Ambulatory Surgical Centres Market Size (2024 – 2030)

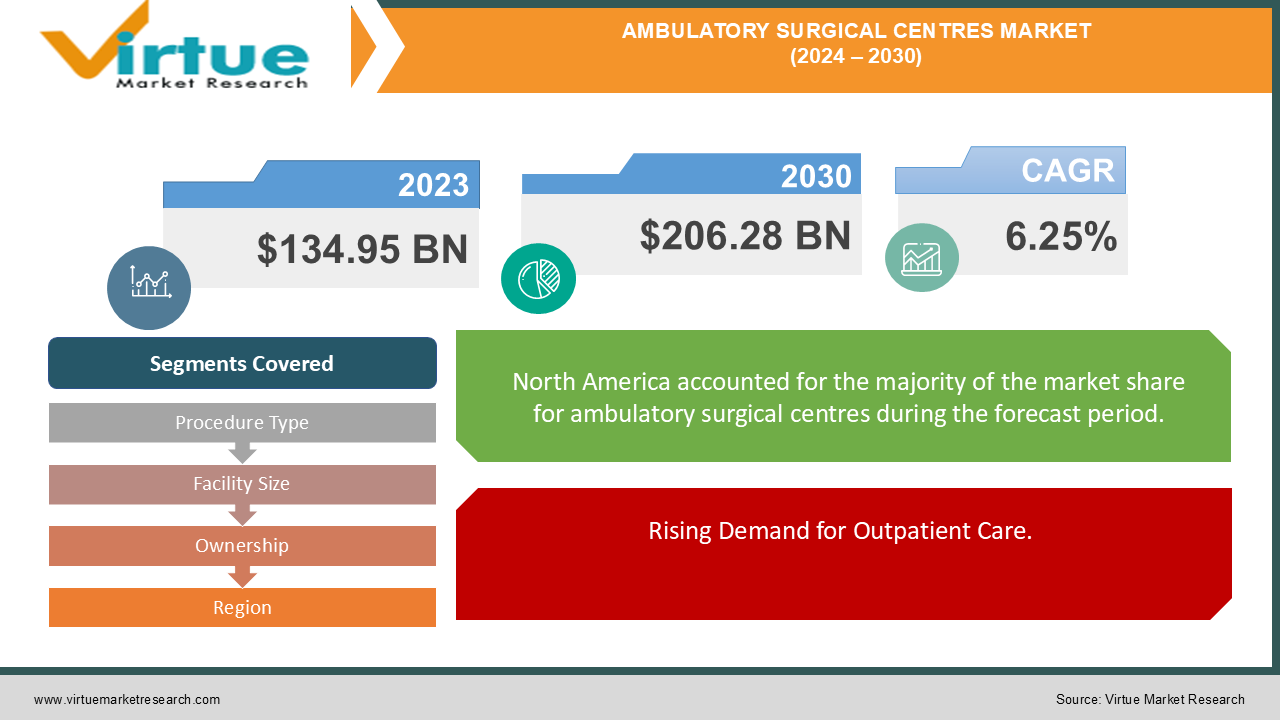

The Global Ambulatory Surgical Centres Market was valued at USD 134.95 billion in 2023 and is projected to reach a market size of USD 206.28 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6.25% between 2024 and 2030.

The Global Ambulatory Surgical Centres (ASC) Market is experiencing significant growth as healthcare systems worldwide increasingly shift towards outpatient care models. Ambulatory Surgical Centres are specialized medical facilities designed to perform surgical procedures that do not require overnight hospitalization. These centers are gaining popularity due to their ability to offer cost-effective, high-quality care with enhanced convenience for patients. By focusing on minimally invasive procedures, ASCs reduce the need for lengthy hospital stays, thereby improving patient recovery times and reducing healthcare costs. The rising demand for outpatient services, driven by an aging population, increasing prevalence of chronic diseases, and advancements in surgical techniques, is fueling the expansion of this market. Additionally, the emphasis on value-based care and patient satisfaction is pushing healthcare providers to adopt ASC models, which offer more personalized and efficient care compared to traditional hospital settings. As technological advancements continue to enhance surgical procedures and patient management, the ASC market is poised for continued growth, reflecting a broader shift towards more flexible and patient-centered healthcare solutions.

Key Market Insights:

ASCs have seen a rise in outpatient surgeries, with over 60% of all surgical procedures now performed in these centers.

The adoption of minimally invasive procedures in ASCs has increased, leading to a reduction in hospital stays by approximately 50%.

Patient satisfaction scores at ASCs are notably high, with around 90% of patients reporting positive experiences.

The ASC market is expected to grow rapidly, driven by the rise in outpatient surgeries and technological advancements.

Operational costs at ASCs are typically lower, with savings of up to 30% compared to traditional hospital settings.

