Ammonium Propionate Market Size (2024 – 2030)

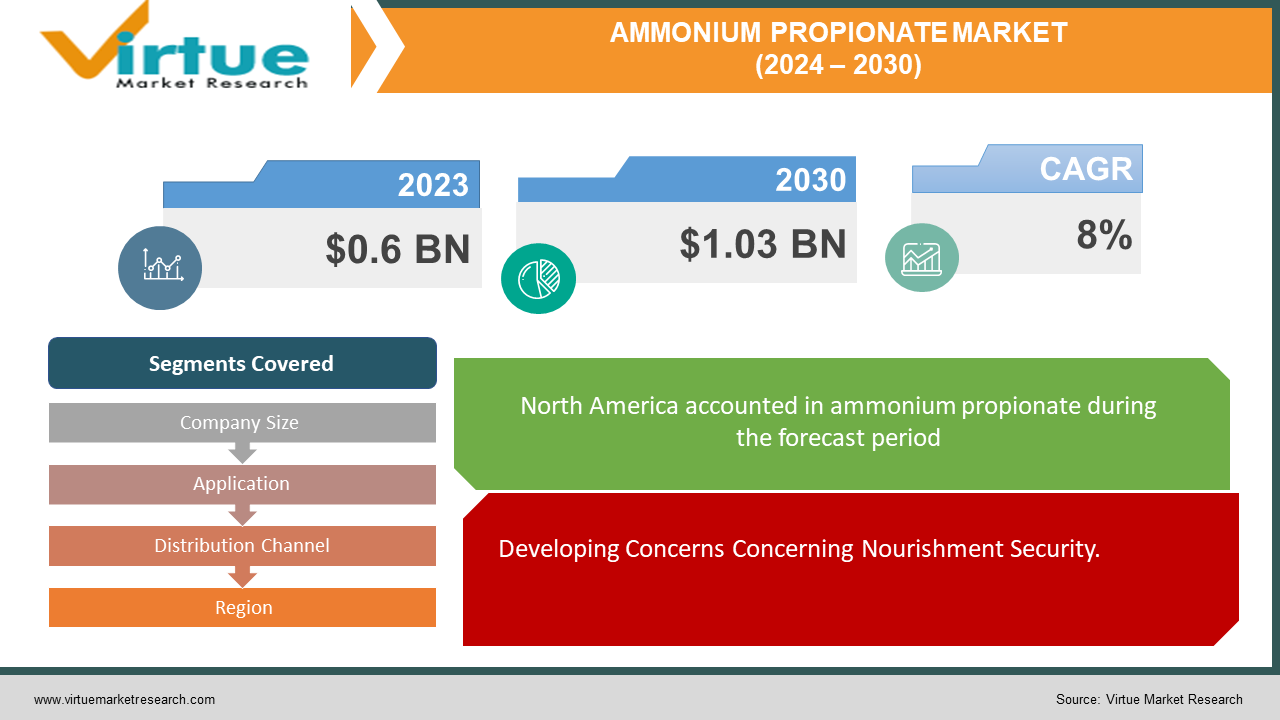

The market for ammonium propionate market at the global level is expanding quickly; it was estimated to be worth 0.6 USD billion in 2023 and is expected to increase to 1.03 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 8% from 2024 to 2030.

The worldwide ammonium propionate showcase presents an energetic scene characterized by consistent development and advancing customer requests. Ammonium propionate, a compound broadly utilized as a nourishment additive and in different mechanical applications, serves as a key fixing within the conservation of prepared products, creature bolsters, and rural silage. With expanding concerns concerning nourishment security and shelf-life expansion, coupled with the extension of the nourishment-preparing industry, the request for ammonium propionate proceeds to rise all-inclusive. In addition, headways in fabricating forms and the developing appropriation of feasible additives encourage fuel showcase development. Districts such as North America, Europe, and Asia-Pacific rise as key donors to showcase development, driven by vigorous nourishment handling divisions and exacting administrative systems. Moreover, the advertiser witnesses developments in item definitions and bundling arrangements to cater to differing customer inclinations and administrative measures. By and large, the worldwide ammonium propionate showcase expects supported development, moved by the ever-evolving scene of nourishment security controls, innovative progressions, and customer inclinations.

