Amla Extract Market Size (2024 – 2030)

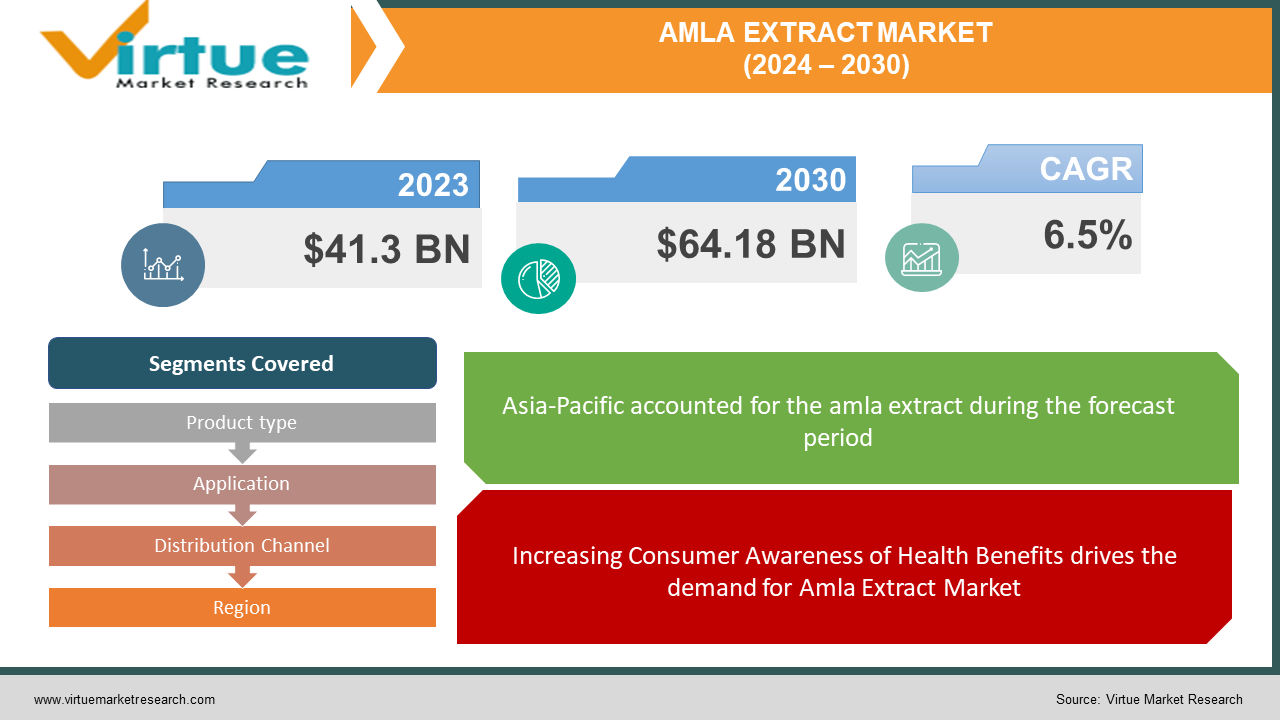

The Global Amla Extract Market was valued at USD 41.3 billion and is projected to reach a market size of USD 64.18 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.5%.

Amla is often known as Indian gooseberry and is rich in vitamin C and antioxidants. Amla extract is used in various applications including pharmaceuticals, cosmetics, and food supplements. The Amla Extract Market is expected to grow significantly in the coming years due to increasing consumer awareness about the health benefits of amla. The major well-established key players in the Amla Extract Market are Dabur India Ltd, Baidyanath Group, Himalaya Drug Company, Patanjali Ayurved Limited, and Herbal Hills.

Top of Form

Key Market Insights:

Amla has traditionally been used in Ayurvedic medicine. There's increased demand for amla extract both in traditional Ayurvedic formulations and modern products. Amla extract is known for its health-promoting properties. Health benefits of amla extract include immune system support, anti-inflammatory properties, and potential anti-aging effects. Amla extract is also used in the cosmetics industry. This is due to its antioxidant properties and potential benefits for skin and hair health. Increasing consumer awareness of its health benefits, expanding demand for natural products, growing interest in Ayurvedic medicine, rising use in cosmetics, and ongoing research and development are propelling the Amla Extract Market. The restraints to the Amla Extract Market include limited supply and seasonality, high production costs, competition from synthetic alternatives, limited awareness in global markets, regulatory hurdles, and perception of taste and odor. Ongoing advancements in technology and research have led to the development of new formulations and applications of amla extracts. Asia-Pacific occupies the highest share of the Amla Extract Market. North America is the fastest-growing segment during the forecast period.

Amla Extract Market Drivers:

Increasing Consumer Awareness of Health Benefits drives the demand for Amla Extract Market

Amla extract contains vitamin C and antioxidants. Amla extract is beneficial for health. Consumer awareness of the health benefits of amla extract is growing rapidly. This is due to the adoption of health-conscious lifestyles and a growing interest in natural remedies. Vitamin C supports the immune system and promotes collagen synthesis for skin health. Amla extract acts as an antioxidant to combat oxidative stress. Antioxidants help neutralize free radicals in the body. Amla extract reduces the risk of chronic diseases and supports overall well-being. Consumers are becoming more aware of the nutritional content and functional properties of amla extract. Consumers are increasingly incorporating amla extract into their diets due to their potential health benefits. Consumers are increasingly seeking out products containing amla extract for health and wellness purposes.