Global Ambulatory Surgical Centres Market Drivers:

Rising Demand for Outpatient Care.

The growing preference for outpatient care is a major driver of the Global Ambulatory Surgical Centres (ASC) Market. Patients increasingly seek procedures that allow them to avoid prolonged hospital stays, driven by both convenience and cost considerations. Ambulatory Surgical Centres cater to this demand by providing a range of surgical services that do not require overnight hospitalization, thereby reducing the overall healthcare costs and enhancing patient satisfaction. The shift towards outpatient care is further supported by advancements in surgical technologies and minimally invasive techniques, which enable effective treatments with shorter recovery times. As the aging population and the prevalence of chronic conditions continue to rise, the need for efficient, cost-effective surgical solutions provided by ASCs becomes even more pronounced, contributing to the market’s growth.

Advancements in Surgical Technologies

Technological advancements play a crucial role in driving the expansion of the ASC market. Innovations in surgical equipment and techniques have significantly improved the efficacy and safety of outpatient procedures. Minimally invasive surgery, enhanced imaging technologies, and sophisticated anesthesia techniques have made it possible to perform complex procedures in an outpatient setting, increasing the appeal and feasibility of ASCs. These advancements not only enhance surgical outcomes but also facilitate quicker patient recovery and discharge, reinforcing the attractiveness of ASCs as an alternative to traditional hospital-based surgeries. As technology continues to evolve, it is expected to further propel the growth of the ASC market by expanding the range of procedures that can be safely and effectively performed in an ambulatory setting.

Global Ambulatory Surgical Centres Market Restraints and Challenges:

The Global Ambulatory Surgical Centres (ASC) Market faces several restraints and challenges that could impact its growth. One significant challenge is the regulatory and accreditation requirements, which can vary by region and often involve rigorous standards for quality and safety. Compliance with these regulations can be costly and complex, particularly for new or smaller ASCs. Additionally, there is a challenge in managing and integrating advanced medical technologies and maintaining up-to-date facilities while controlling costs. The competitive landscape of the healthcare sector also poses a challenge, as ASCs must continuously innovate and offer competitive services to attract patients. Furthermore, reimbursement policies and payment models can be a constraint, as changes in healthcare policies or insurance reimbursements can affect the financial viability of ASCs. Additionally, there is an ongoing concern regarding the potential for increased patient volume leading to staff burnout and the need for adequate personnel to maintain high standards of care. These factors, combined with the challenge of keeping pace with rapid technological advancements and maintaining patient safety, represent significant obstacles that ASCs must navigate to sustain their growth and operational effectiveness.

Global Ambulatory Surgical Centres Market Opportunities:

The Global Ambulatory Surgical Centres (ASC) Market presents several promising opportunities for growth and development. The increasing emphasis on value-based care offers ASCs the chance to capitalize on their cost-effective and efficient service delivery model, which aligns well with the industry's shift towards patient-centered care and improved outcomes. The expansion of minimally invasive surgical techniques and technological advancements, such as robotics and enhanced imaging systems, provides ASCs with opportunities to offer a broader range of procedures and attract a larger patient base. Additionally, the rising prevalence of chronic diseases and an aging population are driving demand for outpatient surgical services, creating a favorable environment for ASC growth. The potential for partnerships with hospitals and healthcare systems also represents a significant opportunity, as such collaborations can enhance service offerings and expand patient reach. Furthermore, the growing trend of consumer-driven healthcare and increasing patient preference for convenient, outpatient services present ASCs with the opportunity to capture a larger market share. By leveraging these opportunities and adapting to evolving healthcare trends, ASCs can enhance their market position and drive sustainable growth in the outpatient surgical sector.

AMBULATORY SURGICAL CENTRES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.25% |

|

Segments Covered |

By Procedure Type, Facility Size, Ownership, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

HCA Healthcare, Inc., Tenet Healthcare Corporation, Surgery Partners, Inc., Mednax, Inc., United Surgical Partners International (USPI), American Surgical Centers, HealthSouth Corporation, Ambulatory Surgical Centers of America (ASCA), Inspire Medical Systems, Inc. |

Global Ambulatory Surgical Centres Market Segmentation: By Procedure Type

-

Orthopedic

-

Gynecological

-

Ophthalmic

-

General Surgery

In 2023, based on market segmentation by Procedure Type, Orthopedic Occupies the highest share of the Global Ambulatory Surgical Centres Market. The Global Ambulatory Surgical Centres (ASC) Market has experienced significant growth, particularly in the demand for orthopedic surgeries. This surge is driven by several factors, including the rising rates of obesity, aging populations, and an active lifestyle, all of which contribute to an increase in orthopedic conditions like arthritis, joint injuries, and fractures. ASCs are particularly well-suited for these procedures due to the minimally invasive nature of many orthopedic surgeries, such as arthroscopic interventions and joint replacements, which result in shorter recovery times and lower risk compared to traditional hospital settings. The cost-effectiveness of ASCs also plays a crucial role, offering patients and insurers a more affordable alternative to hospital-based surgeries without compromising on quality. Technological advancements in surgical techniques and equipment have further enabled the performance of more complex orthopedic procedures within ASCs, enhancing their appeal and accessibility. These factors combined have solidified the position of orthopedic surgeries as the leading procedure type in the ASC market, driving continued growth and expansion. As the demand for efficient, cost-effective, and high-quality outpatient surgical care continues to rise, ASCs are poised to play an increasingly central role in the healthcare landscape, particularly in the field of orthopedics.