Key Market Insights:

Convenience foods, such as ready-to-eat meals and packaged snacks, are increasingly favored by consumers due to their ease of preparation and time-saving benefits. This trend drives demand for food additives like ammonium propionate, which are used to extend shelf life and maintain product freshness in convenience food products. Ammonium propionate is widely utilized as a preservative in the bakery and meat industries to inhibit mold growth and prolong the shelf life of baked goods, processed meats, and other perishable products. The rising consumption of bakery items and processed meats globally contributes to increased demand for ammonium propionate in these industries. Growing consumer awareness regarding food safety issues, including foodborne illnesses and contamination, drives demand for preservatives like ammonium propionate. Consumers are increasingly seeking products with longer shelf life and enhanced safety measures, leading to a higher demand for food additives that help maintain product quality and integrity.

Ammonium Propionate Market Drivers:

Developing Concerns Concerning Nourishment Security.

Increased mindfulness among shoppers and administrative bodies concerning nourishment security benchmarks could be a major driver in moving the worldwide ammonium propionate advertise. With expanding occurrences of foodborne ailments and defilement, there's a developing accentuation on the utilize of successful additives like ammonium propionate to amplify the rack life of perishable nourishment things and guarantee their security for utilization.

Development of Nourishment Handling Industry.

The extension and modernization of the nourishment-preparing industry around the world are critical drivers for the ammonium propionate advertise. As the request for prepared and comfortable nourishments proceeds to rise, producers are increasingly relying on additives like ammonium propionate to preserve item freshness, quality, and taste over expanded periods. This slant is especially articulated in rising economies encountering fast urbanization and changing dietary propensities.

Expanding Appropriation in Creature Nourish Industry.

The creature nourishment industry speaks to a key driver for the worldwide ammonium propionate showcase. With a developing worldwide populace and rising requests for meat items, there's an expanded center on improving creature nourishment and bolstering quality. Ammonium propionate serves as a successful shape inhibitor in creature nourishment, anticipating decay, and protecting wholesome keenness. As animal generation heightens to meet rising protein requests, the request for ammonium propionate as a feed preservative is anticipated to surge.

Global Ammonium Propionate Market Restraints and Challenges:

Administrative Obstacles and Compliance Challenges.

Administrative systems overseeing the utilization of nourishment-added substances and additives, counting ammonium propionate, pose critical challenges for advertising members. Rigid controls related to reasonable levels of additives, labeling necessities, and security appraisals require broad compliance measures, including complexity and costs to item advancement and showcase section techniques. Following assorted administrative guidelines over diverse districts assists in complicating advertising elements, compelling the development potential of the worldwide ammonium propionate showcase.

Customer Inclination for Common and Clean Name Items.

The rising shopper inclination for common, negligibly prepared nourishments with clean names presents an eminent limitation for the ammonium propionate advertise. Expanding mindfulness concerning the potential well-being dangers related to manufactured additives has fueled requests for clean name choices and common conservation strategies. As shoppers prioritize straightforwardness and look for items free from fake added substances, producers confront weight to reformulate items or investigate elective conservation procedures, challenging the conventional dominance of manufactured additives like ammonium propionate.

Chance of Negative Wellbeing Recognitions and Customer Backfire.

Concerns encompassing the security and well-being impacts of engineered additives, counting ammonium propionate, pose a noteworthy challenge to advertising development. Open misgivings concerning the potential collection of additives in nourishment items and their potential antagonistic impacts on well-being can lead to customer skepticism and backfire against items containing such added substances. Negative exposure, customer boycotts, or administrative investigation stemming from health-related contentions can unfavorably affect showcase requests and discolor the notoriety of ammonium propionate and related additives, displaying an impressive challenge for advertising partners.