Expansion of the Cosmetics Industry is propelling the Amla Extract Market

Amla extract is increasingly used in the cosmetics industry. This is due to its beneficial properties for skin and hair health. Amla extract is rich in antioxidants. This helps in protecting the skin from oxidative damage caused by UV radiation and pollution. Amla extract also has anti-inflammatory properties. This makes it suitable for soothing sensitive or irritated skin. Amla extract is popular in hair care products. Amla extract nourishes the scalp, strengthens hair follicles, and promotes overall healthy hair growth. Amla extract is used in hair dyes and treatments. This is due to its natural coloring properties and provides a safer alternative to synthetic dyes. The demand for natural and plant-based ingredients in the cosmetic industry is increasing. Amla extract is used in a wide range of skincare, haircare, and personal care products. Thus, the expansion of the cosmetics industry contributes to the growth of the amla extract market.

Amla Extract Market Restraints and Challenges

The major challenge faced by the Amla Extract Market is the limited supply and seasonality of amla. Amla is a seasonal fruit and can be harvested in certain regions of the world. The limited availability of fresh amla affects the supply chain. This leads to fluctuations in pricing. The price for amla extract is high during off-season periods. Another challenge in the Amla Extract Market is the high production costs. The process of extracting amla can be labor-intensive and expensive. The other restraints to the Amla Extract Market include competition from synthetic alternatives, limited awareness in global markets, regulatory hurdles, and perception of taste and odor.

Amla Extract Market Opportunities:

The Amla Extract Market has various opportunities in the market. With rising consumer interest in health and wellness, the Amla Extract Market is anticipated to witness significant growth in the coming years. Amla contains vitamin C and antioxidant properties. This makes it a suitable ingredient for immune support, energy enhancement, and overall well-being. Other Opportunities in the Amla Extract Market include expansion in the cosmetics industry, incorporation in functional foods and beverages, expansion of nutraceuticals, diversification of product offerings, geographical expansion, collaboration and partnerships, and investment in research and development.

AMLA EXTRACT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dabur India Ltd, Baidyanath Group, Himalaya Drug Company, Patanjali Ayurved Limited, Herbal Hills, Navchetana Kendra, Nature's Velvet Lifecare, Organic India, Amway, Synthite Industries Limited |

Amla Extract Market Segmentation: By Product Type

-

Liquid Extracts

-

Powder Extracts

-

Capsules/Tablets

-

Other Forms (concentrates, oils, and syrups)

In 2023, based on market segmentation by Product Type, capsules/tablets occupy the highest share of the Amla Extract Market. This is mainly due to their convenience and ease of consumption. Capsules and tablets have a longer shelf life compared to liquid and powder forms.

However, Other Forms (concentrates, oils, and syrups) are the fastest-growing segment during the forecast period and are projected to grow at a CAGR of 14%. This is due to their versatility and increasing demand for natural and functional ingredients in various industries. Amla concentrates is used in beverages, smoothies, and foods. Amla oils are used in the cosmetics industry for skincare and haircare formulations. Amla syrups are used in traditional medicine and culinary applications.

Amla Extract Market Segmentation: By Application

-

Pharmaceuticals (Ayurvedic medicines and supplements)

-

Cosmetics and Personal Care (skincare products, haircare products)

-

Food and Beverages (juices, dietary supplements, jams, candies)

-

Nutraceuticals

-

Other Industrial Applications (animal feed additives, herbal formulations)

In 2023, based on market segmentation by Applications, the Pharmaceuticals (Ayurvedic medicines and supplements) segment occupies the highest share of the Amla Extract Market. This is mainly due to its health-promoting properties including immune support, digestive health, and overall well-being. Amla extract is popular for its long-standing use in traditional medicine systems like Ayurveda.

However, Cosmetics and Personal Care (skincare products, haircare products) are the fastest-growing segment during the forecast period. This is mainly due to the increasing consumer awareness of the benefits of natural and herbal ingredients in skincare and haircare products. Amla extract has antioxidant properties and high vitamin C content. This makes it a desirable ingredient for products that promote skin health, combat aging, and nourish hair.

Amla Extract Market Segmentation: By Distribution Channel

-

-

Online Retail

-

Offline Retail

-

Supermarkets/Hypermarkets

-

Health Food Stores

-

Specialty Stores

-

Pharmacies/Drugstores

-

-

Business-to-Business (B2B) channels (ingredient suppliers, manufacturers, distributors)

-

In 2023, based on market segmentation by the Distribution Channel, the Offline Retail segment occupies the highest share of the Amla Extract Market. This is mainly due to the large volume of customers. Supermarkets and hypermarkets offer a wide range of amla extract products, including health supplements and herbal products. Consumers often prefer to purchase amla extract products alongside their regular grocery shopping.