Global Ambulatory Surgical Centres Market Segmentation: By Facility Size

-

Small

-

Medium

-

Large

In 2023, based on market segmentation by Facility Size, Small Occupies the highest share of the Global Ambulatory Surgical Centres Market. The growth and success of small Ambulatory Surgical Centres (ASCs) in the global healthcare landscape can be attributed to several key factors. Lower investment requirements make these smaller facilities more accessible to entrepreneurs and healthcare providers, enabling them to establish centers with less capital compared to larger hospitals or facilities. This accessibility fosters the creation of more ASCs, particularly in underserved areas. Additionally, small ASCs offer greater flexibility, allowing them to adapt quickly to changes in patient demand, healthcare regulations, or advancements in medical technology. This agility is a significant advantage in the rapidly evolving healthcare environment. Many small ASCs also specialize in specific types of procedures, enabling them to develop deep expertise in their chosen fields. This specialization attracts patients seeking high-quality, focused care, further driving the success of these centers. Moreover, the community-based approach of small ASCs allows them to build strong connections with their local populations, offering personalized, convenient care that resonates with patients. This local focus not only enhances patient satisfaction but also strengthens the facility's reputation within the community. Together, these factors position small ASCs as significant players in the healthcare landscape, contributing to their continued growth and success globally.

Global Ambulatory Surgical Centres Market Segmentation: By Ownership

-

Independent

-

Hospital-Based

-

Physician-Owned

In 2023, based on market segmentation by Ownership, Hospital-Based Occupies the highest share of the Global Ambulatory Surgical Centres Market. Hospital-based Ambulatory Surgical Centres (ASCs) enjoy several strategic advantages due to their integration with larger healthcare systems. By leveraging the existing infrastructure, resources, and expertise of the parent hospital, these ASCs can achieve significant operational efficiencies and cost savings. This synergy allows for better resource allocation, such as shared staffing and equipment, which enhances the overall efficiency of the facility. For patients, the convenience of a seamless transition between inpatient and outpatient care is a major benefit, reducing the overall burden of treatment and enhancing the continuity of care. Hospital-based ASCs also benefit from the parent institution’s established regulatory compliance processes, ensuring adherence to healthcare standards and minimizing the risk of regulatory breaches. Financially, hospitals typically have a stronger foundation compared to independent ASCs, providing greater stability and the capacity for ongoing investment in cutting-edge technologies and facilities.However, the landscape of ASCs is evolving, with independent ASCs gaining market share in recent years. Increased competition, technological advancements, and shifting healthcare policies are driving this change, challenging the dominance of hospital-owned centers. As these dynamics continue to unfold, the ownership structure of ASCs may increasingly diversify, reflecting the broader trends in the healthcare industry.

Global Ambulatory Surgical Centres Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, North America Occupies the highest share of the Global Ambulatory Surgical Centres Market. North America has solidified its position as the global leader in the Ambulatory Surgical Centres (ASC) market, driven by several key factors. The region's advanced healthcare infrastructure is a major contributor, with a well-developed system that emphasizes outpatient care, including ASCs. This infrastructure supports the efficient operation and integration of ASCs within the broader healthcare landscape. The favorable regulatory environment, particularly in the United States, has historically encouraged the development and growth of ASCs, providing a supportive framework that promotes innovation and expansion. High adoption rates in North America are also noteworthy; ASCs have been widely embraced due to their efficiency, cost-effectiveness, and ability to enhance patient satisfaction by offering high-quality, convenient care. Furthermore, North America has been a pioneer in healthcare technological advancements, many of which are directly relevant to the functioning and optimization of ASCs. These advancements have allowed ASCs to offer state-of-the-art procedures in a more efficient and patient-friendly setting, further driving their adoption. While other regions are experiencing growth in the ASC market, North America's established infrastructure, supportive regulatory environment, and high adoption rates ensure it remains at the forefront of the global ASC industry.

COVID-19 Impact Analysis on the Global Ambulatory Surgical Centres Market.