Global Ammonium Propionate Market Opportunities:

Rising Request for Clean Name Additives.

The developing buyer inclination for clean-name items presents a critical opportunity for worldwide ammonium propionate advertising. Producers can capitalize on this drift by creating common or clean name options to conventional manufactured additives, counting inventive details of ammonium propionate determined from characteristic sources or created through economical forms. By adjusting to customer inclinations for straightforwardness and characteristic fixings, showcase players can open unused roads for development and separation within the competitive scene.

Extending Applications in Rising Economies.

The burgeoning nourishment handling and agrarian divisions in developing economies offer profitable openings for the extension of the worldwide ammonium propionate advertise. With fast urbanization, changing dietary propensities, and expanding expendable livelihoods driving requests for prepared nourishments and creature nourishing, there's a developing requirement for successful additives to guarantee item security and quality. Advertise members can use this request by deliberately growing their nearness in key developing markets, producing associations with nearby partners, and fitting item offerings to meet the particular needs and inclinations of these energetic locales.

Mechanical Headways and Item Development.

Innovative headways and advancement in conservation innovations show promising openings for the worldwide ammonium propionate showcase. Proceeded investigation and advancement endeavors pointed at upgrading the viability, security, and supportability of additives that can surrender breakthrough arrangements with predominant execution and customer acknowledgment. From epitome methods to controlled-release definitions and characteristic antimicrobial specialists, the investigation of novel approaches to conservation can open undiscovered showcase openings and drive advertise development by tending to advance industry challenges and buyer requests.

AMMONIUM PROPIONATE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Company Size, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Dow Chemical Company, Eastman Chemical Company, Celanese Corporation, Koninklijke DSM N.V. (DSM), Corbion N.V., Hawkins, Inc., Galactic S.A., Impextraco NV, Niacet Corporation, Addcon GmbH, Kemin Industries, Inc. |

Ammonium Propionate Market Segmentation: By Company Size

-

Large Enterprises

-

Small & Medium-sized Enterprises

Within the setting of the worldwide ammonium propionate showcase, fitting division techniques based on company measures is vital for successfully tending to the assorted needs and capabilities of advertising members. Whereas both expansive undertakings and small & medium-sized undertakings (SMEs) play necessary parts within the advertising environment, the foremost compelling division approach regularly includes recognizing the special qualities and challenges related to each category. Huge ventures, with their broad assets, built-up dispersion systems, and vigorous R&D capabilities, are well-positioned to use economies of scale, contribute to cutting-edge innovations, and embrace vital activities such as mergers and acquisitions to grow showcase share and accomplish feasible development. These industry mammoths have the budgetary muscle and organizational nimbleness to explore administrative complexities, capitalize on rising advertise patterns, and drive advancement in item advancement and promoting procedures. On the other hand, SMEs, while working on a smaller scale, display agility, adaptability, and an increased center on client closeness, empowering them to quickly react to changing advertise elements, cater to specialty showcase portions, and cultivate solid client connections. With their nimbleness and versatility, SMEs can carve out a specialty in specialized showcase fragments, separate themselves through personalized administrations and specialty item offerings, and capitalize on developing opportunities in undiscovered geographic locales or specialty applications. Eventually, whereas both huge undertakings and SMEs contribute to the dynamic quality and competitiveness of the ammonium propionate advertise, a successful division technique that recognizes and saddles the particular qualities and capabilities of each fragment is essential for maximizing market potential and driving economic development.