However, Online retail is the fastest-growing segment during the forecast period. This growth is driven by the convenience of online shopping, a wider selection of products, and competitive pricing. Consumers can easily buy amla extract supplements and related products through online platforms.

Amla Extract Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, Asia-Pacific occupies the highest share of the. It has a market share of 45%. This growth is due to the amla’s native origins in the region and its long-standing use in traditional medicine systems like Ayurveda. This growth is also driven by increasing consumer awareness of the health benefits of amla extract, coupled with the growing demand for natural and herbal products. Countries like India, where amla is widely cultivated and consumed, are significant contributors.

However, North America is the fastest-growing segment during the forecast period. This is mainly due to the increasing consumer interest in natural and functional ingredients, as well as the rising popularity of Ayurvedic and herbal supplements. Consumers are continuously seeking alternatives to synthetic ingredients and are attracted to the health benefits offered by amla extract. The presence of amla extract in various products such as supplements, skincare, and haircare products also contributes to the growth of the market in this region.

COVID-19 Impact Analysis on the Global Amla Extract Market:

The COVID-19 pandemic had a significant impact on the Amla Extract Market. There were lockdowns, travel restrictions, and other safety rules and regulations. This led to disruptions in global supply chains and affected the sourcing of raw materials for amla extract production. This also affected distribution in the amla extract industry. During the pandemic, awareness of health and wellness was growing rapidly. This led to increased interest in immune-boosting products like amla extract. The pandemic accelerated the adoption of natural remedies to support their immune systems, potentially driving demand for amla extract-based supplements and functional foods. Thus, the pandemic accelerated certain trends in the Amla Extract Market.

Latest Trends/ Developments:

One of the developments, in the Amla Extract Market is the rise in innovative formulations and delivery formats for amla extract products. This includes gummies, effervescent tablets, and liquid concentrates for different usage occasions. Amla extract is traditionally used in supplements and Ayurvedic medicines. Now amla extract is finding new applications in skincare, haircare, functional foods, beverages, and nutraceuticals. Growing demand for organic products, emphasis on sustainable practices, ongoing health research, market growth in emerging economies, and increased partnerships for market presence are other latest developments in the Amla Extract Market.

Key Players:

-

Dabur India Ltd

-

Baidyanath Group

-

Himalaya Drug Company

-

Patanjali Ayurved Limited

-

Herbal Hills

-

Navchetana Kendra

-

Nature's Velvet Lifecare

-

Organic India

-

Amway

-

Synthite Industries Limited

Market News:

In 2023, Vitamins & Me launched Vitamin C Tablets containing 1000 mg of natural Vitamin C sourced from Amla extract, alongside Zinc, aiming to bolster immunity, enhance skin radiance, and fortify hair strength, ensuring daily safety with chemical-free formulation.

Chapter 1. Amla Extract Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Amla Extract Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Amla Extract Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Amla Extract Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Amla Extract Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Amla Extract Market – By Product Type

6.1 Introduction/Key Findings

6.2 Liquid Extracts

6.3 Powder Extracts

6.4 Capsules/Tablets

6.5 Other Forms (concentrates, oils, and syrups)

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Amla Extract Market – By Application

7.1 Introduction/Key Findings

7.2 Pharmaceuticals (Ayurvedic medicines and supplements)

7.3 Cosmetics and Personal Care (skincare products, haircare products)

7.4 Food and Beverages (juices, dietary supplements, jams, candies)

7.5 Nutraceuticals

7.6 Other Industrial Applications (animal feed additives, herbal formulations)

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Amla Extract Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Online Retail

8.3 Offline Retail

8.4 Supermarkets/Hypermarkets

8.5 Health Food Stores

8.6 Specialty Stores

8.7 Pharmacies/Drugstores

8.8 Business-to-Business (B2B) channels (ingredient suppliers, manufacturers, distributors)

8.9 Y-O-Y Growth trend Analysis By Distribution Channel

8.10 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Amla Extract Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Amla Extract Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)10.1 Dabur India Ltd

10.2 Baidyanath Group

10.3 Himalaya Drug Company

10.4 Patanjali Ayurved Limited

10.5 Herbal Hills

10.6 Navchetana Kendra

10.7 Nature's Velvet Lifecare

10.8 Organic India

10.9 Amway

10.10 Synthite Industries Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Amla Extract Market was valued at USD 41.3 billion and is projected to reach a market size of USD 64.18 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.5 %.

Increasing consumer awareness of its health benefits, expanding demand for natural products, growing interest in Ayurvedic medicine, rising use in cosmetics, and ongoing research and development are the market drivers of the Global Amla Extract Market.

Liquid Extracts, Powder Extracts, Capsules/Tablets, and Other Forms (concentrates, oils, and syrups) are the segments under the Global Amla Extract Market by Product Type.

Asia-Pacific is the most dominant region for the Global Amla Extract Market.

Dabur India Ltd, Baidyanath Group, Himalaya Drug Company, Patanjali Ayurved Limited, and Herbal HillsTop of Form are the key players in the Global Amla Extract Market.