous graphite are some of the driving factors of the amorphous graphite market.

Based on type, the Amorphous Graphite Market is segmented into Carbon Content Below 80% and Carbon Content Above 80%.

Asia-Pacific is the most dominant region for the Amorphous Graphite Market.

Asbury Carbons, South Graphite, Focus Graphite, and Ulanqab Darsen Graphite New Materials are some of the major key players.