Ammonium Propionate Market Segmentation: By Application

-

Preservative

-

Chemical Intermediates

-

Agricultural applications

Among the different division approaches for the worldwide ammonium propionate showcase, division by application develops as especially successful due to its capacity to cater to the assorted needs and inclinations of end-users over diverse businesses. Inside this system, the application fragment of additives stands out as the foremost viable, owing to its broad pertinence and basic part in guaranteeing nourishment security and expanding rack life over different divisions. As an additive, ammonium propionate finds broad utilization within the nourishment industry, particularly in prepared merchandise, confectionery things, and creature nourishment, where it successfully represses the development of form and amplifies item freshness. This application addresses a squeezing buyer concern concerning nourishment security and quality, adjusting with exacting administrative measures and upgrading customer certainty in bundled nourishments. Besides, the flexibility of ammonium propionate as an additive expands past the nourishment industry to include applications in pharmaceuticals, individual care items, and mechanical forms, subsequently differentiating income streams and broadening advertising openings. By centering on the additive application section, advertise players can use the developing request for secure, shelf-stable items, capitalize on advancing administrative scenes, and cultivate advancement in item details and bundling arrangements to meet the energetic needs of customers and businesses around the world.

Ammonium Propionate Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors & Wholesalers

-

Online Retail

Within the setting of the worldwide ammonium propionate advertise, division by conveyance channel offers experiences into the differing pathways through which items reach end-users, with each channel showing interesting openings and challenges. Among these, direct sales develop as the foremost viable conveyance channel, especially for large-scale producers and key market players. Coordinate deals empower producers to set up coordinated connections with clients, giving more noteworthy control over overestimating, item situating, and brand discernment. By bypassing middle people, producers can streamline communication channels, speed up preparation, and guarantee steady item quality and accessibility. In addition, coordinating deals encourages personalized client intelligence, permitting producers to tailor their offerings to meet particular client needs and inclinations, cultivating brand devotion and long-term connections. Whereas coordinated deals require critical speculation in deals and promoting framework, they offer unparalleled openings for advertise infiltration, brand separation, and esteem creation, situating producers to capitalize on rising showcase patterns and shopper requests viably. In any case, it's worth noticing that a multi-channel conveyance technique consolidating wholesalers, wholesalers, and online retail stages may complement coordinate deals endeavors, empowering broader advertise reach and improved client openness in differing geographic locales and showcase portions.

Ammonium Propionate Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The dissemination of the worldwide ammonium propionate advertise over diverse districts reflects a differing scene formed by shifting financial, administrative, and buyer flow. North America develops as the biggest showcase, bookkeeping for 31% of the worldwide share, driven by the vigorous nourishment preparing industry and exacting administrative measures administering nourishment security and quality. In Europe, comprising 23% of the advertising, the request for ammonium propionate is fueled by a comparable accentuation on nourishment security and conservation, coupled with a solid nearness of driving producers and imaginative investigative activities. The Asia-Pacific locale, capturing 27% of the advertisement, shows noteworthy development potential fueled by fast urbanization, changing dietary propensities, and expanding speculations in the nourishment framework. South America and the Center East and Africa districts, speaking to 10% and 9% of the advertisements separately, offer openings for showcase extension driven by rising buyer expendable earnings, urbanization, and the multiplication of prepared nourishment utilization. By and large, the territorial conveyance underscores the worldwide centrality of the nourishment handling industry and administrative systems in forming advertise elements, whereas too highlighting rising openings for development and speculation in assorted geographic districts.

COVID-19 Impact Analysis on the Global Ammonium Propionate Market:

The COVID-19 widespread has had a critical effect on the worldwide ammonium propionate showcase, disturbing supply chains, changing customer behavior, and reshaping showcase elements. Amid the beginning stages of the widespread, far-reaching lockdowns and limitations on development driven to disturbances in fabricating operations, transportation systems, and exchange streams, influencing the generation and dispersion of fundamental merchandise, counting nourishment and nourishing added substances like ammonium propionate. Besides, shifts in shopper inclinations towards shelf-stable and bundled nourishments, coupled with expanded accentuation on nourishment security and cleanliness, drove requests for additives like ammonium propionate. In any case, challenges such as labor deficiencies, calculated bottlenecks, and fluctuating crude fabric costs prevented advertising development to a few degrees. As the world slowly adjusts to the unused typical, the advertise is balanced for recuperation, upheld by the resumption of financial exercises, the rollout of immunization campaigns, and progressing endeavors to moderate supply chain disturbances. Moving forward, showcase players are likely to center on improving generation effectiveness, contributing to digitalization and computerization, and broadening sourcing procedures to construct versatility against future disturbances while tending to advance buyer needs and administrative prerequisites within the post-pandemic time.