The COVID-19 pandemic has had a profound impact on the Global Ambulatory Surgical Centres (ASC) Market, highlighting both challenges and opportunities. During the pandemic, many ASCs faced temporary closures or reductions in elective procedures due to restrictions and safety concerns, leading to a temporary decline in revenue and operational disruptions. However, the pandemic also accelerated the adoption of telemedicine and remote consultations, which can complement the services offered by ASCs and enhance patient care continuity. The shift towards outpatient care was further reinforced by the need for safer, lower-risk settings for surgical procedures, which helped increase the demand for ASC services. Additionally, the pandemic underscored the importance of efficient, flexible healthcare solutions, positioning ASCs favorably as healthcare systems aim to reduce hospital congestion and focus on cost-effective care. As healthcare systems recover and adapt to the post-pandemic environment, ASCs are expected to play a critical role in addressing the backlog of elective surgeries and providing accessible, high-quality outpatient care. This evolving landscape presents ASCs with opportunities to innovate, expand their services, and strengthen their market presence in the aftermath of the pandemic.

Latest trends / Developments:

The Global Ambulatory Surgical Centres (ASC) Market is witnessing several key trends and developments shaping its growth. One notable trend is the increased adoption of advanced surgical technologies, including robotics and minimally invasive techniques, which enhance precision and patient outcomes while reducing recovery times. The integration of digital health solutions, such as telemedicine and electronic health records, is also transforming ASCs by improving patient management, streamlining workflows, and facilitating remote consultations. Additionally, there is a growing emphasis on patient-centered care, with ASCs focusing on personalized treatment plans and enhancing the patient experience to drive satisfaction and loyalty. The expansion of ASC networks and partnerships with larger healthcare systems are becoming common, allowing for greater resource sharing and improved service offerings. Furthermore, the rise of value-based care models is pushing ASCs to demonstrate high-quality outcomes and cost efficiency, aligning with broader healthcare system goals. These developments reflect the ASC market's adaptation to evolving healthcare needs, technological advancements, and a focus on delivering high-quality, efficient outpatient care in an increasingly competitive landscape.

Key Players:

-

HCA Healthcare, Inc.

-

Tenet Healthcare Corporation

-

Surgery Partners, Inc.

-

Mednax, Inc.

-

United Surgical Partners International (USPI)

-

American Surgical Centers

-

HealthSouth Corporation

-

Ambulatory Surgical Centers of America (ASCA)

-

Inspire Medical Systems, Inc.

Chapter 1. Ambulatory Surgical Centres Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ambulatory Surgical Centres Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ambulatory Surgical Centres Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ambulatory Surgical Centres Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ambulatory Surgical Centres Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ambulatory Surgical Centres Market – By Procedure Type

6.1 Introduction/Key Findings

6.2 Orthopedic

6.3 Gynecological

6.4 Ophthalmic

6.5 General Surgery

6.6 Y-O-Y Growth trend Analysis By Procedure Type

6.7 Absolute $ Opportunity Analysis By Procedure Type, 2024-2030

Chapter 7. Ambulatory Surgical Centres Market – By Facility Size

7.1 Introduction/Key Findings

7.2 Small

7.3 Medium

7.4 Large

7.5 Y-O-Y Growth trend Analysis By Facility Size

7.6 Absolute $ Opportunity Analysis By Facility Size, 2024-2030

Chapter 8. Ambulatory Surgical Centres Market – By Ownership

8.1 Introduction/Key Findings

8.2 Independent

8.3 Hospital-Based

8.4 Physician-Owned

8.5 Y-O-Y Growth trend Analysis By Ownership

8.6 Absolute $ Opportunity Analysis By Ownership, 2024-2030

Chapter 9. Ambulatory Surgical Centres Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Procedure Type

9.1.3 By Facility Size

9.1.4 By Ownership

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Procedure Type

9.2.3 By Facility Size

9.2.4 By Ownership

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Procedure Type

9.3.3 By Facility Size

9.3.4 By Ownership

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Procedure Type

9.4.3 By Facility Size

9.4.4 By Ownership

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Procedure Type

9.5.3 By Facility Size

9.5.4 By Ownership

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Ambulatory Surgical Centres Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 HCA Healthcare, Inc.

10.2 Tenet Healthcare Corporation

10.3 Surgery Partners, Inc.

10.4 Mednax, Inc.

10.5 United Surgical Partners International (USPI)

10.6 American Surgical Centers

10.7 HealthSouth Corporation

10.8 Ambulatory Surgical Centers of America (ASCA)

10.9 Inspire Medical Systems, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Ambulatory Surgical Centres market is expected to be valued at US$ 134.95 billion.

Through 2030, the Global Ambulatory Surgical Centres market is expected to grow at a CAGR of 6.25%.

By 2030, the Global Ambulatory Surgical Centres Market is expected to grow to a value of US$ 206.28 billion.

North America is predicted to lead the Global Ambulatory Surgical Centres market.

The Global Ambulatory Surgical Centres Market has segmented By Procedure Type, By Facility Size , By Ownership, and Region.