Latest Trends/ Developments:

The most recent patterns and advancements within the worldwide ammonium propionate advertise reflect a combination of advancing shopper inclinations, innovative headways, and administrative changes. One outstanding drift is the expanding request for common and clean name additives, driven by developing customer mindfulness of well-being and supportability concerns. This slant has incited producers to investigate elective sources and definitions of ammonium propionate inferred from normal sources or delivered through environmentally friendly forms. Moreover, there's a rising accentuation on item development and customization to cater to specialty showcase portions and address particular application needs. Headways in embodiment innovations and controlled-release definitions are empowering producers to improve the viability and solidness of ammonium propionate while minimizing its effect on tangible properties and dietary quality. In addition, administrative improvements, such as corrections to nourishment security guidelines and labeling necessities, are forming showcase flow and affecting item definitions and showcasing strategies. Overall, the most recent patterns and advancements within the worldwide ammonium propionate showcase emphasize a proceeded center on maintainability, development, and administrative compliance to meet the advancing needs of customers and businesses around the world.

Key Players:

-

BASF SE

-

Dow Chemical Company

-

Eastman Chemical Company

-

Celanese Corporation

-

Koninklijke DSM N.V. (DSM)

-

Corbion N.V.

-

Hawkins, Inc.

-

Galactic S.A.

-

Impextraco NV

-

Niacet Corporation

-

Addcon GmbH

-

Kemin Industries, Inc.

Chapter 1. Ammonium Propionate Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ammonium Propionate Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ammonium Propionate Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ammonium Propionate Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ammonium Propionate Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ammonium Propionate Market – By Company Size

6.1 Introduction/Key Findings

6.2 Large Enterprises

6.3 Small & Medium-sized Enterprises

6.4 Y-O-Y Growth trend Analysis By Company Size

6.5 Absolute $ Opportunity Analysis By Company Size, 2024-2030

Chapter 7. Ammonium Propionate Market – By Application

7.1 Introduction/Key Findings

7.2 Preservative

7.3 Chemical Intermediates

7.4 Agricultural applications

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Ammonium Propionate Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors & Wholesalers

8.4 Online Retail

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Ammonium Propionate Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Company Size

9.1.3 By Application

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Company Size

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Company Size

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Company Size

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Company Size

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Ammonium Propionate Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2 Dow Chemical Company

10.3 Eastman Chemical Company

10.4 Celanese Corporation

10.5 Koninklijke DSM N.V. (DSM)

10.6 Corbion N.V.

10.7 Hawkins, Inc.

10.8 Galactic S.A.

10.9 Impextraco NV

10.10 Niacet Corporation

10.11 Addcon GmbH

10.12 Kemin Industries, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for ammonium propionate market at the global level is expanding quickly; it was estimated to be worth 0.6 USD billion in 2023 and is expected to increase to 1.03 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 8% from 2024 to 2030.

The essential drivers of the Worldwide Ammonium Propionate Advertise incorporate expanding concerns around nourishment security and the development of the nourishment-preparing industry.

The key challenge facing the Global Ammonium Propionate Market is the rising preference for natural and clean-label alternatives.

In 2023, North America held the largest share of the global ammonium propionate market.

BASF SE, Dow Chemical Company, Eastman Chemical Company, Celanese Corporation, Koninklijke DSM N.V. (DSM), Addcon GmbH, Kemin Industries, Inc. Are the main players.